Solo Bitcoin miner beats the odds, scoring a $310k jackpot on a single block

- A solo Bitcoin miner efficiently mined one block with a $307,000 reward

- The solo miner defied the percentages, provided that Bitcoin’s mining hash price has elevated considerably over the previous 12 months

A solo Bitcoin [BTC] miner has defied the percentages after mining one Bitcoin block valued at $307,000.

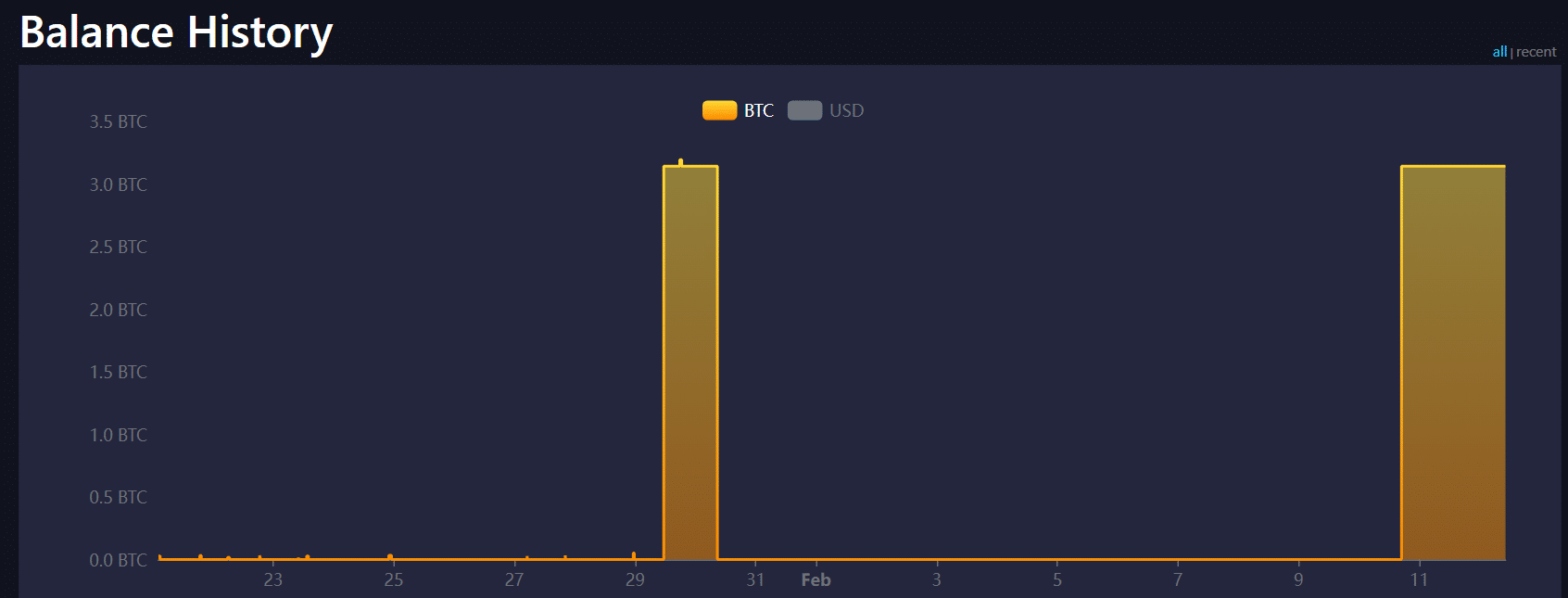

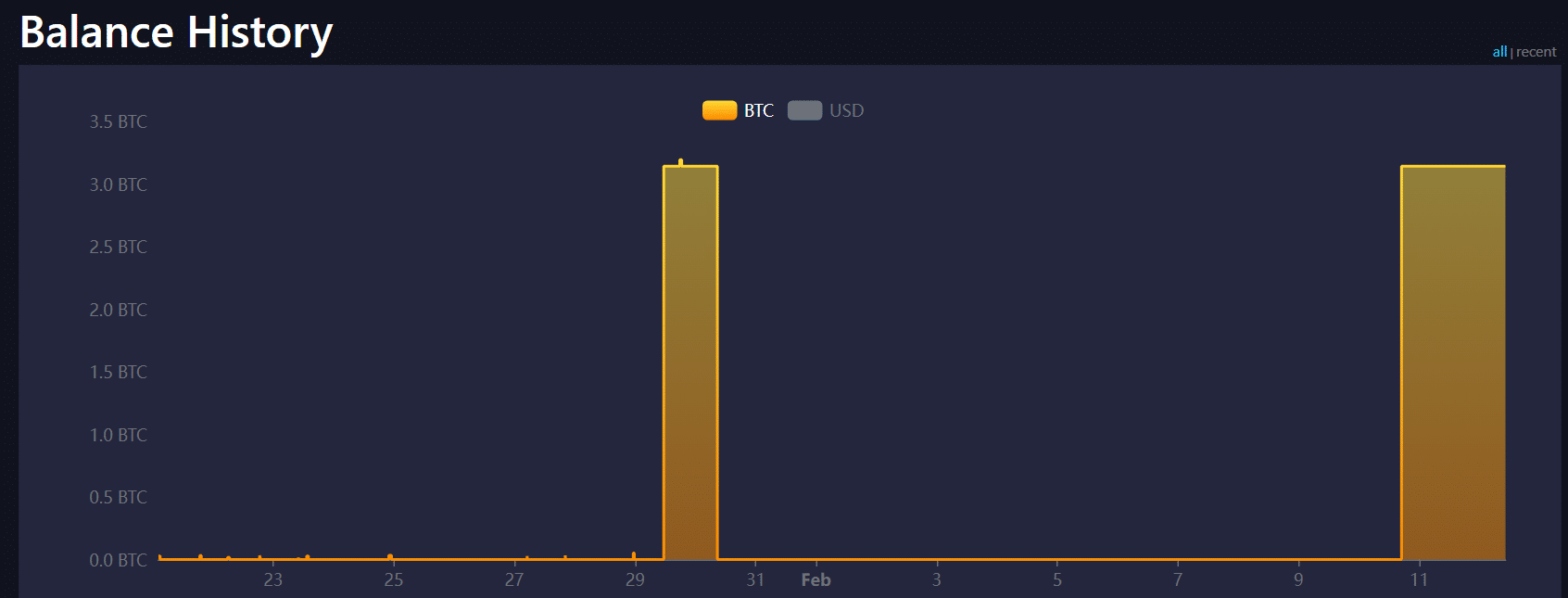

Block 883,181 was mined by this solo miner on tenth February, and it contained 3.158 BTC per mempool.

Given the excessive computing energy that’s wanted to mine Bitcoin, it’s uncommon for solo miners to earn block rewards towards giant mining swimming pools and firms.

Nonetheless, this miner, whose id stays unknown, is thrashing the percentages, provided that the tackle seems to have mined one other block in late January.

Supply: mempool.area

Based on Marshall Long, this miner is perhaps utilizing the Bitaxe mining gadget. This gadget is good for solo miners searching for excessive computational energy to extend their odds of efficiently getting block rewards.

