Here are the key factors behind the delayed altcoin season

- Altcoin season follows Bitcoin’s dominance – Capital shifts when BTC.D declines

- A number of components might pose a major menace to altcoin cycles

Bitcoin dominance [BTC.D] is a key metric to trace altcoin seasons. When BTC.D drops, it normally means buyers are transferring into altcoins in periods of market volatility.

Nonetheless, even with macroeconomic considerations just like the upcoming FOMC assembly and Trump’s 2 April ‘reciprocal’ tariffs, Bitcoin’s dominance stays sturdy. On the time of writing, it had a studying of 61.6%, nonetheless a bit beneath its February peak of 64.3%.

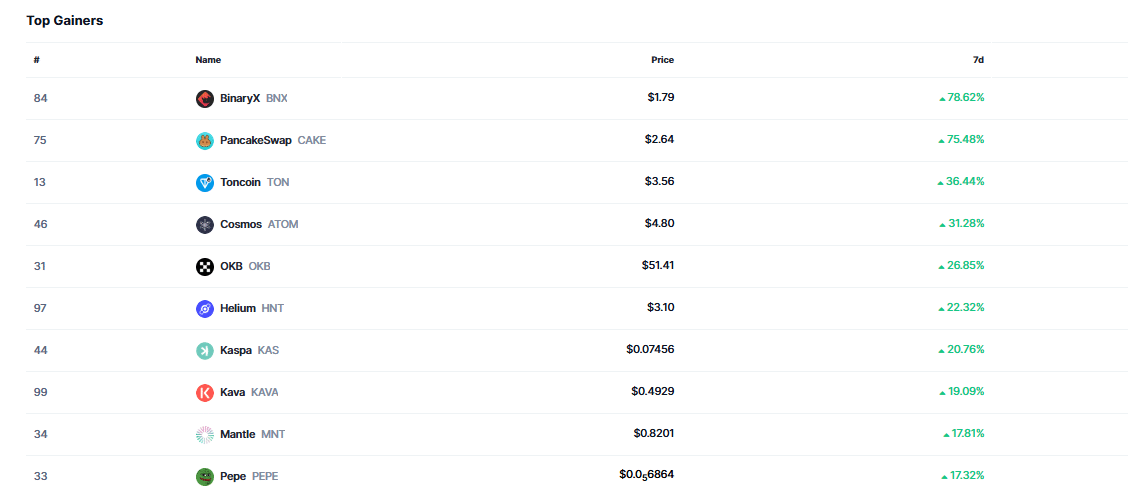

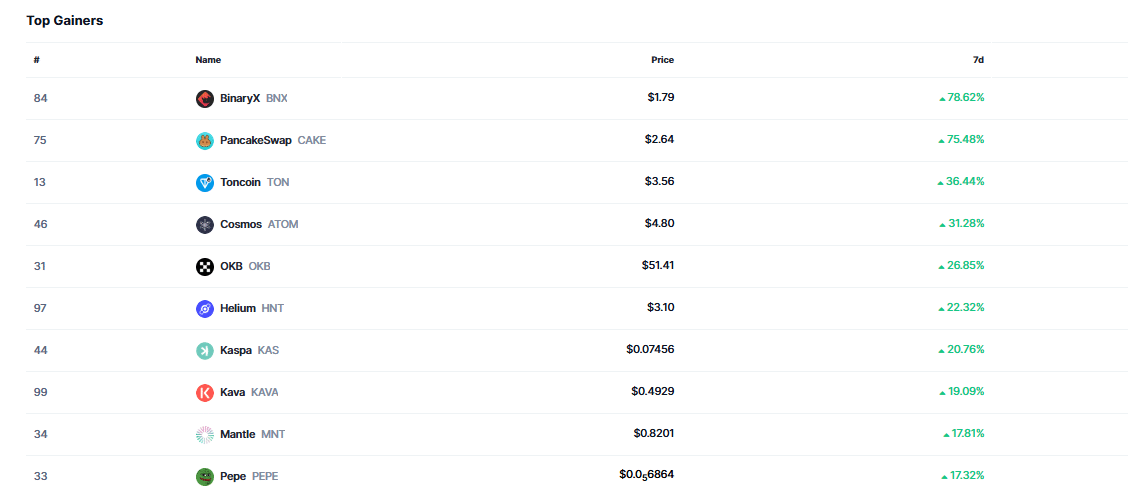

Apparently, a better take a look at the weekly prime gainers revealed that 4 out of the 5 have been mid or low-cap altcoins. This shift suggests buyers have been transferring away from large-cap cash in favor of cheaper, higher-risk choices.

