$1.33B Ethereum Whale Just Moved Another $120M USDT to Binance – Details

Ethereum is displaying indicators of weak spot because it struggles to reclaim greater value ranges amid sustained promoting stress and broader market uncertainty. After a number of failed makes an attempt to interrupt above key resistance close to $3,600, the asset stays range-bound, reflecting the cautious sentiment throughout the crypto market. Regardless of this, a number of analysts imagine the present part may characterize the ultimate shakeout earlier than Ethereum begins its subsequent main rally.

Associated Studying

In line with latest on-chain knowledge, massive holders — together with institutional gamers and crypto whales — proceed to build up ETH at the same time as volatility persists. This regular influx from large consumers suggests rising confidence in Ethereum’s long-term potential, notably as community fundamentals stay robust and liquidity situations start to stabilize.

The divergence between value weak spot and whale accumulation highlights a recurring sample seen in earlier cycles, the place accumulation intensifies close to native lows earlier than a major restoration. Whereas short-term merchants stay defensive, long-term traders seem like positioning forward of a possible breakout as soon as macro situations enhance.

Whale Exercise Indicators Renewed Ethereum Accumulation Forward of Potential Rally

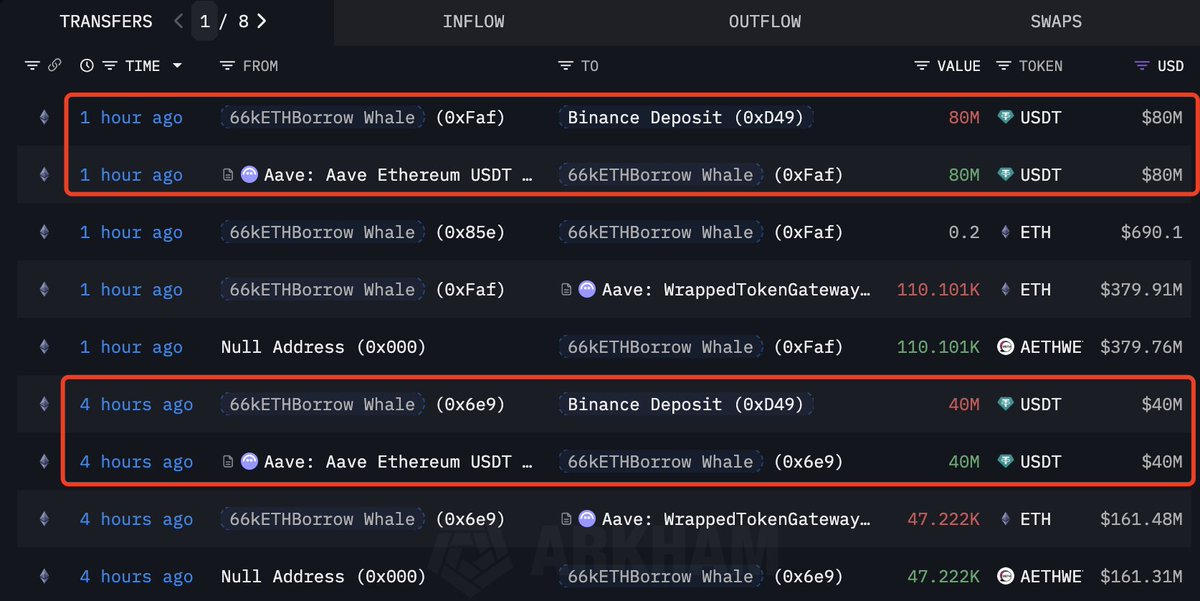

In line with on-chain data, the well-known Ethereum whale “66kETHBorrow” — already some of the energetic massive consumers in latest weeks — has made one other main transfer. After buying 385,718 ETH price roughly $1.33 billion since early November, this whale has now borrowed an extra $120 million USDT from Aave and transferred it to Binance, a transfer broadly interpreted as preparation for additional accumulation.

Such conduct from a high-capital market participant usually indicators renewed confidence in Ethereum’s medium-term outlook. By leveraging borrowed funds, the whale is growing publicity, suggesting expectations of a major value rebound. This sort of leveraged accumulation can create upward stress in the marketplace, particularly when liquidity is skinny and sellers are exhausted.

Nevertheless, this technique additionally carries dangers. If Ethereum fails to maintain its present help close to $3,400–$3,500, the whale may face mounting liquidation stress — amplifying volatility throughout the broader market. Nonetheless, the dimensions and persistence of those purchases point out that sensible cash continues to purchase the dip, positioning forward of what may very well be a significant restoration part.

Associated Studying

Ethereum Consolidates Above as Bulls Try to Regain Management

The each day Ethereum chart reveals a transparent consolidation sample forming above the $3,450–$3,500 zone, signaling an ongoing battle between bulls and bears. After weeks of promoting stress, ETH is trying to stabilize, discovering help on the 200-day transferring common (purple line), which continues to behave as a vital long-term protection degree.

Regardless of failing to reclaim the 50-day transferring common (blue line), at present close to $3,700, the construction means that draw back momentum is weakening. Latest candles present tighter ranges and declining quantity, usually an indication of equilibrium earlier than a possible breakout. For Ethereum to substantiate a shift in pattern, bulls want a decisive shut above $3,650, which might open the door towards $3,900–$4,000, the place the subsequent key resistance cluster sits.

Associated Studying

On the draw back, if ETH loses the $3,400 help zone, the subsequent main space of curiosity lies round $3,100, aligning with earlier response lows and the psychological barrier the place consumers have traditionally stepped in.

Featured picture from ChatGPT, chart from TradingView.com