Analyzing Bitcoin’s rising hash price

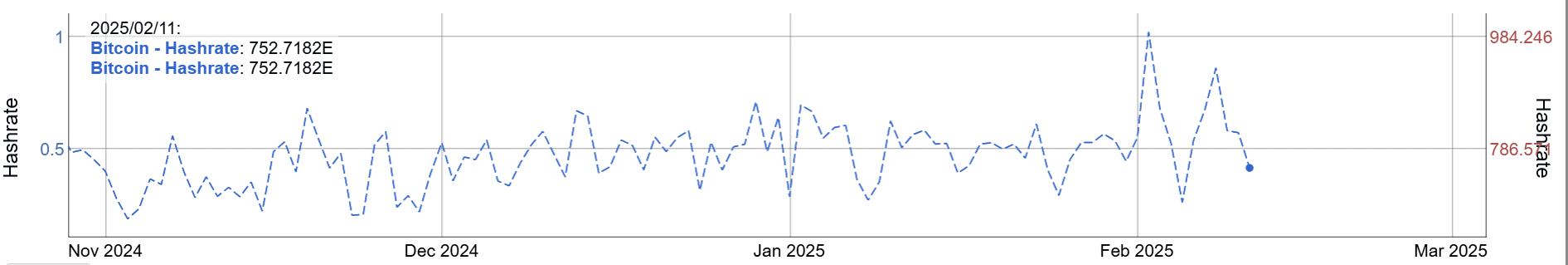

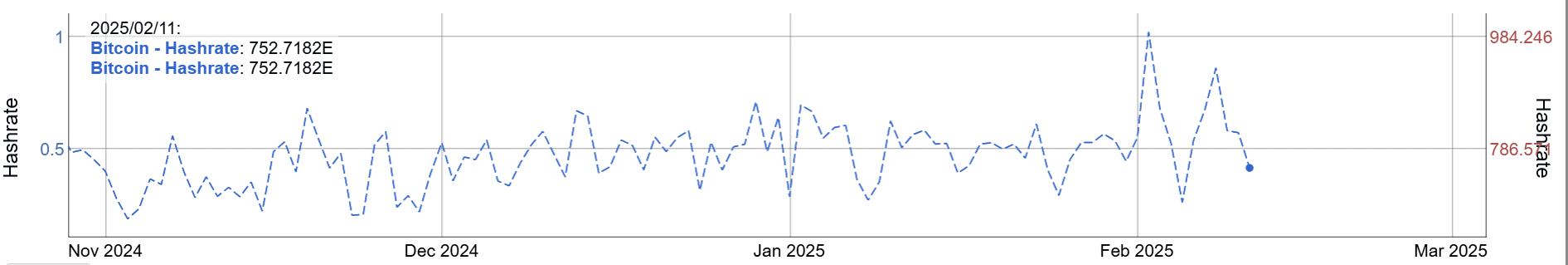

Bitcoin’s hash price is the computational energy wanted by miners to mine blocks, and due to this fact safe BTC rewards. On the 2nd of February, the hash price hit a document excessive of 992 exahashes per second, in keeping with Bitinfocharts.

It has since dropped to 752 exahashes per second.

Supply: BitInfoCharts

A rising hash price reveals that extra miners are becoming a member of the community, growing the mining issue. This spike comes barely one 12 months after the Bitcoin halving occasion that slashed block rewards.

The rising hash price amid low rewards makes it difficult for solo Bitcoin miners to grow to be worthwhile.

Nonetheless, in current months, there was an uptick in solo miners mining BTC. In December, person Vivek reported on X (previously Twitter) that one miner mined a whole Bitcoin block for a $311,000 reward.

In late January, one other solo miner additionally secured a $326,000 reward

Are Bitcoin miners promoting?

Miners are inclined to promote their cash to fulfill operational prices. Nonetheless, a surge in miner inflows to exchanges might trigger downward strain on the worth.

