Bitcoin CBD Heatmap Marks $95,500–$97,000 As Make-Or-Break Zone – Details

Since hitting a brand new all-time excessive nearly a month in the past, Bitcoin has carried out little to guarantee traders of intent to discover new worth territories. Amid announcement of latest US commerce tariffs and rising geopolitical tensions between Israel and Iran, the premier cryptocurrency has come beneath bearish influences to commerce as little as 101,000.

At press time, Bitcoin is hovering close to $104,000 following a 2.03% % decline previously day. Nonetheless, standard analytics firm Glassnode has highlighted an important worth vary price monitoring particularly within the creation of an additional worth decline.

Associated Studying: Bitcoin Sees Modest Beneficial properties, However Demand Weak spot Limits Breakout Potential

$95,500–$97,000: Bitcoin’s Line In The Sand

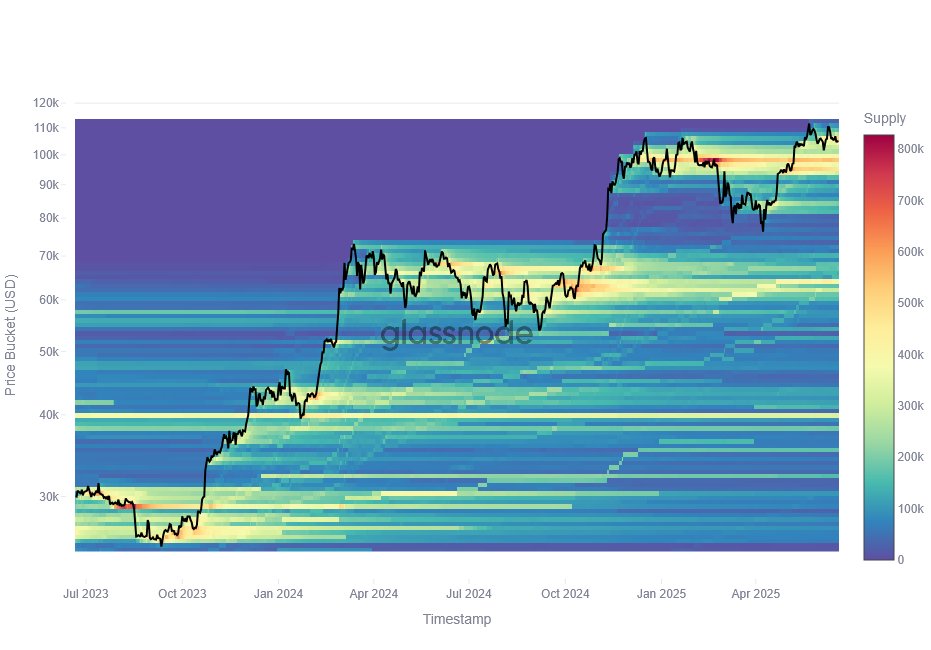

In a recent X post, Glassnode shares an perception into the Bitcoin market primarily based on knowledge from Value Foundation Distribution (CBD) heatmap. The CBD is a standard on-chain metric that tracks the value ranges at which tokens had been final bought or bought. When a considerable quantity of cash are traded inside a selected worth vary, it varieties a provide cluster able to appearing as a assist or resistance degree.

In accordance with Glassnode’s report, the Bitcoin’s CBD heatmap reveals the primary dense provide cluster under the present market worth lies at $95,500 – $97,000 worth zone. Curiously, this vary rests just under the short-term holders (STH) value foundation suggesting a confluence of technical and on-chain metric to current a high-stake battleground.

Due to this fact, Glassnode analysts clarify that holding the market worth above this threshold reinforces bullish momentum and boosts Bitcoin possibilities of re-entering a worth discovery mode. Nonetheless, a breakdown under the $95,500 worth degree may set off panic promoting supporting bearish projections for the mid-term to short-term.

Curiously, distinguished market analysts together with nameless X knowledgeable with username Mr. Wall Road has backed the latter state of affairs stating Bitcoin is due for an additional worth drops. Mr. Wall Road strictly warns Bitcoin wouldn’t maintain above the $100,000 psychological assist zone forecasting a worth fall to across the $93,000 – $95,000 which Glassnode predicts ought to induce widescale market liquidations.

Bitcoin Market Overview

On the time of writing, Bitcoin is buying and selling at $103,753 with a cumulative 1.27% decline previously week. Throughout this era, the flagship cryptocurrency remained largely beneath $106,000 barring a weak worth breakout between June 16 and June 17.

On a month-to-month scale, Bitcoin has now recorded a 6.10% loss, signaling a gradual shift in momentum with bearish forces regaining management of the market. In the meantime, with a market cap of $2.05 trillion, the “digital gold” continues to rank as the most important cryptocurrency with a reported market dominance of 64.3%.