Supply: CoinMarketCap

Bitcoin’s resilience within the face of altcoin overload

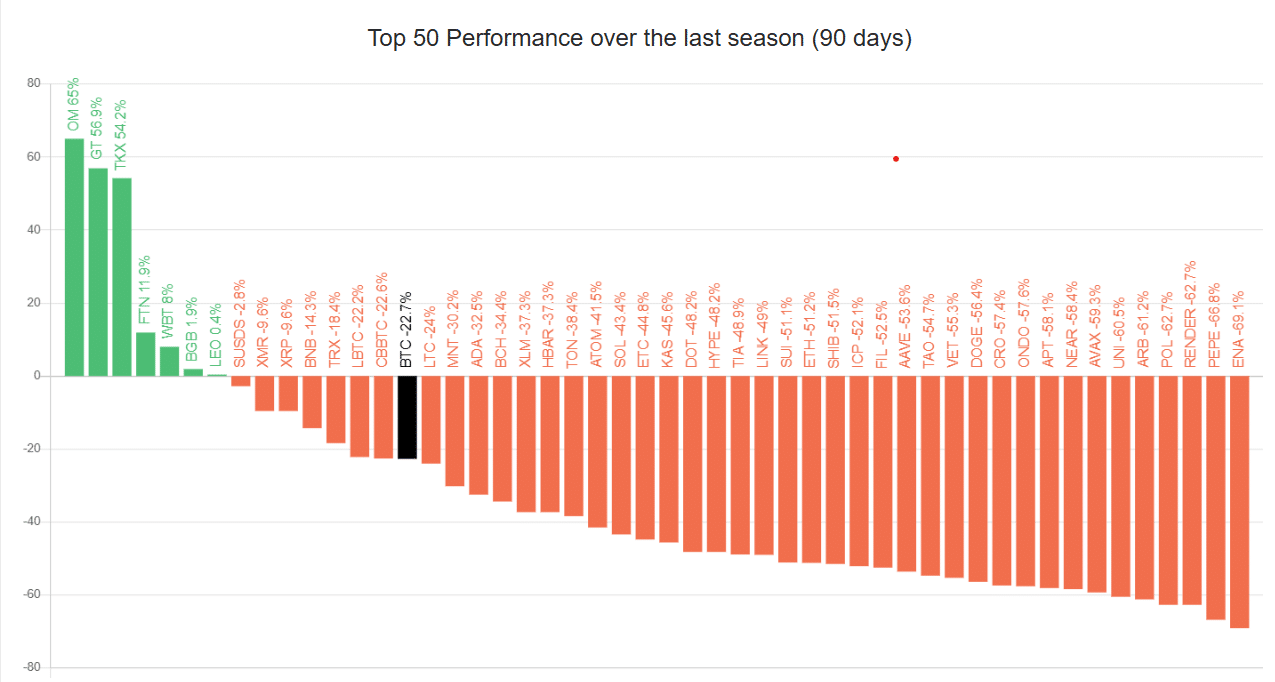

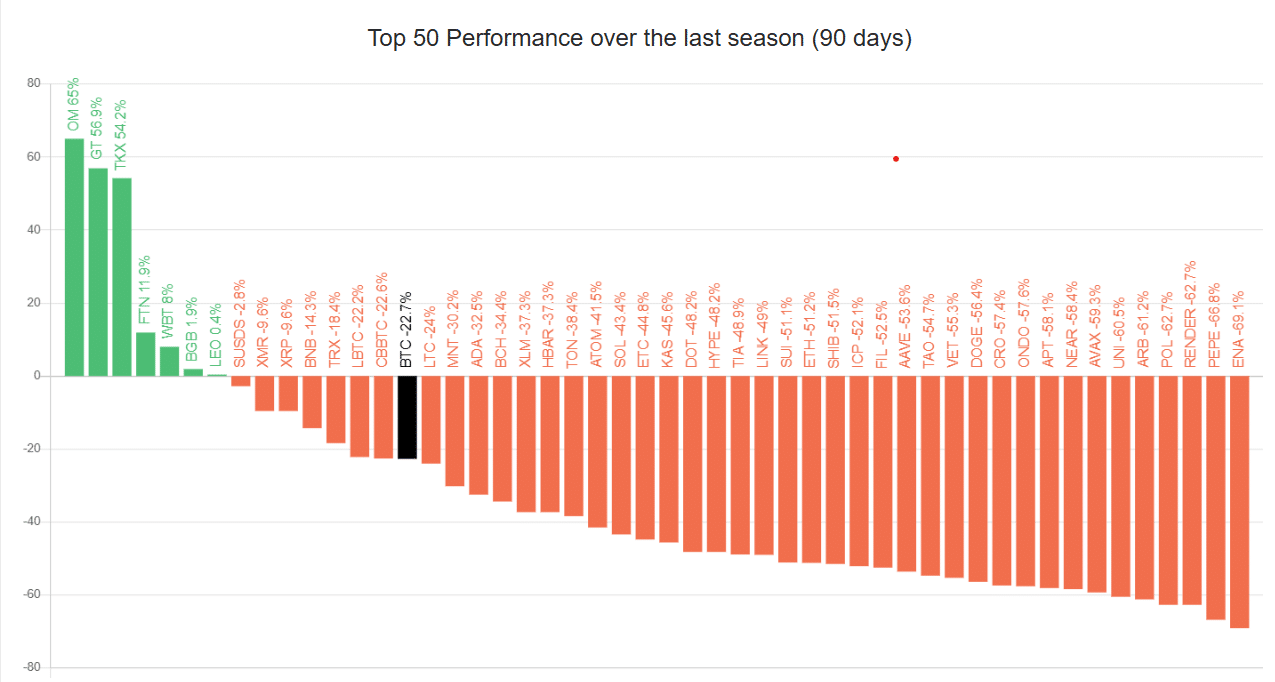

Traditionally, Bitcoin dominance has served as an necessary gauge for altcoin seasons. When BTC.D rises, it sometimes alerts that buyers are transferring their funds into Bitcoin for security. Nonetheless, this time, issues really feel completely different. For starters, the danger with Bitcoin is larger than common. Q1 didn’t finish as anticipated – Bitcoin continues to be caught beneath $100k, disappointing many.

Moreover, no charge cuts are anticipated till not less than the top of Q2, retaining the market in a wait-and-see mode. Regardless of this, the altcoin season is nowhere to be seen.

Even with Bitcoin holding regular, the altcoin season index sat at 29 at press time, that means 58% of altcoins are outperforming BTC. Particularly the low-to-mid cap cash.

Nonetheless, this was nonetheless far beneath the 75% threshold sometimes wanted to kickstart a real altcoin season.

Supply: Blockchaincenter.internet

A key issue behind this cycle is the rise of Bitcoin ETFs. Simply days earlier than Bitcoin hit its all-time excessive of $109k in January, Bitcoin ETFs noticed $1.078 billion in inflows.

Since then, tens of millions have poured into these ETFs, retaining capital locked in BTC. This shift has delayed the everyday altcoin season, particularly as liquidity stays restricted.

The top of the altcoin season?

As of 18 March, there have been over 12.88 million digital property listed on CoinMarketCap, up from 11 million in February. This surge, primarily from memecoins and low-cap tokens, is spreading investor consideration skinny.

Whereas Bitcoin dominance holds sturdy and delays altcoin season, buyers are turning to high-risk alternate options. Many tokens at the moment are caught with market caps between $10,000 and $100,000, locking up capital in short-term property.

That is placing strain on prime high-cap cash. As an example – The ETH/BTC pair, as soon as sturdy, has now fallen to a five-year low.

Supply: TradingView (ETH/BTC)

In conclusion, Bitcoin’s dominance stays sturdy, with new tokens and the rise of ETFs reshaping the market. The standard stream of capital from Bitcoin to altcoins appears to be fading too, leaving the cryptocurrency firmly in management.