SushiSwap surges 80%, this cohort joins the party

- Sushi continued its uptrend with an over 2% improve.

- The Funding Fee additionally remained optimistic at press time.

SushiSwap [SUSHI] has skilled a major improve in worth, making it one of many winners within the present market. Are spinoff merchants additionally sharing this bullish sentiment as a result of worth uptrend?

How a lot are 1,10,100 SUSHIs value at present?

SushiSwap spikes by over 80%

SushiSwap stands out as one of many main beneficiaries within the present bull marketplace for altcoins. This bullish development is partly as a result of latest uptick in Bitcoin’s [BTC] worth over the previous few weeks.

As Bitcoin maintained a worth above $34,000, its earnings have flowed into these altcoins. Moreover, in line with a Santiment report, it has witnessed a formidable 82% improve in worth over the previous week.

Analyzing SUSHI’s development

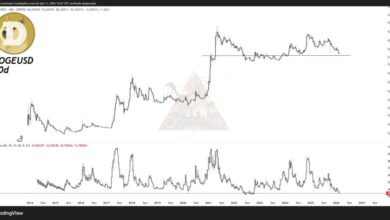

On the every day timeframe chart, a good portion of SushiSwap’s exceptional 80% worth rise occurred throughout a single commerce. The commerce accounted for 47.80% of that improve on 1 November.

After that, the asset skilled a slight drop of greater than 8% within the following buying and selling session. Nevertheless, it nonetheless held throughout the new worth vary. On the time of this writing, it was buying and selling at round $1.0, with a 2% improve in worth.

Supply: TradingView

Moreover, the Relative Energy Index (RSI) instructed the potential for a worth correction within the close to future. The RSI had risen above 80, signaling that the asset was overbought and in a bullish development on the time of writing.

Moreover, the declining buying and selling quantity indicated {that a} worth retracement may occur quickly.

By-product merchants financial institution on worth improve

An examination of the funding price on Coinglass signifies that spinoff market merchants additionally exhibited a optimistic outlook on costs. The SushiSwap funding price surged to its highest degree in a number of months, reaching round 0.2%.

Subsequently, it progressively declined however remained in optimistic territory, standing at round 0.01% on the time of this report.

Is your portfolio inexperienced? Try the SUSHI Revenue Calculator

Furthermore, the liquidation chart revealed that the value spike led to a rise in liquidations. At press time, there was solely a minor disparity between brief and lengthy liquidations.

Quick liquidations amounted to roughly $213,000, whereas lengthy liquidations stood at round $218,000.