Bitcoin traders are back in profit, but are they ignoring THESE warning signs?

- Bitcoin’s Inventory-to-Circulation Ratio dropped by 16.66%, reflecting diminished shortage from elevated miner or holder distribution.

- BTC’s short-term holder margin flipped from -19% in April to +21% in Could.

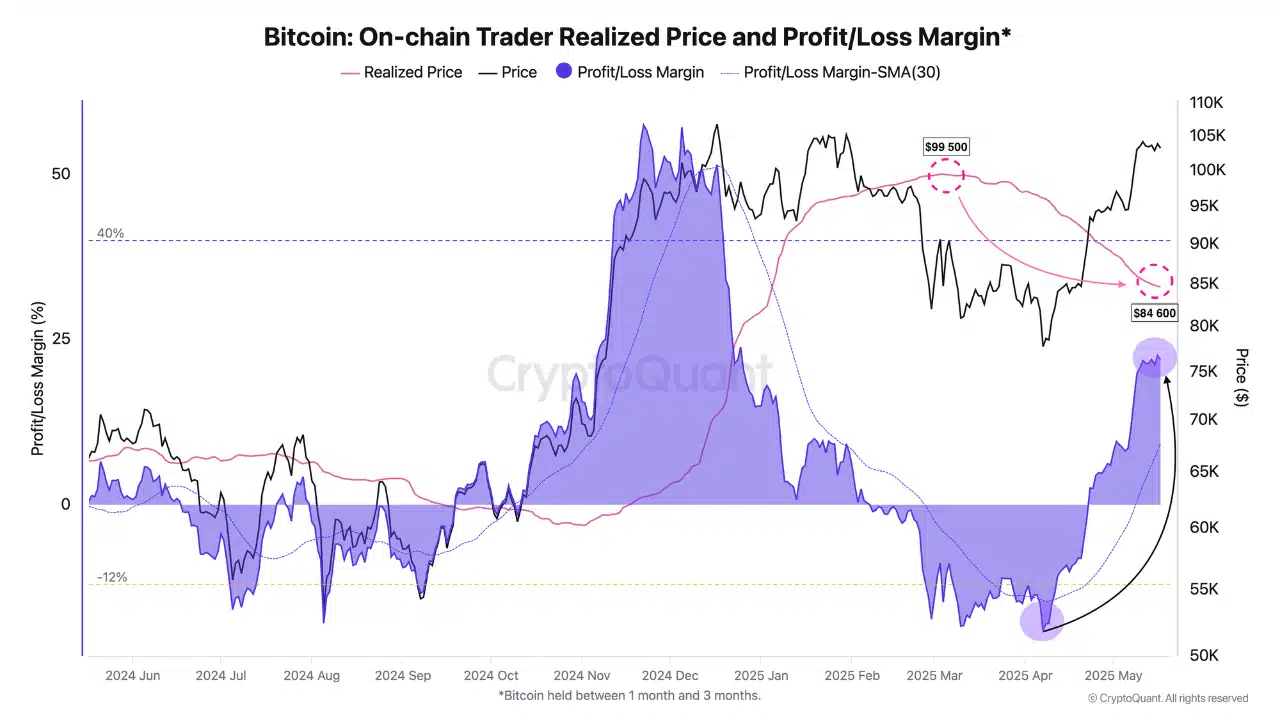

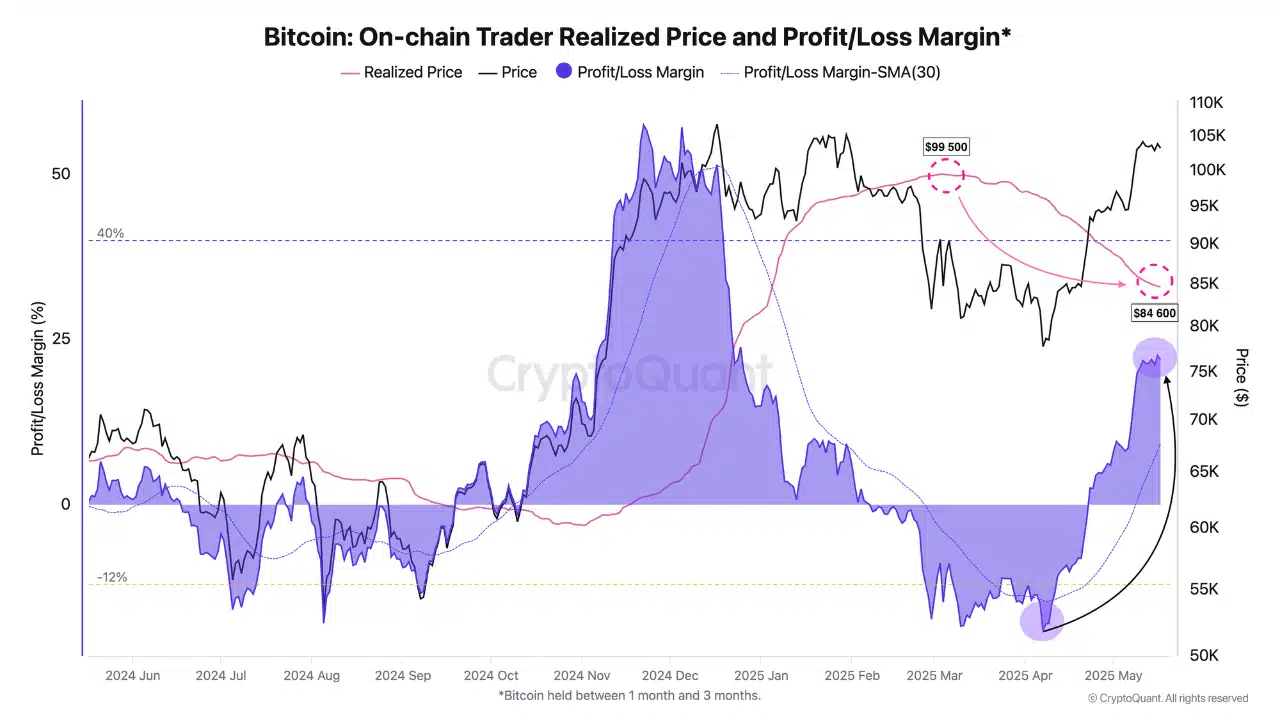

Bitcoin [BTC] short-term holders have rebounded sharply, with their Revenue/Loss Margin leaping from -19% in April to +21% in Could. This turnaround alerts renewed dealer optimism after weeks of correction.

The Realized Worth for the 1–3 month cohort has stabilized at $84,600, additional supporting accumulation sentiment. At press time, BTC hovered at $103,447, up 0.03% within the final 24 hours.

Furthermore, the 30-day Transferring Common of the Revenue/Loss Margin now sits at +9%—effectively under the overheated +40% threshold.

This means headroom for extra beneficial properties with out triggering aggressive profit-taking.

Supply: CryptoQuant

Is BTC’s valuation outpacing its fundamentals?

Having mentioned that, not all indicators aligned with the value restoration.

The Community Worth to Transaction (NVT) Ratio climbed by almost 70% to hit 52.81. This sharp rise implies Bitcoin’s market capitalization is rising quicker than the precise transferred quantity on-chain.

Though this could replicate bullish valuation enlargement, it usually precedes native tops when not supported by lively community utilization.

Subsequently, the present spike raises early warning, particularly if the expansion stays indifferent from transaction throughput.

Supply: CryptoQuant

In actual fact, community utilization did not sustain.

Bitcoin’s Inventory-to-Circulation Ratio dropped by 16.66% to 1.0595 million. This decline displays diminished shortage strain, doubtlessly attributable to shifting miner habits or a slowdown in accumulation from long-term holders.

