US To Buy 1 Million Bitcoin For Reserves, Hints Michael Saylor

Este artículo también está disponible en español.

MicroStrategy founder and government chairman Michael Saylor advised that america may buy a million Bitcoin for its strategic reserves. His remarks got here throughout an interview with FOX Enterprise forward of Friday’s White Home Crypto Summit, to be hosted by US President Donald Trump.

Saylor, whose firm is extensively identified for its important Bitcoin holdings, confirmed that MicroStrategy owns roughly 500,000 of the digital tokens, accounting for “about 2.4% of the worldwide provide.” He’s one in every of a number of crypto-industry figures anticipated to hitch the presidential roundtable that may advise the administration on digital asset coverage.

Will Trump Purchase 1 Million Bitcoin?

When requested how the federal government would finance such a big crypto reserve, Saylor pointed to a deliberate, multi-year timeline, referencing a “six-month course of” set out by the current government order. He added: “There are 12 members on the presidential working committee. There’ll be involvement from the {industry}. There’ll be involvement from the Senate and from the home and I and it’s above my pay grade to determine how it’s decided.”

Associated Studying

In line with Saylor, “the longest invoice [by Senator Lummis] has laid out the concept of buying Bitcoin strategically over 4 years, simply constantly daily in an effort to attain one million Bitcoin goal.” At the moment, the US authorities is believed to carry 200,000 BTC—value an estimated $17 billion at in the present day’s costs.

Ought to it proceed with extra large-scale buying, the impact on the worth of Bitcoin could possibly be appreciable. Nonetheless, Saylor argued that probably the most “accountable” strategy can be “to go sluggish and regular and deliberate with clear telegraphing and transparency” somewhat than making abrupt acquisitions that might roil the market.

Central to Saylor’s stance is the classification of Bitcoin as “digital property,” an asset with out a central issuer.

“The true key about Bitcoin is for folks to grasp that it’s a digital property. It’s a financial savings account that empowers each single American to save lots of their wealth and protect it over time,” Saylor defined. He emphasised that if the US authorities offers readability round this standing, it may instill better confidence in residents to think about cryptocurrencies a professional financial savings car.

Associated Studying

In discussing whether or not taxpayer cash ought to be used to buy Bitcoin, Saylor drew a distinction between totally different digital property. Whereas Bitcoin (as a “digital commodity”) is, in his view, well-suited for strategic reserves, he additionally acknowledged the significance of digital currencies (stablecoins), tokenized securities (for capital effectivity), and token-based utility initiatives. Nonetheless, he singled out Bitcoin because the prime candidate for a nationwide reserve, calling it “the one universally agreed-upon foundational asset in your complete crypto economic system.”

MICHAEL SAYLOR HINTS THE USA WILL BUY 1 MILLION #BITCOIN FOR ITS RESERVE

IT’S HAPPENING

pic.twitter.com/jr73piPfNY— Vivek

(@Vivek4real_) March 5, 2025

Saylor additionally addressed skeptics who query the rationale for a nationwide Bitcoin reserve in comparison with extra conventional strategic reserves resembling oil or medical provides. He in contrast Bitcoin to property, invoking a historic analogy: “We purchased 75% of this nation with about 40 million {dollars} […] We purchased Louisiana. We purchased California. We purchased Texas. We purchased Alaska. It’s property. When you consider Bitcoin as property in our on-line world and also you say the place is all the cash on the earth headed? Effectively, it’s headed from overseas nations […] It needs to go from the bodily world to the digital world.”

For these involved in regards to the elementary ethos of Bitcoin as a decentralized asset with no authorities involvement, Saylor insisted that official adoption needn’t contradict the cryptocurrency’s unique design. “Satoshi gave us a course of, a protocol for prosperity. That’s what we name Bitcoin,” he mentioned. Whereas early adopters might have favored minimal regulation, Saylor believes nation-states “all in favour of financial empowerment and prosperity” will inevitably comply with people and companies into the digital area.

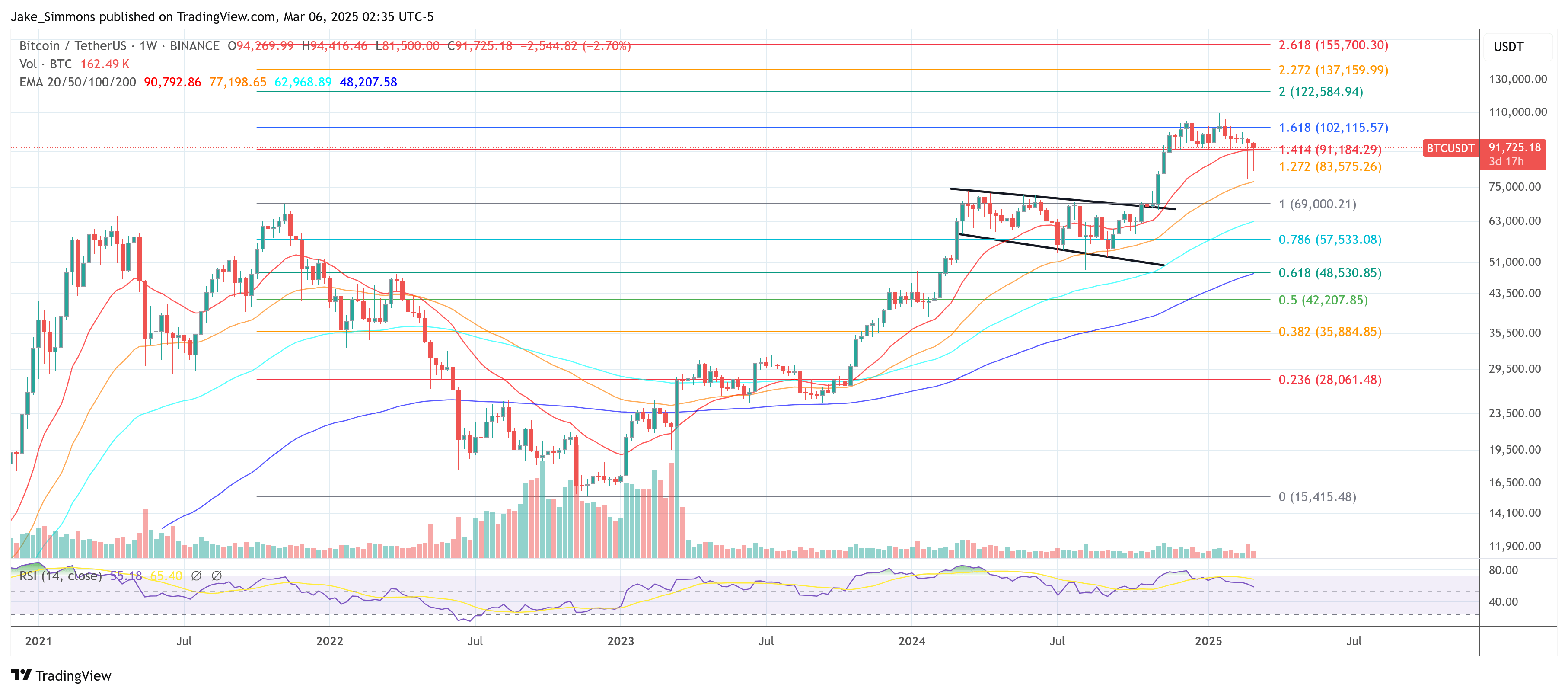

At press time, BTC traded at $91,725.

Featured picture from YouTube, chart from TradingView.com