Solana’s momentum against Bitcoin weakens – Explained

- SOL/BTC has been in decline since mid-January 2025, exhibiting weakening demand

- Sharpe Ratio and NRM metrics indicated rising volatility and potential threat for Solana

Solana’s [SOL] battle in opposition to Bitcoin [BTC] has been an exciting experience, however experts suggest that the tide could also be turning. As Solana faces growing strain, a number of key metrics are hinting at a possible bear marketplace for SOL/BTC, harking back to the struggles Ethereum [ETH] confronted in its personal battle with Bitcoin.

With momentum slowing and bearish indicators mounting, are the nice instances for Solana coming to an finish?

State of the SOL/BTC market

The SOL/BTC buying and selling pair has seen a decline in latest weeks, indicative of broader market situations. The truth is, the info highlighted a transparent downtrend since mid-January 2025, with the pair dropping from its excessive of 0.0024 BTC to its press time stage close to 0.0020 BTC.

A hike in promoting strain and falling buying and selling volumes have exacerbated the drop, signaling weaker demand relative to Bitcoin.

Supply: TradingView

Traditionally, Solana has proven intervals of sturdy outperformance in opposition to BTC. Nonetheless, its present decline aligns with market corrections and fading momentum.

The MFI, as an illustration, confirmed a latest uptick, alluding to a attainable short-term restoration as patrons cautiously re-enter the market.