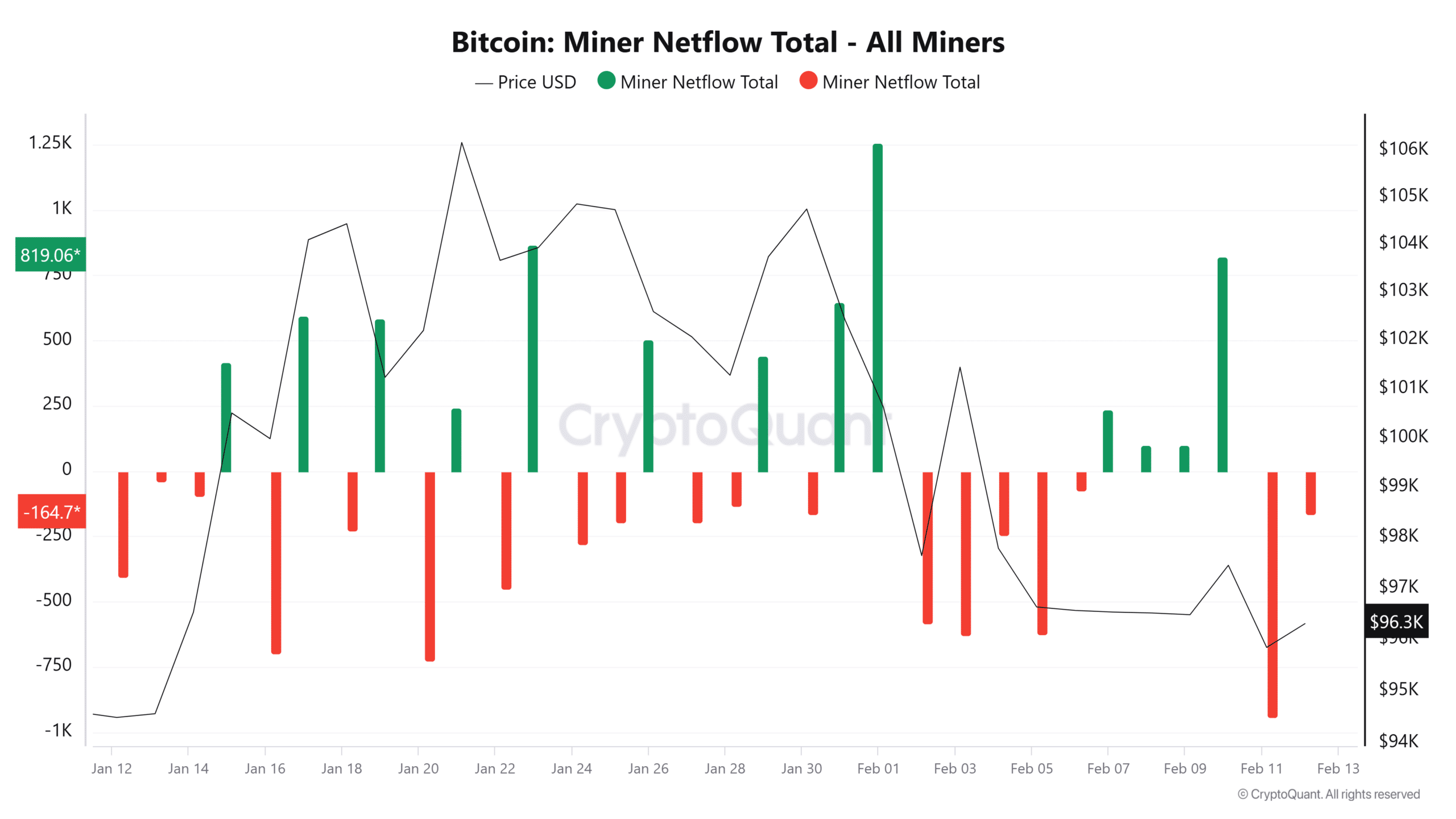

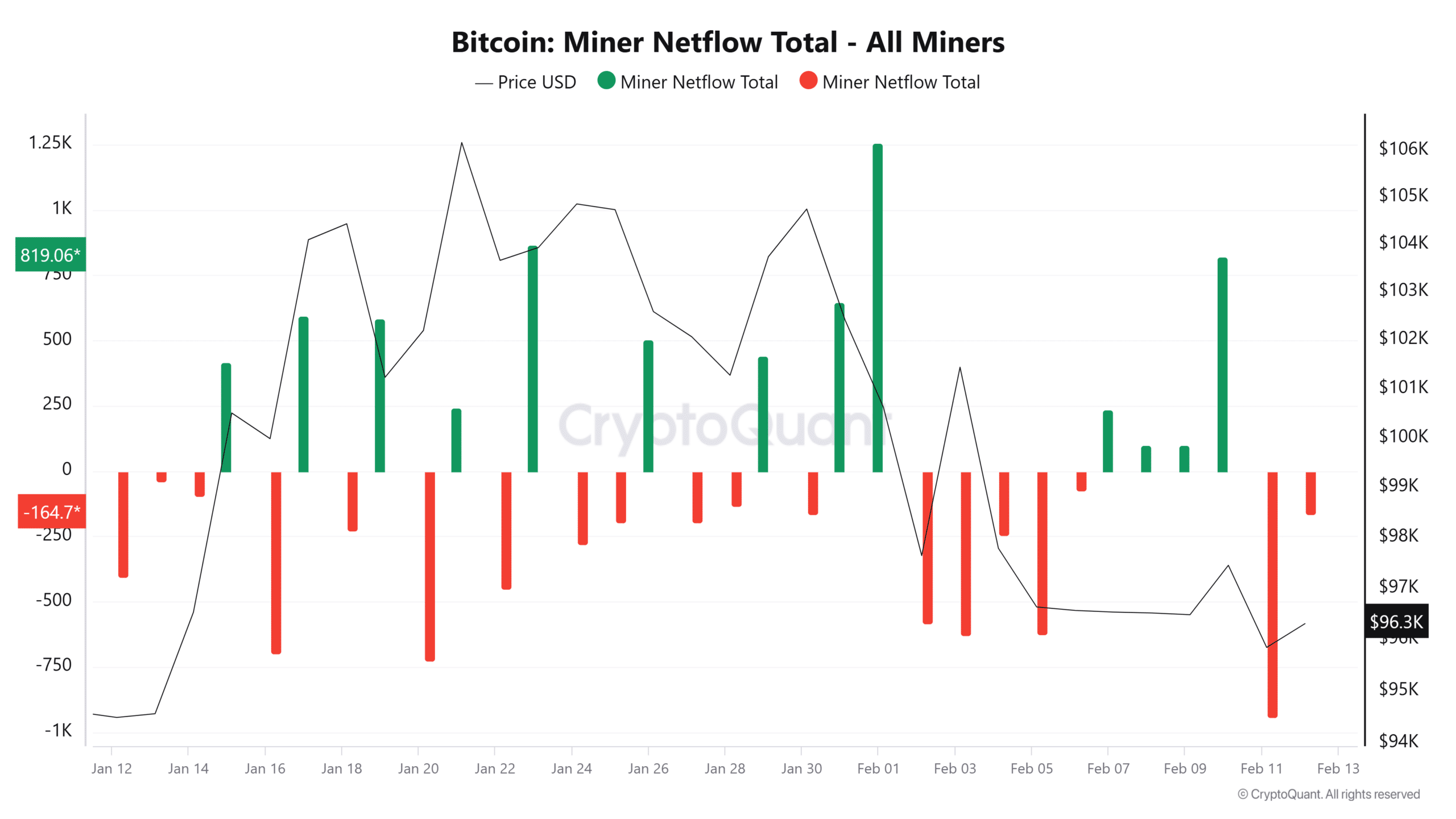

Based on CryptoQuant, miner netflows have flipped unfavourable and dropped to the bottom stage in a single month, This means that they offered extra cash than they produced.

Supply: CryptoQuant

Bitcoin, at press time, was buying and selling at $96,325 after a 2% drop in 24 hours.

If miners proceed to promote, it might exert downward strain on the worth that would hinder the king coin’s capacity to reclaim the $100,000 psychological stage.