ADA, MATIC, SOL face the music as Robinhood delists tokens

- The choice to finish assist for the tokens prompted a $387 million wipeout from the crypto market.

- A number of indicators revealed that ADA, SOL, and MATIC’s momentum have been bearish.

The costs of Cardano [ADA], Polygon [MATIC], and Solana [SOL] tumbled in double-digit figures after Robinhood confirmed that it was delisting the tokens from its platform.

Is your portfolio inexperienced? Test the Solana Revenue Calculator

Whereas the U.S. buying and selling platform didn’t give cogent causes for its determination, hypothesis went round that it was linked to the latest SEC “unregistered securities” tag.

Not like not too long ago focused exchanges like Binance [BNB] and Coinbase, Robinhood is duly regulated by the SEC. Therefore, it might have been essential to take such motion.

Regulatory concern leads merchants to liquidation

In its statement, Robinhood famous that no different cash have been affected. However holders of the ADA, SOL, and MATIC had till 27 June to cease transacting the tokens.

The change defined:

“We frequently overview the crypto we provide on Robinhood. Based mostly on our newest overview, we’ve determined to finish assist for Cardano (ADA), Polygon (MATIC), and Solana (SOL) on June twenty seventh, 2023 at 6:59 PM ET.”

Because the sudden transfer despatched shockwaves by the crypto market, the implication of the choice revealed itself.

Based on CoinMarketCap, SOL’s worth decreased by 22.47% within the final 24 hours. ADA couldn’t escape the warmth, registering a 23.06% lower. As for MATIC, it was down by 26.12% throughout the identical interval.

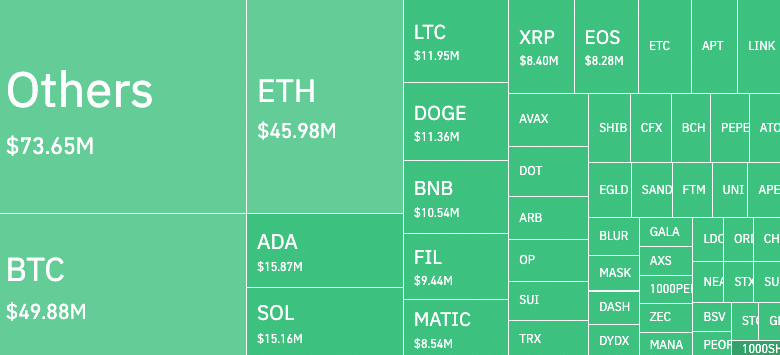

Due to the numerous decline within the costs of those tokens, liquidations previously 24 hours surged to $387 million, with longs struggling probably the most.

Supply: Coinglass

Based mostly on the liquidation heatmap from Coinglass above, SOL accounted for $15.15 million out of the entire wipeout. MATIC’S liquidation went as much as $8.54 million, whereas ADA was $15.87 million.

Purple season for the cohort

In the meantime, an analysis of the ADA/USD each day chart confirmed that the token’s momentum had breached the oversold area, as indicated by the Relative Energy Index (RSI).

At 17.21, the RSI confirmed that promoting strain was great. Thus, the momentum was bearish, and slight shopping for energy would possibly do nearly nothing to avoid wasting the worth motion from the press time state.

![Cardano [ADA] price action](https://statics.ambcrypto.com/wp-content/uploads/2023/06/ADAUSD_2023-06-10_12-38-40.png)

Supply: TradingView

With a pointy purple bar, SOL’s Transferring Common Convergence Divergence (MACD) positioned sellers in absolute management of the market.

Lifelike or not, right here’s ADA’s market cap in MATIC phrases

Right here, the orange dynamic line was above the bullish, indicating how bullish strides have been utterly neutralized. Moreso, each strains have been under the zero-midpoint histogram. So, the probabilities of a fast restoration have been near non-existent.

![Solana [SOL] price action](https://statics.ambcrypto.com/wp-content/uploads/2023/06/SOLUSD_2023-06-10_12-42-26.png)

Supply: TradingView

The each day timeframe of MATIC was not any higher. This was as a result of the Superior Oscillator (AO) was right down to -0.1139. Thus, AO crossing into the damaging territory indicated a bearish sign.

Supply: TradingView