Staking Pools in Crypto: A Beginner-Friendly Guide

Staking swimming pools are how common individuals like you possibly can faucet into crypto’s proof-of-stake networks with out operating heavy {hardware} or locking up big quantities of cash. Along with different pool members, you share the work, and share the staking rewards when it’s finished, in fact. It’s the simple method to flip crypto belongings into regular passive earnings whereas serving to safe the community.

Right here, we cowl all of the necessities you’ll want to know earlier than diving into staking swimming pools your self.

What Is a Staking Pool?

A staking pool is a gaggle of crypto holders who all mix their cash to take part in a proof-of-stake (PoS) community. As a substitute of staking alone, all of the delegators add their staked belongings right into a single pool, managed by a pool operator, who runs the validator with the mandatory validator keys. This pool features as one massive validator, securing the chain and incomes rewards within the community’s native token.

However why is working collectively higher than going solo? Effectively, solo staking requires the chain’s full minimal stake (for instance, a minimum of 32 ETH is required to stake on Ethereum), in addition to technical abilities, and nonstop validator uptime. However in crypto staking swimming pools, members share assets, enhance their collective staking energy, and enhance their odds of validating transactions by working collectively. Which means even small holders can probably earn rewards that are in any other case reserved for giant operators.

How Staking Swimming pools Work

Staking swimming pools flip a troublesome solo job right into a shared venture. They comply with the identical guidelines as any proof-of-stake community however break the method into smaller elements in order that extra individuals can take part. Let’s break down precisely how the staking course of features.

Consensus Mechanism

Every thing begins with the consensus mechanism. In PoS blockchains, validators safe the chain by pool staking cash and confirming new blocks. Different blockchains use delegated proof-of-stake (DPoS), the place token holders vote for validators as an alternative of operating them immediately.

You will discover out precisely how proof-of-stake consensus works in our devoted article: What Is Proof-of-Stake (PoS)? A Newbie’s Information

Both manner, the community wants validators to maintain it sincere. However the barrier to entry is simply too excessive for many, and being a validator requires fixed uptime. That’s the place swimming pools are available in: they use delegation to carry smaller holders into the method. Customers pool assets, and may play an lively position in chain safety.

Pooling Sources

As a substitute of staking alone, customers mix their very own funds right into a shared pool. The blockchain then sees that total pool as one massive stake. This offers everybody inside higher odds of being chosen to assist produce new blocks. Consider it like stacking lottery tickets: the larger the stack, the upper the possibility to win. Pooling makes the system accessible, however dimension solely issues if the community truly chooses the validator. How does that course of work?

Validator Choice

In spite of everything assets are mixed, the blockchain should choose a validator. Choice is random however weighted by stake dimension. Larger pool dimension means the next likelihood of being chosen to verify the subsequent block. As soon as chosen, the validator performs its duties, validating transactions and including new blocks. Choice determines who will get the rewards—the primary concern of each delegator.

Incomes Rewards

When a pool’s validator is chosen, it earns staking rewards within the chain’s native token. Rewards usually come from community inflation and transaction charges. The pool then runs a rewards distribution course of to divide earnings amongst delegators. Your share matches your stake relative to the pool’s complete. For instance, staking 1% of a pool’s steadiness means you’ll obtain 1% of every payout. On Ethereum, annual yields have ranged from 20% again in 2020 to about 5% in 2024, as extra ETH joins swimming pools. Rewards are the primary cause delegators be part of, however earlier than any payouts can attain your pockets, the pool deducts charges.

Keep Secure within the Crypto World

Discover ways to spot scams and shield your crypto with our free guidelines.

Pool Charges

Each staking pool costs charges to cowl prices and pay the pool operator. This fee price is normally a proportion of rewards, although some networks add mounted quantities. As an illustration, on Ethereum, most swimming pools cost round 10%. Decrease charges imply extra rewards for delegators, however a dependable operator is usually value the associated fee. Charges are the ultimate piece of the method: they arrive after rewards are earned, and earlier than payouts are despatched to your withdrawal handle.

Varieties of Staking Swimming pools

There are lots of various kinds of staking swimming pools on the market. The way in which they’re arrange adjustments how protected, versatile, and open they’re. You’ll run into three important splits: custodial vs. non-custodial, public vs. personal, and centralized vs. decentralized.

Custodial and Non-Custodial Swimming pools

A custodial staking pool takes custody of your cash. You deposit them with a service supplier—normally an alternate—and so they deal with the validator. The upside is comfort. The draw back is custodial threat: you surrender your personal keys and depend on the supplier’s honesty and compliance with KYC/AML necessities.

A non-custodial staking pool works otherwise. You delegate with out giving up possession. Your cash keep in your pockets, or in a sensible contract that solely you possibly can withdraw from. This avoids custodial threat and retains funds safer. Cardano’s 3,000+ unbiased swimming pools are a basic non-custodial mannequin.

