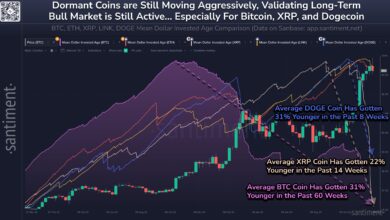

Stellar eyes $0.90: 2 bullish patterns set the stage for rally

- After a 300% worth rise final month, XLM’s worth dropped final week.

- Shopping for strain elevated, however there have been probabilities of a bearish crossover.

After a month of large worth hikes, Stellar [XLM] bears took again management. Nevertheless, regardless of this, a number of bullish patterns had appeared on the token’s worth chart. In case of a profitable breakout, XLM may eye $0.90 subsequent.

Stellar’s new bull patterns

XLM showcased unimaginable efficiency within the final 30 days, outperforming most high cryptos. To be exact, the token’s worth surged by greater than 300% throughout that point.

Nevertheless, the development modified within the final seven days because the taken witnessed a slight 3% worth drop. On the time of writing, XLM was buying and selling at $0.4879.

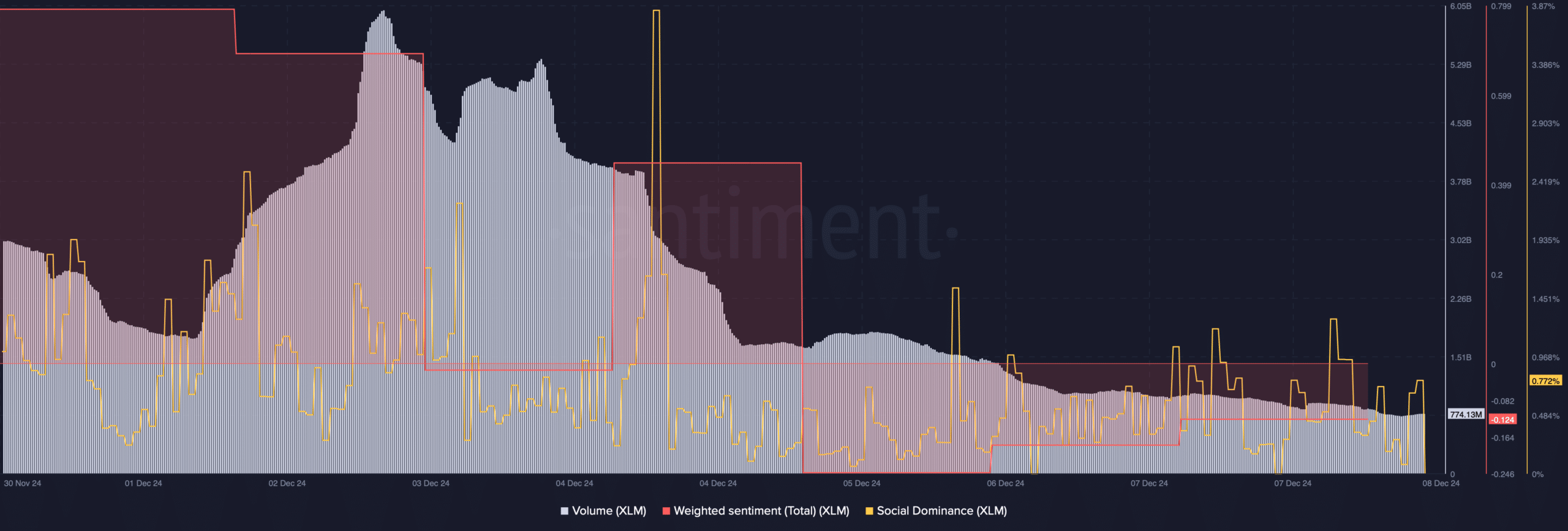

The newest worth decline had a destructive impression on Stellar’s social metrics. For example, XLM’s Social Dominance declined, which hinted at a decline within the token’s recognition.

