Can OP Reclaim 200% Gains Before 2025 Ends?

The dialogue across the optimism op worth prediction 2025 is intensifying because the Layer-2 token navigates considered one of its most crucial phases of the yr. After months of persistent decline, the Optimism OP present worth motion in November sits at a significant demand zone that might form the following massive transfer, which might be a 200% bullish reversal or new lows.

Yr-long Decline Units the Stage for November’s Essential Check

All through 2025, the Optimism crypto has remained in a pronounced downtrend. The yr opened close to $2.18 earlier than slipping persistently right into a steep falling wedge sample, hitting a low of $0.234 on October 10. This extended bearish stretch illustrates how weak bullish demand has been repeatedly overshadowed by dominant promoting stress.

Nevertheless, November brings a notable shift. The Optimism OP worth at present is consolidating close to the wedge’s decrease boundary round $0.390, whereas the Optimism OP market cap stabilizes close to $737.77 million. This zone has traditionally acted as a response level, making the present setup very important for any significant optimism op worth forecast 2025.

Technical Indicators Trace at Rising Purchaser Power

Though short-term EMA bands, notably the 20-day and 50-day, proceed to suppress upward break makes an attempt for the time being, however momentum indicators inform a unique story.

The Bullish MACD has already printed a bullish cross with a slowly rising histogram, indicating purchaser conviction in November is making an attempt its finest to enhance from the present vary.

Equally, the AO indicators histogram can be recovering from October’s bearish dominance, reinforcing the concept that short-term bullish energy is actually re-entering the market. Cash circulate metrics are additionally shifting upward, with CMF at 0.02, confirming optimistic inflows.

In the meantime, RSI has climbed from oversold ranges to 42.86, suggesting restoration towards a extra neutral-to-bullish zone. If this momentum pushes RSI above 55–60, a sharper rally is probably going.

Because of this, a possible retest of the wedge’s higher boundary close to $0.70 seems possible right now. This degree aligns with the 200-day EMA, which is a crucial structural barrier.

A breakout above this degree might speed up the optimism op worth prediction 2025 goal towards the $1.20 area earlier than the yr ends. Conversely, failure to carry present demand might expose a psychological help close to $0.10.

On-Chain Power Counters Value Weak point

Aside from muted worth motion of OP and regardless of a pointy drop in TVL from $1.02 billion in March 2024 to $301.42 million at present, Optimism remains to be removed from an inactive state and dying state that many are assuming after witnessing TVL crash and worth altogether.

In response to Defillama, the community hosts 352 protocols, together with Uniswap, AAVE, Chainlink, Morpho, Farcaster, and plenty of extra. the OP ecosystem nonetheless hosts aggressive and related on-chain exercise.

