Stellar price breakdown – Will $0.2 be the last line of defense?

- Stellar retested $0.3 as resistance, however confronted rejection over the past ten days

- Retest of the $0.2 demand zone may need a minor bullish response, however traders should stay cautious

Stellar [XLM] has confronted 14.5% losses within the final 24 hours. This, after Bitcoin [BTC] fell to $74.5k a number of hours earlier than press time as inventory markets worldwide plunged within the aftermath of the tariff shockwaves. Altcoin merchants must be cautious although. Particularly because the bearish pattern of the previous three months received a lot stronger resulting from current occasions.

Patrons might be affected person as a substitute of attempting to purchase the underside instantly since there aren’t any clues but {that a} backside has even shaped. BTC developments may also be monitored for clues concerning the wider market.

Stellar to fall under $0.2 as promoting strain intensifies as soon as extra

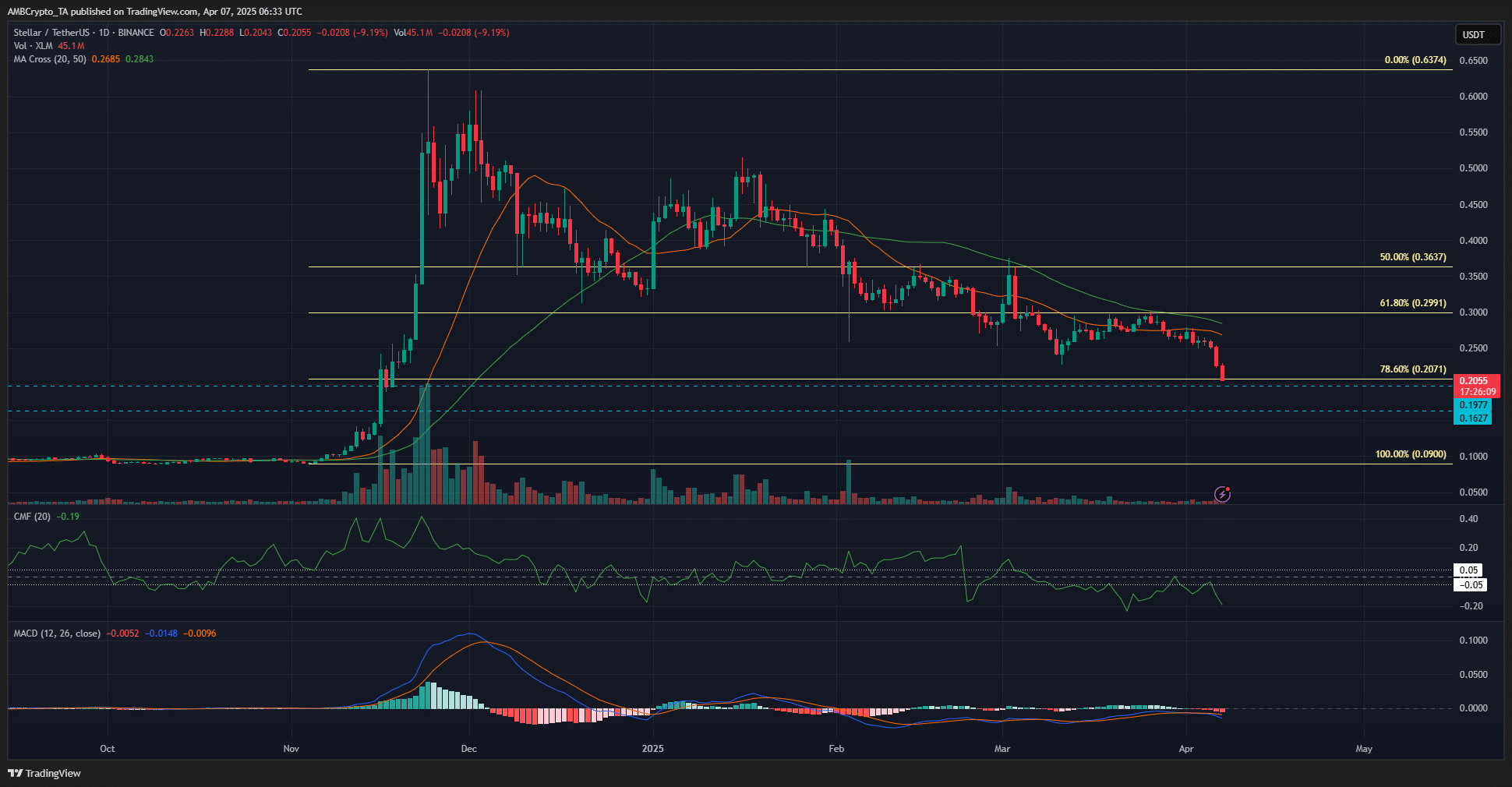

Supply: XLM/USDT on TradingView

The 1-day pattern remained severely bearish. The 20 and 50-period shifting averages had been above the value and confirmed that bearish momentum was dominant. The MACD was diving decrease as soon as once more after showing to make a transfer above the zero line.

