Bitcoin net position change for STH hits +750k BTC.

- Bitcoin’s short-term holders held the market with a internet place change worth of +750k.

- BTC declined over the previous week by 12.37%.

Since hitting $108k, Bitcoin [BTC] has struggled to keep up an upward momentum. As such, BTC has traded in a consolidation vary between $92k and $97k.

On the time of writing, Bitcoin is buying and selling at $93,905, marking a 2.18% decline on the each day charts. Moreover, the cryptocurrency has dropped by 12.37% on the weekly charts.

This dip has left most short-term holders at a loss, together with those that purchased Bitcoin in November. The widening loss margins amongst short-term holders have analysts deliberating over the subsequent transfer.

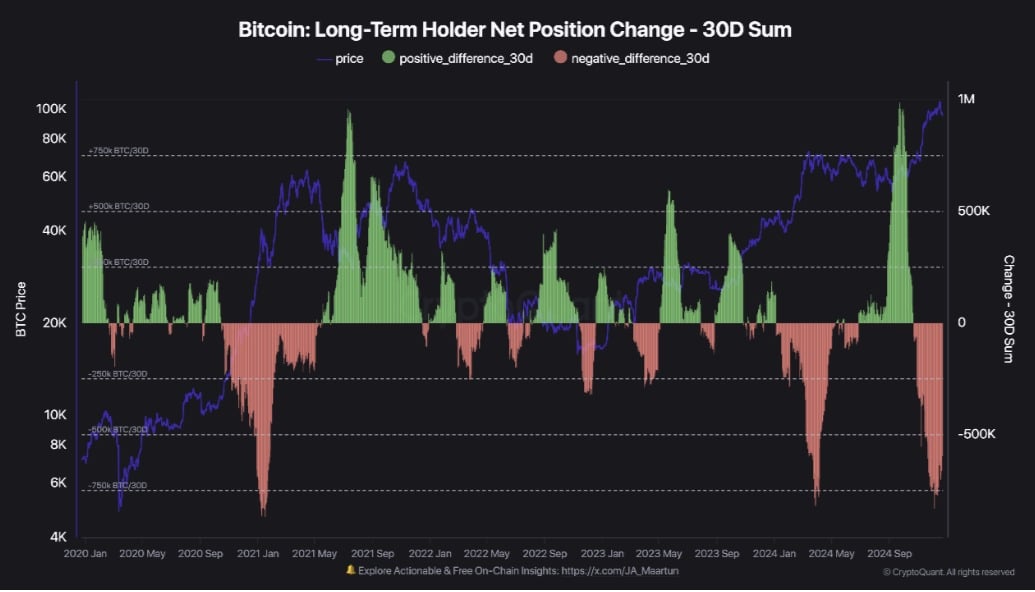

Bitcoin’s LTH vs STH internet place change

In accordance with Cryptoquant, the 30-day internet place change for long-term holders (LTH) has turned detrimental hitting -750k BTC.

Supply: CryptoQuant

Regardless of this alteration, Bitcoin costs have managed to carry sturdy and didn’t expertise a powerful drop. It is because short-term holders (STH) have continued to build up at the same time as BTC rallied to a brand new ATH.