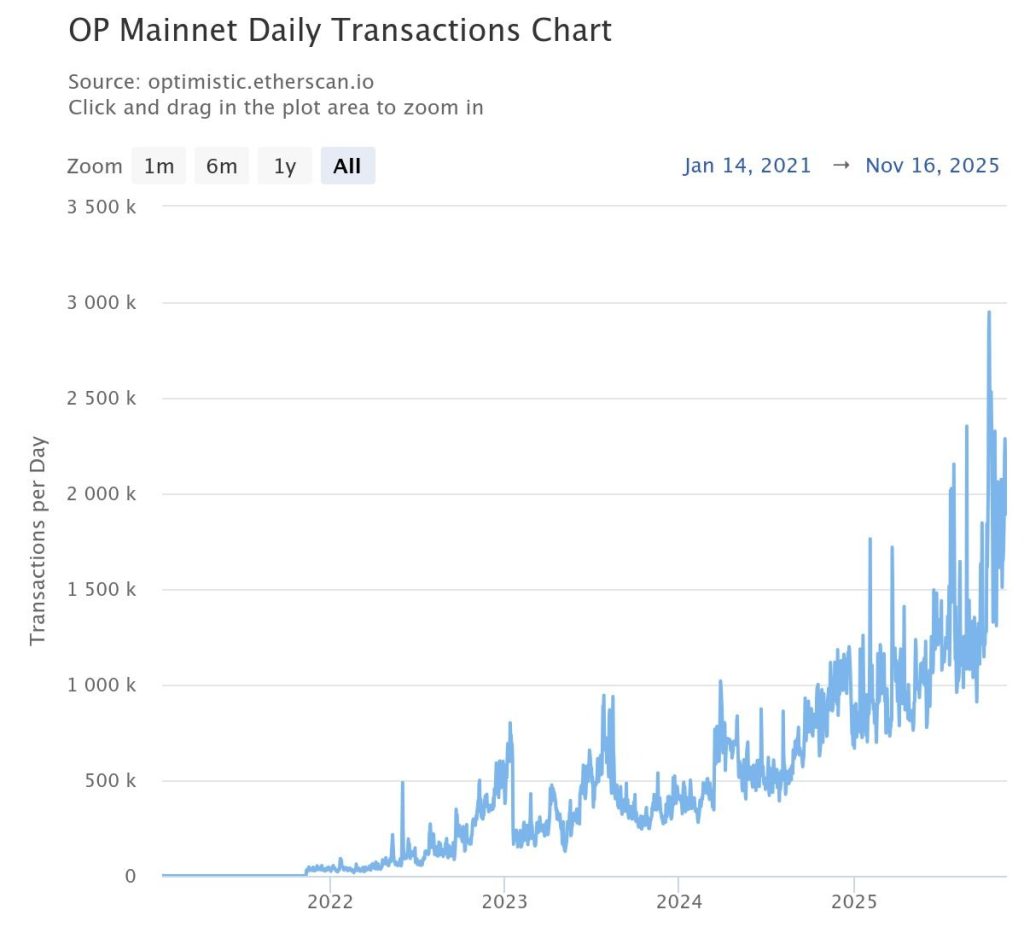

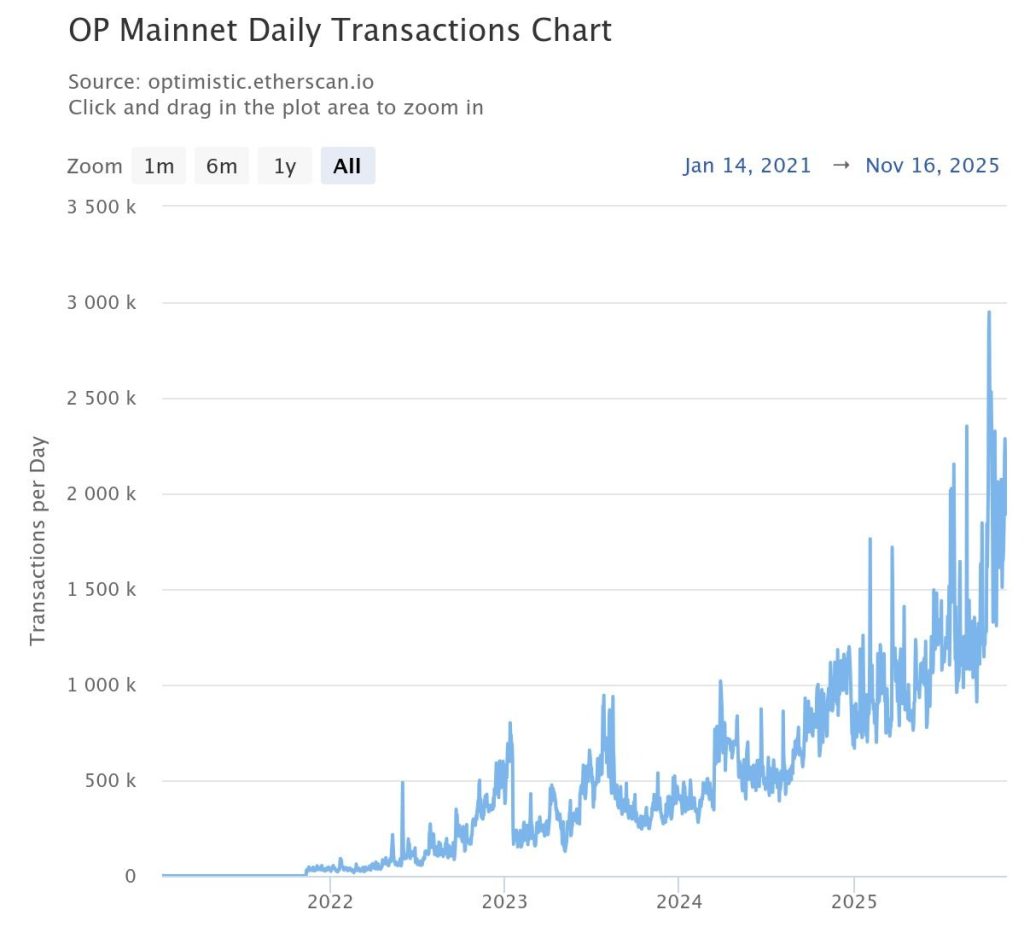

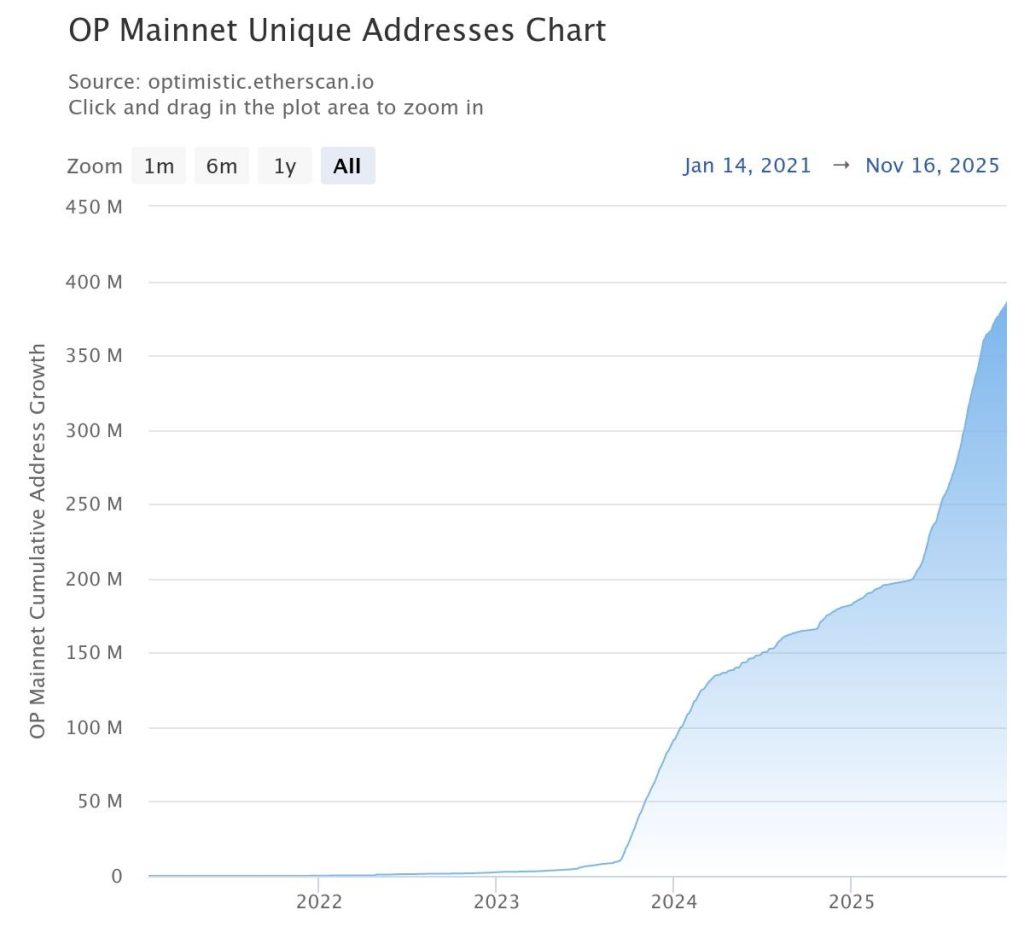

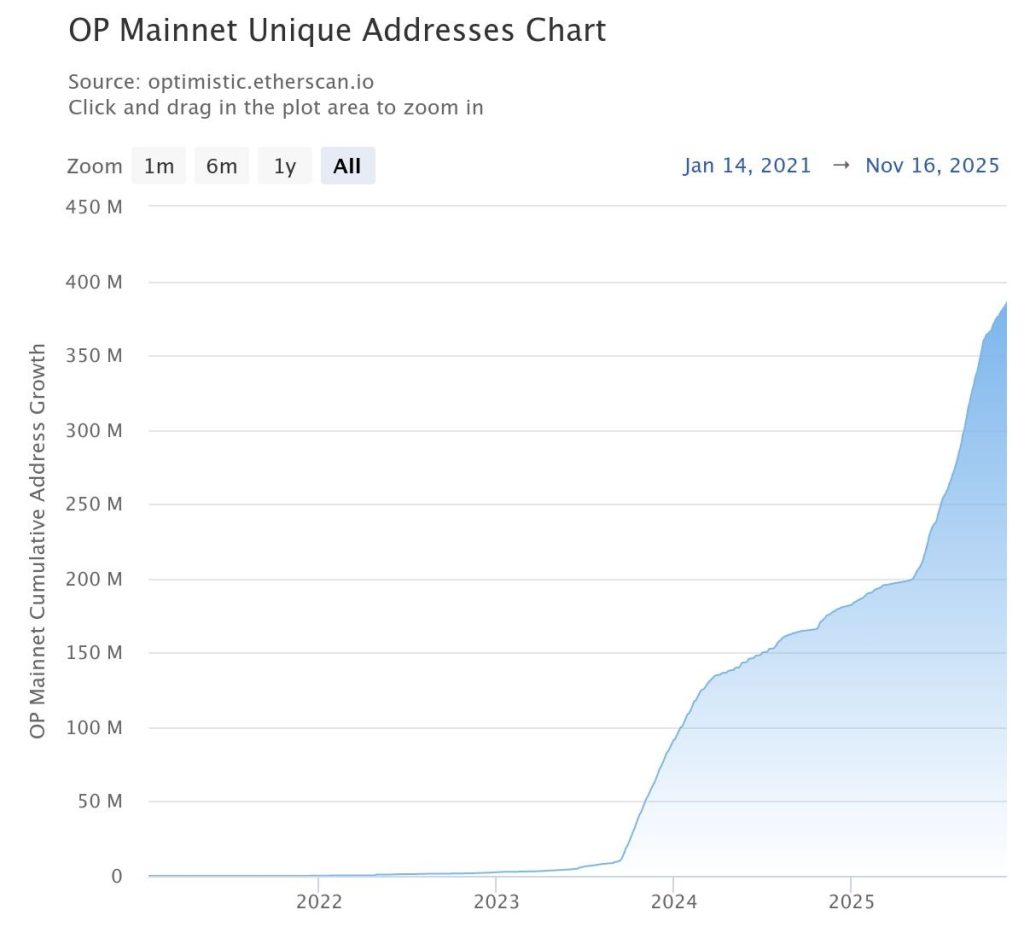

Furthermore, blockchain fundamentals stay sturdy. Daily transactions on OP Mainnet proceed to development upward, whereas the whole variety of distinct addresses has surged to an all-time excessive of 384.257 million.

This increasing consumer base reinforces long-term utility, supporting a optimistic optimism op worth prediction 2025 regardless of current declines.

Belief with CoinPedia:

CoinPedia has been delivering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our knowledgeable panel of analysts and journalists, following strict Editorial Tips primarily based on E-E-A-T (Expertise, Experience, Authoritativeness, Trustworthiness). Each article is fact-checked in opposition to respected sources to make sure accuracy, transparency, and reliability. Our overview coverage ensures unbiased evaluations when recommending exchanges, platforms, or instruments. We attempt to supply well timed updates about all the pieces crypto & blockchain, proper from startups to trade majors.

Funding Disclaimer:

All opinions and insights shared characterize the writer’s personal views on present market circumstances. Please do your personal analysis earlier than making funding selections. Neither the author nor the publication assumes duty in your monetary selections.

Sponsored and Commercials:

Sponsored content material and affiliate hyperlinks might seem on our web site. Commercials are marked clearly, and our editorial content material stays solely impartial from our advert companions.