Stablecoin dominance to fall once again? Impact on Bitcoin’s market will be…

- Stablecoin trade reserves highlighted rising shopping for energy available in the market

- Bitcoin’s dominance chart urged the market may favor BTC within the coming weeks

Tether [USDT] and USD Coin [USDC] are the most important stablecoins by market capitalization proper now. Actually, their mixed dominance stood at 7.19% at press time. The dominance developments of Bitcoin [BTC] or stablecoins can make clear market-wide sentiment and what the long run value actions might be.

Therefore, the query – What can we discover out from their metrics, and the way does it mix with the BTC dominance chart to offer actionable insights for merchants?

Stablecoin and Bitcoin dominance metrics present altcoins might be set to endure extra

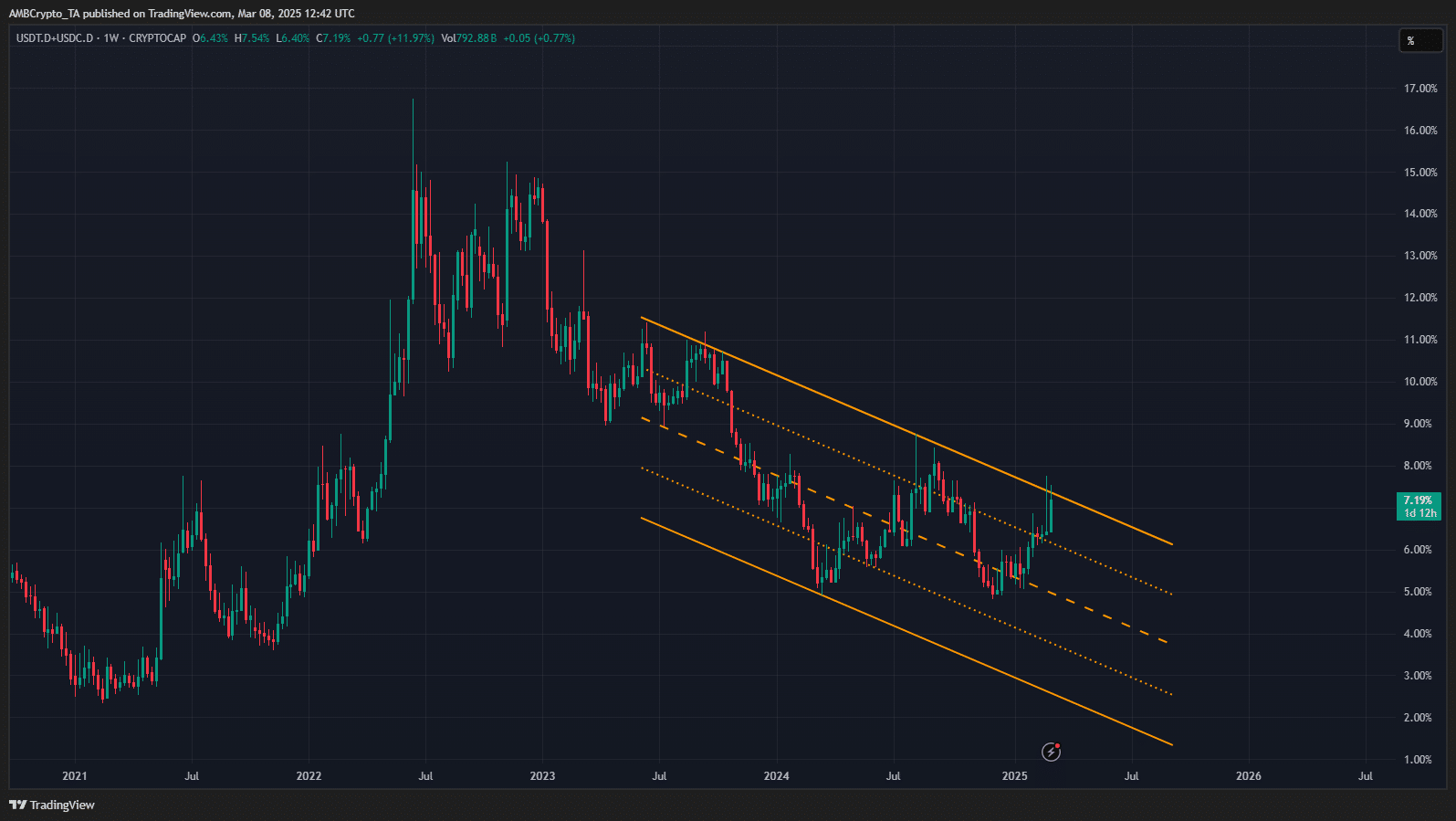

Supply: USDT.D+USDC.D on TradingView

The mixed dominance of Tether and USD Coin have been shifting inside a descending channel on the 1-week chart, plotted in orange. The motion of the stablecoin dominance might be inversely associated to crypto costs. Larger stablecoin dominance implies traders want to carry stables, as an alternative of altcoins or Bitcoin.

