Sotheby’s Auctions NFTs From Bankrupt Crypto Hedge Fund

Sotheby’s, one of many world’s oldest and largest public sale homes, introduced on Friday the public sale of seven NFTs that belonged to the bankrupt cryptocurrency hedge fund, Three Arrows Capital (3AC).

The public sale noticed the gathering of digital artwork items being bought for a formidable sum of roughly $2.5 million. This important occasion was a testomony to the persevering with relevance and worth of NFTs, even amid the collapse of their authentic proudly owning entity.

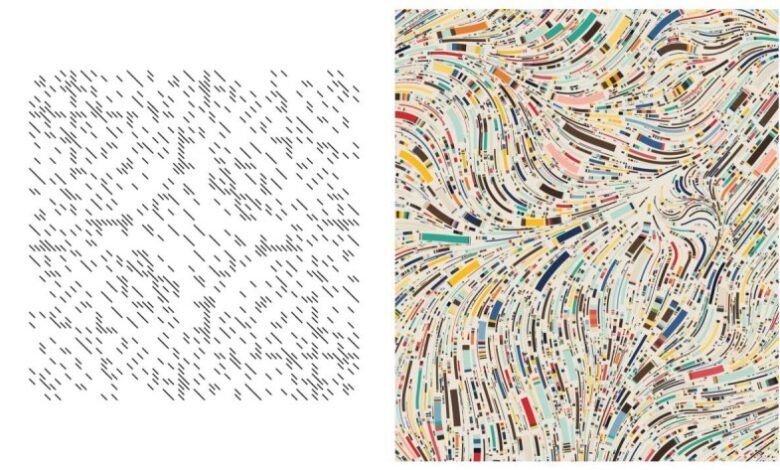

The Highlight on Fidenza #725

Of the seven auctioned NFTs, one which stood out was a digital piece titled “Fidenza #725“. This digital artwork, with its distinctive composition of graphic dashes and curves displayed in a muted palette of cream, yellow, pink, and black, was the showstopper. It not solely attracted the best bid however was ultimately bought for a whopping sum of over $1 million.

Three Arrows Capital had bought this piece for 135 Ether in 2021, which was roughly equal to about $341,786 at the moment. Because of this the promoting worth on the public sale represented an nearly threefold enhance from the unique buy worth, highlighting the potential profitability of the NFT market.

Three Arrows Capital: A Case of Crypto Chapter

The public sale of 3AC’s NFTs was a part of the broader liquidation course of for the hedge fund. In line with a memo launched in February by Teneo, one of many court-appointed liquidators, 3AC’s belongings have been being liquidated following its chapter submitting.

Primarily based in Singapore, 3AC had the unlucky recognition of being the primary important cryptocurrency agency to declare chapter in 2022. The agency was significantly hard-hit by the extreme downturn of two cryptocurrencies – Luna and TerraUSD, which led to its eventual chapter submitting within the British Virgin Islands in late June 2022.

When Three Arrows Capital declared chapter, it estimated its complete belongings to be round $1 billion. Roughly $22 million of those belongings have been linked to the agency’s in depth assortment of NFTs.

The Greater Image

The profitable public sale of 3AC’s NFTs demonstrates the resilience and inherent worth of those digital belongings, even amidst difficult circumstances. Regardless of the chapter of 3AC, the appreciable costs realized on the public sale spotlight the potential worth that digital belongings proceed to carry within the market.

Furthermore, this occasion underscores the unstable nature of the cryptocurrency and digital artwork markets. The involvement of conventional establishments like Sotheby’s within the auctioning of NFTs alerts a rising acceptance and integration of those digital belongings into mainstream tradition.