Bitcoin climbs solo, without altcoins – Risk alert for traders!

- Altcoin-Bitcoin correlation was breaking down, hinting at fragility beneath Bitcoin’s solo rally.

- Whale-driven dominance surge confirmed warning, not conviction; danger of snapback looms close to all-time highs.

Bitcoin’s [BTC] newest surge is popping heads, however not for the same old causes. Whereas the BTC slowly climbs, the broader altcoin market is stalling – a uncommon divergence.

With Bitcoin dominance rising and historic correlations breaking down, analysts are sounding alarms: this rally could also be operating on fumes, and the danger of a sudden reversal is rising.

Altcoin correlation crumbles as Bitcoin climbs

Bitcoin’s ascent is not lifting all boats.

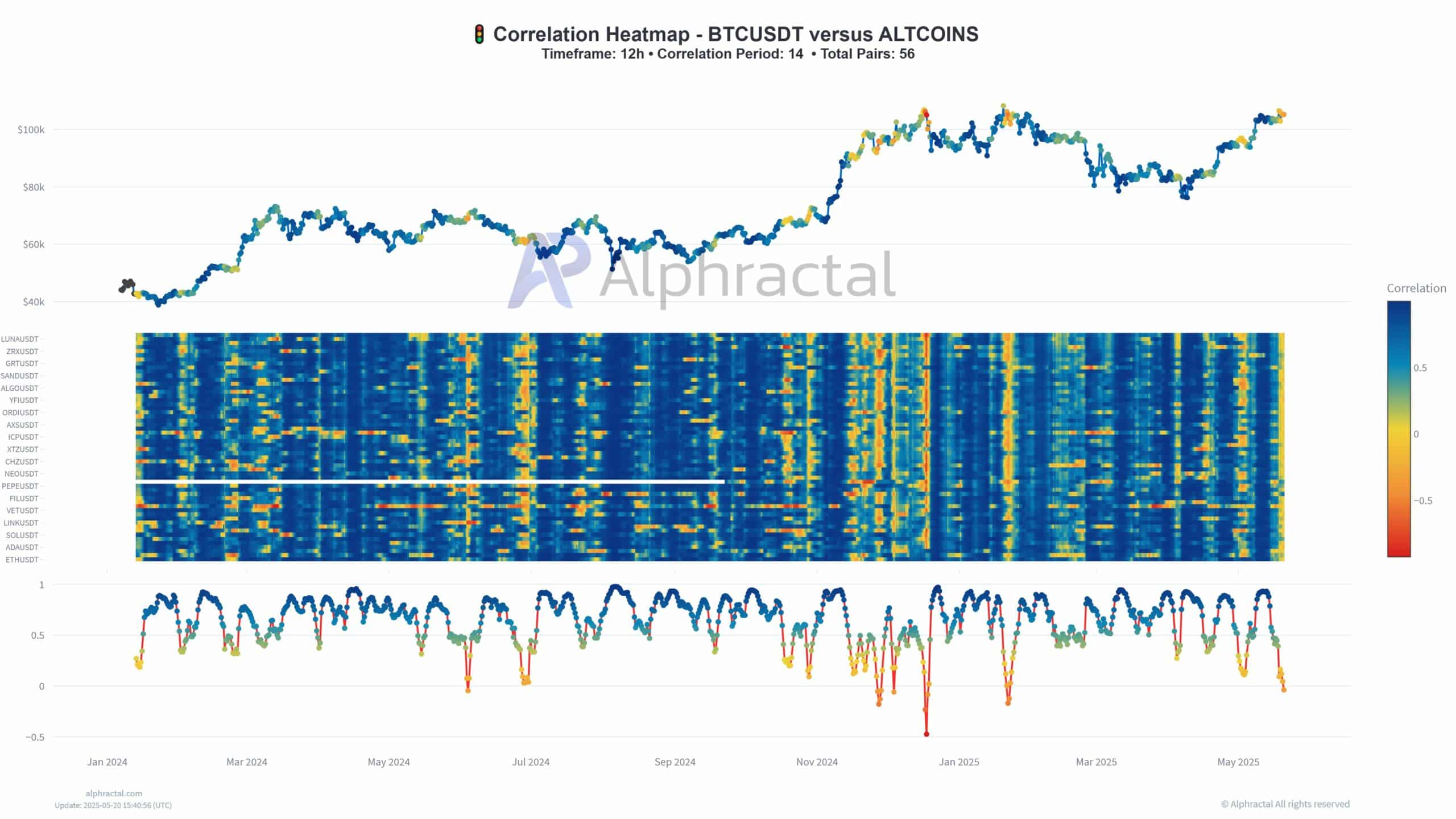

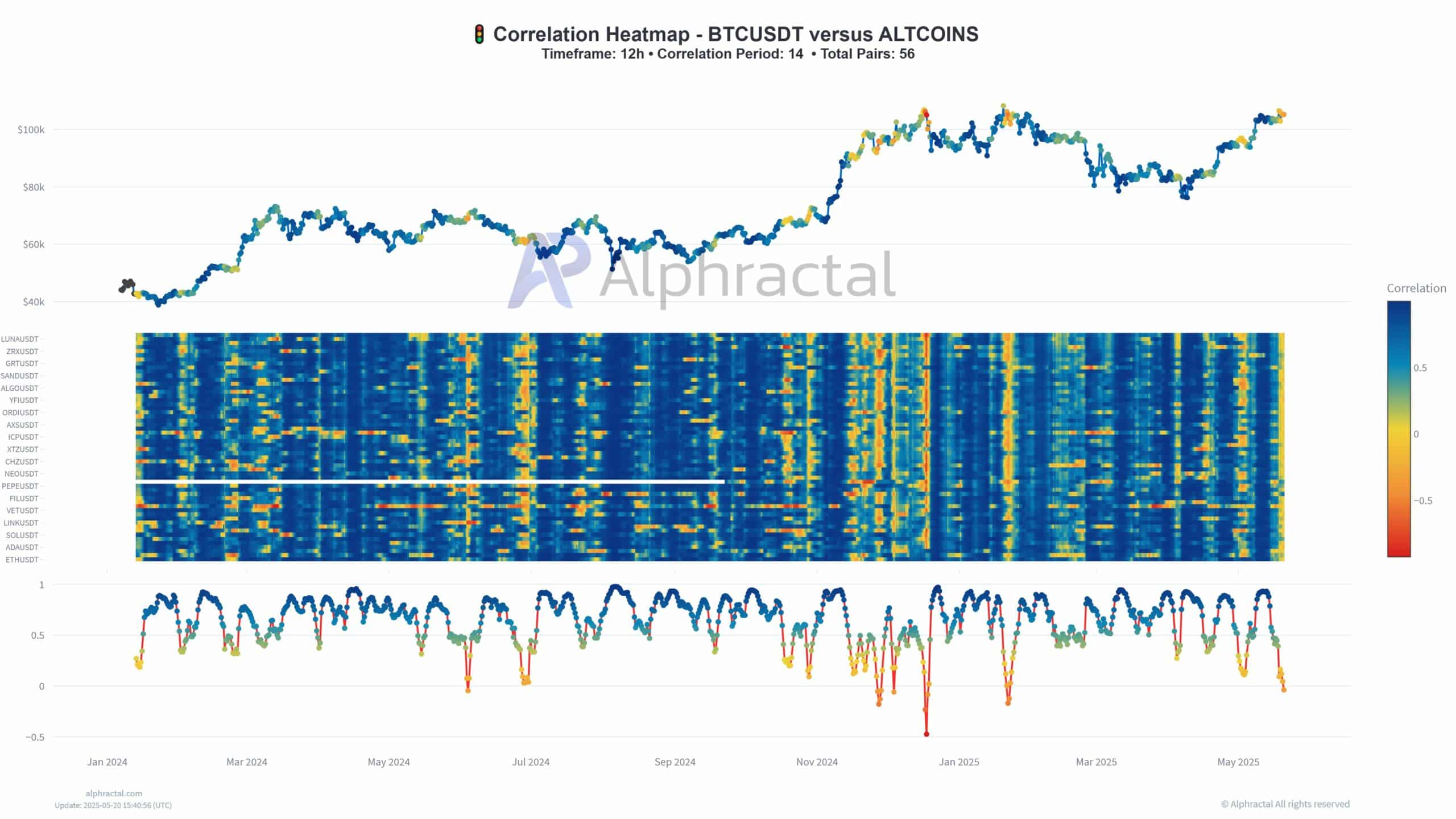

Supply: Alphractal

The 14-period rolling correlation between BTC and major altcoins has sharply declined since late April 2025.