Its Weighted Sentiment additionally plummeted—a transparent signal of rising bearish sentiment. Nonetheless, Stellar’s buying and selling quantity declined sharply, together with its worth. This meant that there have been probabilities of a bullish development reversal.

Supply: Santiment

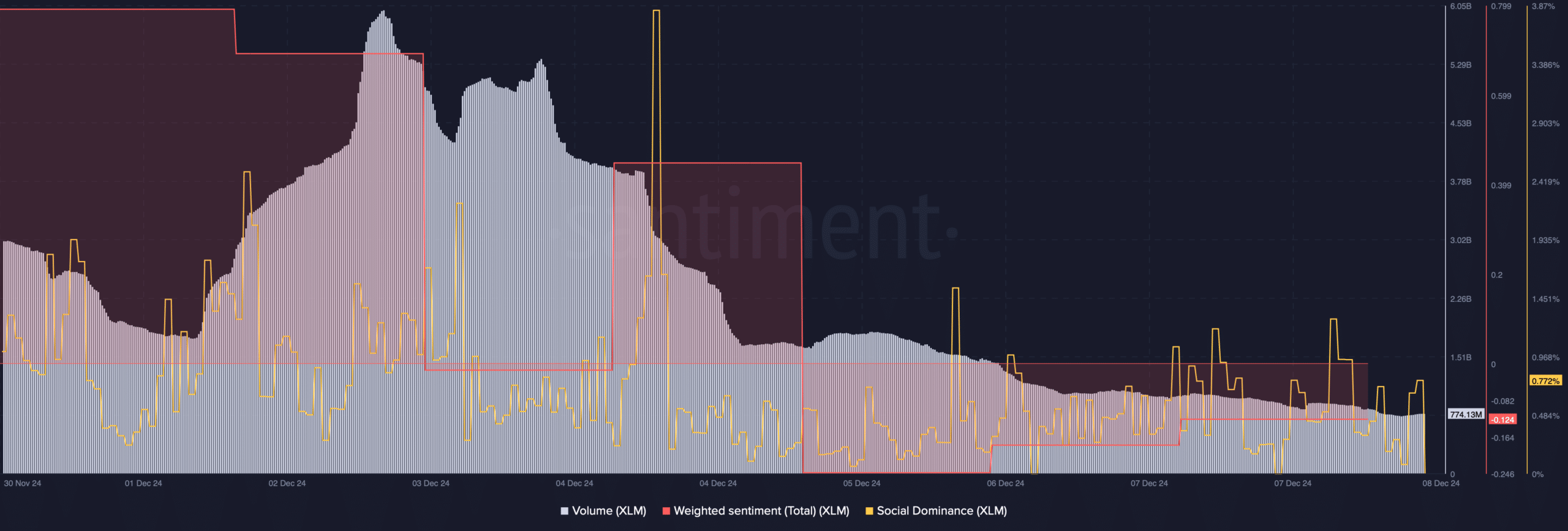

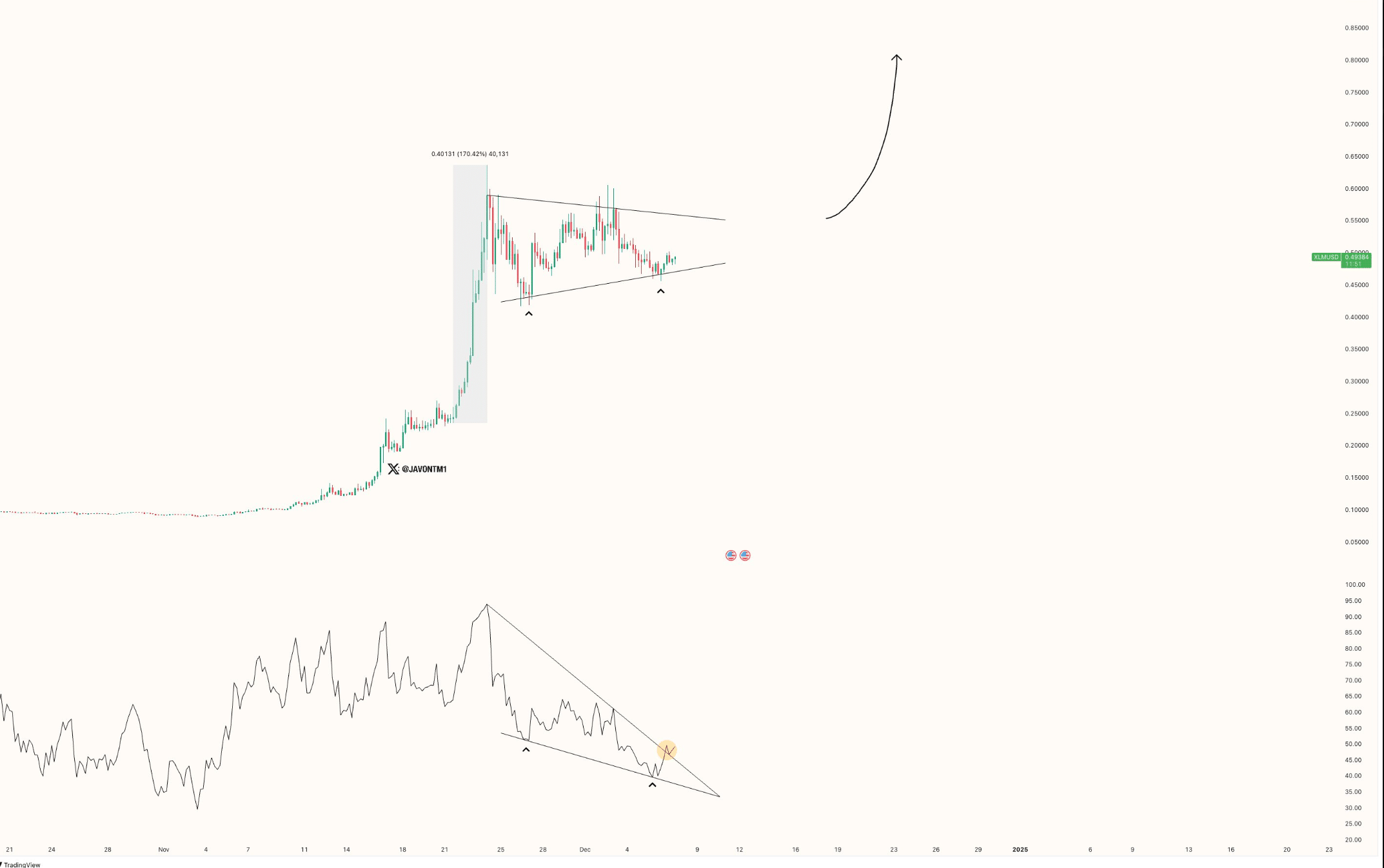

In actual fact, Javon Marks, a well-liked crypto analyst, not too long ago posted a tweet revealing two bullish patterns that appeared on Stellar’s charts. The primary one was a bullish symmetrical triangle sample that fashioned in November.

XLM’s worth was consolidating contained in the sample and at press time, it was on its technique to method the resistance of the sample.

The second falling wedge sample fashioned on the token’s Relative Energy Index (RSI) chart. Fortunately, the RSI broke above the bullish sample.

If XLM’s worth follows the same development and manages a breakout, the token may transfer in direction of $0.90 within the coming days.

Supply: X

Will XLM breakout quickly?

