Can Bitcoin Copy Apple’s 80,000%+ Rise Since the Dot-Com Burst? Fidelity Macro Expert Says BTC Poised To Thrive

Constancy Investments’ international macro director Jurrien Timmer says that the alternating bullish and bearish cycles of crypto belongings are just like the tech bubble.

Noting that Amazon and Apple are among the tech shares that emerged as winners from the tech bubble, Timmer says that the crypto trade is in related circumstances the place some digital belongings will rise whereas others die.

Based on Timmer, Bitcoin (BTC) might be the “Apple” of crypto belongings.

“Crypto’s boom-bust cycle may be in comparison with the dot-com bubble of the late Nineties. The web bubble took many unqualified shares to astronomical heights, solely to see them lose most or all their worth when the bubble burst.

In that course of, the long-term winners, reminiscent of Apple and Amazon, have been separated from the losers. The identical has up to now confirmed to be true for crypto. If we assume Bitcoin is the Apple of the digital-asset age, then it may make sense that Bitcoin not solely survives the crypto winter however even thrives and takes market share from different digital belongings.”

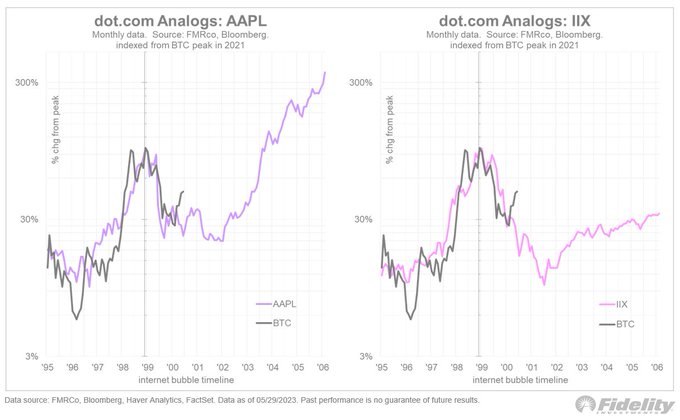

Whereas overlaying Bitcoin’s present chart over Apple and an web inventory index chart from twenty years in the past, it seems that Timmer is suggesting that BTC has displayed related worth motion relative to the 2.

“Under, I present an overlay of Bitcoin in the present day vs. Apple twenty years in the past (left), and Bitcoin vs the Interactive Web Index (IIX) on the appropriate. The IIX was a now-defunct index of web shares that noticed its worth come full circle from nothing to bubble again to nothing.”

Based on Timmer, Apple’s inventory recovered after falling considerably in the course of the dot-com bubble and it stays to be seen whether or not Bitcoin will do the identical.

“Word that even stalwarts like Apple suffered a big draw-down when the bubble burst however recovered to develop into a dominant power, whereas so many also-rans fell into oblivion. Time will inform what’s in retailer for Bitcoin.”

Apple (AAPL), which ended 2002 at $0.22, is buying and selling at $177.25 as of Wednesday’s shut – a achieve of about 80,345%.

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Examine Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Generated Picture: Midjourney