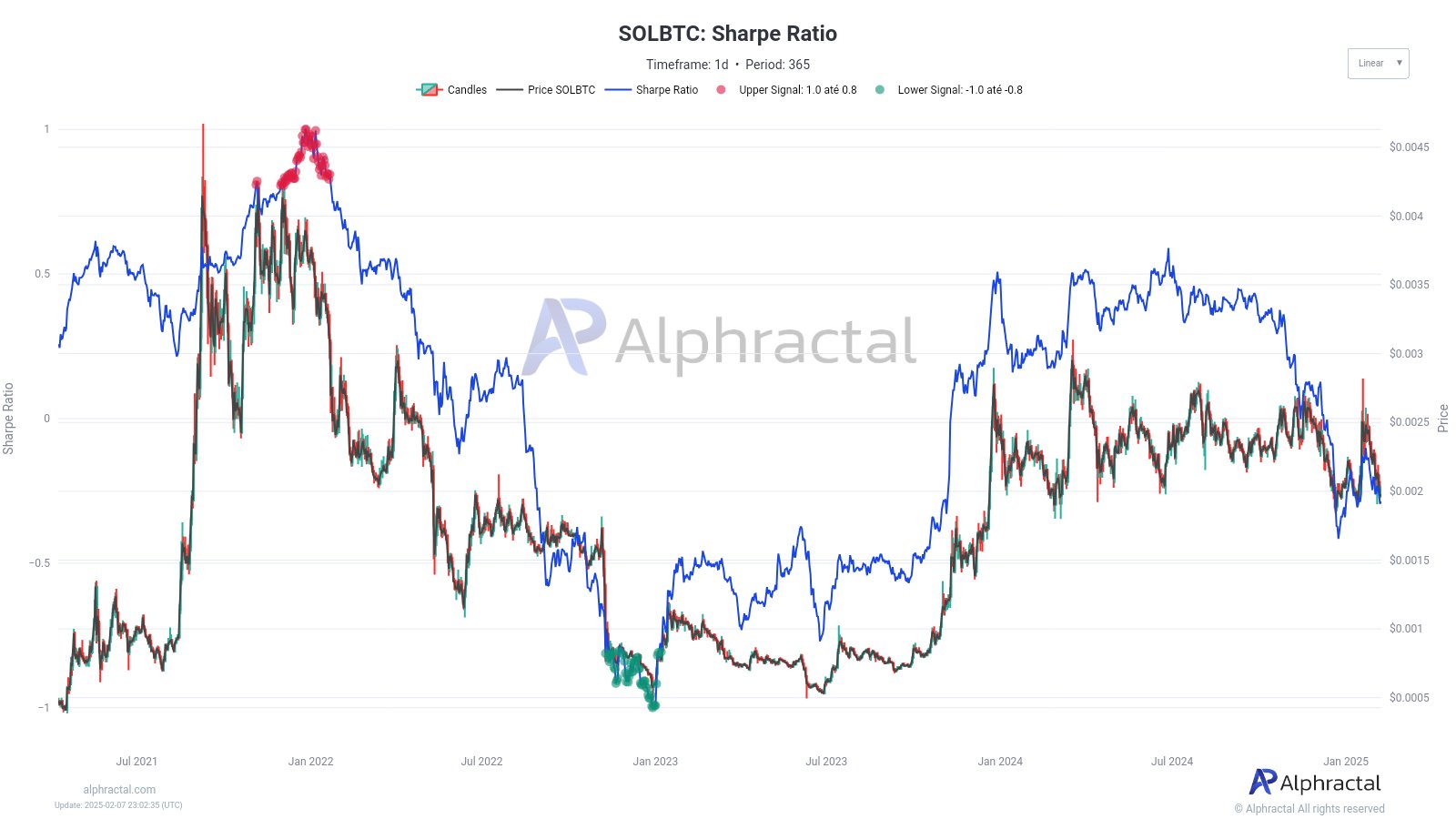

SOL/BTC – Sharpe ratio insights

The info highlighted the connection between the SOL/BTC pair’s worth and its Sharpe Ratio. Traditionally, peaks within the Sharpe Ratio align with worth surges, as seen in mid-2021 and mid-2023.

Nonetheless, sharp declines on this ratio typically sign heightened volatility and threat – Coinciding with worth downturns.

Supply: Alphractal

On the time of writing, the Sharpe Ratio was hovering close to impartial or destructive territory, reflecting diminished risk-adjusted efficiency for SOL relative to Bitcoin.

This gave the impression to be consistent with the latest worth weak spot. The sample pointed to market hesitation, with buyers cautious about allocating closely to SOL throughout unsure intervals. Until a notable enchancment in risk-reward dynamics happens, sustained outperformance in opposition to Bitcoin is likely to be unlikely within the quick time period.