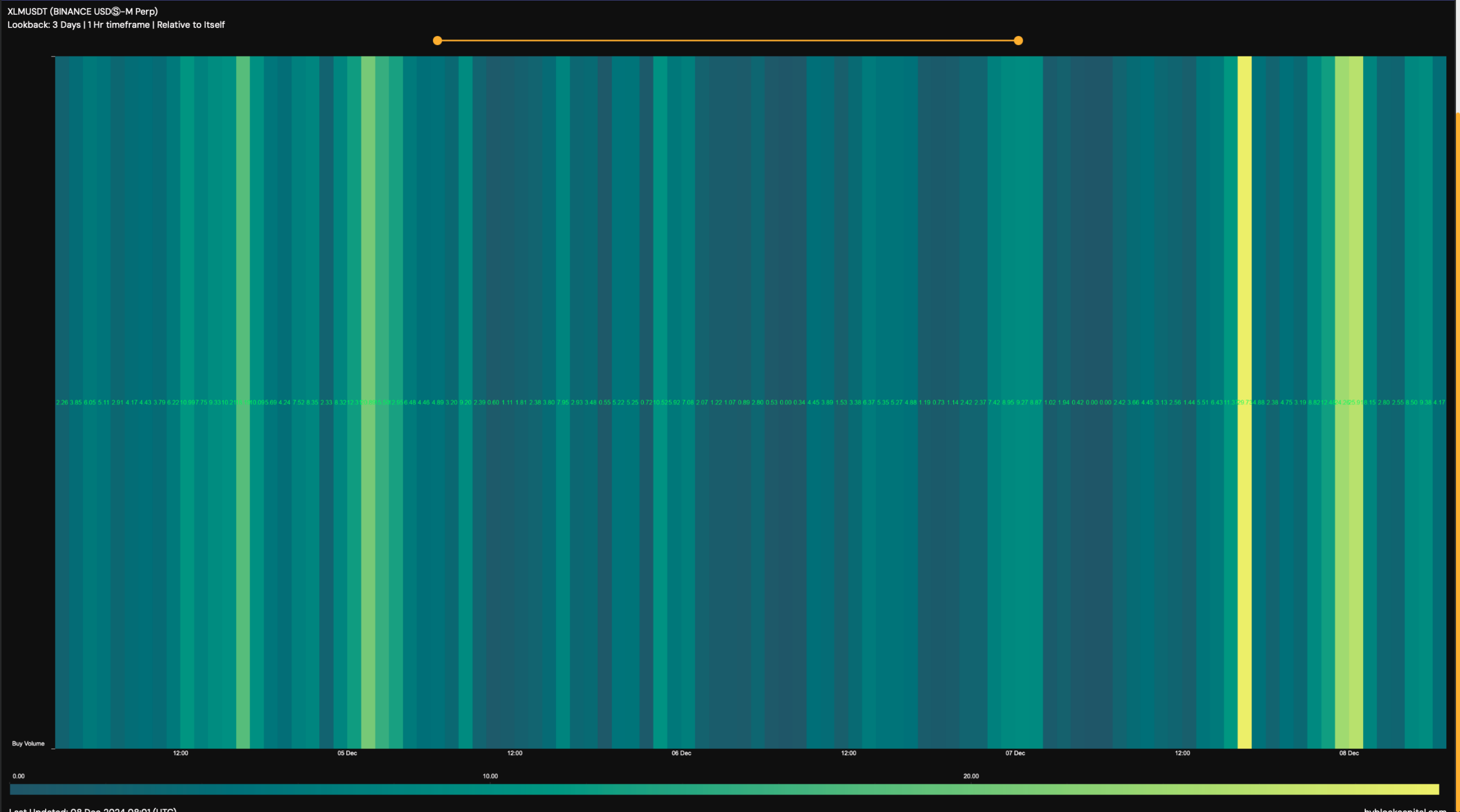

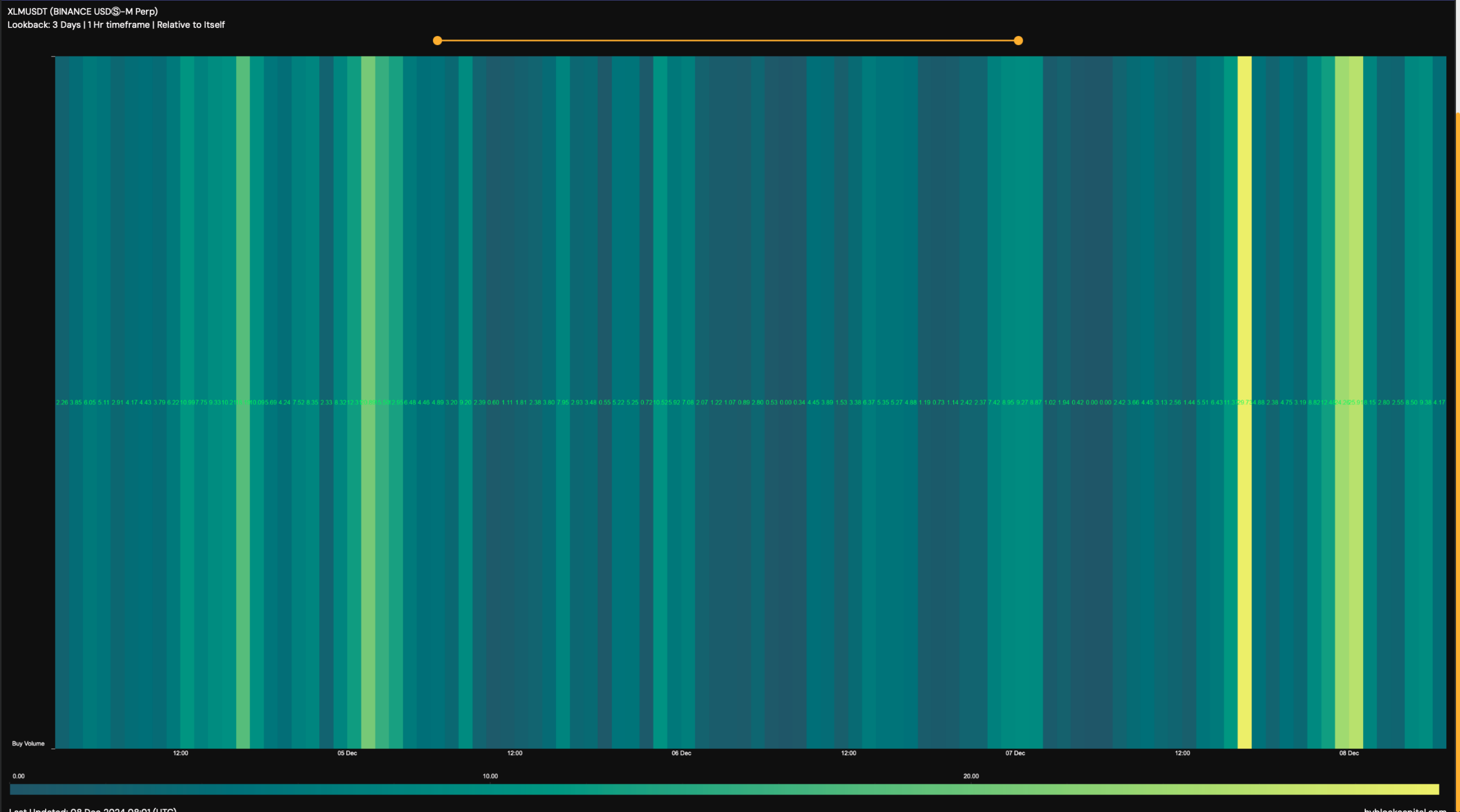

Hyblock Capital’s knowledge revealed that whereas XLM’s worth fell sufferer to a correction, traders purchased the dip. The token’s purchase quantity elevated on a few events prior to now few days.

Every time the metric rises, it signifies that there’s extra shopping for exercise taking place out there for a selected token.

Supply: Hyblock Capital

Nevertheless, not all the pieces was within the token’s favor. For example, the long/short ratio registered a pointy decline.

This meant that there have been extra quick positions out there, which typically signifies much less confidence amongst traders in an asset.

