Forget A Bitcoin Yearly Top, BTC Price Might Have Hit A 16-Year Cyclical Peak

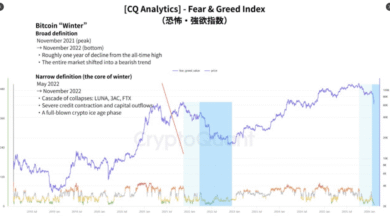

Crypto skilled Tony Severino has opined that Bitcoin isn’t simply exhibiting indicators of a yearly prime but in addition that the BTC value could have hit a 16-year cyclical peak. This comes amid the flagship crypto’s latest crash to $60,000, which sparked fears of a bear market.

Bitcoin Could Be Exhibiting Indicators Of A Peak Amid BTC Value Crash To $60,000

In an X post, Severino alluded to the yearly Bitcoin chart, which he mentioned appears to be like like a 16-year cyclical peak slightly than only a yearly prime. The skilled additionally outlined a number of causes this seems to be a major cyclical top for the BTC value. First, he famous that the white candlesticks have been lowering in measurement over time, whereas black candlesticks engulf extra white candles with every look.

Associated Studying

Moreover, Severino highlighted the Doji on the prime of a rising wedge sample whereas the Night Star is in progress, which is a bearish reversal sign for the BTC value. In the meantime, the Fischer Remodel is crossing bearish with divergence, and the Stochastic is crossing bearish after being rejected from 80. He added that Bitcoin’s Relative Energy Index (RSI) is falling again under 70 after making it above this stage on the best timeframe chart.

His evaluation comes because the BTC value continues to say no, suggesting the crypto market could also be in a bear market after topping final October. Bitcoin dropped to as little as $60,000 earlier this week, struggling its largest each day decline since the FTX collapse. Veteran dealer Peter Brandt has additionally opined that Bitcoin is in a bear market, predicting that it may nonetheless drop to as little as $42,000 earlier than it sees a backside.

Purpose For The Current BTC Crash

BitMEX co-founder Arthur Hayes has commented on the explanation for this latest Bitcoin crash, suggesting that it was because of exterior components slightly than a part of an ongoing bear market. In an X post, he acknowledged that the BTC value dump was in all probability because of a supplier hedging off the again of BlackRock’s BTC ETF structured merchandise. Notably, BlackRock’s IBIT noticed a file buying and selling quantity of $10 billion on the day of this crash to $60,000.

Associated Studying

Hayes’ remark comes on the again of Bitcoin’s rebound above $70,000, with the flagship crypto recording one among its largest ever each day good points yesterday following the crash to $60,000. Galaxy Digital’s Head of Analysis, Alex Thorn, suggested that the drop to $60,000 could mark the underside for the BTC value. This got here as he famous that the 200-week MA, which is round $60,000, has traditionally been a robust entry level for long-term buyers.

On the time of writing, the BTC value is buying and selling at round $70,000, up over 6% within the final 24 hours, in accordance with data from CoinMarketCap.

Featured picture from Pngtree, chart from Tradingview.com