When stock-to-flow tendencies decrease, newly mined BTC usually enters circulation quicker, doubtlessly creating mid-term provide strain if demand doesn’t rise in tandem.

Is BTC’s community exercise too weak to maintain the rally?

Regardless of Bitcoin rallying to over $103K, Day by day Lively Deal with (DAA) Divergence stays deeply adverse at -241.32%.

This indicated a significant disconnect between worth motion and person exercise, as fewer distinctive addresses are interacting with the community relative to its rising valuation.

Traditionally, such steep adverse divergence alerts weakening on-chain fundamentals behind worth strikes.

Supply: Santiment

On prime of that, transaction depend and community progress dropped sharply to 67.2K and 52.9K, respectively.

The cool-off in utilization alerts hesitation from each new and current members—an uncommon backdrop for a sustained rally.

A wholesome rally usually aligns with elevated person adoption and transaction throughput. Nonetheless, this latest decline contradicts worth momentum and suggests the rally could lack sturdy elementary assist.

Supply: Santiment

Lengthy/Quick Ratio alerts rising indecision within the derivatives market

Taking a look at derivatives, the Lengthy/Quick Ratio fell to 0.9964.

Longs made up 49.91%, whereas shorts ticked as much as 50.09%—almost even.

This near-equal distribution reveals growing uncertainty in dealer expectations. The sharp shift from a beforehand long-heavy bias highlights rising warning after Bitcoin’s latest worth surge.

Supply: CoinGlass

The present market outlook presents a conflicting narrative.

On one hand, Bitcoin’s restoration in dealer revenue margins and sustained worth energy suggests bullish momentum.

Then again, a pointy rise in valuation just isn’t being matched by progress in transaction exercise, person engagement, or community enlargement.

This disconnect raises issues in regards to the sustainability of the rally. For the upward pattern to proceed in a wholesome method, elementary on-chain metrics should enhance.