Conversely, a fall in dominance from USDT and USDC would suggest traders’ capital is pouring into different belongings, driving their costs increased and indicating a extra bullish market setting.

Within the aforementioned chart, the descending channel formation meant the dominance would quickly fall. A breakout is feasible, however unlikely, as this channel has been revered since July 2023. A fall in stablecoins’ dominance may see an uptrend for Bitcoin, and probably many altcoins too.

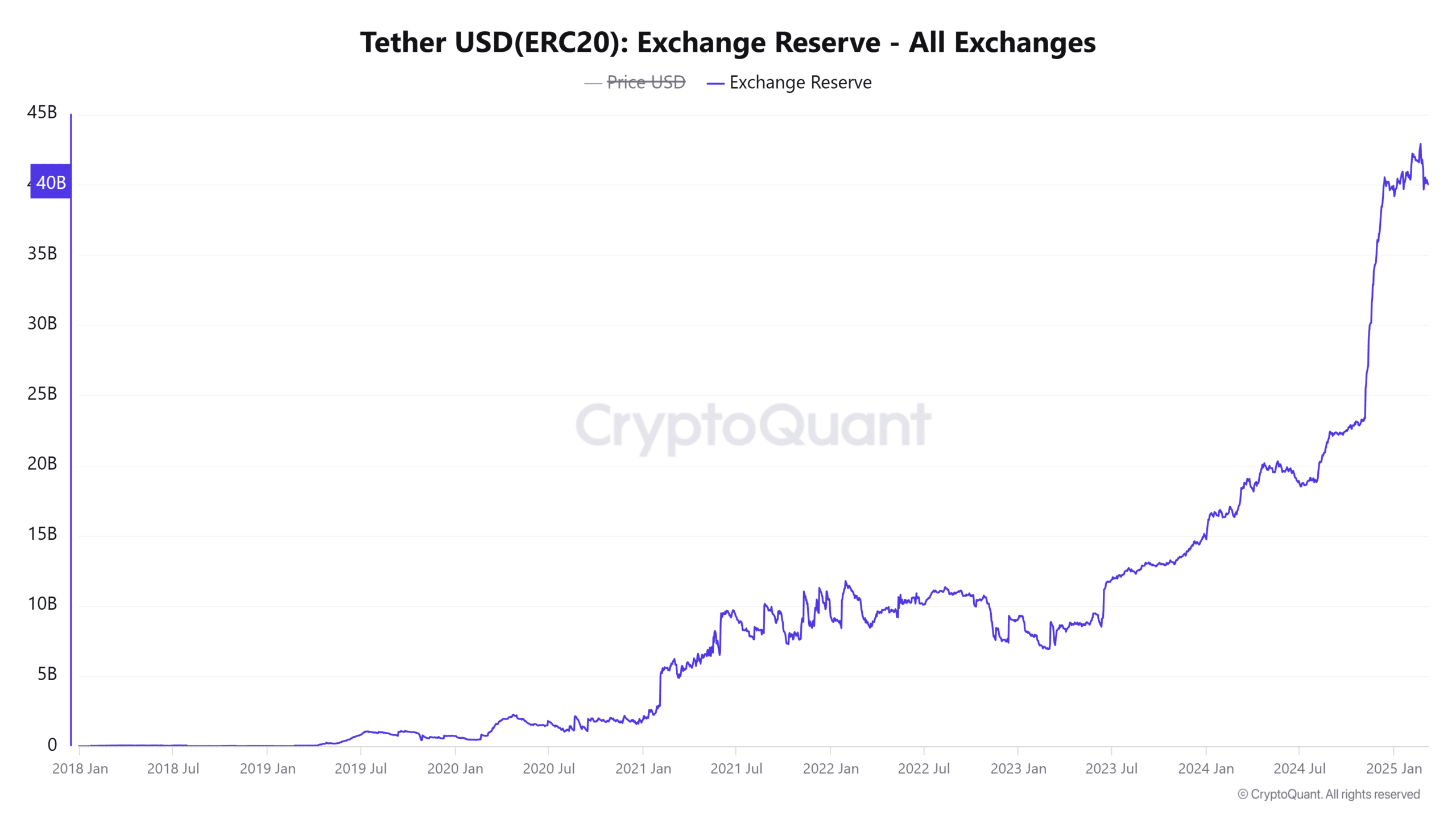

Usually, a crypto asset’s rising trade reserves would suggest heightened possibilities of promoting strain.

