Solana’s TVL Plummets as Lido Finance Exits the Ecosystem

Within the fast-paced world of blockchain and cryptocurrency, even probably the most distinguished platforms can expertise sudden twists and turns. Solana, acknowledged for its high-speed and low-cost transactions, lately confronted a major setback as its Complete Worth Locked (TVL) took a staggering hit, plummeting by $100 million in a single day. This abrupt decline coincided with an announcement from Lido Finance, a well known liquidity staking platform, declaring its departure from the Solana blockchain.

In associated information, the FTX property boldly staked over 5.5 million SOL on 13 October 2023. This transfer by the property, a key participant within the cryptocurrency house, despatched shockwaves by means of the neighborhood, shedding gentle on the dynamics of the cryptocurrency market and the evolving story of FTX. Because the cryptocurrency world continues to evolve, the implications of this vital stake by FTX and its ongoing authorized battles add layers of complexity to the ever-changing panorama.

Solana Bids Adieu to Lido

Lido Finance, a revered supplier of liquid staking companies, delivered the shocking information confirming its intention to stop operations on the Solana community over the approaching months. Lido Finance is a major participant within the blockchain house, rating because the third-largest protocol on Solana and sustaining a presence on 5 completely different blockchain networks, together with Ethereum. The choice to discontinue its Solana companies was reached following in depth discussions throughout the Decentralized Autonomous Group (DAO) discussion board and a subsequent neighborhood vote. In an official assertion, Lido Finance defined, “The sunsetting of the Lido on Solana protocol was authorised by Lido token holders, and the method will start shortly.”

The first catalyst for this determination was a proposal put forth by P2P Validator, a key contributor to the Solana ecosystem. This proposal laid out the challenges and future prospects of Lido Finance’s presence on the Solana blockchain. The DAO extensively deliberated on whether or not to proceed Lido’s operations on Solana with the backing of the treasury or to discontinue companies altogether. On account of this determination, customers of Lido’s staking companies on Solana, generally known as stSOL holders, will proceed to obtain community rewards all through the method of discontinuation. Lido Finance ceased accepting new staking deposits on Solana as of Monday, initiating node off-boarding on 17 November 2023, with front-end assist scheduled to stop on 4 February 2024.

Solana TVL Loses $100 Million

Knowledge from defiLlama, a distinguished decentralized finance monitoring platform, paints a stark image of Solana’s latest monetary turbulence. The platform, which boasted a TVL of $313 million on 16 October 2023, skilled a precipitous drop, with the determine plummeting to only $210 million on Tuesday. What makes this growth significantly intriguing is that in the identical timeframe, Lido Finance witnessed a constructive change in its TVL. The liquidity-staking dApp, which at present dominates roughly $56.4 million of Solana’s TVL, recorded a notable 7% improve in simply 24 hours.

Solana’s TVL decline occurred concurrently with Lido Finance’s determination to sever its ties with the platform. This decline is noteworthy, particularly contemplating that Solana had been experiencing a constructive value motion over the earlier 24 hours.

Because the substantial lack of TVL on Solana continues to boost eyebrows throughout the cryptocurrency neighborhood, there are at present no different obvious elements to account for this dramatic decline. This example warrants shut monitoring, significantly in gentle of Solana’s latest TVL improve over the previous week, which defied the general sluggish efficiency of the altcoin market. Whereas the latest robust value motion on Solana presents a glimmer of hope for the chain within the brief time period, the long-term ramifications of Lido Finance’s exit stay unsure and can undoubtedly be a subject of intense scrutiny within the blockchain trade.

FTX Property Bullishly Stakes 5.5 Million SOL

In the meantime, the FTX property, identified for its vital presence within the cryptocurrency market, lately demonstrated its bullish sentiment in direction of Solana (SOL) by staking a powerful 5.5 million SOL on 13 October 2023. Based on on-chain information, an FTX-identified pockets initiated the transaction, sending these substantial holdings to Figment, a staking validator agency catering to institutional traders.