In contrast to earlier rallies the place altcoins moved in sync with Bitcoin, the present development reveals fragmentation. Most altcoins now show near-zero or unfavorable correlation on the 12-hour timeframe.

This disconnect, highlighted by cooler blue shades within the heatmap, alerts a narrowing market.

A Bitcoin-led rally typically lacks long-term energy and may typically precede a broader risk-off shift out there.

Dominance reclaimed

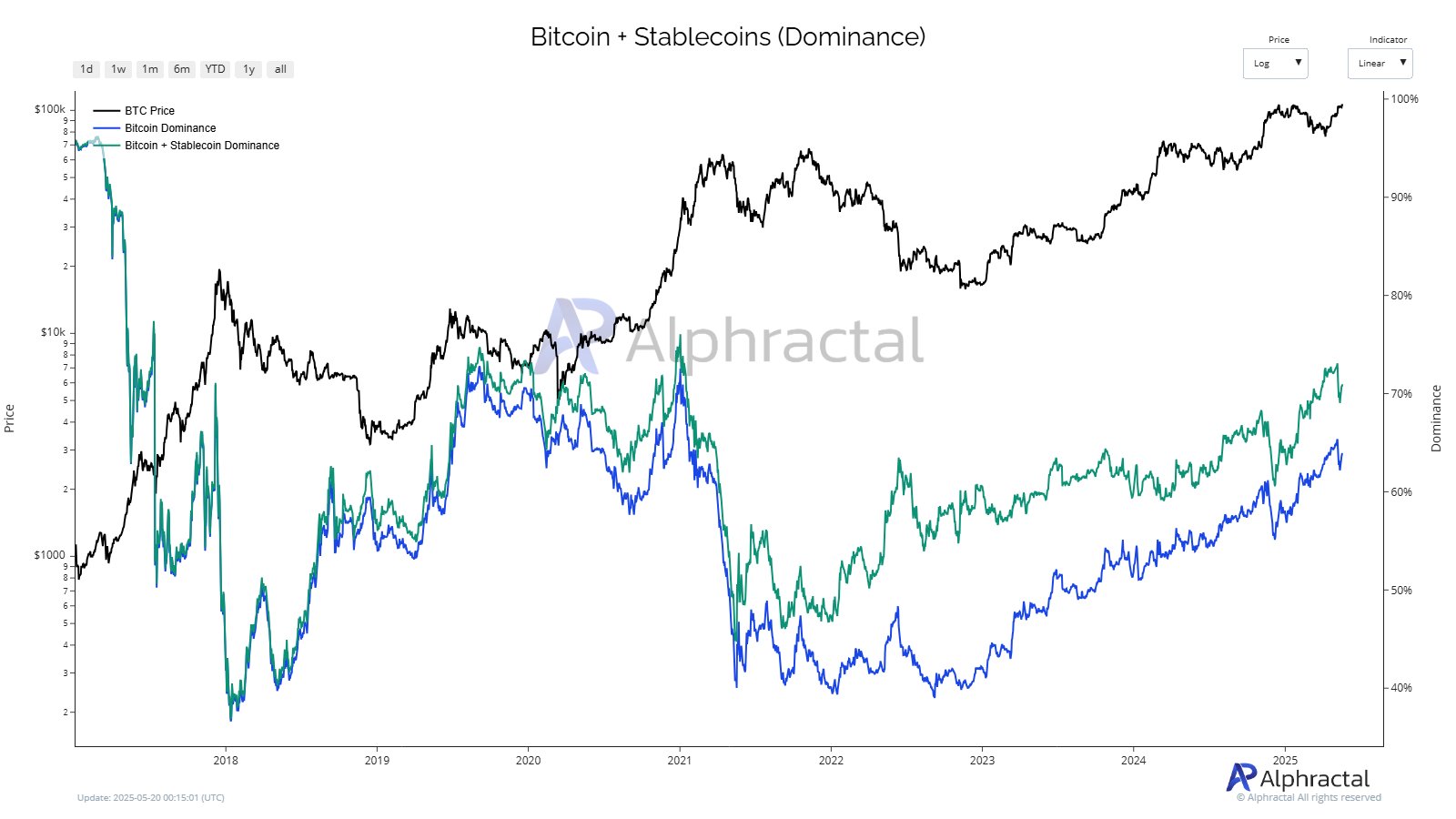

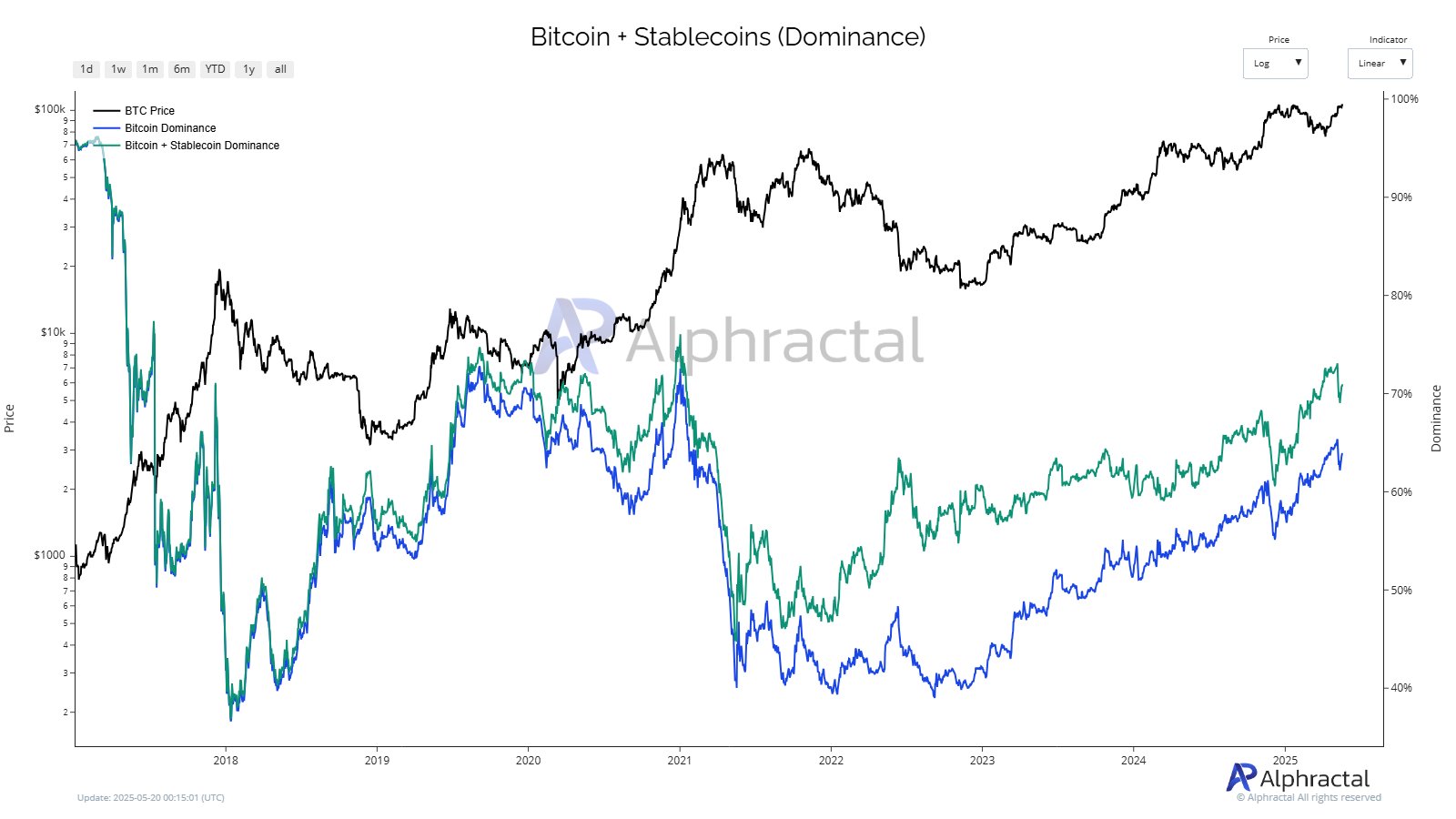

BTC’s worth climb has been accompanied by a strong resurgence in market dominance, not only for BTC alone, however when mixed with stablecoins.

