Spot XRP ETFs Hit Record Trading Volume In Past Week — Details

The launch of the spot XRP ETFs (exchange-traded funds) in the US was one of many uncommon success tales of 2025’s remaining quarter. The crypto-linked merchandise have helped guarantee important capital inflow into the altcoin in latest months.

Whereas the XRP ETFs recorded their first detrimental outflow day up to now week, the exchange-traded funds additionally reached a brand new report when it comes to the entire worth traded in a single week. This milestone displays the rising maturity of the XRP ETF market within the US.

XRP Funds Publish $219M Buying and selling Quantity In Previous Week

In accordance with the newest market information, the spot XRP ETFs posted their highest weekly buying and selling quantity since debut at $219 million. This determine is sort of double the worth traded within the XRP ETF market within the earlier week ($117.4 million).

In the meantime, this new report merely surpasses the earlier report of $213.9 million reached within the third week of December 2025. This feat alerts the rising investor demand for the XRP exchange-traded funds regardless of the waning curiosity within the broader crypto ETF market.

As talked about earlier, the US-based XRP ETFs registered their first detrimental efficiency up to now week, with a web outflow of $40.8 million on Wednesday, January 7. Nonetheless, this single-day efficiency didn’t cease the exchange-traded merchandise from ending the week within the inexperienced.

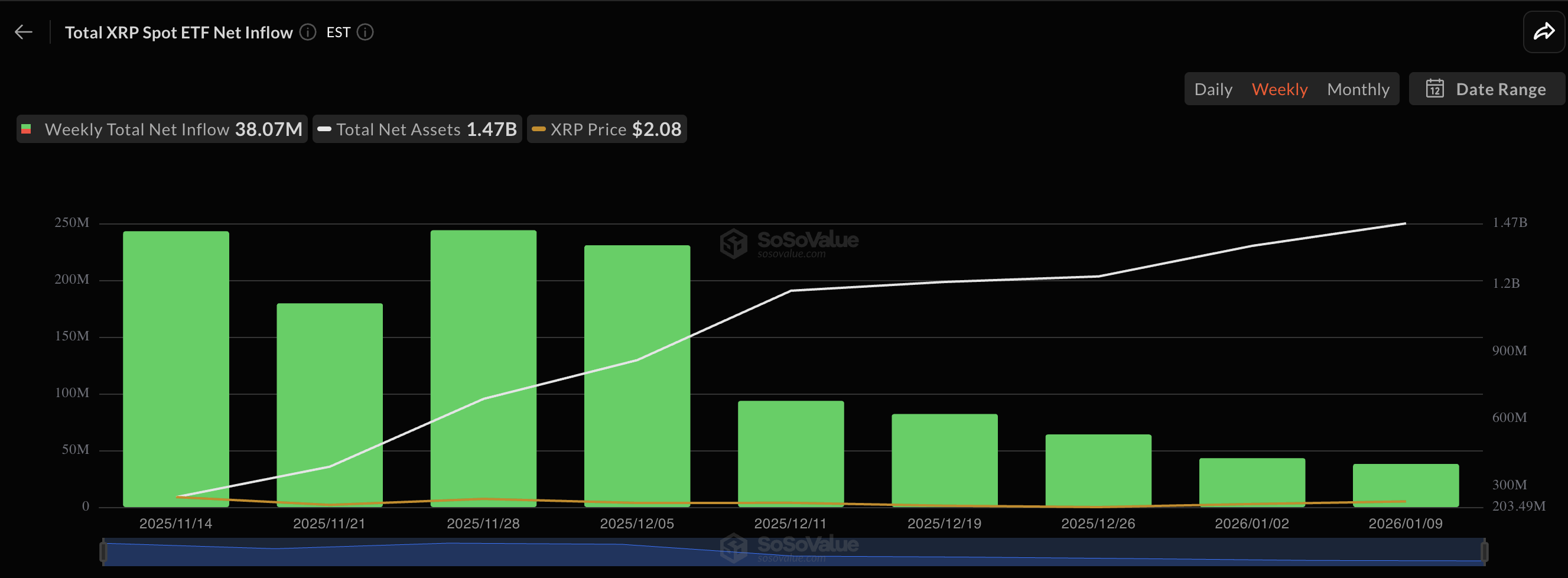

Data from SoSoValue reveals that the XRP ETF market noticed an extra $38.07 million in worth for the week ending January 9. Nonetheless, a take a look at the chart reveals that the capital influx for the crypto-linked merchandise is steadily declining.

As of this writing, the spot XRP ETFs have accrued $1.47 billion in whole web property since launching in mid-November 2025. Canary Capital’s XRPC tops the checklist with $375.1 million in web property below administration (AUM), adopted by Bitwise’s XRP fund at $300.3 million, and Franklin Templeton’s XRPZ at $279.6 million.

XRP ETFs Shine Whereas Crypto ETF Market Flounders

Whereas the XRP ETFs appear to be enduring the market storm, the more-established Bitcoin and Ether ETFs have seen higher days. In accordance with recent market data, the crypto funds noticed a mixed withdrawal of $749.6 million throughout their first full buying and selling week of the yr.

Most notably, the spot Bitcoin ETFs noticed their largest single-day web outflows of $486.1 million on Wednesday, January 7. The BTC exchange-traded funds closed the week with a web outflow of over $681 million.

In the meantime, the Ethereum ETF market, which began on a constructive notice with inflows of $168.1 million on January 5 and $114.7 million on January 6, finally ended the week with web withdrawals of $68.6 million.