BNB sees weakening demand and increased sell-offs: What’s next?

- BNB has recorded weakening on-chain sentiment as individuals present an absence of curiosity within the asset.

- Open Curiosity within the Choices market has continued to drop, whereas spot buyers are promoting.

Binance Coin [BNB] has maintained a comparatively regular degree over the previous day, with no vital acquire or loss recorded throughout this era.

Present on-chain sentiment doesn’t assist a market rally. As curiosity wanes in each the spot and by-product markets, promoting stress is changing into extra seen. Right here’s every thing to know.

On-chain curiosity in BNB fades quick

Curiosity in buying and selling and the utility of BNB throughout the BNB Chain has weakened over the previous day.

On the time of writing, the variety of Every day Transactions accomplished on-chain has seen a steep decline, reaching its lowest degree this month.

This drop occurred after a 12.02% decline, following 12.7 million Every day Transactions accomplished in the course of the interval, as indicated on BSCScan.

Supply: BSCScan

This decline in exercise implies that market individuals aren’t actively partaking with the community or utilizing BNB.

Potential market individuals could also be reacting to this sign, because the variety of New Addresses has dropped considerably over the previous day.

On the time of writing, the variety of new individuals had declined by 25%. Sometimes, this metric will increase in periods of excessive curiosity and reduces in periods of low curiosity.

