US Crypto Exchange-Traded Funds Beat Out Vanguard’s Legendary S&P 500 ETF in Record-Setting Month of Inflows: Analyst

New information from senior Bloomberg analyst Eric Balchunas reveals that US crypto ETFs (exchange-traded funds) beat out Vanguard’s famend S&P 500 ETF (VOO) in July.

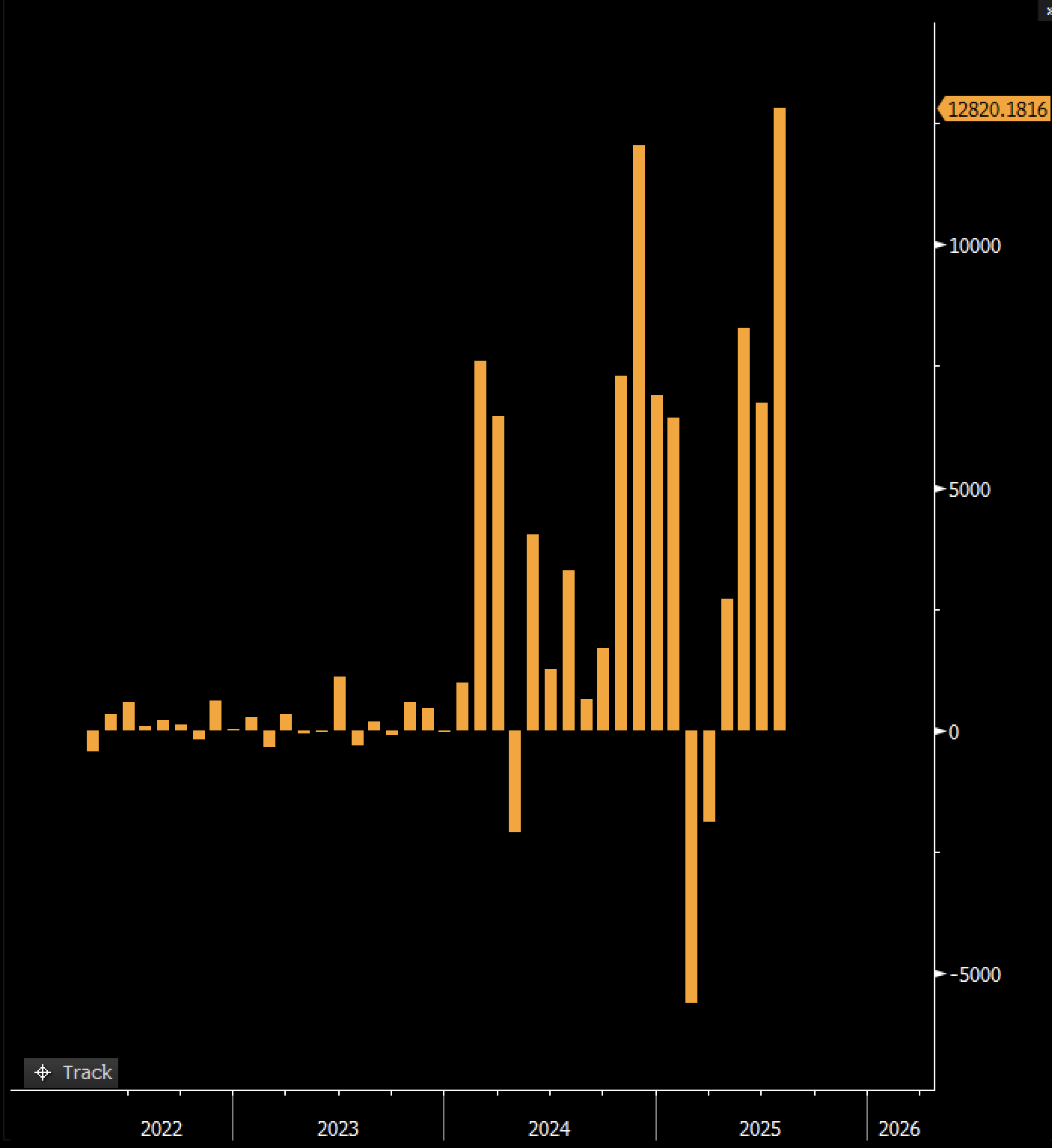

In a brand new thread on the social media platform X, Balchunas notes that US crypto ETFs had a staggering $12.8 billion price of inflows in July, outpacing all different ETFs, together with VOO, which presently has $713.13 billion in assets under its management.

“US Crypto ETFs took in $12.8 billion in July, the very best month ever, [at] a $600m/day tempo, about double [the] common. As a gaggle, that’s greater than any single ETF did, together with the Mighty VOO.

Additional, each ETF in [the] class took in money (ex the transformed trusts) w/ Bitcoin and Ether making equal contributions. Most all-around dominant efficiency for the reason that Eagles ended the Chiefs within the Tremendous Bowl. Might be laborious to high.”

The analyst goes on to say that asset administration titan BlackRock’s iShares Bitcoin Belief ETF (IBIT) is doing nicely and drawing in new clients.

“Wonderful stat: 75% of the traders who purchased IBIT ($87 billion by way of a million folks) had been first-time clients of BlackRock. And 27% of them went on to purchase one other iShares ETF. Only a complete coup for BLK throughout.”

In response to Balchunas, IBIT – which launched in January 2024 – had a significant hand in Bitcoin’s (BTC) huge value progress during the last two years.

“1) ETFs maintain BTC at a 1:1 ratio. There isn’t a lending, there is no such thing as a paper IOUs. ETFs are clear and above board and each dime of AUM is linked to the proportional Bitcoin.

2) Zoom out: Bitcoin is up almost 300%(!) for the reason that notorious BlackRock submitting two years in the past. ETF flows large a part of that.

3) From what I’m listening to on right here, the promoting is irritated OGs who don’t like that Wall St. and the federal government has adopted BTC. I assume they like BTC to have intermediaries like Sam Bankman-Fraud as an alternative.”

Bitcoin is buying and selling for $113,763 at time of writing, a 3.2% lower on the day whereas IBIT and VOO are valued at $64.27 and $572, respectively.

Observe us on X, Facebook and Telegram

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Worth Motion

Surf The Each day Hodl Combine

Generated Picture: Midjourney