South Korean crypto trading volumes soar with altcoins taking center stage

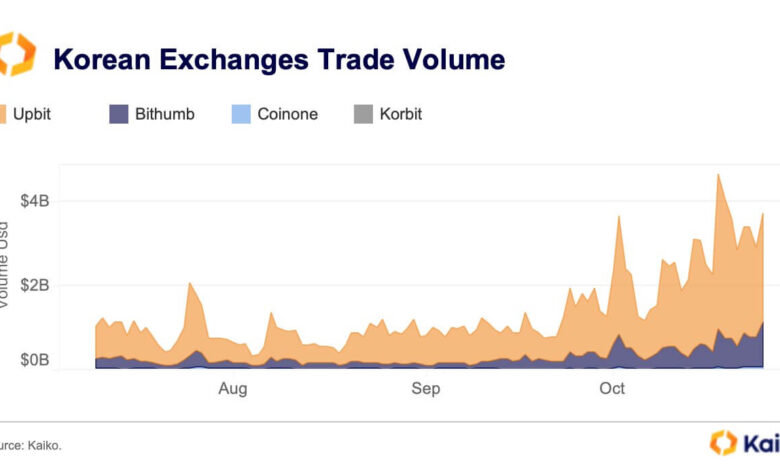

Each day buying and selling volumes on South Korean exchanges have hit their highest level since August final 12 months, with altcoins dominating the transactions, in response to data from blockchain analytical agency Kaiko.

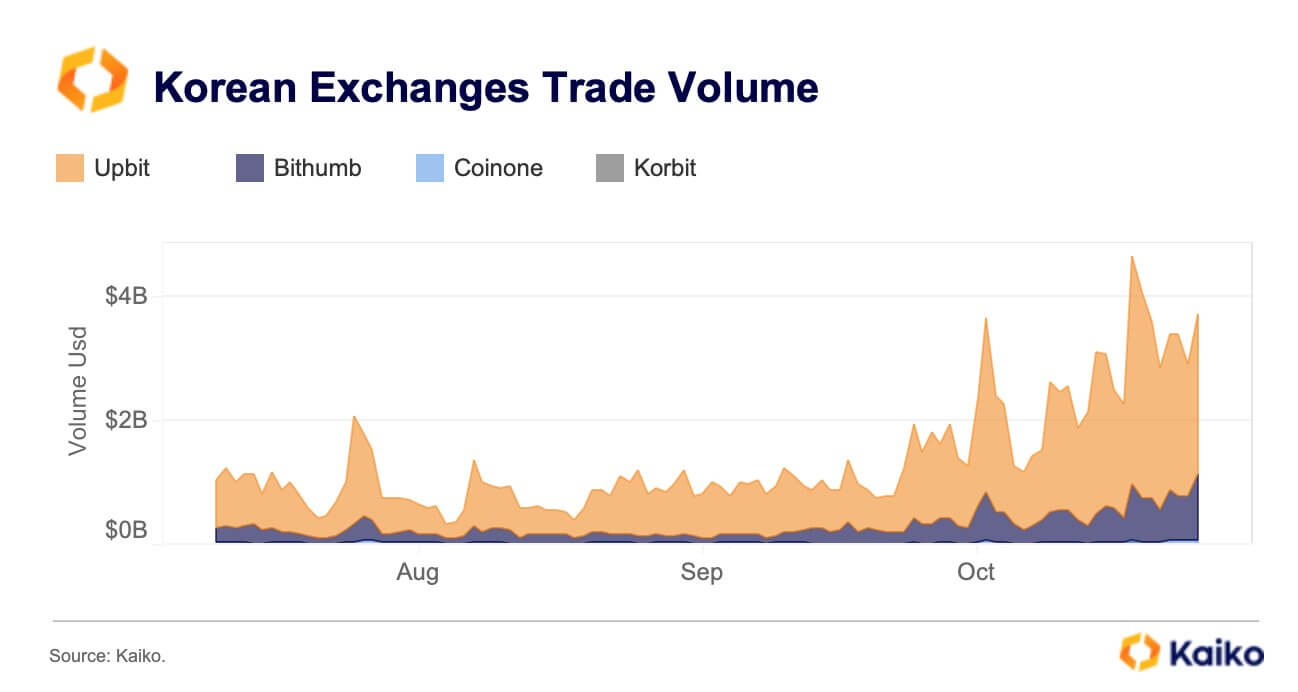

Buying and selling actions on main South Korean platforms, together with Upbit, Bithumb, Coinone, and Korbit, surged to a median of greater than $4 billion in direction of the top of October and the start of November earlier than dropping to greater than $3 billion.

Information from CCData, as reported by Bloomberg, additionally corroborates these upward buying and selling actions on South Korean exchanges. Based on the report, crypto buying and selling platforms within the Asian nation noticed their market shares rise to round 13% from the 5.2% recorded in January.

Round this era, the crypto market noticed flagship digital belongings like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) rally to new yearly highs pushed by the market optimism surrounding the attainable approval of a spot exchange-traded fund (ETF) in the US.

Nevertheless, South Korean crypto merchants closely commerce altcoins, in response to CryptoQuant analysts.

Upbit dominates

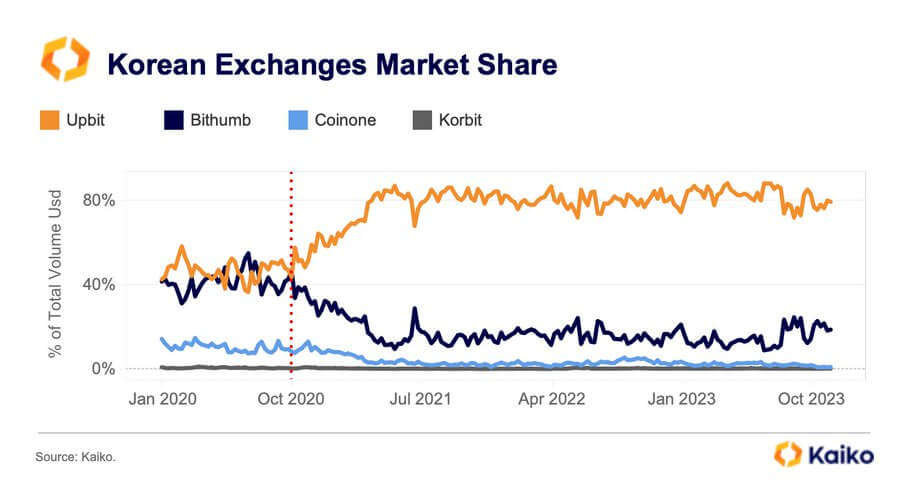

In the meantime, the Kaiko information restates Upbit’s South Korean crypto market dominance, because the trade accounts for many buying and selling actions.

Kaiko noted that Upbit’s market dominance had soared to as excessive as 90% in Could final 12 months earlier than barely declining to round 80% in October 2023. Altcoins account for 88% of all buying and selling actions on Upbit.

However, its rival, Bithumb, controls round 20% of the market. Throughout the previous 12 months, the crypto trade’s management has confronted varied challenges, with its majority shareholder, Kang Jong-hyun, being arrested for allegedly embezzling roughly $50 million.

This has resulted in its newest efforts to rebuild public belief by planning an Preliminary Public Providing (IPO) for 2025 and eradicating transaction charges.