Ethereum reserves plunge to 9-year low – Is a massive price rally imminent?

- Ethereum’s alternate provide has plunged to its lowest stage in 9 years.

- Might this provide squeeze set off a worth surge?

The availability of Ethereum [ETH] on exchanges has dropped to its lowest stage since 2016, signaling a liquidity squeeze that helps a medium-term bullish outlook.

With sell-side stress easing and accumulation rising, may ETH reclaim the important $3.5K resistance within the close to time period?

Key technicals flash bullish

Regardless of no indicators of overheating, Ethereum stays 32% beneath its post-election peak of $4,016, having fashioned 4 consecutive decrease lows.

This time, nonetheless, the RSI has bottomed out, and a bullish MACD crossover is taking form – suggesting ETH’s consolidation might be constructing momentum for a breakout.

But, historic patterns recommend warning. Earlier recoveries didn’t breach key resistance as demand struggled to soak up promote stress.

Supply: TradingView (ETH/USDT)

Nonetheless, Ethereum’s spot alternate supply has plunged to a 9-year low of 8.2 million ETH.

With tightening liquidity and potential demand acceleration, situations are aligning for a provide shock – one that might gasoline a breakout previous key resistance ranges.

Mapping Ethereum’s subsequent main resistance zone

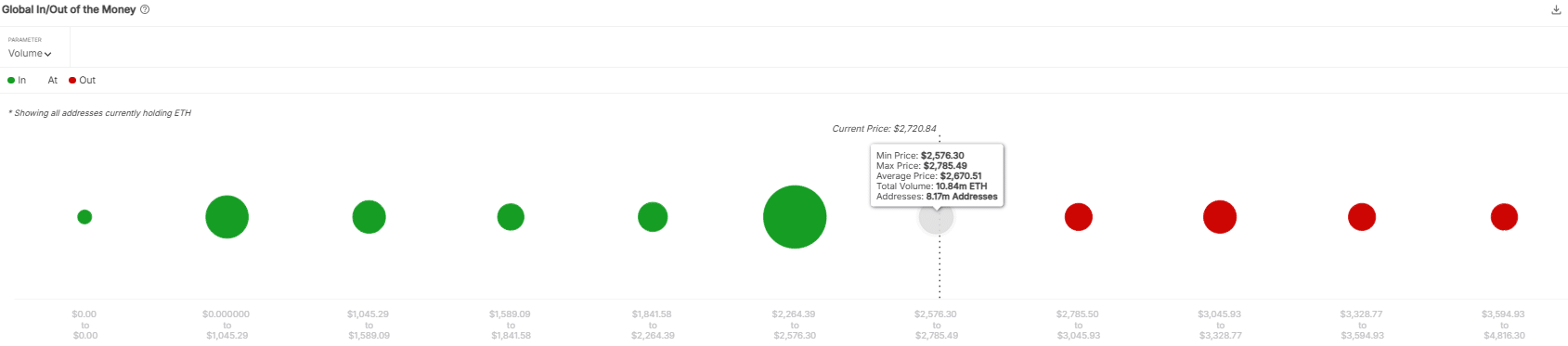

Ethereum faces a important resistance at $2,785, the place 8.10 million addresses would flip worthwhile, exposing $20 billion to potential promote stress.

Supply: IntoTheBlock

Whereas spot reserves hit a 9-month low, signaling accumulation, traders offloaded over 2 million ETH into exchanges in February, elevating issues about mounting promote stress.

Weak demand from U.S. and Korean traders additional threatens upside momentum, probably trapping leveraged longs within the futures market.

If demand fails to recuperate, Ethereum may face a pullback towards $2,264, the place 62.38 million ETH is concentrated.