Solana – Will institutions help SOL after 50% drop in memecoin activity?

- SOL shed over half its worth in Q1 amid macro uncertainty and declining DEX volumes

- Altcoin has attracted extra institutional curiosity, however can it change SOL’s fortunes?

Solana [SOL] slipped briefly beneath $100 for the primary time in over 12 months. Prevailing macro uncertainty had a hand within the downward stress.

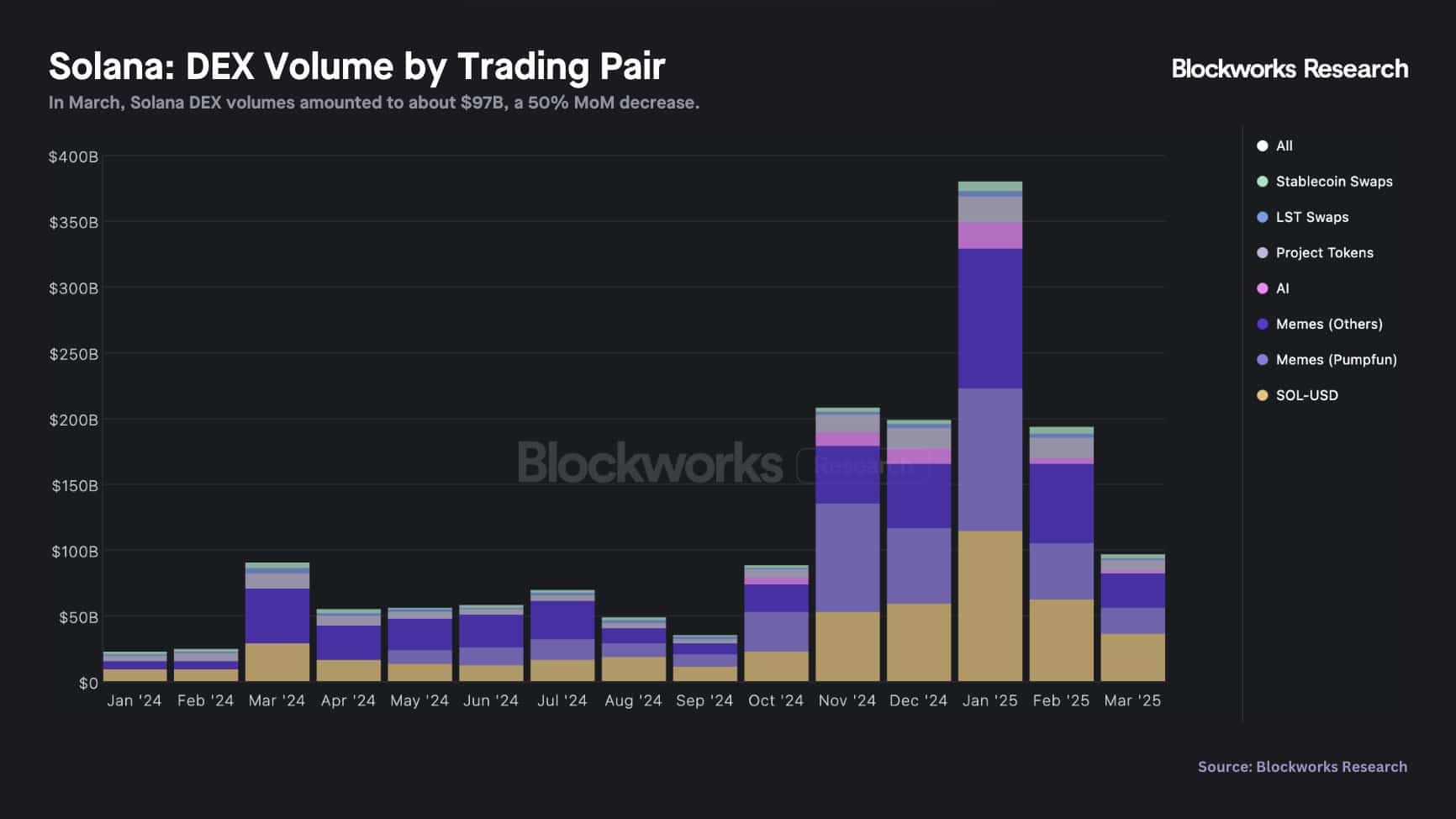

Moreover, the numerous fall in Solana DEX (decentralized exchanges) volumes may exacerbate the worth decline. In truth, based on Blockworks analysis, Solana DEX volumes fell by 50% in March to $97 billion from $193 billion in February.

Supply: Blockworks

Solana’s prime DEX quantity phase, memecoins, additionally dropped from $60 billion to $26 billion over the previous two months. The cool-off in memecoin exercise capped demand for SOL for transactions throughout the ecosystem.

SOL’s value dropped 53% from $240 to $100 over the identical interval.

SOL attracts establishments

Nonetheless, marginal consumers have been aping Technique’s Bitcoin play, similar to SOL Methods.

A brand new entrant, Janover actual property platform, additionally announced plans to amass Solana validators and create a SOL treasury technique. The agency’s JNVR inventory exploded by +800% after the SOL treasury replace.

For its half, SOL Methods had over 3M SOL (practically $400M) staked throughout its validators. The agency’s March report indicated that it purchased 24k SOL and held 267k SOL.

Such institutional demand may increase SOL’s worth in the long run. Nonetheless, the altcoin could also be underneath the whims of the broader market sentiment within the brief time period.

Supply: Deribit

On the Choices market, merchants have been pessimistic about SOL crossing $150 within the first half of April. Nonetheless, solely 10% of merchants count on the altcoin to hit $150 by the tip of the month.

From a technical chart perspective, SOL appeared to defending the slopping trendline assist. Nonetheless, the each day chart RSI was but to faucet the oversold territory – An indication that sellers may nonetheless drag it decrease.

Supply: SOL/USDT, TradingView

As such, SOL may rebound from its press time ranges. Nonetheless, an extra decline to $80 can’t be overruled.