Staking frenzy grips Ethereum: 33.9% of ETH now staked

- Curiosity in staking Ethereum surged considerably over the previous few days.

- Community development for ETH fell materially regardless of the surge in worth.

Over the previous couple of days, Ethereum [ETH] has seen large volatility by way of worth motion, which has impacted sentiment across the token considerably.

Curiosity in Ethereum staking surged

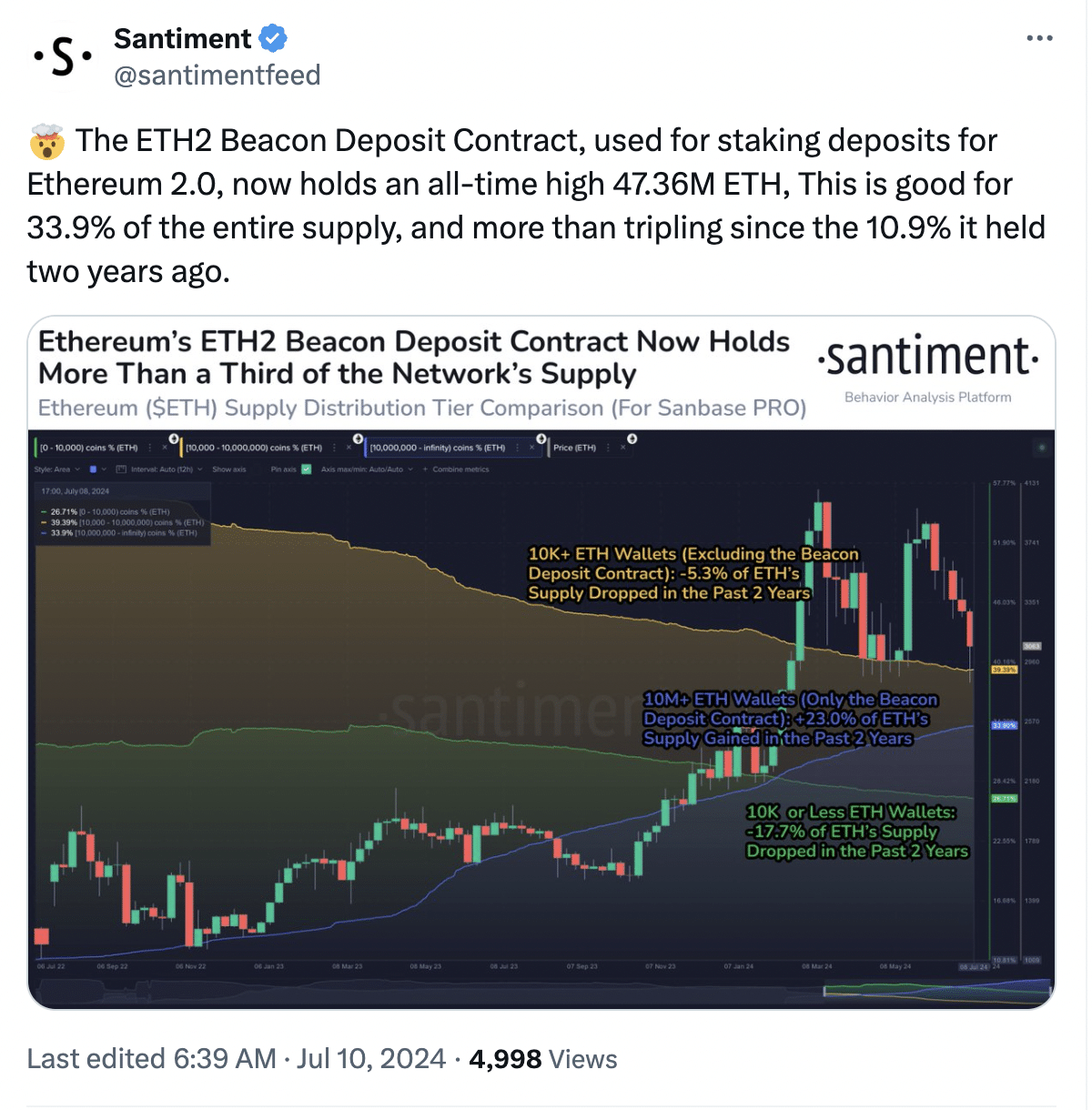

The ETH2 Beacon Deposit Contract, the spine for staking deposits in Ethereum 2.0, has reached a brand new peak, locking in a whopping 47.36 million ETH. This represents a major chunk of the whole provide, amounting to 33.9%.

The worth is greater than triple the quantity staked simply two years in the past, which was solely 10.9%. The surge in deposits signifies rising confidence in Ethereum 2.0 and its potential to revolutionize the Ethereum blockchain.

With a good portion of ETH locked up in staking deposits, the circulating provide of ETH successfully decreases. This will result in upward stress on the worth on account of fundamental ideas of provide and demand.

Furthermore, since staked ETH is locked up for a time period, it’s much less more likely to be offered on the open market within the brief time period. This might help scale back downward stress on the worth, particularly in periods of market volatility.

