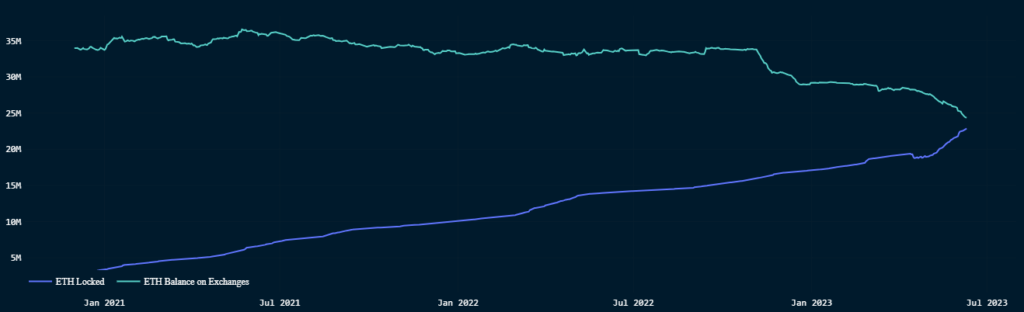

Staked ETH On Steady Course To Surpass Exchange Balances

Abstract:

- Information from Blockchain Intelligence startup Nansen reveals a gentle enhance within the variety of staked ETH.

- To date, customers and entities have locked over 22 million cash which quantity to about 18% of the token’s provide.

- On the identical time, balances in crypto exchanges are declining and now sit beneath 30 million tokens.

- Analysts say the Shapella improve eradicated considerations round withdrawals and triggered a growth in locked tokens since stakers can earn rewards versus simply holding their cash.

The variety of staked ETH continues to extend following the discharge of Shapella which enabled withdrawals for locked cash on Ethereum’s Beacon chain.

Following the Merge – Ethereum’s large technological transition from proof-of-work to proof-of-stake – proponents have been involved about withdrawal performance and attainable promoting stress in the marketplace.

Each considerations have been rendered non-events, mentioned Nansen’s Martin Lee as Shapella galvanized customers and entities alike to stake extra tokens.

At press time, the variety of staked cash crossed 22 million tokens. This quantities to round 18% of the obtainable provide. The Merge additionally slashed emissions that means that fewer tokens are launched per block as rewards, taking ETH right into a deflationary state.

ETH On Exchanges

On the time when staked tokens proceed on the upswing, token balances on crypto exchanges have steadily declined. Balances in crypto exchanges have dropped beneath 30 million, per Nansen information.

One cause for this might be that entities usually tend to stake their token now that withdrawals are enabled relatively than merely hodl the asset.

Analysts opine that the staking incentive is bigger now since withdrawals are attainable and stakers can earn yield or rewards for locking their tokens. In distinction, holding the token on crypto exchanges earns no yield.

Following lawsuits from the U.S. Securities and Change Fee towards Binance and Coinbase, crypto costs fell throughout the board. Merchants have been in a position to scoop up tokens round $1,740 a pop throughout buying and selling hours on Monday.