Mapping Tron’s road ahead as Trump-backed moves ignite surge

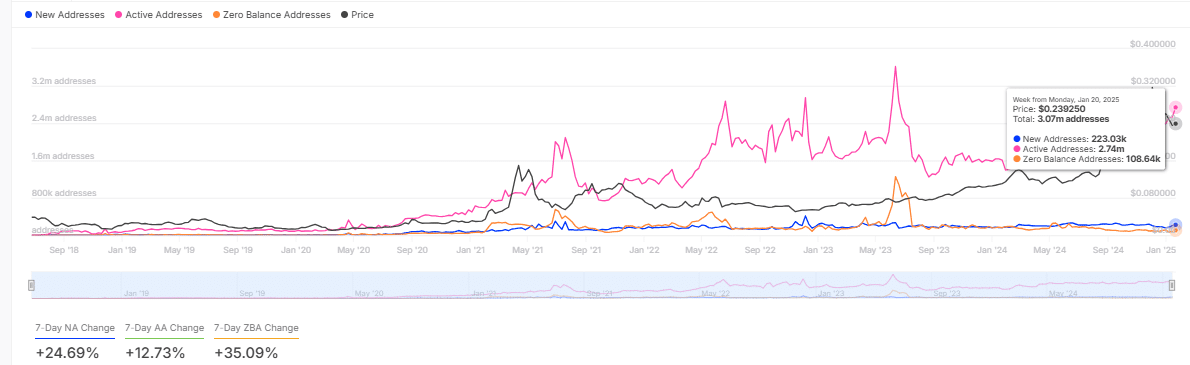

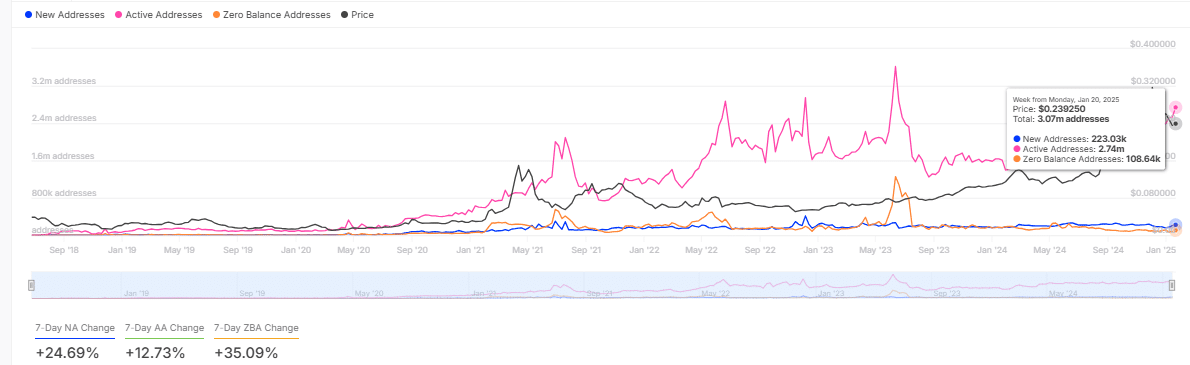

- Tron rose 24.69% and a 12.73%% in new and in energetic addresses respectively, indicating rising person engagement.

- World Liberty Finance’s acquired 10.8 million TRX for $2.65 million USDT.

Tron [TRX] has been within the highlight just lately as a result of notable on-chain developments and strategic acquisitions. Its rising adoption and exercise have mirrored its value actions.

The latest high-profile purchases by World Liberty Finance (WLFi) have fueled market hypothesis.

On-chain knowledge has revealed a gradual rise in TRX energetic addresses, which just lately hit 2.47 million. This improve aligned with its value appreciation, which reached $0.239 throughout the identical interval.

Notably, new addresses surged by 24.69% over the previous week, indicating heightened curiosity within the community. This development highlights sturdy community adoption, possible pushed by optimistic market sentiment and renewed use circumstances.

Supply: Into The Block

Apparently, zero-balance addresses additionally grew by 35.09%, suggesting a wave of speculative curiosity.

Whereas the info factors to wholesome adoption, the worth correlation indicators potential profit-taking within the close to time period. Ought to energetic addresses preserve this tempo, TRX might obtain sustained development.

Nevertheless, a slowdown might trace at value consolidation forward.

Trump’s WLFi acquisition of TRX regardless of cautious sentiment

World Liberty Finance’s acquisition of 10.8 million TRX for $2.65 million USDT showcases the rising institutional curiosity in Tron.

WLFi’s complete holdings now stand at 30.1 million TRX, valued at $7.36 million.

