Outshines Gold And Silver, Analyst Says

In response to market commentators, a pointy break up has opened between backers of Bitcoin and supporters of treasured metals after a 12 months of huge strikes in each camps. Bitcoin’s long-run beneficial properties are being held up as proof it stays the highest performing asset, whereas gold and silver have staged a dramatic rally that has stunned some traders. Opinions are divided and the talk is loud.

Associated Studying

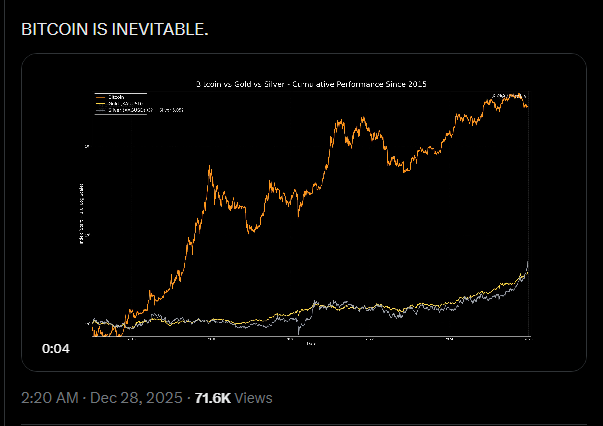

Bitcoin’s Large Lead Since 2015

Bitcoin has climbed about 27,700% since 2015, a determine cited by analyst Adam Livingston. That determine dwarfs the beneficial properties recorded for silver and gold over the identical stretch, that are roughly 400% and 280% respectively.

Livingston argued that even for those who ignore Bitcoin’s earliest years, the cryptocurrency nonetheless outpaced the metals by a big margin. Some see that as a transparent win for the crypto thesis. Others should not satisfied.

Bitcoin vs. Silver vs. Gold since January 1st, 2015:

Silver: 405%

Gold: 283%

Bitcoin: 27,701%Even ignoring the primary 6 years of Bitcoin’s existence for the crybabies who whine concerning the timeframe comparability…

…gold and silver drastically underperform the APEX ASSET.… pic.twitter.com/vdAnatqRKG

— Adam Livingston (@AdamBLiv) December 27, 2025

Critics Push Again On Timeframes

Gold advocate Peter Schiff informed Livingston to concentrate on a shorter span — the final 4 years — and mentioned Bitcoin’s second could have handed. That problem displays a wider fear amongst steel holders that previous efficiency could not repeat.

Now do the final 4 years solely. Instances have modified. Bitcoin’s time has handed.

— Peter Schiff (@PeterSchiff) December 27, 2025

Orange Horizon Wealth co-founder Matt Golliher supplied a distinct angle, saying commodity costs have a tendency to maneuver again towards the price of making them, and that increased costs typically set off extra provide. He additionally identified that sources of gold and silver that weren’t worthwhile a 12 months in the past at the moment are being mined at a revenue.

Provide And Macro Forces Driving Costs

Gold and silver each surged to new highs in 2025. Experiences present gold reached about $4,533 per ounce and silver approached practically $80 per ounce. On the identical time, the US greenback has weakened, with the US Greenback Index down roughly 10% for the 12 months.

A number of analysts linked these strikes to expectations round Fed easing in 2026 and to rising geopolitical tensions that may push merchants into scarce belongings. Zaner Metals strategist Peter Grant mentioned thinner buying and selling and the Fed outlook helped gasoline sharp swings.

Surprisingly unpopular opinion: Gold and silver don’t must decelerate for Bitcoin to do nicely.

Bitcoiners pondering that should occur, are low T, and don’t perceive any of those belongings.

— _Checkmate 🟠🔑⚡☢️🛢️ (@_Checkmatey_) December 28, 2025

Associated Studying

Bitcoin’s Path Is Not Tied To Metals

In response to analysts from Glassnode and macro strategists, Bitcoin doesn’t want gold or silver to chill off earlier than it may rise once more.

James Verify, a lead analyst at Glassnode, argued that the belongings don’t have to commerce towards each other. Macro strategist Lyn Alden echoed that view, noting the 2 can each entice demand on the identical time and should not strict rivals in follow.

Arthur Hayes added that Fed easing and a weaker greenback ought to elevate scarce belongings broadly, together with digital and bodily shops of worth.

Featured picture from Unsplash, chart from TradingView