Nevertheless, a hike in USDT reserves on centralized exchanges implies heightened shopping for energy. Actually, their pattern has been pointing increased over the previous 18 months, with fast development seen particularly in November 2024.

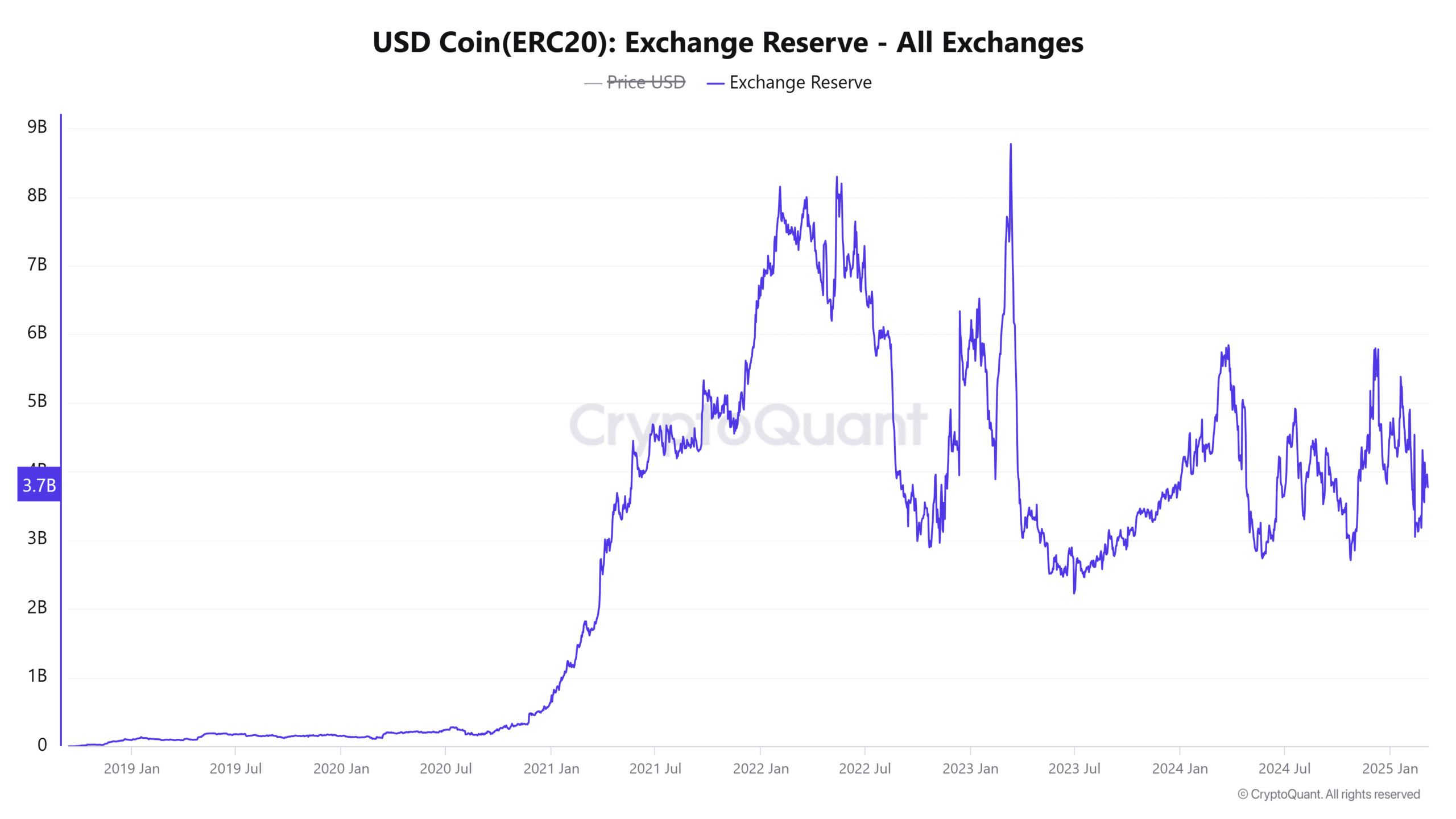

USD Coin additionally noticed development in its trade reserves, however not as fixed as USDT.