This aligns with their broader technique, as additionally they bought $47 million value of ETH, wBTC, and $4.7 million every of AAVE, LINK, TRX, and ENA to commemorate Donald J. Trump’s inauguration because the forty seventh President of the USA.

These high-value acquisitions spotlight confidence in TRX and its ecosystem. This inflow of institutional capital might drive additional value appreciation within the brief time period.

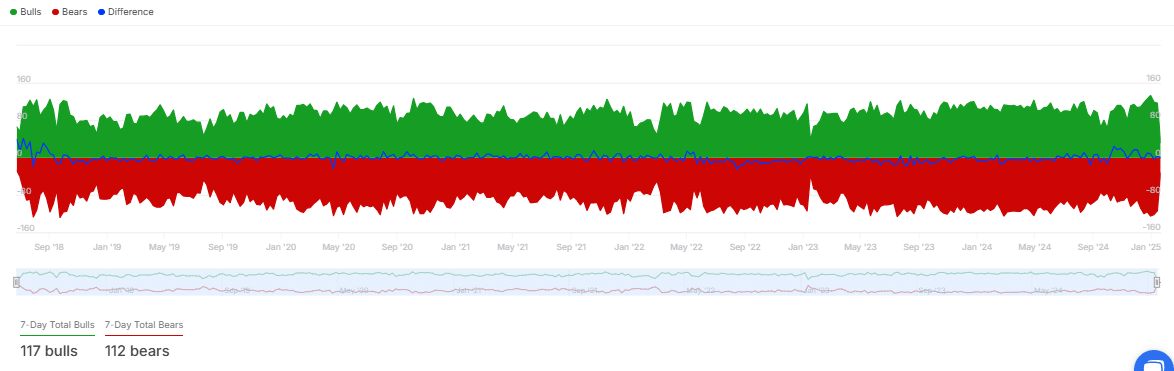

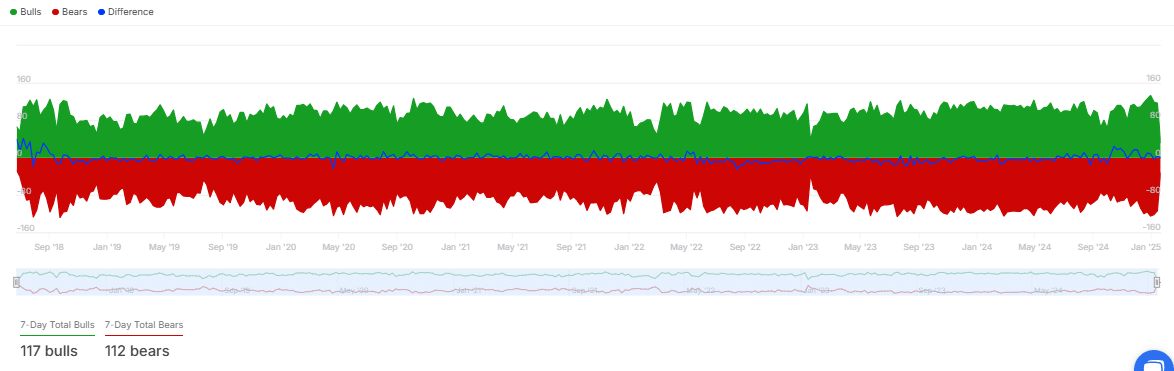

Regardless of the bullish sentiment pushed by WLFi’s acquisitions and rising energetic addresses, the TRX bulls-versus-bears metric suggests a balanced however cautious outlook.

The newest knowledge exhibits 117 bulls in comparison with 112 bears, indicating a slim edge for bullish merchants. This slim distinction implies that market contributors stay divided on TRX’s subsequent motion.

Supply: Into The Block

Traditionally, related patterns have preceded short-term volatility, as neither facet dominates the market decisively.

If bulls achieve momentum, TRX might push in direction of increased resistance ranges. Conversely, a stronger bear presence would possibly result in a value correction.

Will TRX preserve its bullish momentum?

The broader query stays whether or not TRX, buoyed by WLFi’s strategic purchases and rising adoption metrics, can maintain its bullish momentum.

Whereas the token’s value motion and on-chain metrics have aligned positively, exterior components like macroeconomic situations and Bitcoin’s dominance might affect its trajectory.

Learn Tron’s [TRX] Value Prediction 2025–2026

Traditionally, tokens tied to high-profile narratives have seen short-term surges however struggled with sustainability.

For TRX to keep up upward momentum, it’s going to require continued institutional help, sturdy community exercise, and a positive market surroundings.