Ethereum’s liquidity inflow hits $128 mln – Potential for future upside?

- Ethereum rose 2.32% as spot promoting cooled and liquidity returned.

- Open Curiosity hit $21.5B, with lengthy merchants paying optimistic Funding Charges.

Ethereum [ETH] recorded a modest 2.32% worth achieve up to now 24 hours. This shift in sentiment comes as promoting stress eases and liquidity begins to enter the market.

Evaluation means that ETH could possibly be in a preparatory part for a possible rally to the upside.

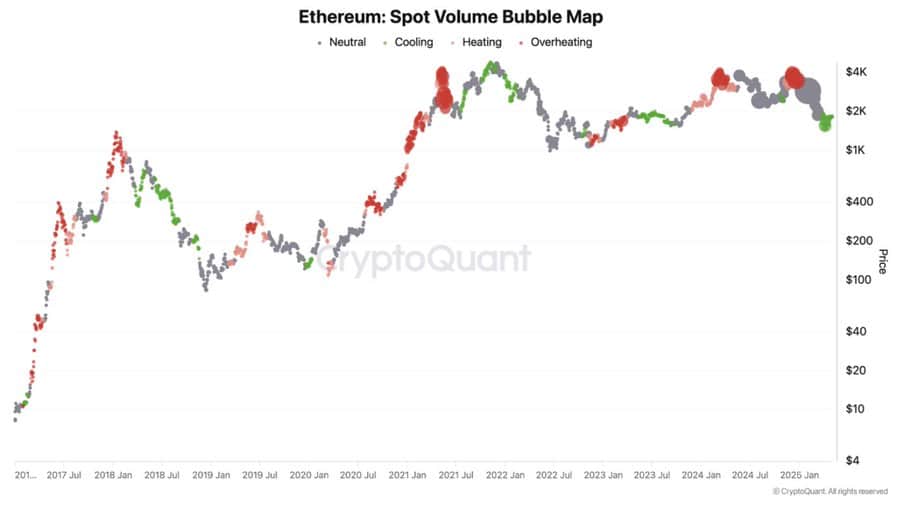

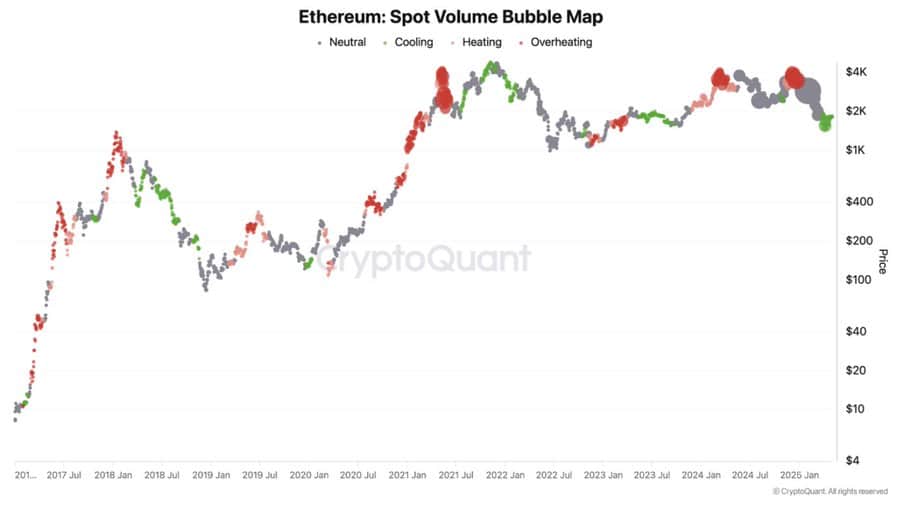

Spot quantity cools—How good is that this for ETH?

ETH’s Spot Buying and selling Quantity has begun to say no, persevering with its downward development.

The chart shows this via bubble sizes, with bigger bubbles indicating larger quantity and smaller bubbles indicating decrease quantity.

Supply: CryptoQuant

In truth, decrease quantity throughout a correction part usually displays cooling sell-side momentum. This means that continued promoting curiosity from merchants is steadily fading, resulting in decreased volatility.

Spot market exercise, nonetheless, reveals that some cohorts are nonetheless promoting.

On the time of writing, these merchants bought $32 million price of ETH up to now 24 hours, a substantial decline from the 102,000 ETH (price $190 million) bought on the sixth of Might.

Supply: CoinGlass

On the identical day, massive buyers had bought 105,000 ETH price $195 million, reflecting a insecurity in ETH’s near-term potential.

As promoting stress cools, liquidity influx has began to rise, as an early signal of a possible rally.

Liquidity influx sees surge

Up to now 24 hours, Ethereum recorded the very best on-chain influx amongst main property—$128.4 million in Chain Netflow.

Chain Netflow measures the quantity of liquidity added to a blockchain via its native token.

Supply: Artemis

A big netflow like this suggests that ETH purchases by patrons exceeded the quantity bought by sellers. This added liquidity suggests elevated on-chain exercise, notably on Ethereum-based protocols.

Such exercise usually has a web optimistic impact on worth. If momentum continues, different market individuals could observe.

Futures merchants keep forward of the motion

Within the Futures market, merchants are already positioning for an ETH rally. That is evident within the quantity of unsettled contracts now held by lengthy merchants, who’re paying a premium payment.

Open Curiosity, which measures the worth of unsettled positions, was $21.5 billion at press time.

Supply: CoinGlass

The Funding Fee at 0.0048% confirmed lengthy dominance—patrons had been paying a premium to carry their positions.

Having stated that, such conviction from spinoff merchants usually precedes spot rallies. If lengthy positions and quantity rise additional, ETH could break larger within the days forward.