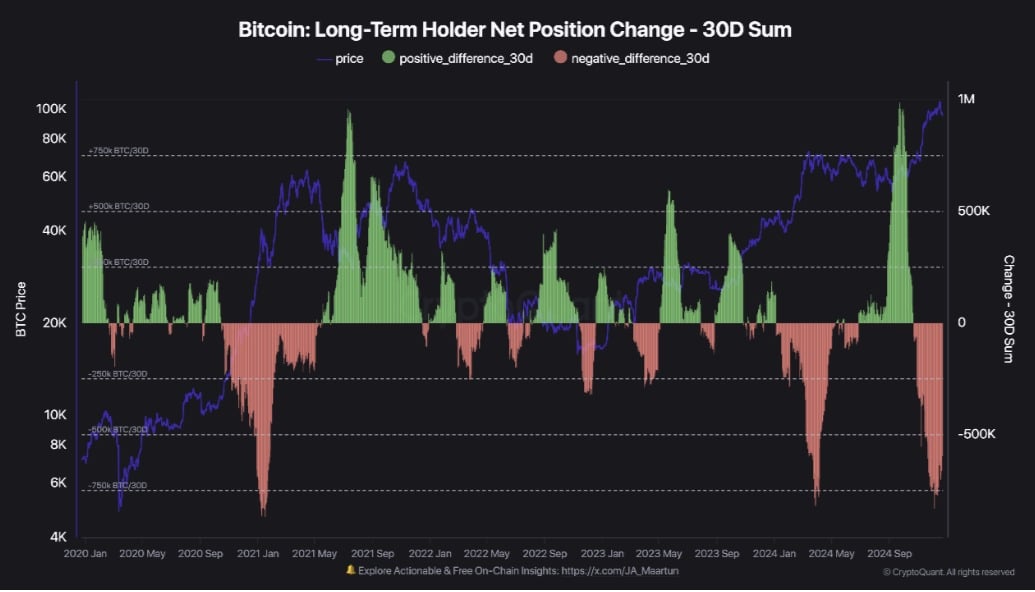

Supply: CryptoQuant

The online place change for short-term holders (STH) surged to a optimistic worth of +750k BTC.

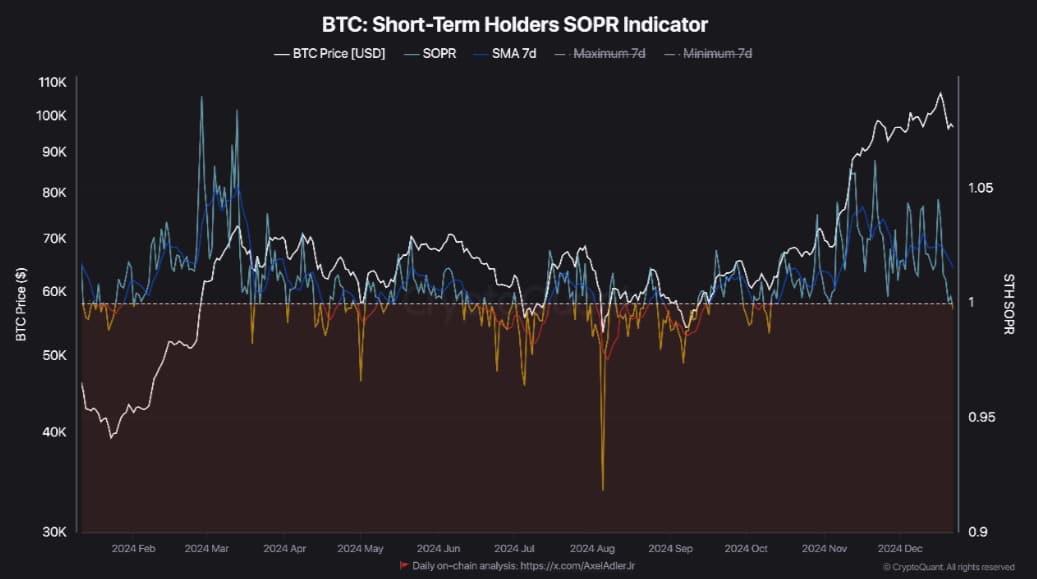

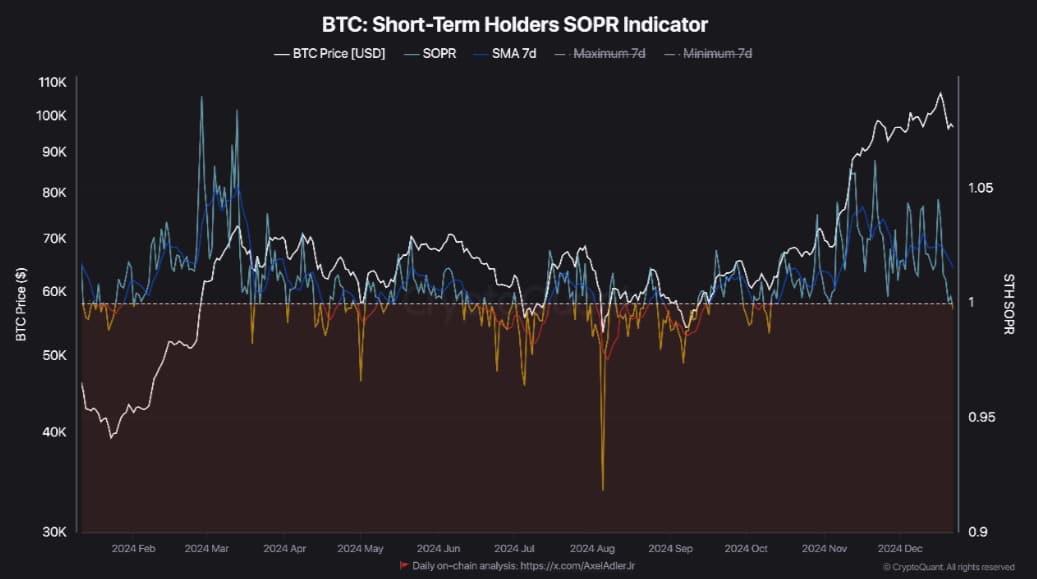

Whereas short-term traders continued to build up as BTC costs surged, the STH SOPR turned detrimental. This means that STH holders are working at a loss.