The reserves have been at $4.2 billion at press time, in comparison with USDT’s $42.1 billion. These volumes urged that USDT doubtless stays the favored stablecoin for buying and selling and liquidity functions.

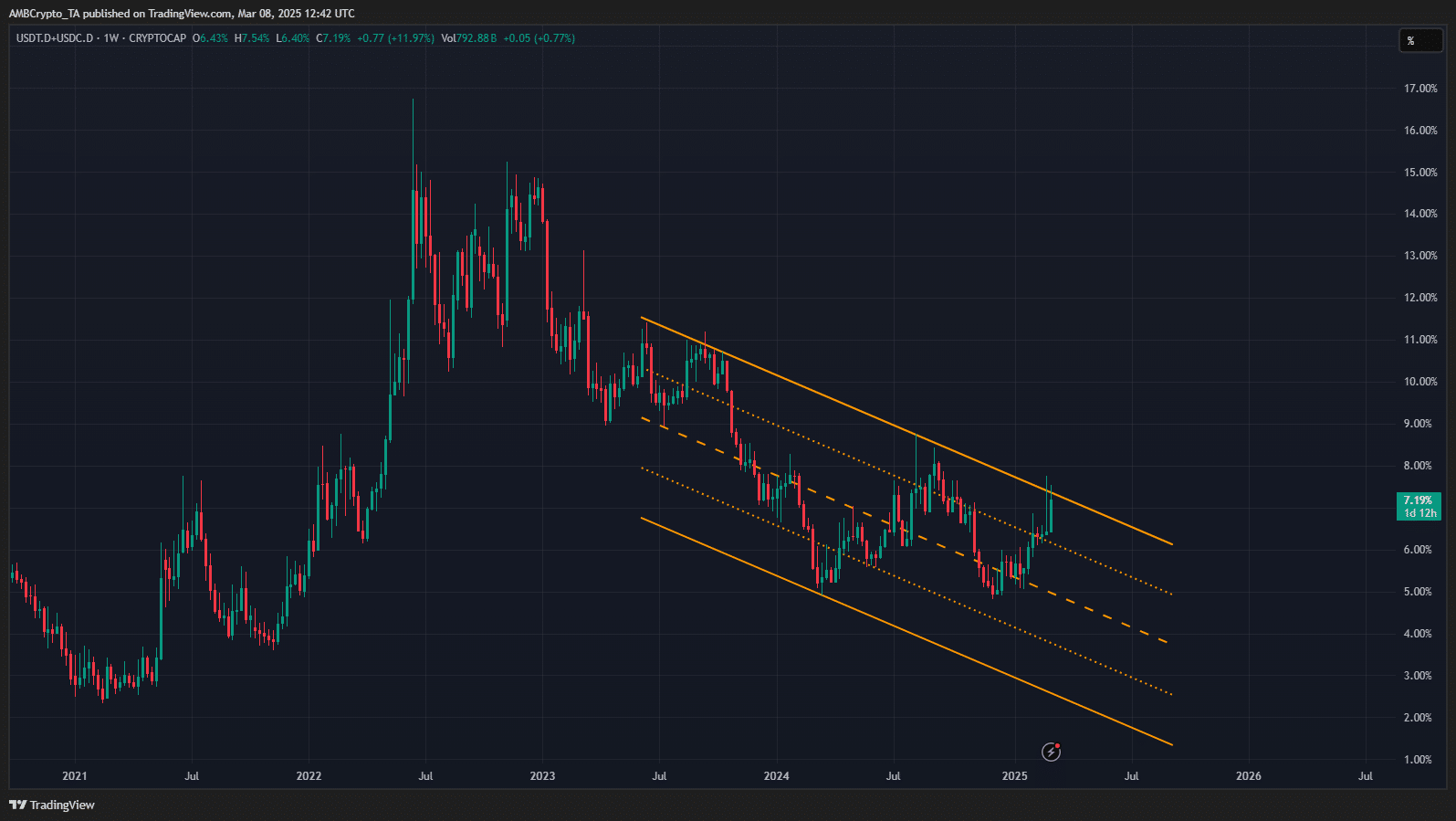

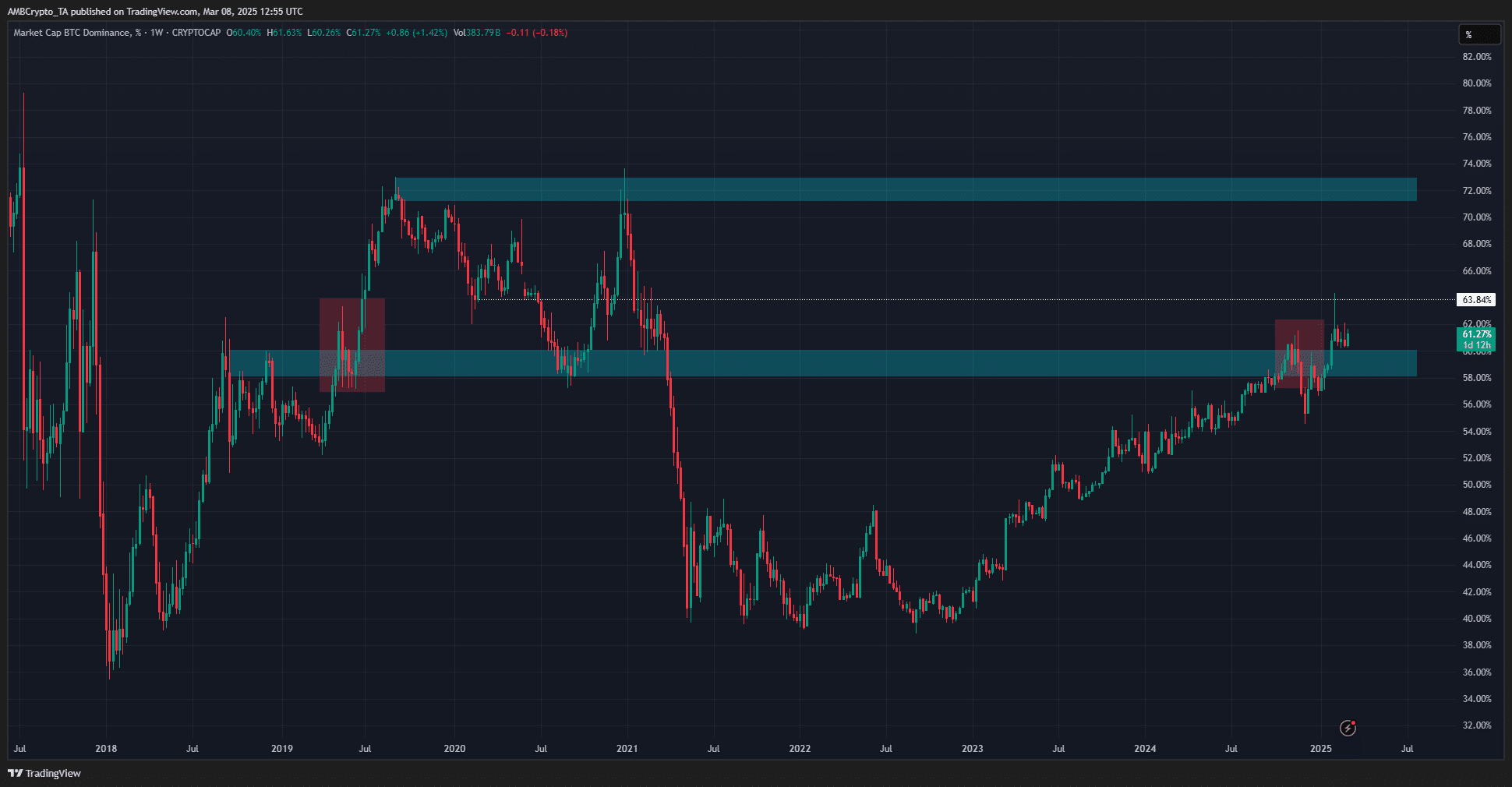

Supply: BTC.D on TradingView

The weekly chart of BTC.D underlined some similarities between November-December 2024 and Might 2019. On each events, the 60% stage served as resistance and was flipped to help after a deviation beneath it.

What remained was a transfer to the 72% stage. Like stablecoin dominance, BTC.D is inversely correlated to altcoin efficiency. An uptick in BTC.D implies Bitcoin gaining extra worth than the altcoin market (or shed much less worth).

Nevertheless, capital rotation after robust BTC-centered positive aspects may usher in an altseason. Whereas the value motion in current months has killed this hope amongst market contributors, maybe, it may not be really useless.