Public and Non-public Swimming pools

Public staking swimming pools welcome anybody. They decrease boundaries, unfold staking assets, and provides all pool members entry to staking rewards. They’re the usual in networks like Ethereum and Solana.

Non-public swimming pools, then again, prohibit entry. They may be run by an organization or a single entity with their very own capital. Generally, operators demand a pool pledge or minimal that retains out small holders. Non-public swimming pools can imply higher management, however they scale back neighborhood entry.

Centralized and Decentralized Swimming pools

A centralized staking pool is managed by one group or platform. They typically deal with big quantities of staked funds—Lido, for example, controls round 24% of all staked ETH. However the threat is clear: An excessive amount of energy in a single place can threaten community safety.

Decentralized swimming pools unfold management throughout many operators. They depend on code, open participation, and generally, DAOs. This mannequin reduces reliance on one operator however will increase sensible contract threat and liquidity threat if tokens commerce poorly.

Staking Pool Returns

Returns in a staking pool hinge on three issues: how a lot you stake, how lengthy you keep, and the community’s guidelines. Swimming pools make rewards regular, however not mounted.

Rewards come from two sources: community inflation (new cash issued) and transaction charges. A pool then runs a rewards distribution system. Your slice is dependent upon your share of the pool dimension. Put in 2% of the pool’s staked funds, and also you’ll obtain about 2% of every payout.

