Staked Ethereum reaches weekly high: How whales played a part

- Deposits on the chain have outpaced withdrawals this week.

- The variety of ETH staked decreased as the worth of the altcoin jumped.

In three separate transactions, a whale despatched 12,800 Ethereum [ETH] to the Beacon Chain on the twenty seventh of March. Based on Whale Alert, the primary switch was 6400 ETH, valued at $23.05 million.

The subsequent ones have been additionally with the identical quantity.

For the uninitiated, the Beacon Chain has been a key a part of Ethereum because it transitioned to Proof-of-Stake (PoS). With the chain, customers can take part in governance, act as validators, and in addition stake their ETH.

It’s raining curiosity on the chain

Beforehand, the Beacon Chain solely allowed deposits by way of a contract. Nevertheless, the 2023 Shanghai improve modified that and offered validators to withdraw their staked property.

AMBCrypto’s analysis confirmed that these transactions talked about above have had a optimistic impression on the staking sector.

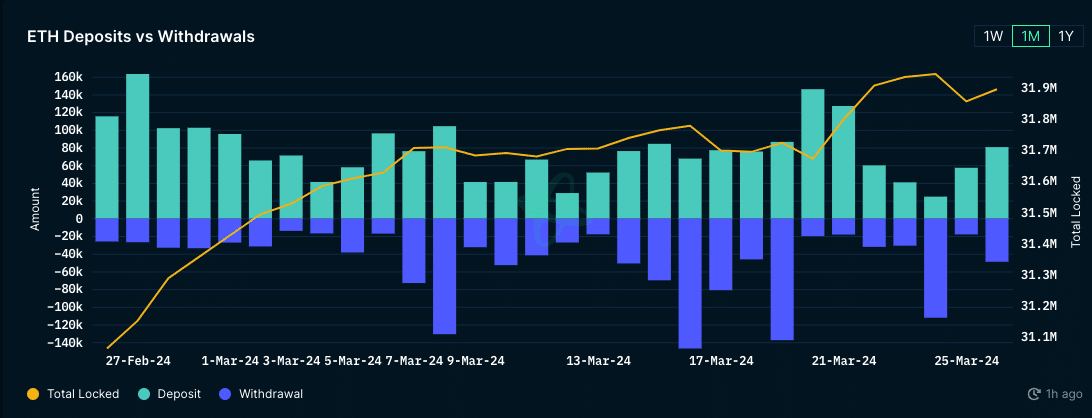

At press time, Nansen knowledge confirmed that deposits for the reason that starting of the week tapped a brand new excessive.

Supply: Nansen

Particulars from our examination showed that ETH deposits have been as excessive as 80,463. Nevertheless, withdrawals couldn’t match up because the quantity was 49,101 ETH as of this writing.

This distinction was proof that validators, who have been to deposit a minimal of 23 ETH, trusted Ethereum to provide a superb yield. In complete, 23.9 million ETH has been deposited since Shanghai.

Withdrawals, alternatively, have been decrease at 10.1 million.

As anticipated, Lido Finance [LDO] led the highest entities’ cohort. Nevertheless, there was a change within the provide of ETH staked. In a earlier article, AMBCrypto reported how almost 30% of the availability was locked.

Value will increase drive withdrawals

However press time knowledge confirmed that the ratio has declined to 26%. This lower might be related to the surge in withdrawals at completely different occasions.

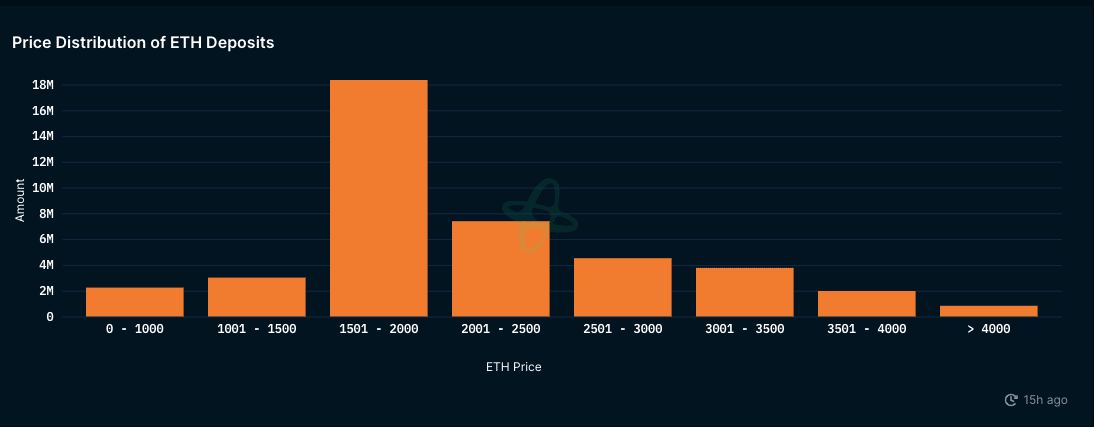

Moreover, on-chain knowledge confirmed that as the worth of ETH elevated, the deposits fell.

From the chart under, you may see that the quantity of staking deposits when the cryptocurrency traded between $2,500 and $3,000 was increased than when the worth was over $4,000.

Supply: Nansen

This knowledge explains that some validators have been glad with the reward as these costs. If this pattern continues, then deposits on Ethereum’s Beacon Chain may scale back as the worth will increase.

Nevertheless, the sentiment may change contemplating what occurred when ETH modified palms under $1,500 and when it traded above it.

Within the meantime, ETH’s worth was $3,585. This worth was a 2.05% lower within the final 24 hours. Regardless of the current decline, there have been bullish predictions for the cryptocurrency.

Sensible or not, right here’s ETH’s market cap in BTC phrases

If these predictions come to move, then it would instill confidence in validators ready on the sidelines to lock their property.

On the similar time, those that have staked at a a lot decrease worth might view the hike as a chance to get their yield.