This was a results of the consolidation section round $0.25-$0.3 in March, which was adopted by sharp losses in April. The CMF has been under zero since March and has as soon as extra dived effectively under -0.05 to point heavy capital flows out of the Stellar market.

Collectively, the momentum and promoting strain meant that additional losses could also be seemingly for Stellar. The Fibonacci retracement ranges based mostly on November’s rally confirmed that the 78.6% degree was at $0.207.

At press time, the value was slightly below this key help degree. The $0.197 and $0.162 ranges had been additionally long-term help ranges to be careful for.

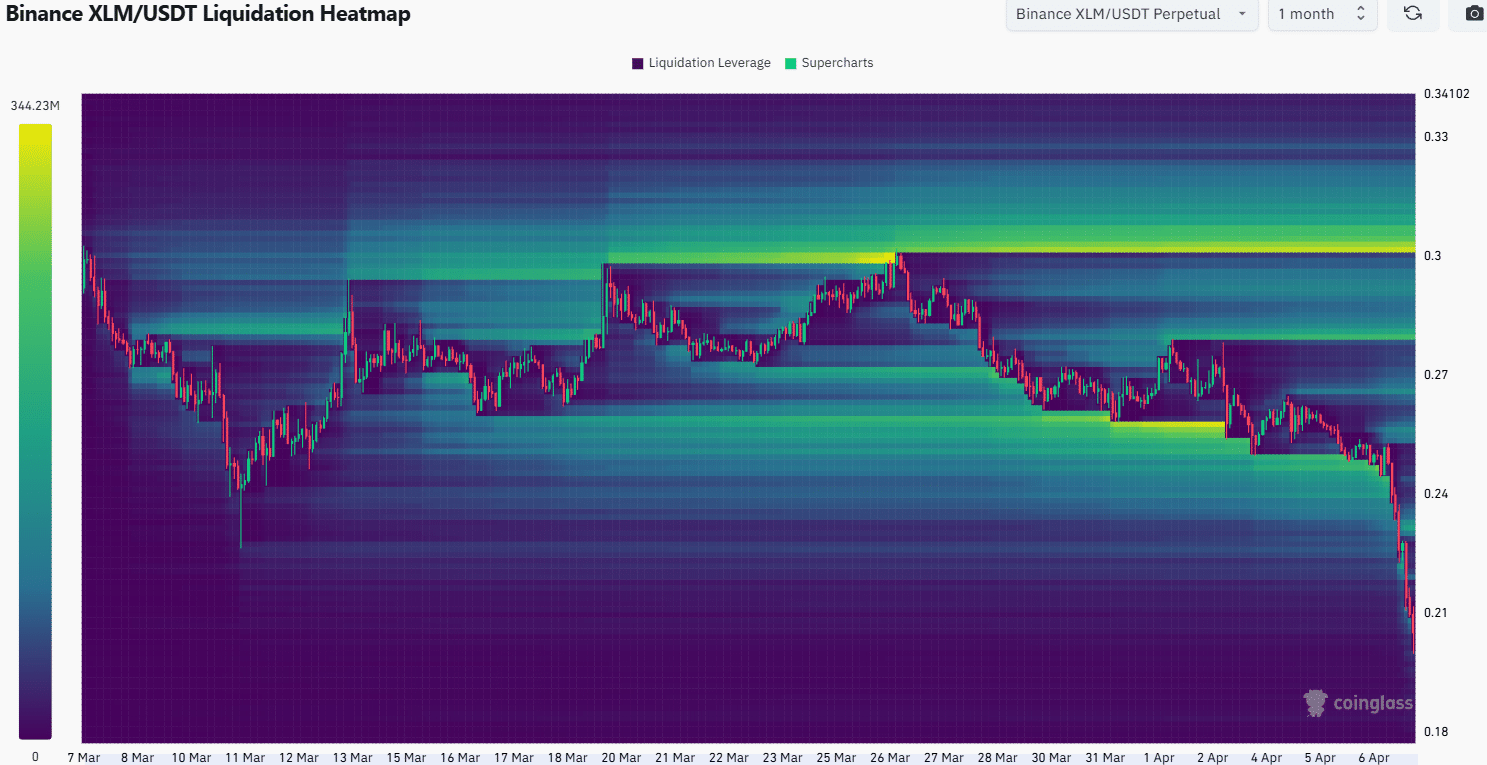

Supply: Coinglass

The 1-month liquidation heatmap revealed that the $0.246-$0.26 zone has been full of lengthy liquidations.