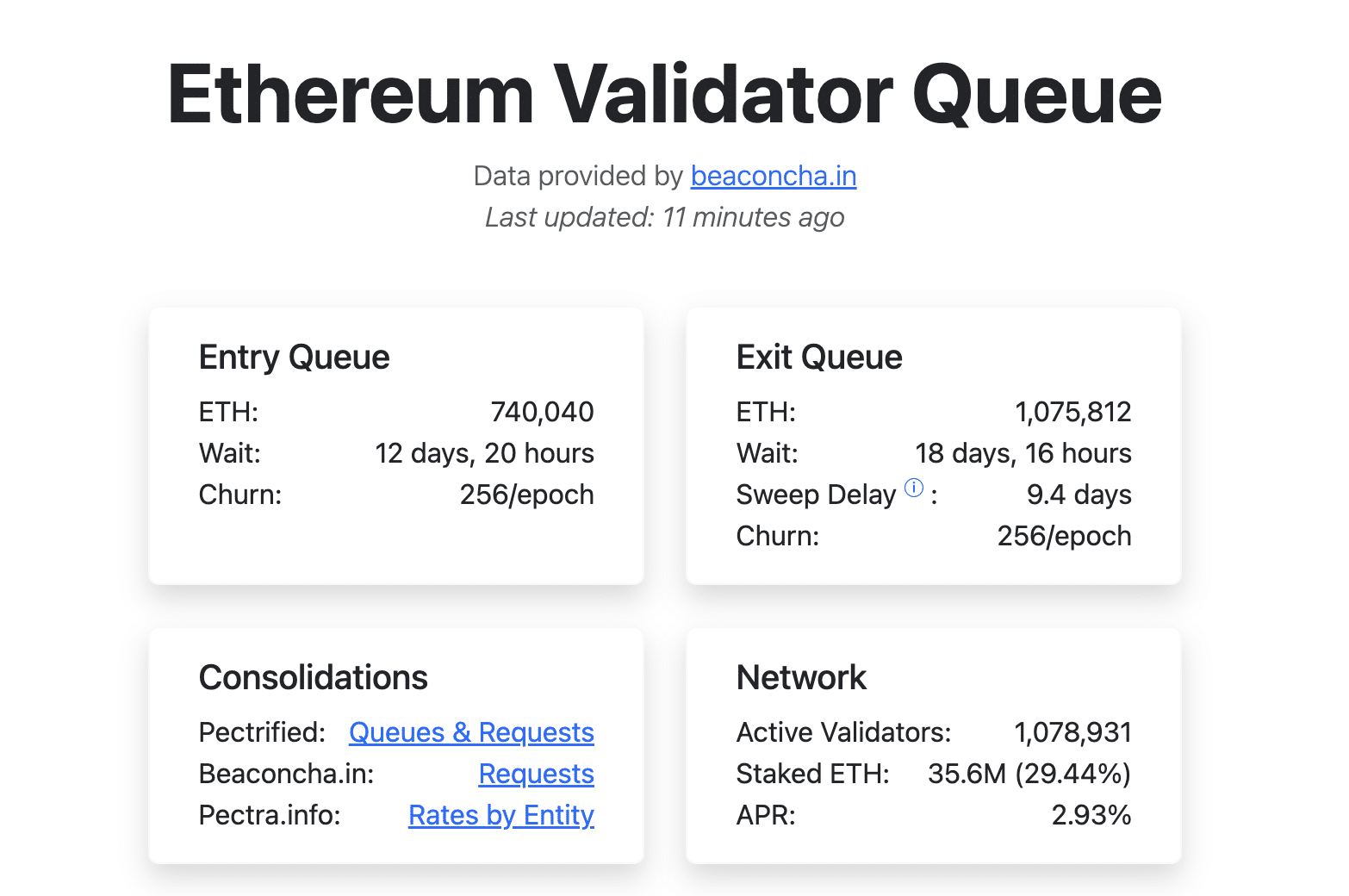

The reward price (APR/APY) in staking swimming pools adjustments over time. Ethereum stakers noticed 20% APR early on, however by mid-2024, because the variety of complete ETH staked grew to twenty-eight%, the APR dropped to ~4%. Immediately, Cardano averages round 4.5%, Polkadot ~9%, and Solana ~6%.

Compounding can improve these returns. It’s the method of reinvesting your rewards in order that they generate much more earnings. Some swimming pools additionally supply restaking, the place tokens are locked on multiple chain directly for additional yield.

Each compounding and restaking can develop your potential passive earnings, however they could additionally add additional charges and complexity.

Advantages of Becoming a member of a Staking Pool

Staking swimming pools supply expanded entry, they unfold threat, and enable you to earn extra passive earnings by means of regular staking rewards, with none of the large upfront prices. Let’s check out every of these advantages in additional element.

Elevated Probabilities of Rewards

By yourself, validating a block can really feel extra like profitable the lottery than producing passive earnings. A staking pool will increase these odds, as a result of members are capable of mix their stakes. The pool’s bigger steadiness boosts its probability of being chosen to validate. When it wins, you get a lower by means of the rewards-distribution system. Which means you’re persistently incomes rewards, not simply occasional payouts.

Decrease Minimal Staking Necessities

Solo staking typically calls for excessive minimums. Ethereum requires 32 ETH to run your individual validator, which is round $140,000 as of August 2025. That’s out of attain for most people. Swimming pools take away this barrier by letting you stake any minimal quantity. Some allow you to begin with as little as just a few {dollars}’ value of tokens. Staking swimming pools can help you be part of with much less and nonetheless achieve rewards. Because of this they’ve change into the default selection for smaller holders.

Lowered Danger

Working a validator your self means {hardware} prices, uptime calls for, and the possibility of slashing penalties for those who make errors. In a pool, you offload these considerations to the operator. You continue to face potential dangers (like counterparty threat for those who use a custodial pool) however many complications may be prevented by being in a staking pool.

Swimming pools additionally clean out earnings. As a substitute of massive wins or nothing, you earn smaller however regular rewards. That steadiness helps you handle total threat whereas nonetheless rising your stake.

Democratized Entry

Maybe the most important good thing about staking swimming pools is entry. Staking swimming pools supply a manner for anybody to take part in securing digital belongings, not simply whales with large stakes. They unfold assets and strengthen safety by together with extra members in PoS methods. Increasing the quantity of staked crypto belongings retains blockchains honest and community-driven, and pool staking ensures it isn’t only a sport reserved for elites.

Potential Drawbacks

Staking swimming pools remedy many issues, however something that good comes with its personal potential dangers. From charges to operator habits, token value swings and ready occasions, there are dangers it is best to weigh earlier than committing any funds.

Pool Operator Charges

Each pool costs charges. Pool operators deal with {hardware}, uptime, and safety, and so they take a fee price for doing so. In Cardano, that’s at least 340 ADA per epoch plus a margin. On Ethereum, exchange-run swimming pools typically take 10%. These pool charges lower into your last payout. Although low charges enhance your web rewards, high quality service generally prices extra. At all times steadiness price dimension towards reliability.

Misconduct by Pool Operators

All staking swimming pools require some stage of belief, because you’re delegating your belongings, and that is very true in custodial staking swimming pools. An operator can act towards your pursuits by going offline, hiding charges, or mishandling your stake. This introduces custodial threat and the possibility a service supplier loses or withholds funds. Choose operators with clear information, clear phrases, and transparency.

Worth Volatility

Rewards don’t matter if the token’s value crashes in a single day. Staking protects towards community inflation however not market swings. Even with engaging rewards, token values can fall sooner than you earn. Polkadot’s ~9% APR sounds nice, however a pointy value drop might wipe all of it out. This isn’t funding recommendation, only a reminder that market threat is actual. Swimming pools can create a supply of passive earnings, however they’ll’t protect you from crypto’s volatility.

Learn extra: What Is Volatility in Crypto?

