Supply On Exchanges Continues To Hit New All-Time Lows

On-chain knowledge exhibits the Ethereum provide on exchanges has continued to drop decrease lately, an indication that may very well be bullish for the asset.

Ethereum Provide On Exchanges Has Gone Down Not too long ago

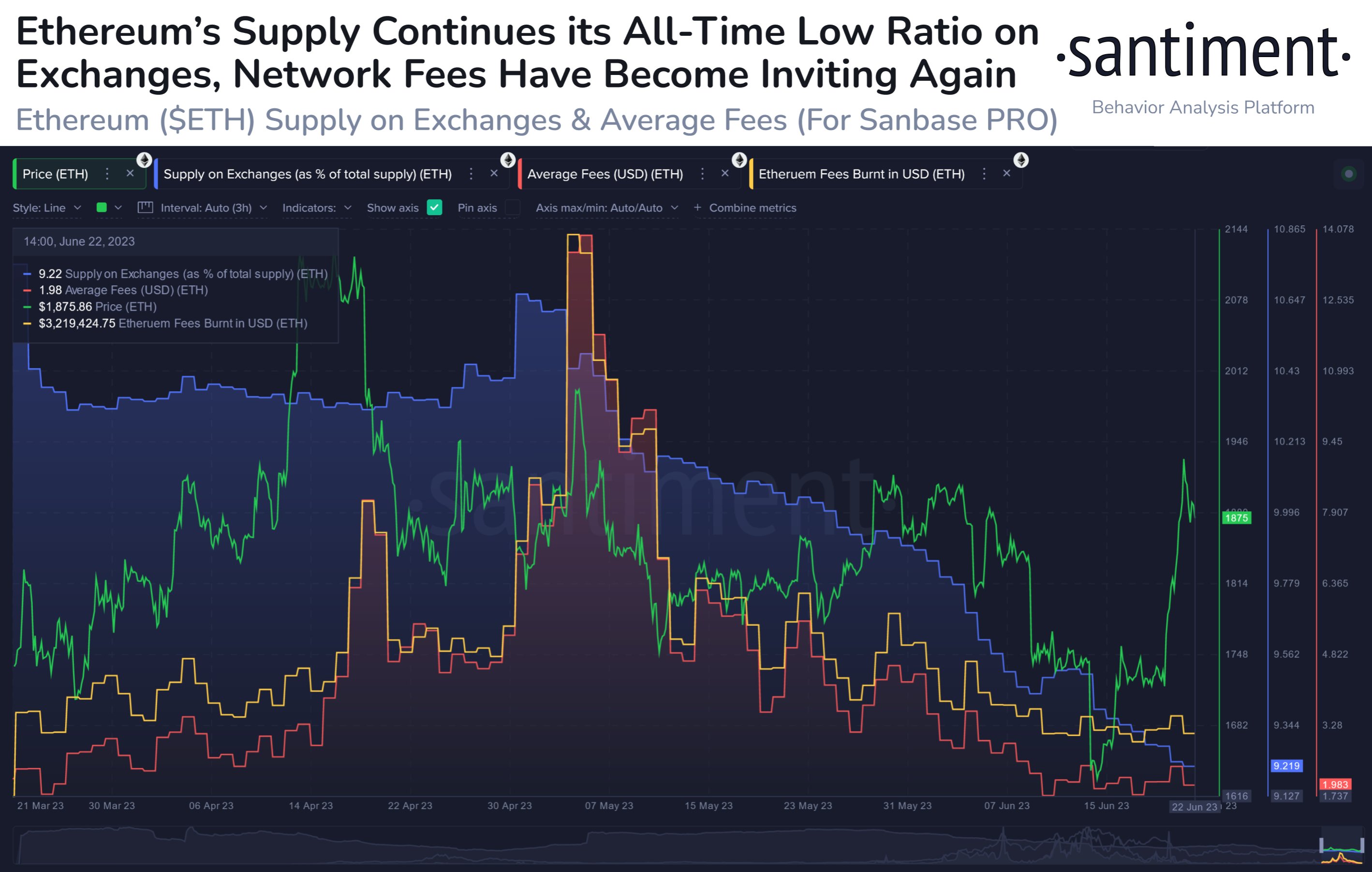

In line with knowledge from the on-chain analytics agency Santiment, provide has continued to depart exchanges lately. The related indicator right here is the “provide on exchanges,” which measures the full proportion of the Ethereum provide that’s sitting within the wallets of all centralized exchanges.

When the worth of this metric will increase, it signifies that a web variety of cash is getting into the provision of those platforms. As one of many major the explanation why traders may need to deposit their ETH to the exchanges is for selling-related functions, this sort of development can have a bearish impact on the asset’s worth.

Then again, reducing values of the indicator indicate the holders are withdrawing their cash from these platforms proper now. Such a development, when extended, could also be a touch that the traders are accumulating at present, and therefore, could be bullish for the cryptocurrency.

Now, here’s a chart that exhibits the development within the Ethereum provide on exchanges over the previous couple of months:

The worth of the metric appears to have been taking place in latest days | Supply: Santiment on Twitter

As displayed within the above graph, the Ethereum provide on exchanges has been in a downtrend throughout the previous couple of weeks, implying that traders have been always taking out their cash from these platforms.

When these withdrawals began, the indicator had reached what was primarily an all-time low (the one time the metric’s worth was decrease was method again through the first week of the asset going reside for public buying and selling).

Because the holders have continued to switch their ETH out of the exchanges, new all-time lows within the metric have continued to be hit. Curiously, even after the newest sharp rally within the Ethereum value has occurred, the metric hasn’t deviated from its downward trajectory.

Often, throughout speedy will increase within the asset’s worth, the provision on exchanges tends to go up as some traders look to benefit from the profit-taking alternative.

Because the indicator has solely continued to go down additional lately, it’s attainable that even when there may be some promoting happening, there may be additionally sufficient shopping for going to make up for it.

Within the chart, Santiment has additionally included the information for the “common charges,” an indicator that measures the typical quantity of charges that traders are attaching to their Ethereum transactions at present.

From the graph, it’s seen that this metric has been comparatively low lately. It will seem that although the rally has taken place, the community exercise hasn’t but exploded, because the charges usually shoot up when there’s a excessive quantity of site visitors on the blockchain.

The analytics agency notes, nonetheless, that this setup is kind of much like that noticed again in March, following which Ethereum noticed a speedy rise towards the $2,100 degree.

ETH Worth

On the time of writing, Ethereum is buying and selling round $1,800, up 12% within the final week.

Seems like the worth of the asset has seen a pointy surge lately | Supply: ETHUSD on TradingView

Featured picture from DrawKit Illustrations on Unsplash.com, charts from TradingView.com, Santiment.web