Strategy’s Michael Saylor outlines decade-long plan for United States’ Bitcoin holdings

- Saylor needs the united statesto personal 1M-4.2M BTC in 10 years

- Bitcoin’s worth has been muted, regardless of potential nation-state FOMO.

Michael Saylor, Founding father of Technique (previously MicroStrategy), has doubled his requires the USA to amass 5%-20% of the full Bitcoin [BTC] provide.

Throughout the inaugural crypto summit on the White Home, Saylor shared his framework for U.S digital dominance within the twenty first century. A part of the proposal outlined a 10-year BTC acquisition plan.

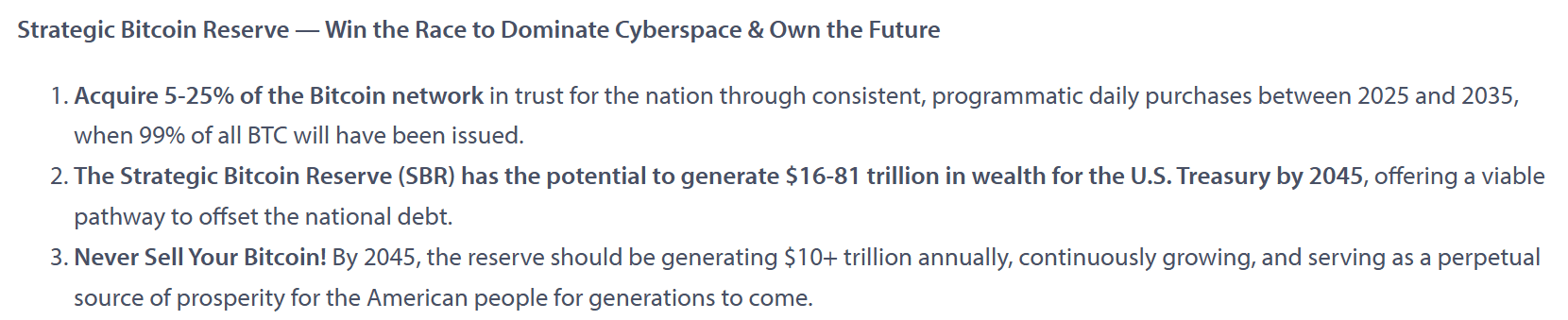

In keeping with Saylor’s plan, if the united statesacquires 5%-20% provide (1.05M-4.2M BTC), it might generate $16-$81 trillion within the subsequent 20 years and assist alleviate the sticky fiscal debt downside. Nevertheless, the plan would price $90 billion – $362 billion at present costs.

Value stating although that it isn’t the primary time the exec has known as for the USA to manage 20% of Bitcoin’s market. Final month, Saylor warned that one other nation would seize the chance if the united statesdoesn’t, citing aggressive bids from UAE, Russia, and China.

Bitcoin – Nation-state FOMO probably?

Brian Armstrong additionally echoed the potential FOMO on Bitcoin by different nations after the President established the united statesstrategic BTC reserve. He said,

“The remainder of the G20 are America on offense on this business (Bitcoin, crypto), and shall be prone to observe go well with.”

In keeping with Arkham knowledge, the united statesgovernment at the moment owns 198k BTC, value $17 billion at present costs. Nevertheless, market analysts have acknowledged that among the forfeitures might be returned to Bitfinex, probably lowering the stash to 88k BTC.

How the U.S. authorities would undertake ‘budget-neutral methods’ to amass extra BTC, as instructed by govt order, stays to be seen.

Nevertheless, the nation-state FOMO might decide up quickly. In actual fact, in accordance with latest reports, South Korea’s prime monetary insiders need authorities to contemplate a strategic BTC reserve, too. Such FOMO might positively have an effect on BTC’s worth.

Quite the opposite, the short-term response to the united statesstrategic BTC reserve has been a typical “promote the information” occasion. Regardless of the bullish replace, the world’s largest cryptocurrency declined from $92.8k to $86.8k – An 8% drop.

Even the end-March worth projection didn’t look constructive at press time. In keeping with predictions web site Polymarket, the market is anticipating a possible dump to $70k quite than a robust rally above $100k. The same outlook was evident amongst Choices merchants too.

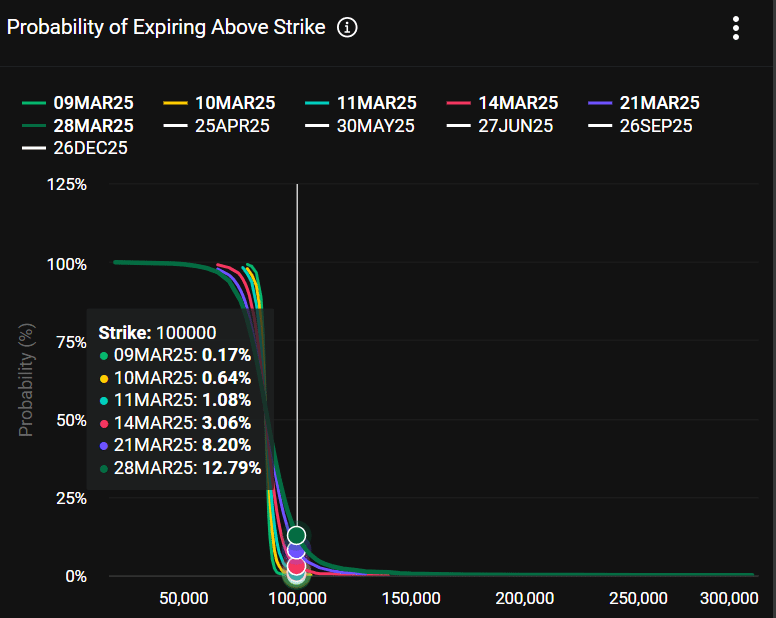

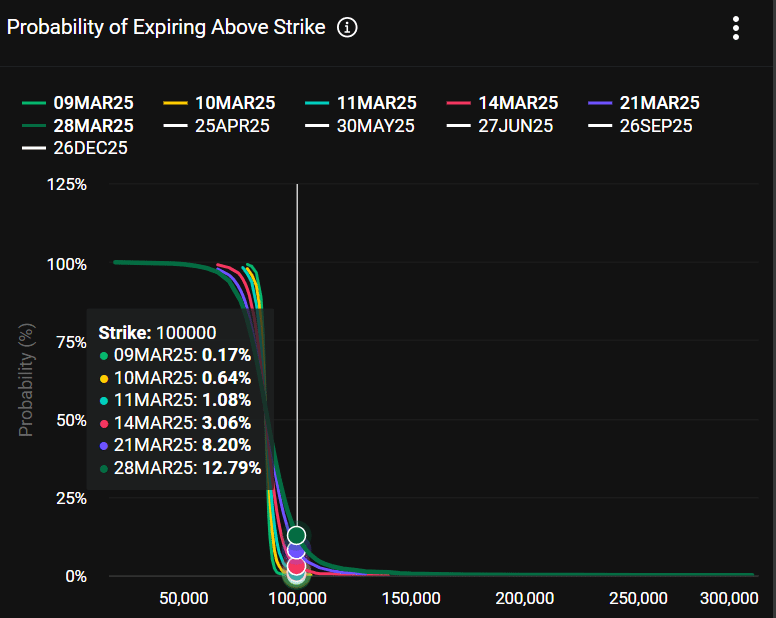

In keeping with Deribit knowledge, Choices merchants have been pricing solely a 12% probability that BTC would reclaim $100k by the tip of March.

Supply: Deribit