The transaction, initially detected by the blockchain tracker Whale Alert, raised eyebrows within the cryptocurrency neighborhood and was later recognized as belonging to the FTX property by the pseudonymous on-chain researcher generally known as Ashpool. These staked cash have a present market worth of roughly $122 million, representing solely a fraction of FTX’s general holdings of SOL.

Staking within the cryptocurrency realm includes locking up a certain amount of cash for a predetermined interval. In return for securing the community by means of their stakes, members obtain SOL coin rewards. This method not solely helps the Solana community’s safety but in addition gives stakers with further incentives.

FTX’s religion in Solana extends again to its early funding within the mission, and the alternate persistently receives a considerable quantity of unlocked SOL, adhering to a longtime vesting schedule. The FTX property, beneath the oversight of a chapter trustee, retains the choice to liquidate these holdings at its discretion. The first mission of the property is to recuperate belongings for distribution amongst FTX’s collectors.

In a major growth in September, a United States court docket granted approval for the sale of $1.3 billion price of SOL from FTX’s holdings. This determination initially precipitated considerations amongst market members, fearing a possible value stoop. To mitigate any adversarial influence on the cryptocurrency market, the chapter court docket mandated that the sale happen by means of an funding adviser in weekly batches. Consequently, SOL’s value skilled a brief dip, hitting a two-month low of $17.34 on 11 September 2023.

FTX, as a distinguished participant within the cryptocurrency house, holds a various portfolio of digital belongings, together with however not restricted to Solana, Bitcoin, Ethereum, Aptos, and numerous different cryptocurrencies. Courtroom filings from September point out that over $7 billion has been efficiently recovered since FTX filed for chapter safety in November 2022.

You will need to be aware that Sam Bankman-Fried, the co-founder of FTX, at present faces a trial at a district court docket in Manhattan. He stands accused of fraud and conspiracy to commit fraud, with the potential of serving as much as 115 years in jail if discovered responsible. This ongoing authorized battle provides a further layer of complexity to the broader FTX story, making the alternate’s latest bullish transfer in Solana much more intriguing to market observers.

Worth Overview

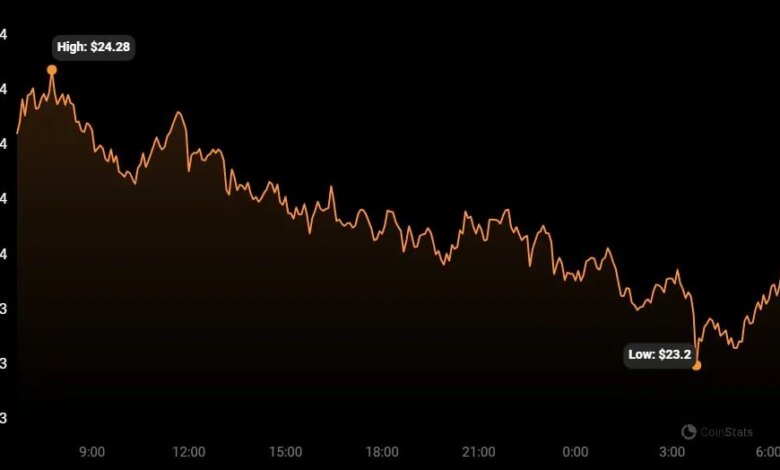

Knowledge from the cryptocurrency value monitoring web site CoinStats indicated that SOL suffered a 1.67% loss over the previous day of buying and selling. Consequently, the altcoin was altering fingers at $23.58 at press time. Notably, the latest drop in value was not sufficient to flip SOL’s weekly efficiency into the crimson. In consequence, the cryptocurrency’s value was nonetheless up 8.73% over the previous 7 days.

Worth chart for SOL (Supply: CoinStats)

Along with weakening in opposition to the Greenback, SOL was additionally outperformed by the main cryptocurrency Bitcoin (BTC) all through the previous 24 hours. CoinStats information confirmed that SOL was down 0.75% in opposition to BTC. This meant that 1 SOL token was price 0.00083529 BTC.