Additionally they coincided with the native help ranges from the primary half of March. The most recent value plunge took XLM’s value effectively under the $0.24 liquidity cluster.

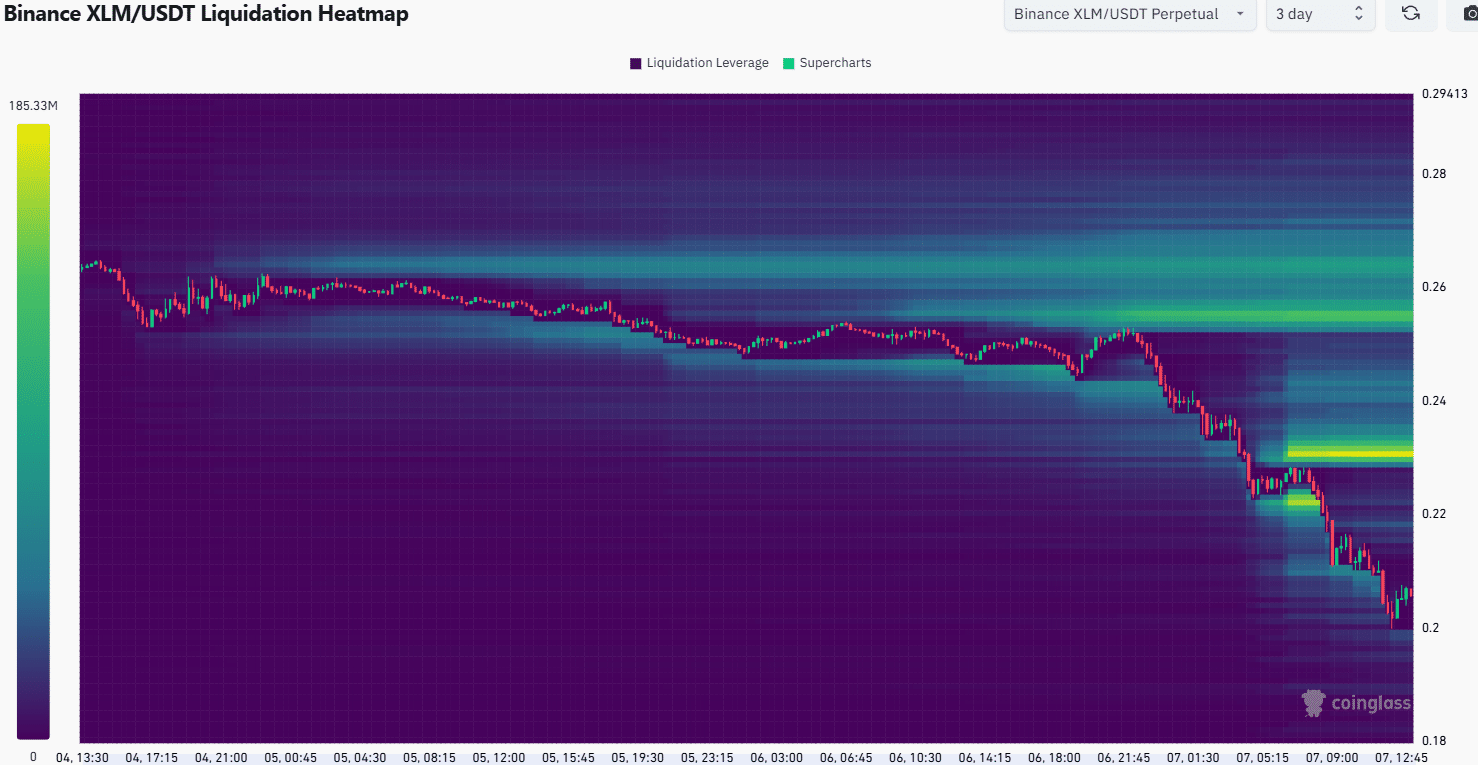

Supply: Coinglass

A more in-depth have a look at the native liquidation ranges gave some clues about XLM’s subsequent transfer. The build-up of liquidity round $0.23 offered a beautiful goal, and the potential for a bearish reversal in case of a value bounce.

Past that, the $0.255-$0.265 zone is the subsequent magnetic zone to be careful for. Stellar merchants must be cautious and never attempt to purchase the underside instantly.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion