Can Ethereum’s ‘multi-year high’ push ETH above $4K after price crash?

- ETH’s Futures Open Curiosity touched an all-time excessive.

- Its Funding Price throughout exchanges remained constructive.

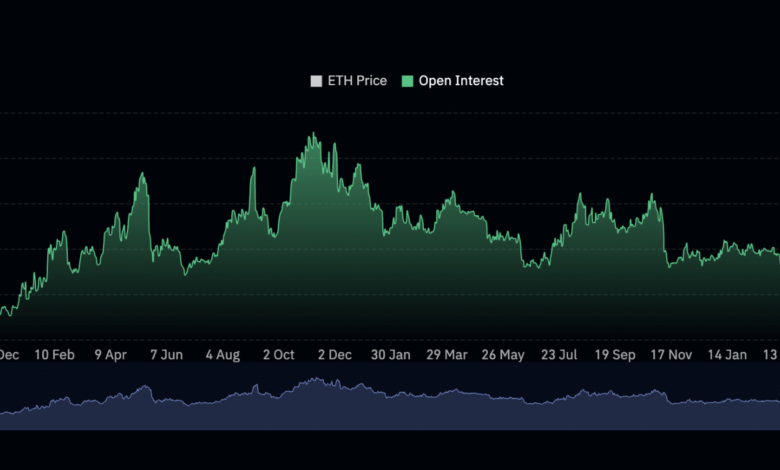

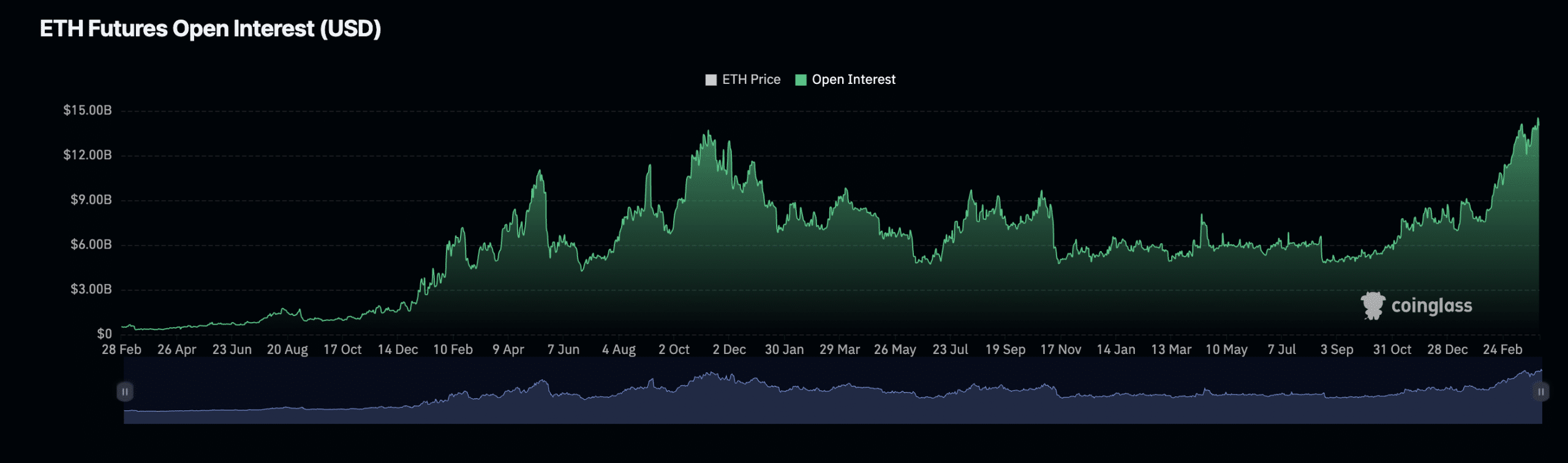

Ethereum [ETH] Futures Open Curiosity climbed to an all-time excessive because the uncertainty across the potential approval of a spot Ether exchange-traded fund (ETF) within the U.S. deepened.

Futures Open Curiosity refers back to the complete variety of a coin’s Futures contracts which have but to be settled or closed. When it rises, it signifies a rise within the variety of market contributors getting into new positions.

Based on AMBCrypto’s evaluation of Coinglass’ knowledge, ETH’s Futures Open Curiosity totaled $14.53 billion on the first of April, having risen by 86% year-to-date.

For context, ETH’s Futures Open Curiosity was beneath $10 billion initially of the yr.

Supply: Coinglass

March was good for Ethereum’s Futures market

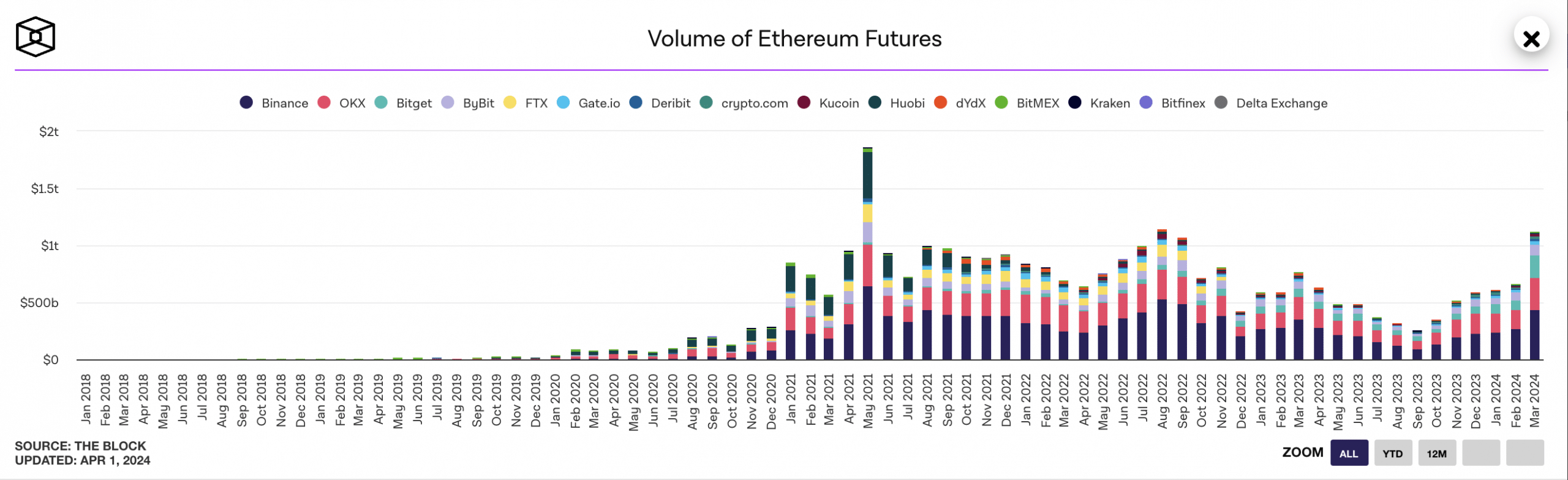

ETH’s Futures market recorded vital success in March, on-chain knowledge has revealed.

Based on AMBCrypto’s evaluation of The Block’s data dashboard, ETH Futures’ month-to-month buying and selling quantity throughout the most important cryptocurrency exchanges touched a three-year through the 31-day interval.

Our take a look at The Block additional confirmed that ETH Futures buying and selling quantity throughout these platforms exceeded $1 trillion. The final time the coin’s month-to-month buying and selling quantity was that top was in Might 2021.

Supply: The Block

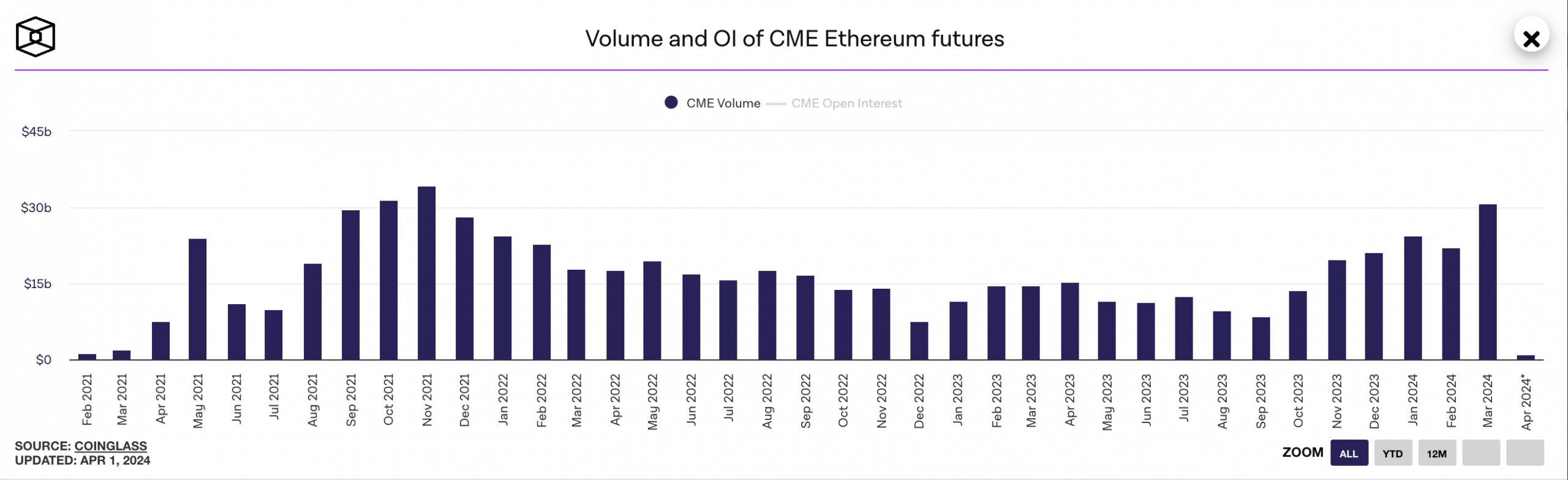

Following an identical development, the coin’s month-to-month futures buying and selling quantity on the Chicago Mercantile Trade (CME) market additionally rose to a three-year excessive.

With over 120,000 lively customers unfold throughout 60 international locations, CME is likely one of the world’s largest derivatives marketplaces.

When the buying and selling quantity on the trade climbs on this method, it indicators a spike in market participation by institutional traders resembling hedge funds and huge asset managers.

AMBCrypto discovered that through the 31-day interval, the aggregated month-to-month buying and selling volumes of CME Ethereum Futures totaled $30 billion. The final time it was this excessive was in November 2021.

Supply: The Block

Market unmoved by latest headwinds

ETH’s worth has confronted vital headwinds within the final month because it continued to face resistance on the $3500 stage at press time.

Actually, on the twentieth of March, the coin’s worth plummeted to a 30-day low of $3100 earlier than reclaiming its beneficial properties to trade fingers at $3354 at press time.

Regardless of this, the coin’s Funding Charges throughout cryptocurrency exchanges remained constructive at press time.

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

A constructive Funding Price is an effective signal, because it suggests a surge in market demand for bullish leverage positions. This implies extra market contributors are getting into commerce positions in favor of a worth rally.

At press time, ETH’s Funding Price was 0.019%