With short-term holders at a loss, they’ve two choices: maintain and await BTC costs to get well, or purchase at decrease costs. If STH demand stays sturdy and long-term holder (LTH) demand is impartial or optimistic, it may create optimistic momentum for BTC.

Nonetheless, if STH decides to promote at a loss, it may create promoting stress and drive costs additional down. The route that short-term holders take will have an effect on BTC’s value trajectory.

Supply: CryptoQuant

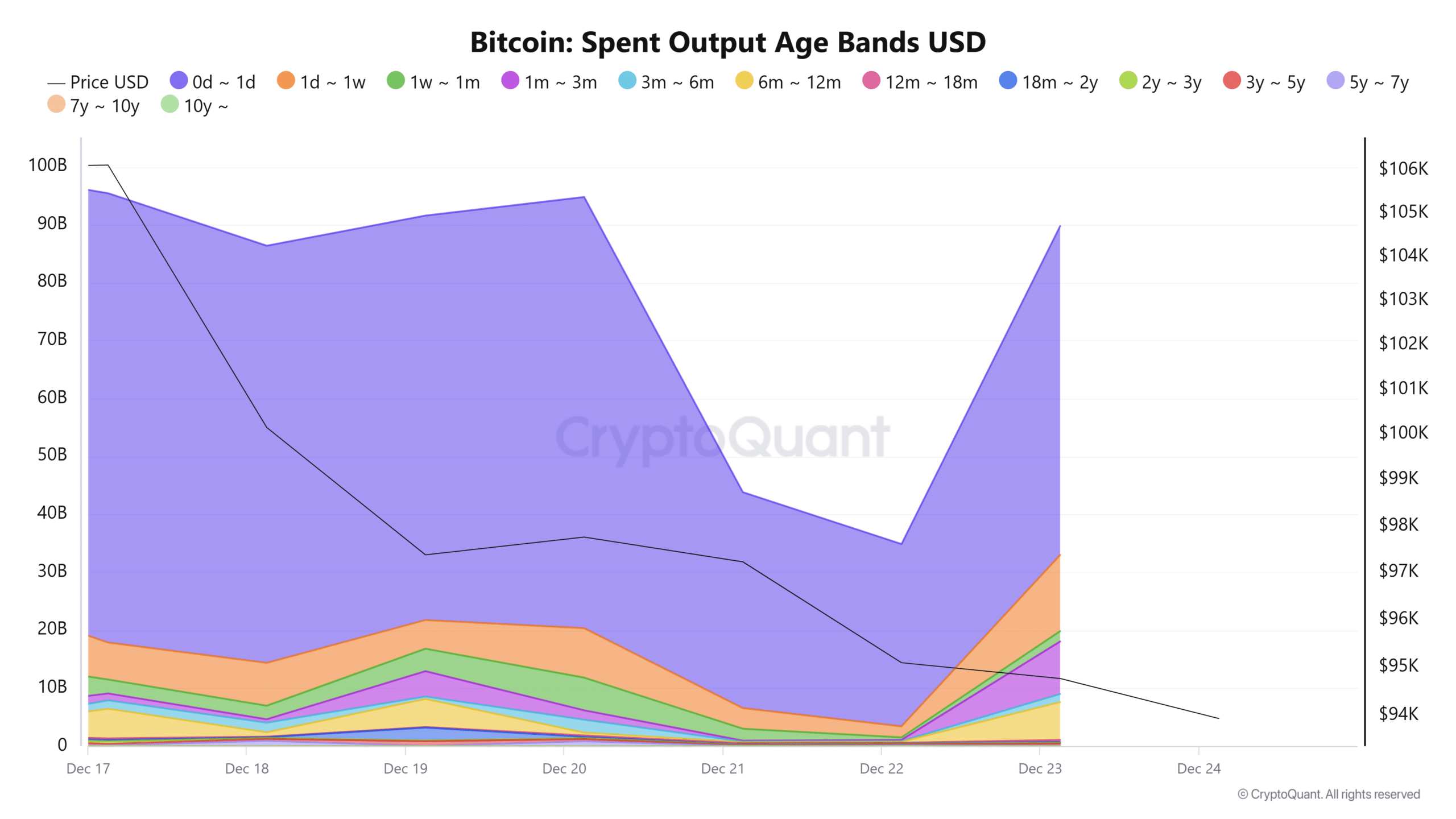

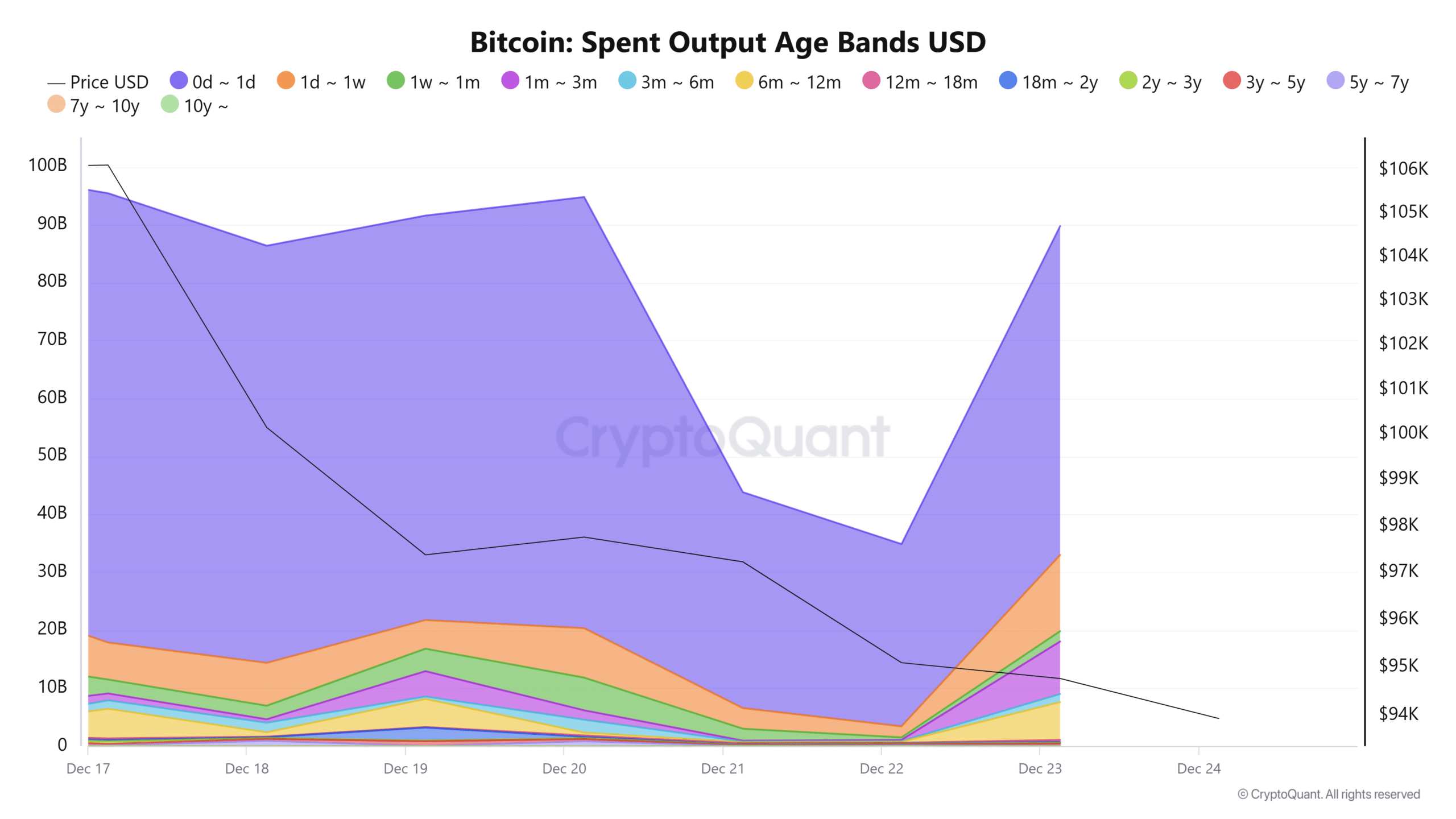

By means of the output spent age bands, we will see short-term holders are actively promoting. Thus short-term holders have spent extra cash than LTH, with cash held for at some point hitting 56 million and people held for per week reaching 9 million.

