Rails taps Stellar to launch onchain vaults for institutional derivatives liquidity

Institutional crypto derivatives supplier Rails introduced the launch of “Institutional-Grade Vaults” on the Stellar community on Tuesday, permitting brokerages, fintechs and different intermediaries to plug into crypto perpetuals through a single backend. The corporate goals for choices buying and selling in Q2 2026.

Satraj Bambra, CEO of Rails, instructed Cointelegraph that the core thought was to separate matching from cash. “The essential distinction is custody and verifiability,” he mentioned.

Rails runs a centralized matching engine, whereas shopper property will sit in audited sensible contract vaults on Stellar. Each 30 seconds of revenue and loss (PnL), charges and liabilities are dedicated onchain, as Merkle roots that establishments can independently reconcile in opposition to their very own information.

Associated: Crypto derivatives change Paradex experiences outage, cancels open orders

Lowering counterparty danger

A core design declare is that vaults decrease counterparty and operational danger by ring‑fencing shopper collateral from market-making capital and Rails’ personal working funds.

Bambra framed this as a direct response to prior change implosions, the place property sat in an omnibus account, and shoppers needed to belief their inner ledger.

“In the event that they fail, you develop into an unsecured creditor in chapter,” he mentioned. “That is precisely what occurred to FTX prospects.”

He mentioned that the lesson right here was clear: “Separate execution from custody,” and harassed that consumer funds stay in onchain sensible contracts relatively than on Rails’ stability sheet.

In accordance with Bambra, the corporate selected the Stellar community for its quick settlement finality and a decade of labor with banks, remittance suppliers and tokenized asset platforms.

“If you find yourself asking establishments to belief sensible contracts holding tens of thousands and thousands in capital, that heritage issues,” he mentioned.

In accordance with the announcement shared with Cointelegraph, the corporate has processed greater than $3.4 billion in buying and selling quantity so far. It’s registered underneath the Cayman Islands Financial Authority (CIMA), however Bambra instructed Cointelegraph that Rails had “begun its registration course of” with america Nationwide Futures Affiliation.

Associated: Fenwick agrees to settle lawsuit alleging function in FTX collapse

Crypto derivatives hit $85.7T in annual quantity

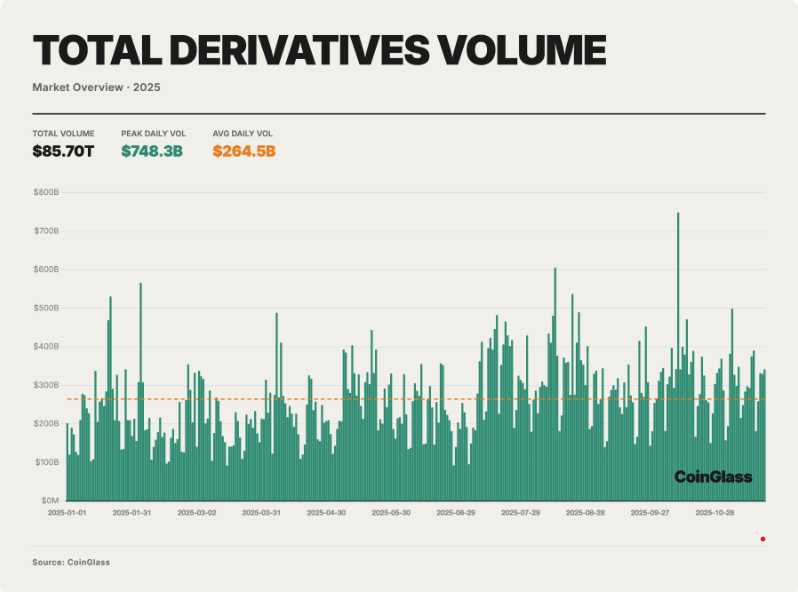

Derivatives have quick develop into crypto’s predominant venue for value discovery and danger switch. CoinGlass’ 2025 annual report estimates derivatives buying and selling quantity at roughly $85.7 trillion final 12 months, with common day by day turnover of about $264.5 billion.

These figures marked file volumes and deeper open curiosity as institutional merchants used futures and choices as their main instruments for value discovery and danger administration.

Whole crypto derivatives quantity in 2025. Supply: CoinGlass

The identical report warns that larger complexity and deeper leverage chains have “elevated systemic tail dangers,” with the Oct. 2025 deleveraging occasion exposing how fragile liquidation engines, auto-deleveraging (ADL) mechanisms and extremely concentrated venues can nonetheless flip crowded positions into outsized losses throughout the market.

Journal: Meet the onchain crypto detectives preventing crime higher than the cops