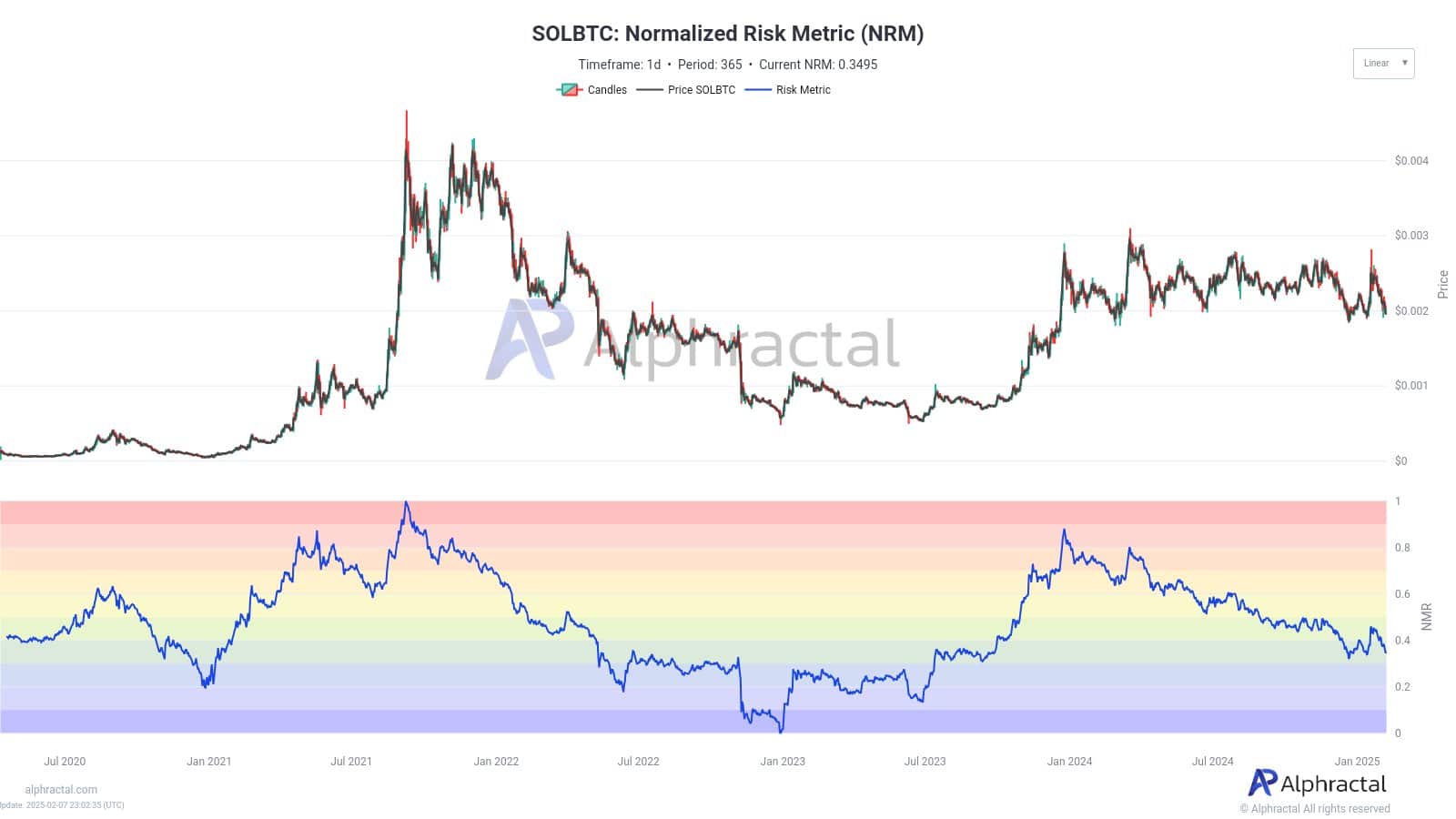

Decoding market traits

The Normalized Threat Metric presents a extra nuanced perspective although. The NRM oscillates inside a gradient band, with greater values in crimson indicating elevated threat and decrease values in blue signaling decreased threat ranges.

Supply: Alphractal

Traditionally, worth peaks coincide with elevated NRM ranges, as seen in mid-2021, suggesting overbought situations and heightened market euphoria. Conversely, dips into the decrease bands have marked accumulation phases, comparable to early 2023, signaling decreased market threat.

Presently, the NRM is hovering within the mid-band, reflecting a extra cautious equilibrium. Which means that the market is neither overly exuberant nor fearful, hinting at a consolidation part for SOL relative to Bitcoin.

Evaluating SOL/BTC to ETH/BTC

When juxtaposing SOL/BTC with ETH/BTC, distinct divergences emerge of their market habits. Whereas ETH/BTC historically mirrors broader market sentiment as a bellwether for altcoin efficiency, SOL/BTC underlines greater volatility, reflecting Solana’s place as a high-beta asset.

Ethereum’s stronger risk-adjusted returns highlighted its attraction to institutional and long-term buyers. Quite the opposite, Solana’s sharper fluctuations pointed to larger speculative curiosity, amplifying each upside potential and draw back dangers.

ETH/BTC has maintained stable help ranges too, reinforcing its standing as a portfolio anchor. In the meantime, SOL/BTC’s frequent excursions into threat zones imply shorter cycles of euphoria and worry, making it extra vulnerable to speedy shifts pushed by whale exercise and ecosystem developments.

Learn Solana’s [SOL] Value Prediction 2025–2026