Learn Stellar’s [XLM] Value Prediction 2024–2025

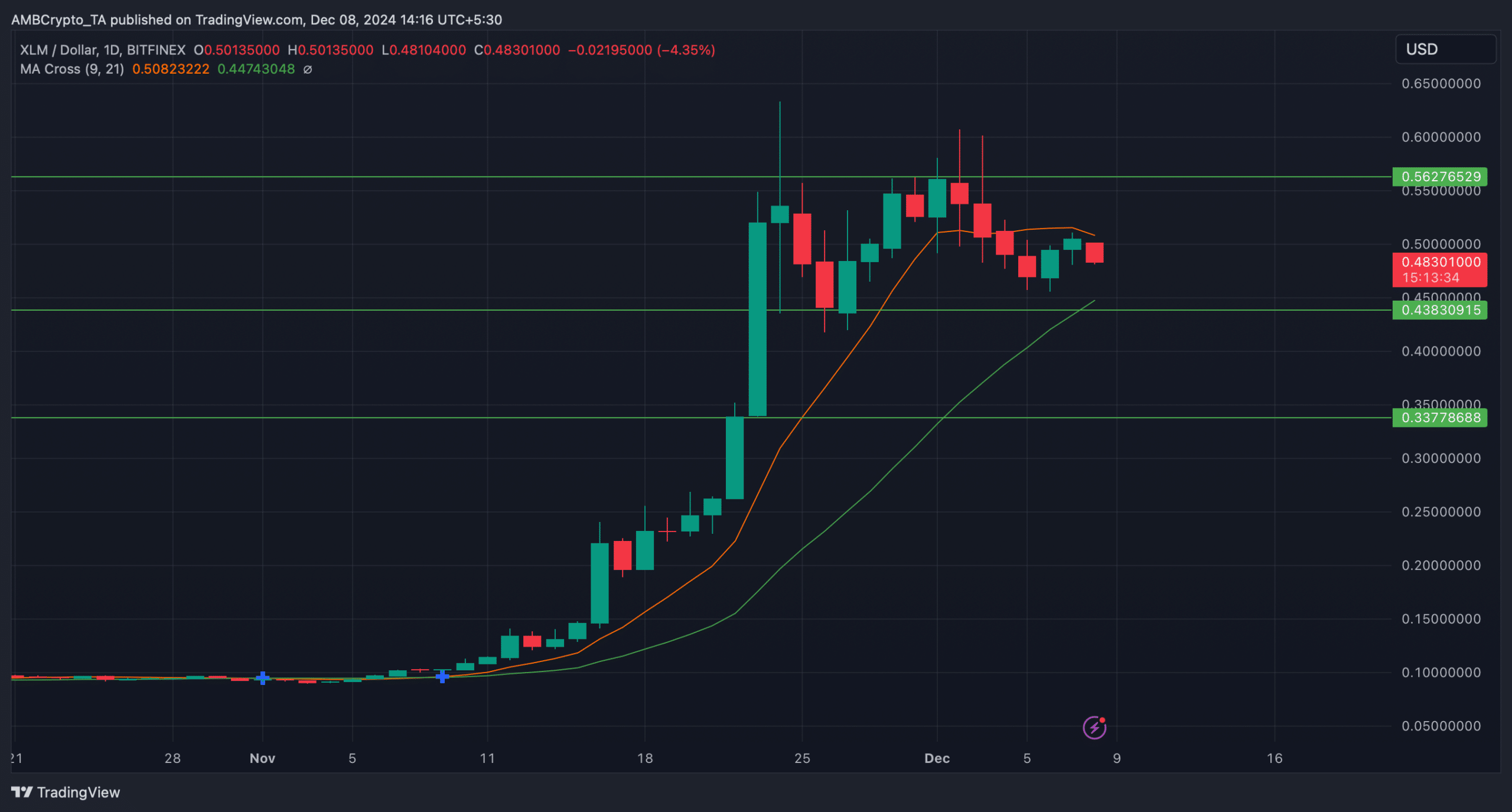

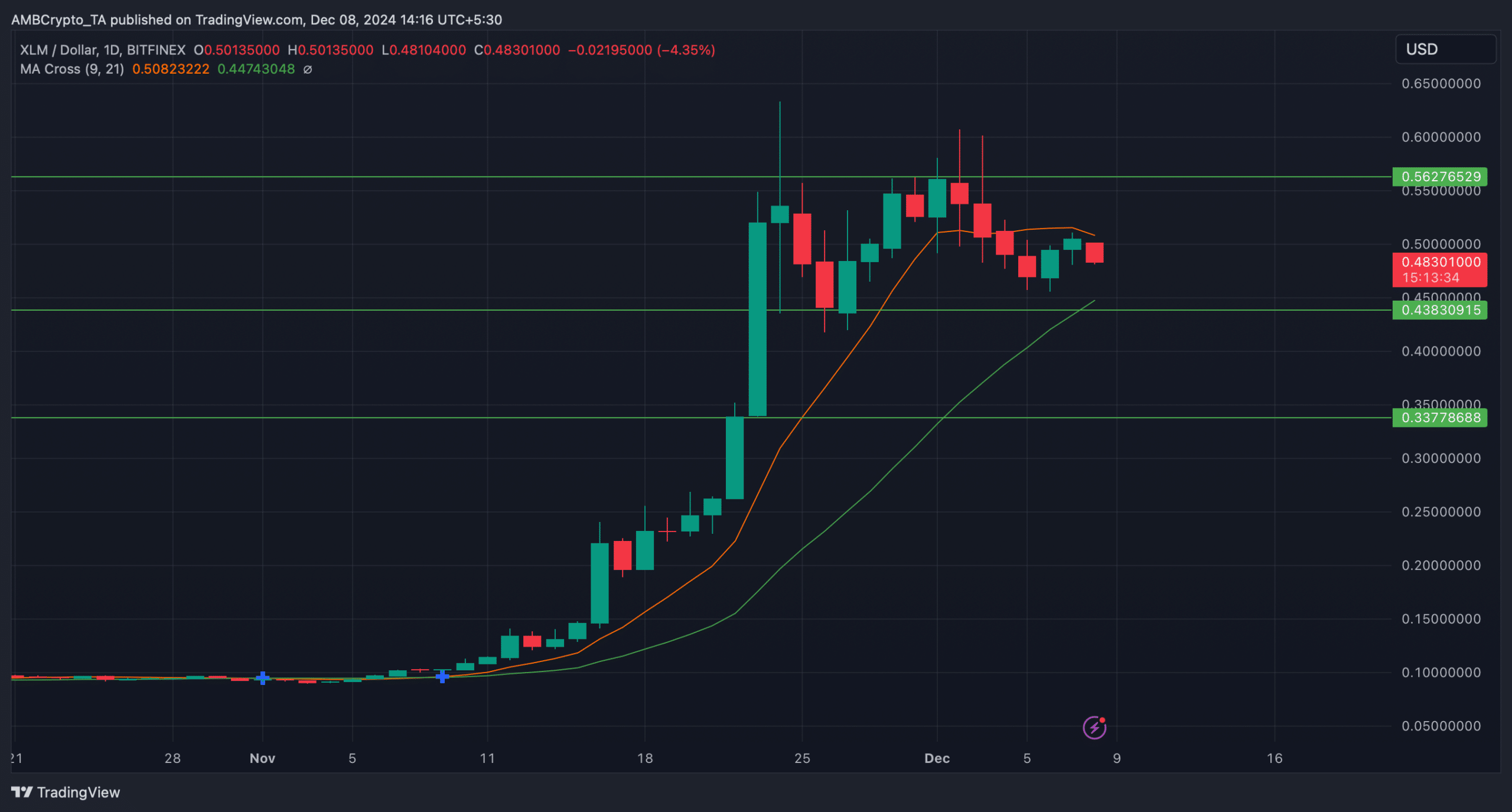

The MA Cross indicators displayed the opportunity of a bearish crossover, as the space between the 21-day MA and the 9-day MA was lowering.

If XLM continued to drop, then its worth may discover help at $0.43. Nonetheless, in case of a bullish development reversal, will probably be essential for Stellar to cross the $0.56 resistance to be able to maintain the rally.

Supply: TradingView