SYRUP slips, $1.85M in profits taken – Yet 85% of bulls hold strong: Why?

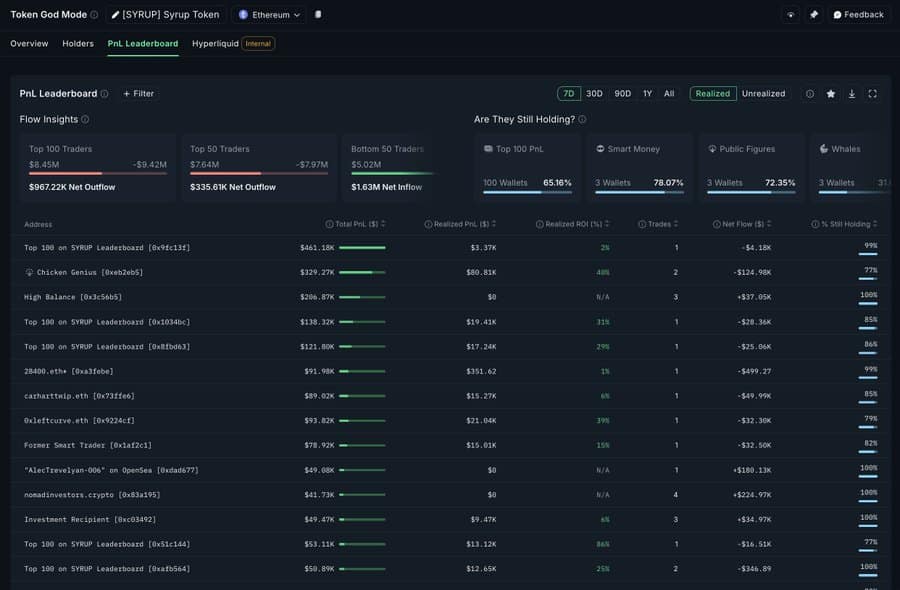

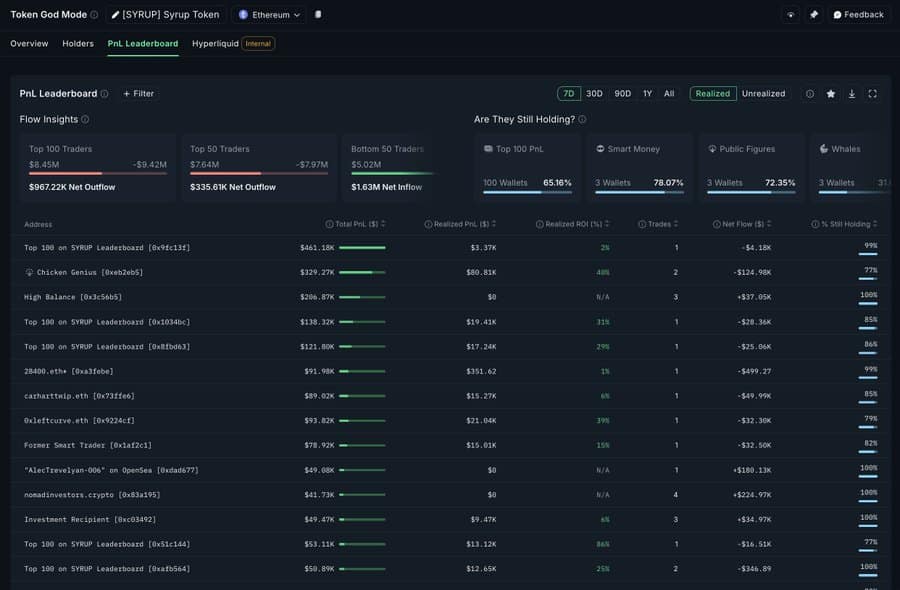

- SYRUP’s prime holders realized $1.85 million earnings; 65% are nonetheless holding.

- Different market contributors—led by Binance merchants—have continued to dump the altcoin, growing downward stress.

Maple Finance [SYRUP] dipped 3.25% on the twenty eighth of June, paring positive aspects from its sharp 6.17% soar the day before today.

Market situation evaluation prompt that long-term holders’ profit-taking is a key cause behind the sell-off. In response to AMBCrypto’s evaluation, Binance-based sellers look like main this wave of decline.

Good cash makes its exit

Naturally, when costs rise quick, the earliest patrons typically promote first. That’s precisely what performed out.

In response to Nansen, prime SYRUP holders—lots of whom entered early—realized over $1.85 million in earnings this week.

Supply: Nansen

About 65% of the highest 100 wallets nonetheless maintain the token, however the outflows are gaining tempo.

In truth, the highest three wallets alone secured over $911K in positive aspects. What’s extra telling? 78% of those addresses are tagged as ‘sensible cash’—entities recognized for purchasing excessive and promoting low.

Usually, robust holding conduct would possibly encourage market confidence and persuade others to purchase.

Nonetheless, the present pattern suggests the alternative, as many of those buyers proceed to promote, probably because of earlier sell-off patterns.

Binance merchants drive promote stress

Knowledge from Binance spinoff markets confirmed that merchants on the platform are driving a lot of the promoting stress.

In response to CoinGlass, the Lengthy/Brief Ratio hovered close to 0.47, signaling heavy promoting. A ratio beneath 1 sometimes signifies promoting dominance, and the additional the determine drops from 1, the stronger the bearish sentiment.

Supply: CoinGlass

The affect of Binance merchants is important, as they management a big portion of Open Curiosity (OI), Buying and selling Quantity, and Commerce Depend.

On the twenty eighth of June, each OI and complete buying and selling quantity declined, seemingly because of Binance’s market impression. Quantity dropped from $451.63 million to $242.31 million, whereas Open Curiosity declined 10.16% to $71.75 million.

Supply: CoinGlass

If promoting persists, it might result in decreased liquidity inflows, limiting value discovery as merchants step away from hypothesis.

Spot market sell-off provides to SYRUP’s liquidity crunch

The spot market, or non-leveraged buying and selling surroundings, additionally witnessed a spike in promoting exercise, reinforcing the market’s bearish tilt.

Per Coinglass, $2.9 million in SYRUP was offloaded through spot Trade Netflows on the twenty eighth of June.

Quantity on CoinMarketCap confirmed the sample, shrinking from $118 million on the twenty sixth of June to $77 million on the twenty ninth of June.

Supply: CoinMarketCap

Regardless of this, information from CoinMarketCap’s Neighborhood Sentiment chart reveals that not all contributors count on additional decline.

On the twenty eighth of June, Neighborhood Sentiment remained bullish, with 85% anticipating a value enhance.

If these bullish buyers proceed to step in, SYRUP would possibly keep away from deeper losses and even stage a robust rebound.