Supply: CryptoQuant

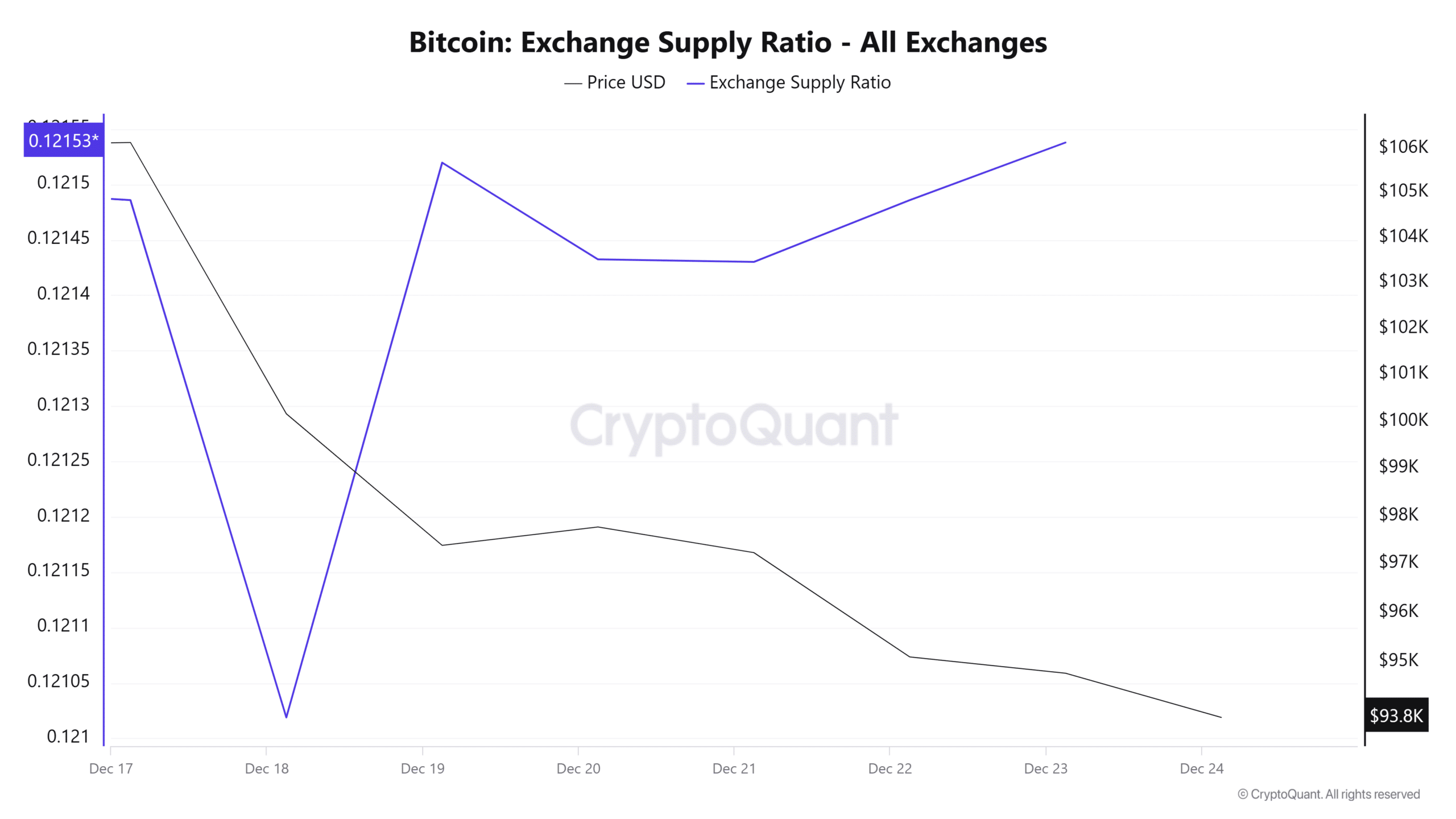

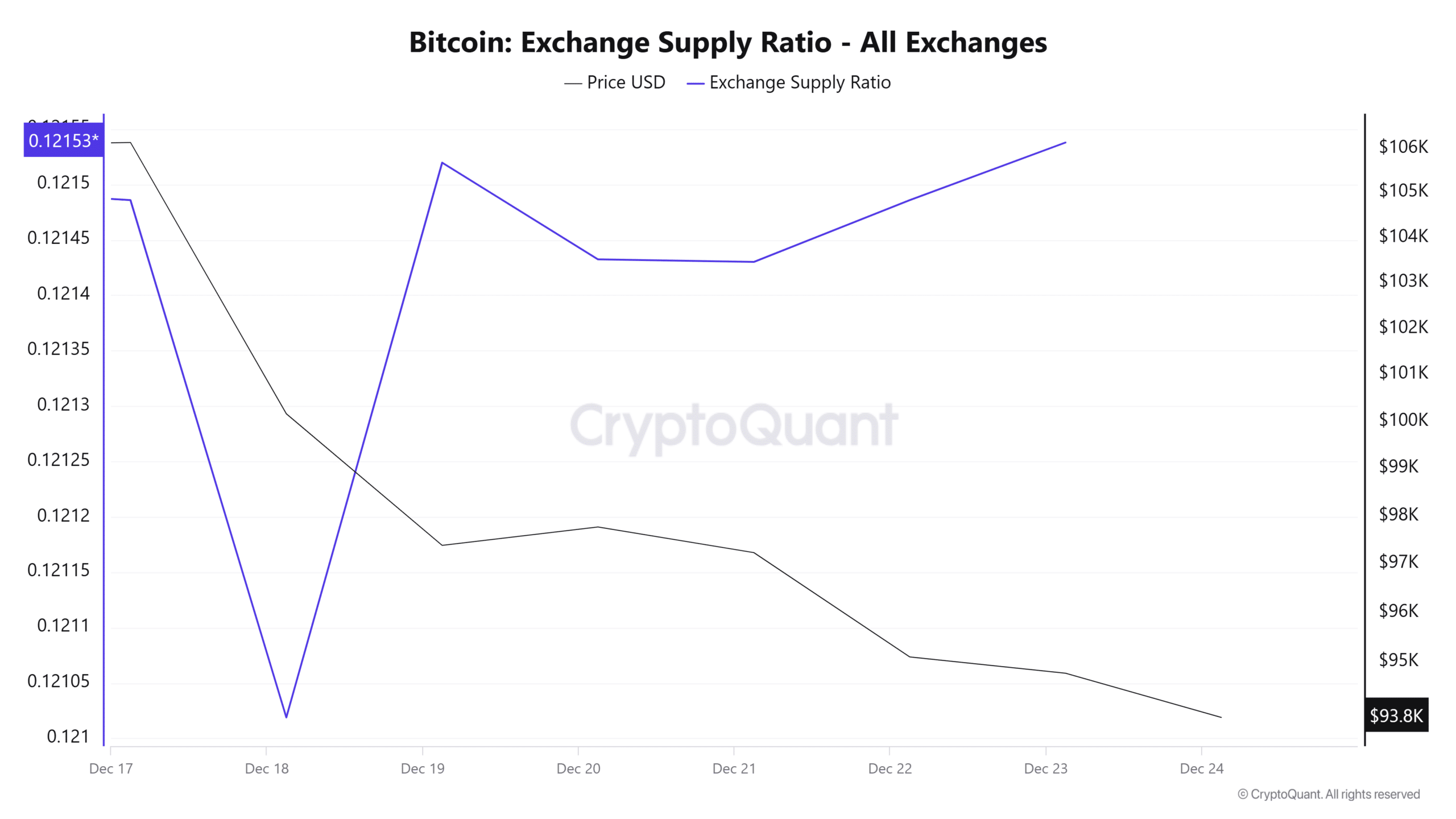

As such, the previous week has skilled a spike within the alternate provide ratio. A surge in alternate provide means that these spent cash are going to exchanges, thus merchants are transferring extra Bitcoin tokens into exchanges both to promote or making ready to take action.

This suggests that there’s excessive speculative buying and selling amongst STH merchants and are even promoting at a loss to amass at decrease charges.

Implications on BTC?

As noticed above, Brief-term holders are holding the market. As such, BTC dangers going through increased promoting stress from this cohort, which may in flip drive costs down.

Learn Bitcoin (BTC) Worth Prediction 2024-25

With STH actively promoting their tokens, it exhibits their lack of market confidence and turns to purchase at decrease ranges after promoting at a loss. If their internet place modifications and turns detrimental like Lengthy-term holders, Bitcoin may drop additional.

Due to this fact, if this bearish sentiment persists, BTC may drop to $92130. Nonetheless, if the demand from STH continues, BTC will try restoration in the direction of $95800.