Ethereum bears lose ground, but ETH bulls may not be safe just yet!

- Ethereum’s rebound above $2,670 triggered an enormous quick squeeze, liquidating $500 million in shorts

- Rising ETH inflows to derivatives and constructive funding charges recommend extra volatility could also be forward

Ethereum [ETH] simply reminded merchants what a brief squeeze looks like.

After clawing its manner again above $2,670, the sudden rebound worn out over half a billion {dollars} briefly positions on Binance alone, marking one of many largest liquidations the market has seen in latest instances.

And now, with recent ETH flowing into spinoff exchanges, the setup appears to be like primed for extra.

Ethereum: What triggered the squeeze?

Ethereum’s rally above $2,670 caught leveraged quick merchants off guard, setting off one of many largest liquidation waves in latest months.

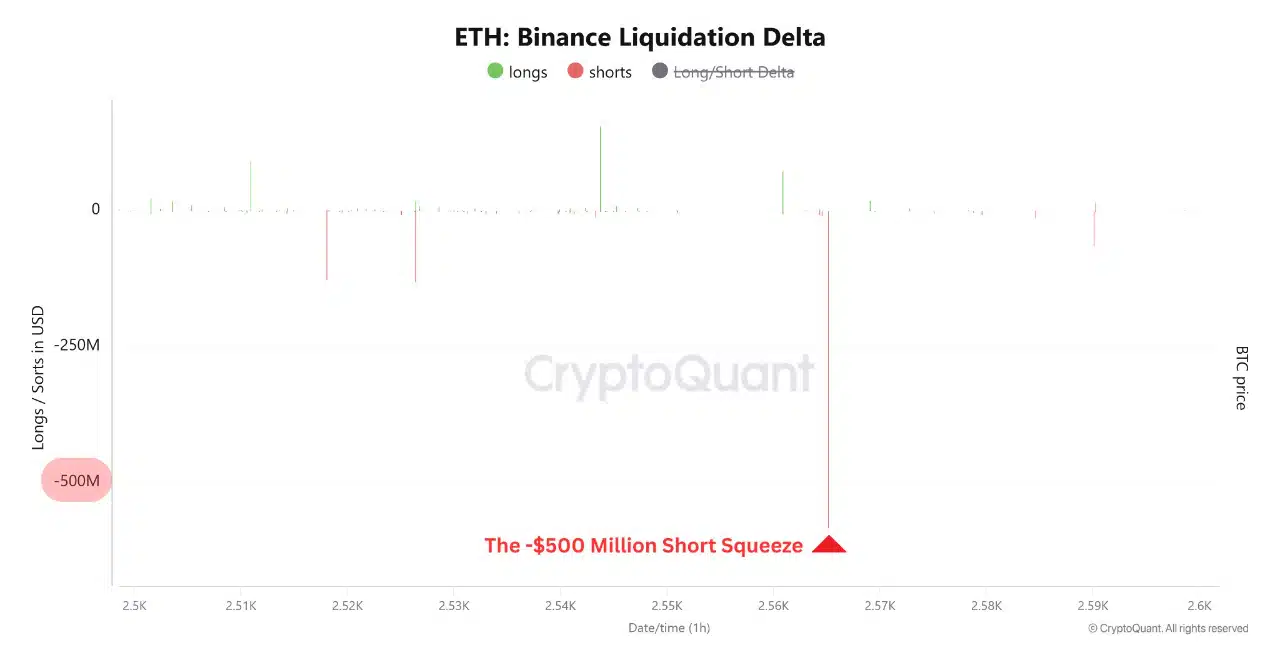

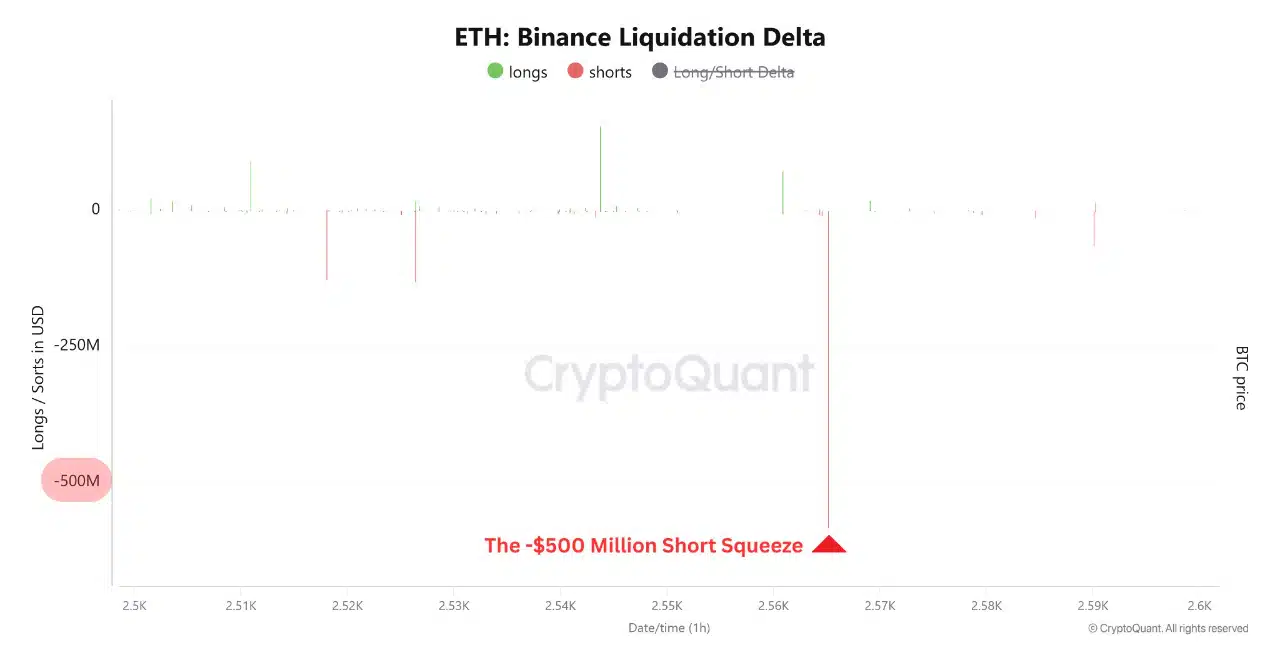

CryptoQuant data reveals a dramatic $500 million delta briefly liquidations on Binance – a transparent signal of overcrowded bearish bets.

Supply: CryptoQuant

Anticipating additional draw back, merchants aggressively entered quick positions. However when ETH reversed path, margin calls compelled speedy buybacks.

These compelled liquidations fueled the worth rally, squeezing late shorts and swiftly shifting market sentiment.

The chain response pushed funding charges into constructive territory, highlighting the sharp unwinding of bearish leverage.