The joint dominance borders on 70%, displaying a return to risk-off habits and consolidation of capital in “safer” crypto belongings.

Supply: Alphractal

Whereas Bitcoin dominance alone stays beneath its 2021 peak, the inclusion of stablecoins reveals that merchants are ready on the sidelines.

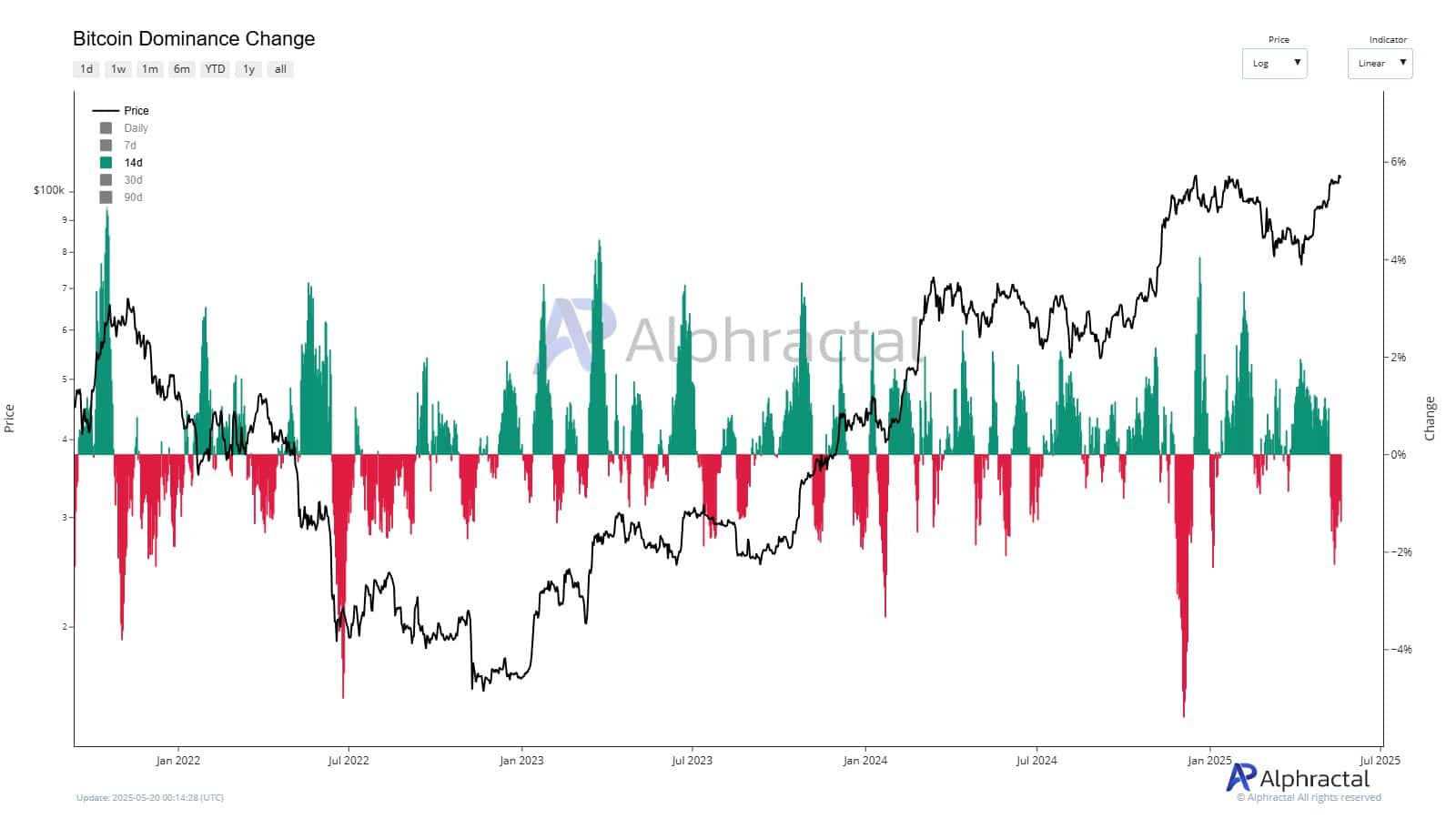

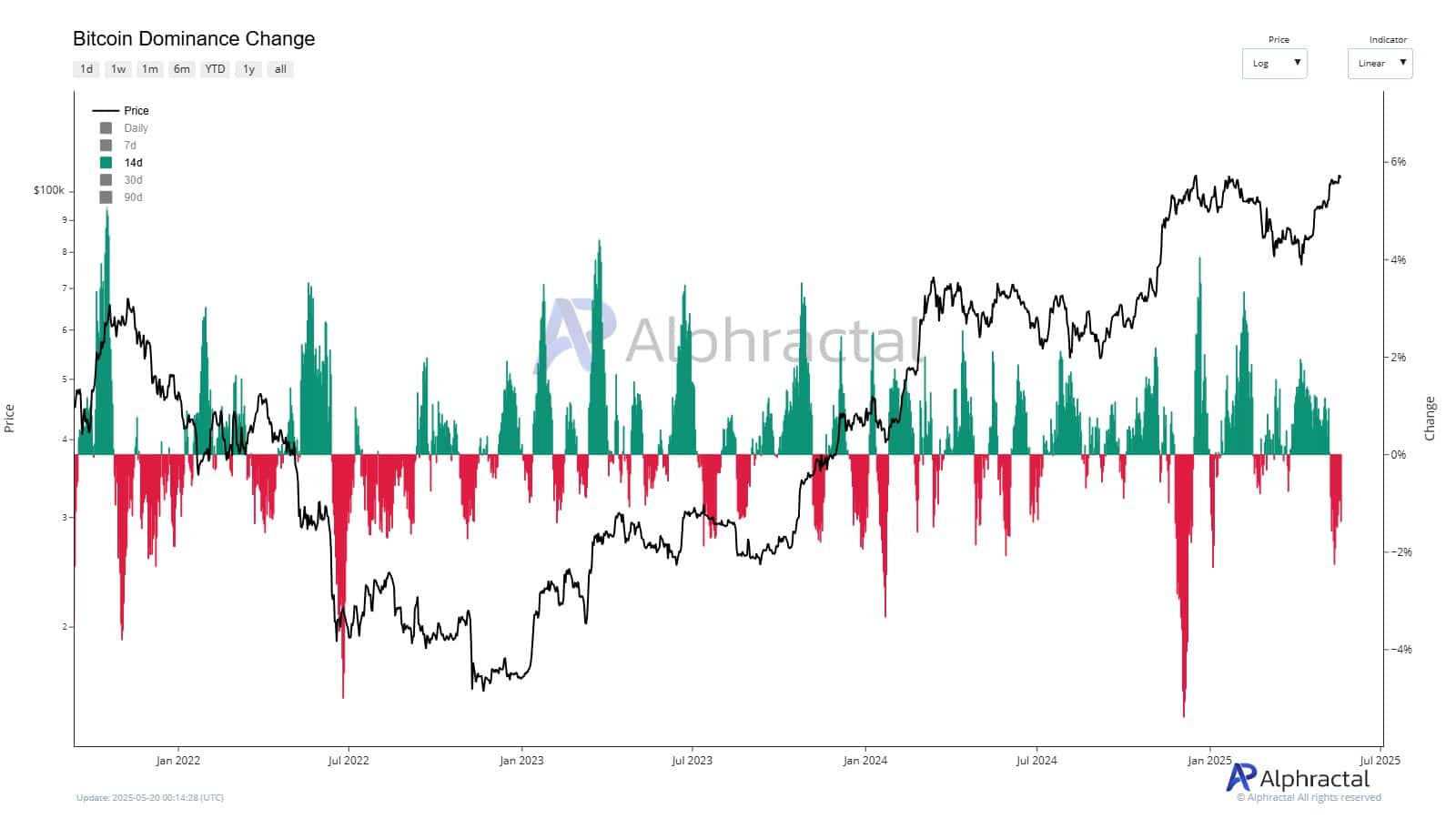

Supply: Alphractal

Regardless of worth beneficial properties, BTC dominance change has steadily turned unfavorable, highlighting continued capital rotation and market indecision beneath the floor energy.