Unbonding Interval

If you wish to go away a pool, the method isn’t at all times quick. Many chains impose an unbonding interval or lock-up intervals earlier than you possibly can withdraw. Cosmos requires ~21 days, Polkadot ~28, and Ethereum has an exit queue. Throughout that point, you cease incomes and may’t promote. If markets swing, you’re caught. Some liquid staking choices remedy this with tradable liquid staking tokens, however that brings slashing penalties and liquidity threat of their very own. At all times test withdrawal guidelines earlier than pool staking.

Widespread Cryptocurrencies That Assist Staking Swimming pools

Let’s spotlight 4 main PoS blockchains that allow you to stake by way of swimming pools, with statistics as of August 2025.

- Ethereum (ETH)

Ethereum exhibits power in stakes. Round 29.6% of all eligible ETH is at the moment staked, all of which locks in safety and offers delegators constant rewards. This dimension exhibits how a lot staking swimming pools matter to Ethereum’s ecosystem. - Cardano (ADA)

Cardano shines with mass participation. Round 60% of all ADA is currently staked, totaling 21.2 billion ADA tokens dedicated to safe the community. - Polkadot (DOT)

Polkadot exhibits robust engagement too. Roughly 49% of its DOT provide is staked by way of nomination and pooling, reinforcing each the safety and governance of the community. - Solana (SOL)

Solana’s staking stage is excessive, with about 66% of circulating SOL staked. The community makes use of computerized validator rebalancing to maintain stake unfold evenly throughout the community. This exhibits each robust person belief and the recognition of crypto staking swimming pools on this fast-growing blockchain.

How you can Select the Proper Staking Pool

Not each staking pool is value your cash. The correct selection balances prices, dimension, and reliability. Listed here are the important thing elements to test earlier than delegating your staked funds.

- Staking pool charges

Each pool takes a lower. Take a look at the fee price, normally 5–10%, and any mounted costs. Decrease charges imply extra rewards, however a stable operator is normally value paying for. - Minimal stake requirement

Some swimming pools set a minimal quantity you’ll want to be part of. On Ethereum, solo staking requires tens of hundreds in ETH, however most staking swimming pools can help you begin with a lot much less. Examine the entry bar earlier than committing. - Pool dimension

An even bigger pool dimension means extra possibilities of validating blocks. That mentioned, outsized swimming pools can diminished payouts or strengthen centralization. Center-sized swimming pools typically give one of the best steadiness of returns and decentralization. - Pool pledge

Some blockchains use a pool pledge, the place the operator’s personal stake is locked into the pool. A better pledge exhibits pores and skin within the sport, aligning the operator’s pursuits with yours. - Stay stake

The stay stake is how a lot is actively staked in a pool proper now. It helps you gauge exercise and whether or not a pool is approaching saturation (the purpose the place rewards begin shrinking). - Pool rating

Many networks publish a pool rating based mostly on efficiency and rewards. Use it to match choices, however don’t simply chase the highest, as a result of diversifying throughout swimming pools can unfold threat.

Last Ideas

With crypto staking swimming pools, you don’t want a server farm or a mountain of cash to stake, simply cash, a pockets, and customary sense. Staking swimming pools improve each safety and accessibility throughout PoS networks, serving to you earn a little bit within the course of, too. They let everybody, not simply the whales, participate in constructing the way forward for the blockchain.

FAQ

What’s the goal of a staking pool?

A staking pool lets many customers mix their cash to behave as one validator. This boosts the possibilities of validating blocks, incomes staking rewards, and lowers the barrier to entry for small holders.

How do staking swimming pools earn money?

They earn money by charging fee charges. Every time a block reward is received, the operator retains a lower, and the remaining is shared amongst pool members.

What is best, a staking or liquidity pool?

Every serves a distinct goal. Staking swimming pools generate rewards by securing a blockchain, whereas liquidity swimming pools earn buying and selling charges in DeFi markets. Your selection is dependent upon whether or not you need regular yield or publicity to buying and selling threat.

Learn extra: What Are Liquidity Swimming pools?

Can I lose my crypto by becoming a member of a staking pool?

Sure, although dangers fluctuate. Unhealthy pool operators can set off slashing penalties, and custodial swimming pools carry counterparty threat. On prime of that, token value swings can wipe out beneficial properties.

How a lot crypto do I want to affix a staking pool?

It is dependent upon the community. Solo staking normally requires vital upfront price, however staking swimming pools enable entry with a lot smaller quantities, generally only a few {dollars}’ value.

Can I unstake my crypto anytime?

Not at all times. Some blockchains implement an unbonding interval (starting from days to weeks), whereas others, like Cardano, enable versatile exits. At all times test lock-up guidelines earlier than you stake something.

Disclaimer: Please observe that the contents of this text will not be monetary or investing recommendation. The knowledge supplied on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native laws earlier than committing to an funding.