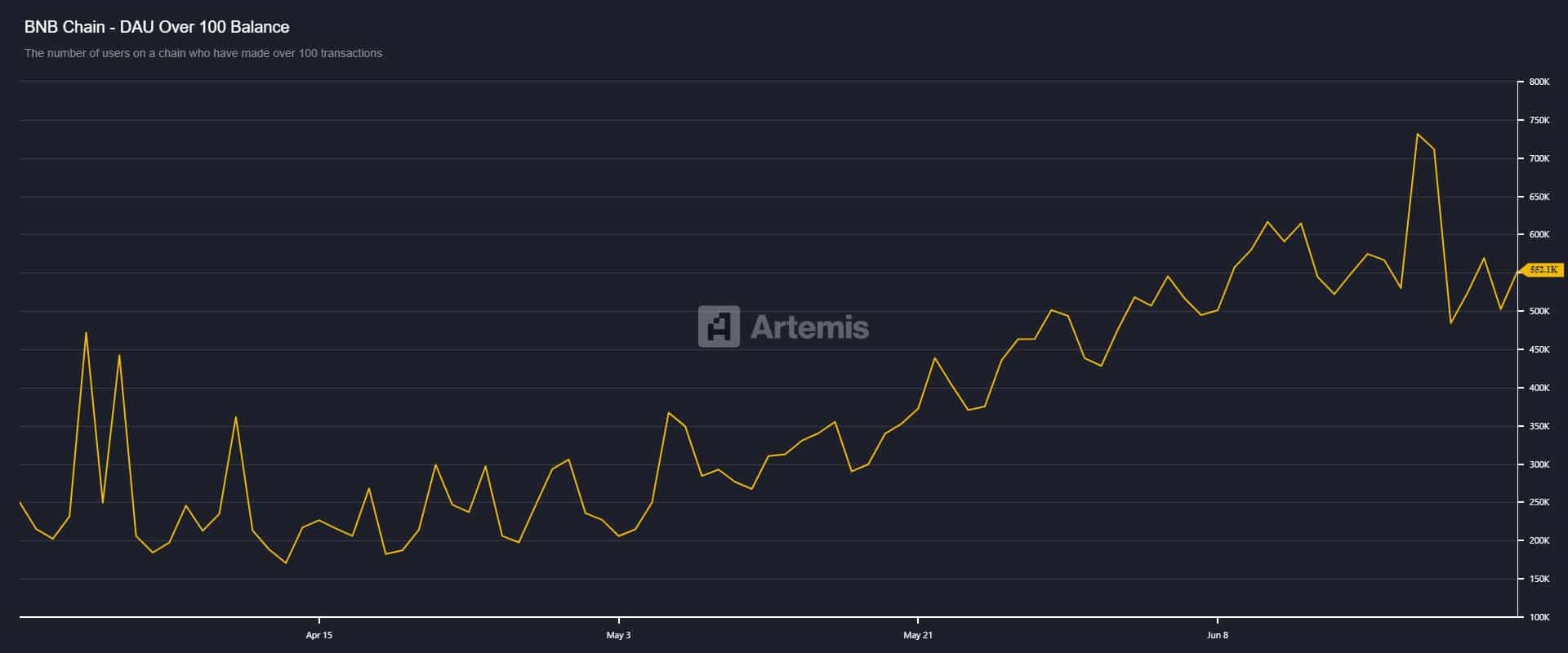

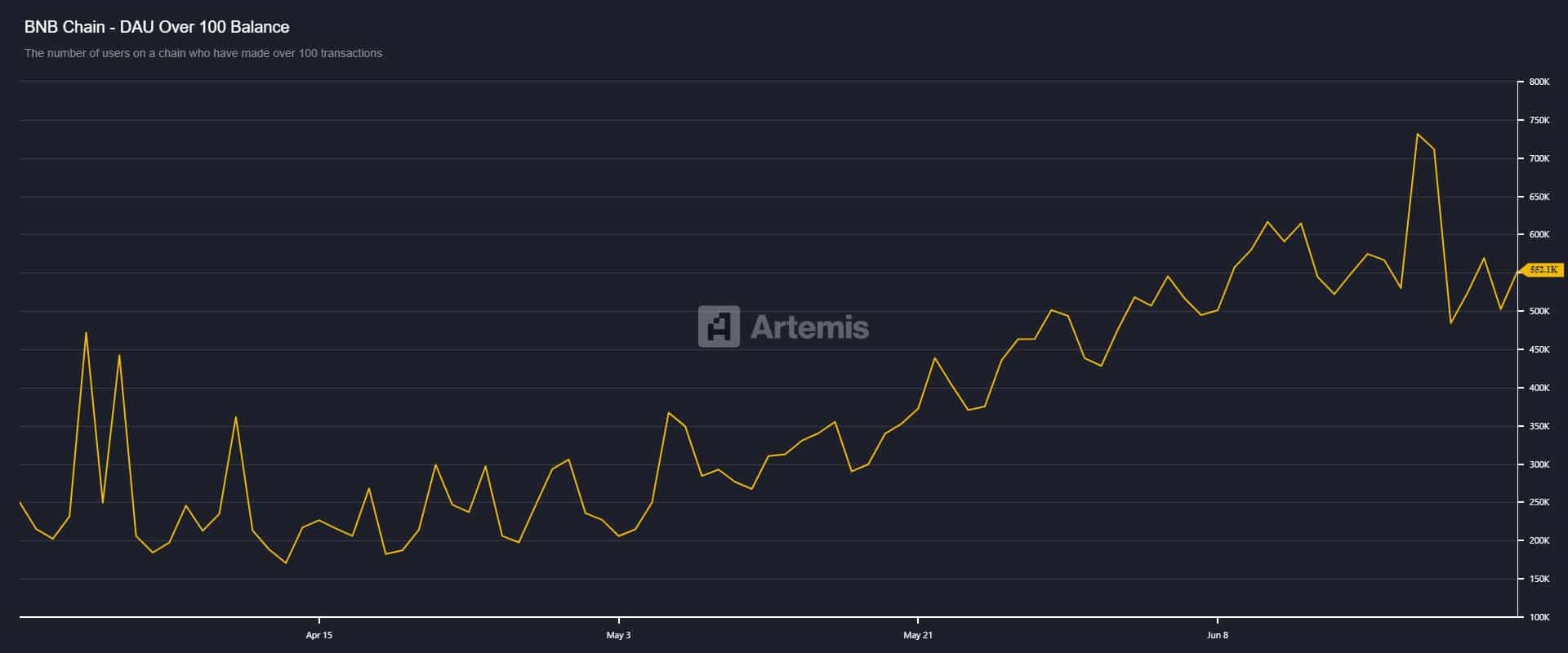

There’s extra: essentially the most lively addresses have doubtless begun promoting as nicely, as they noticed a big spike in exercise over the previous day.

Supply: Artemis

The variety of Every day Lively Addresses that finalized over 100 transactions surged considerably throughout this era, in line with Artemis.

This development means that essentially the most lively individuals and merchants utilizing BNB are exiting, significantly as quantity has dropped to $1.29 billion following an 8% decline.

Spinoff market sides with the bears

The by-product markets on CoinGlass have each turned bearish on BNB, with buyers anticipating additional worth declines.

Within the by-product market, choices merchants have led the sell-off. On the time of writing, Possibility Open Curiosity—which determines whether or not liquidity is coming into or exiting the market—signifies the latter.

Possibility Open Curiosity fell by 71.36%, right down to $3.09 million up to now day, implying widespread contract closures, with lengthy liquidations contributing to the development.

Supply: CoinGlass

A better have a look at the OI-Weighted Funding Fee—which provides higher perception into total by-product sentiment—confirms that bears are in management.

This metric has fallen into detrimental territory, with a studying of -0.0023%, suggesting that almost all open contracts are from sellers betting on a worth drop.

$36M weekly sell-off recommend extra ache forward

Evaluation reveals that the spot market displays the conduct of each on-chain individuals and by-product buyers.

Promoting quantity has elevated within the spot market, with merchants offloading $2.18 million value of BNB in alternate for different belongings, probably stablecoins or options with stronger worth outlooks.

Supply: CoinGlass

This sell-off has pushed cumulative weekly gross sales to $36 million, a big outflow into different ecosystems. If this detrimental development continues throughout markets, it’s more likely to set off an additional worth downturn for BNB.