Staking Crypto Yields in Top 35 Cryptocurrencies Hit Historic Low

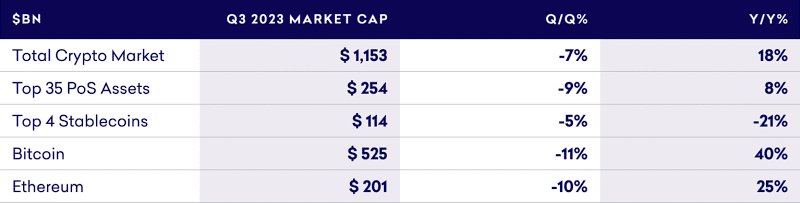

As proof of stake networks see a surge in stake charges, a consequent plummet in staking yields is regarding buyers and market watchers. According to a third-quarter report from Staked, a subsidiary of the Kraken change, the typical staking yield for the highest 35 stakable cryptocurrencies has dwindled to a record-breaking low. Staking crypto has typically been touted as a approach to generate passive revenue, however the declining yields have raised questions on its long-term viability and potential regulatory implications.

The Metrics That Baffle the Market

The common staking yield throughout proof of stake networks has sagged to a meager 10.2%, attributed to a rising common stake fee of 52.4% amongst buyers. Ethereum, the most important community that employs proof of stake, displayed a very noticeable drop. Its Consensus layer yield sank to three.2%, and the entire provide of staked belongings within the community rose to an unprecedented 22%. As for Ethereum’s Execution layer, it plummeted to a mere 1.3%.

“The mixture of a excessive stake fee, and transaction exercise shifting from Mainnet (L1) to the assorted Ethereum Layer 2 networks (L2), resulted in a Q3 staking yield of 4.5%, ETH’s lowest on file,” the report acknowledged.

Why Staking Crypto Yields Matter

Staking crypto

is not only a way for buyers to earn; it additionally kinds an important a part of the blockchain ecosystem. Staking enhances the network’s overall security and stability by locking a certain quantity of cryptocurrency for a particular interval.

🚀Crypto staking hits new highs in Q3 2023!📈Aptos and Sui lead the cost with 84.1% and 80.5% staked. Regardless of the surge, common yield dips to 10.2%. Polkadot and Cosmos shine with yields above 7.5%, whereas Ethereum hits a low at 4.5% .#CryptoNews #StakingSurge #EthereumUpdate🚀

— Market Movers (@MarketMovers_1) October 26, 2023

As staking yields decline, the attractiveness of this sort of funding might wane. Even with its chapter proceedings, FTX staked $150 million in Ethereum and Solana tokens, a transfer with a aim of producing further income to compensate its purchasers, highlighting the draw that staking crypto has had even for institutional gamers.

Regulatory Consideration and Its Results

Staking actions haven’t escaped regulatory discover. In February, the U.S. Securities and Exchange Commission (SEC) slapped Kraken with a $30 million fine for failing to register its staking product as a securities providing. Moreover, the SEC’s ongoing legal action against Coinbase has additionally categorized staking as securities. This heightened regulatory scrutiny might be an element influencing the staking yields and stake charges available in the market, as firms would possibly change into extra cautious in providing such companies.

Whereas the decline in staking yields has been a gradual pattern since peaking at 15.4% in March of final 12 months, Polkadot and Cosmos stand as outliers, at the moment providing yields greater than 7.5%. These exceptions apart, the downward trajectory of staking yields and the complexities launched by regulatory oversight current an evolving problem for each particular person buyers and the broader cryptocurrency market.

The diminishing returns from staking within the cryptocurrency market sign a maturing, but more and more sophisticated, funding panorama. Because the market adjusts to new norms, each particular person and institutional buyers are confronted with recalibrating their expectations and techniques. The decline in staking yields just isn’t an remoted problem; it intersects with broader themes of market saturation, technological shifts, and regulatory scrutiny.