Data shows Bitcoin dominance in US is on the rise – Here’s what it means

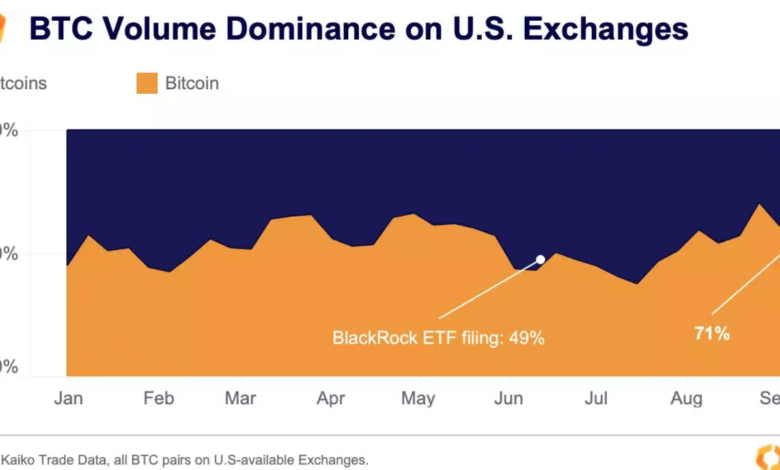

- Bitcoin’s dominance on US exchanges soared to 71%.

- Total exercise on Bitcoin declined regardless of the surge in value.

Within the wake of Bitcoin’s surge past the $26,000 threshold, the crypto market was infused with renewed bullish sentiment.

Learn Bitcoin’s Worth Prediction 2023-2024

Excessive on dominance

Moreover, Bitcoin’s [BTC] dominance on US exchanges witnessed a considerable upswing. In accordance with Kaiko’s information, the dominance reached 71% final month, marking its highest degree since October 2022.

The surge far exceeded the earlier peak of 66%, noticed in the course of the US banking turmoil in March. This resurgence in dominance suggests a possible inflow of institutional merchants into Bitcoin, probably influenced by rising actual yields and a deteriorating world threat sentiment.

Supply: Kaiko

In direction of the tip of September, Bitcoin’s cumulative quantity delta (CVD) transitioned into constructive territory, indicating a web shopping for development.

This elevated shopping for strain will help clarify why Bitcoin largely maintained its value vary, even after a quick dip beneath $25,000 in early September following FTX’s announcement of offloading its $3.4 billion crypto holdings as a part of chapter proceedings.

Nonetheless, the latest capital injection into altcoin markets forward of the anticipated launch of 9 Ethereum ETFs within the US may quickly disrupt this development.

Supply: Kaiko

Wanting on the previous

Historic information from Kaiko additionally revealed that September historically tends to be a difficult month for each typical equities and cryptocurrencies, with Bitcoin registering detrimental returns in 8 out of the previous 12 years.

Regardless of modest buying and selling volumes and surging risk-free charges, BTC recorded one among its strongest September month-to-month performances, closing final month with a 4.7% achieve.

Quite the opposite, QCP Capital, a crypto asset buying and selling agency, expressed skepticism relating to the sustainability of the latest value surge. They acknowledged that Bitcoin may check the vital help degree of $25,000 within the closing quarter of 2023.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Components contributing to this outlook embody the potential diversion of demand from the spot market as a result of accredited Ethereum futures ETFs and lower-than-expected core PCE inflation.

As of the latest information accessible, Bitcoin was buying and selling at $27,000. Regardless of the rising value, the variety of every day energetic addresses on the Bitcoin community skilled a big decline, elevating questions in regards to the underlying dynamics of the market.

Supply: Santiment