Supply: Santiment

Each day exercise on the community fell

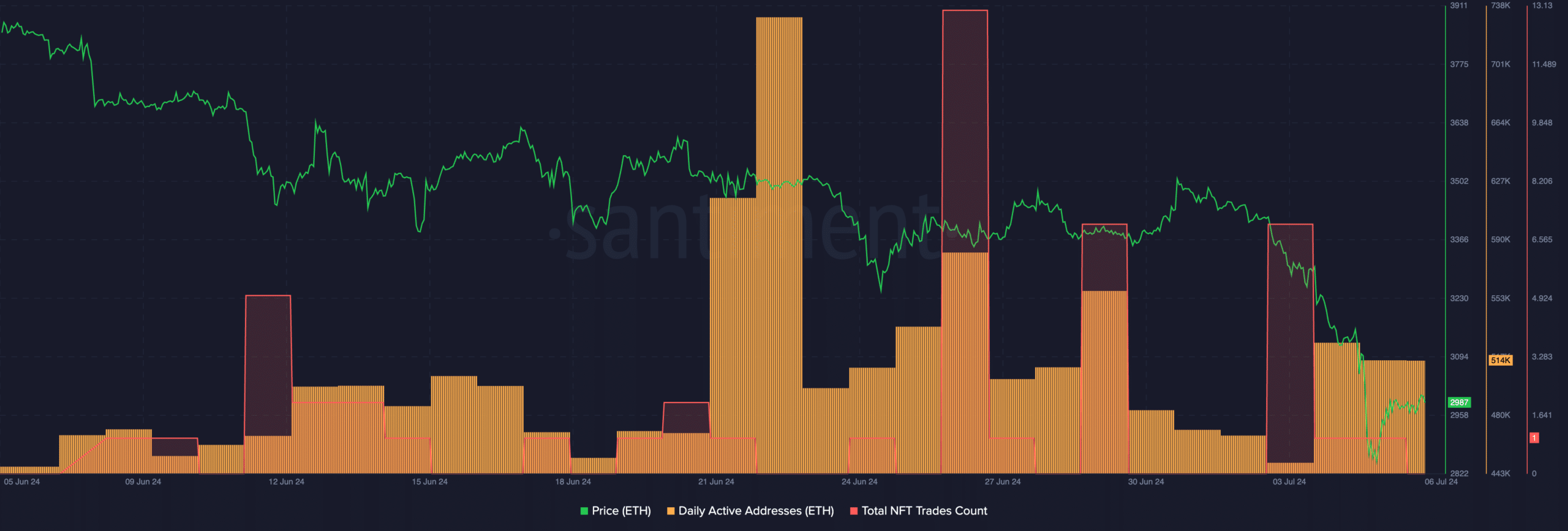

Nonetheless, regardless of the surge in ETH staking, the general curiosity within the Ethereum ecosystem waned.

AMBCrypto’s evaluation of Santiment’s information revealed that the general energetic addresses on the Ethereum community declined considerably over the previous month.

Furthermore, this decline in exercise coincided with the variety of NFT trades occurring on the Ethereum community falling.

This implies that regardless of the potential advantages of staking, fewer individuals are actively utilizing the Ethereum community for different functions.

This may very well be on account of quite a lot of elements, equivalent to excessive gasoline charges, an absence of latest functions, or a basic bearish sentiment within the cryptocurrency market.

Supply: Santiment

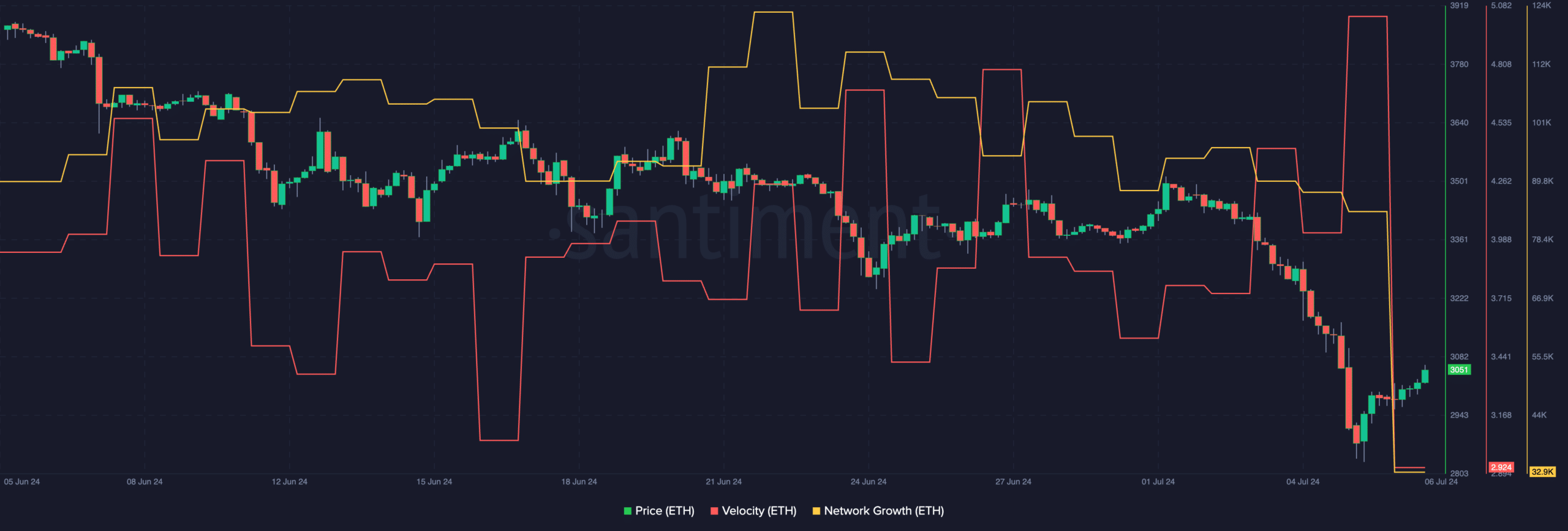

At press time, ETH was buying and selling at $3,087.00 and its worth had grown by 10.91% because the tenth of July. Regardless of the surge in worth, the general pattern for ETH remained bearish.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

Moreover, the community development for ETH fell materially, indicating that new addresses have been dropping curiosity in ETH.

Coupled with that, the rate at which ETH was buying and selling at had additionally fallen,, implying that the frequency at which ETH was being exchanged had declined.

Supply: Santiment