Are Bitcoin ETF inflows finally back after IBIT ETF’s 7% jump?

Bitcoin’s [BTC] worth jumped over 8% to over $93K up to now 24 hours, at press time, following renewed ETF inflows led by BlackRock.

On the 2nd of December, BlackRock’s iShares BTC ETF (IBIT) netted $120 million in Each day Internet Influx, marking a 7% surge. Constancy’s FBTC and Bitwise’s BITB additionally drew institutional inflows of $22 million and $7.4 million, respectively.

Nonetheless, ARK Make investments’s ARKB bled out about $91 million, bringing the overall Daily Net Inflows to $58.5 million.

Supply: SoSo Worth

Even so, the efficiency on the 2nd of December marked the fifth consecutive day of internet inflows, which has stabilized the BTC worth above $80,000.

However do the optimistic inflows sign the return of the ‘Santa rally’?

Macro and ‘Vanguard impact’ on BTC

For his half, Bloomberg ETF analyst Eric Balchunas considered the IBIT-induced worth restoration because the “Vanguard impact.”

The world’s second-largest $11 trillion asset supervisor lifted the crypto ban on the 2nd of December, permitting over 50 million customers to commerce crypto ETFs, together with IBIT.

Balchunas stated that the IBIT’s renewed influx was doubtless pushed by Vanguard shoppers. He added,

“Additionally $1B in IBIT quantity in first 30min of buying and selling. I knew these Vanguardians had a little bit degen in them, even a few of the most conservative buyers like so as to add a little bit scorching sauce to their portfolio.”

Based on him, Vanguard saved BTC from the This fall plunge.

For Coinbase analysts, nevertheless, the easing macro entrance was juicing up liquidity and threat property.

“With quantitative tightening ending, the Fed is again within the bond market, and the drain of money from markets could also be behind us. That’s often good for risk-on property like crypto.”

The analysts highlighted that the present macro panorama favors ‘breakout trades over knife catching.’

Merchants eye $100K stage

Notably, the prolonged BTC drop up to now few weeks cleared key helps, together with the $98K-$100K which was a big cluster as a price foundation for many bulls.

For Coinbase analysts, this was the following key stage to look at.

Supply: Coinbase/Glassnode

Put otherwise, reclaiming $98K-$100K may entice extra demand or cap BTC restoration if most bulls decide to interrupt even and exit positions on the stage.

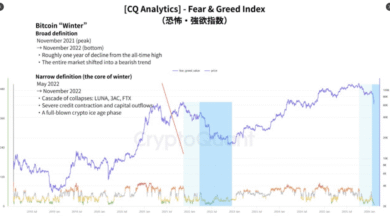

Swissblock analytics additionally echoed the Coinbase outlook. It projected a possible ‘tactical restoration’ from mid-December, citing previous liquidity capitulation occasions that have been adopted by a powerful rebound after 1–3 weeks.

Supply: Swissblock

Regardless of the optimism, the danger of the Yen carry commerce unwinding nonetheless seems doubtless, with an 86% likelihood of a 25-basis-point price enhance by the Financial institution of Japan (BoJ) at its assembly set for the nineteenth of December.

Closing Ideas

- Institutional inflows are again and have boosted BTC worth restoration.

- The macro panorama was additionally enhancing, however the threat of the Yen carry commerce unwind was lurking.