Ethereum: Retail traders bet against ETH—Will it see a short squeeze?

- Ethereum’s retail quick place rising as longs decline amid rising OI signaled retail buyers are bearish.

- Binance is dumping huge quantities of ETH and different cryptos regardless of the MACD confirming a bullish crossover.

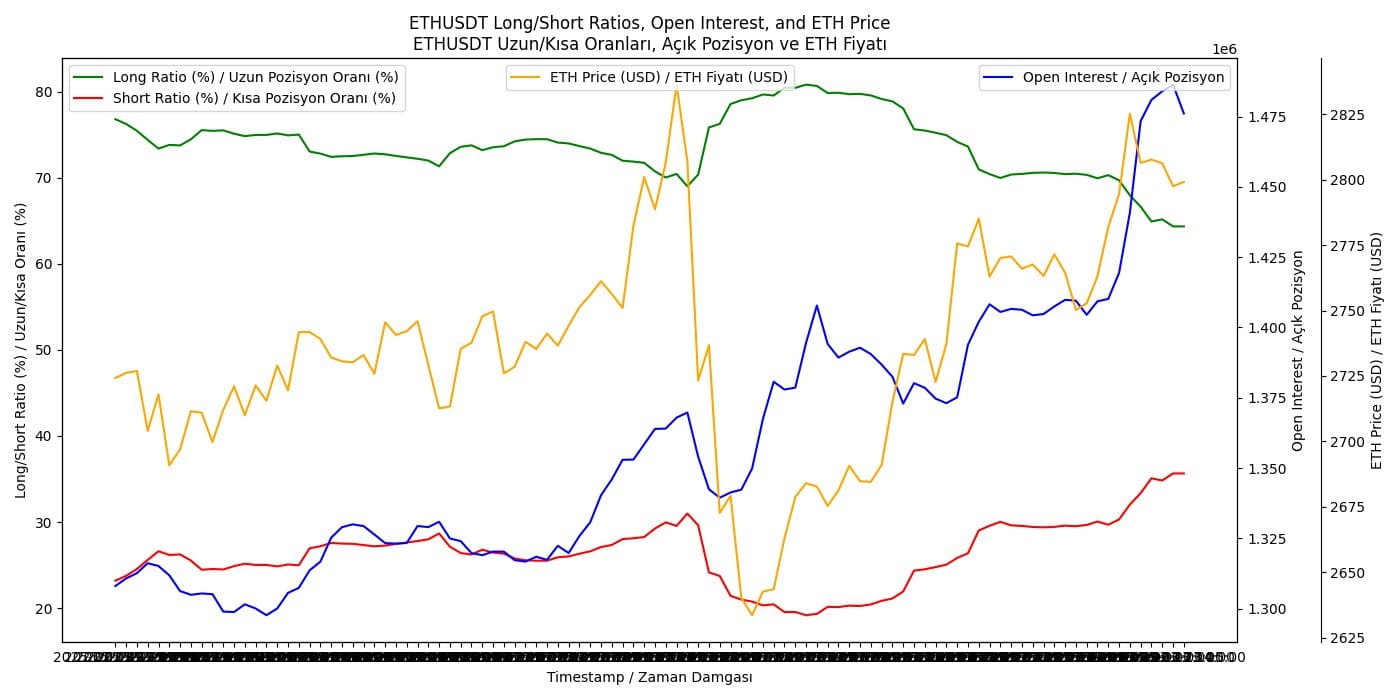

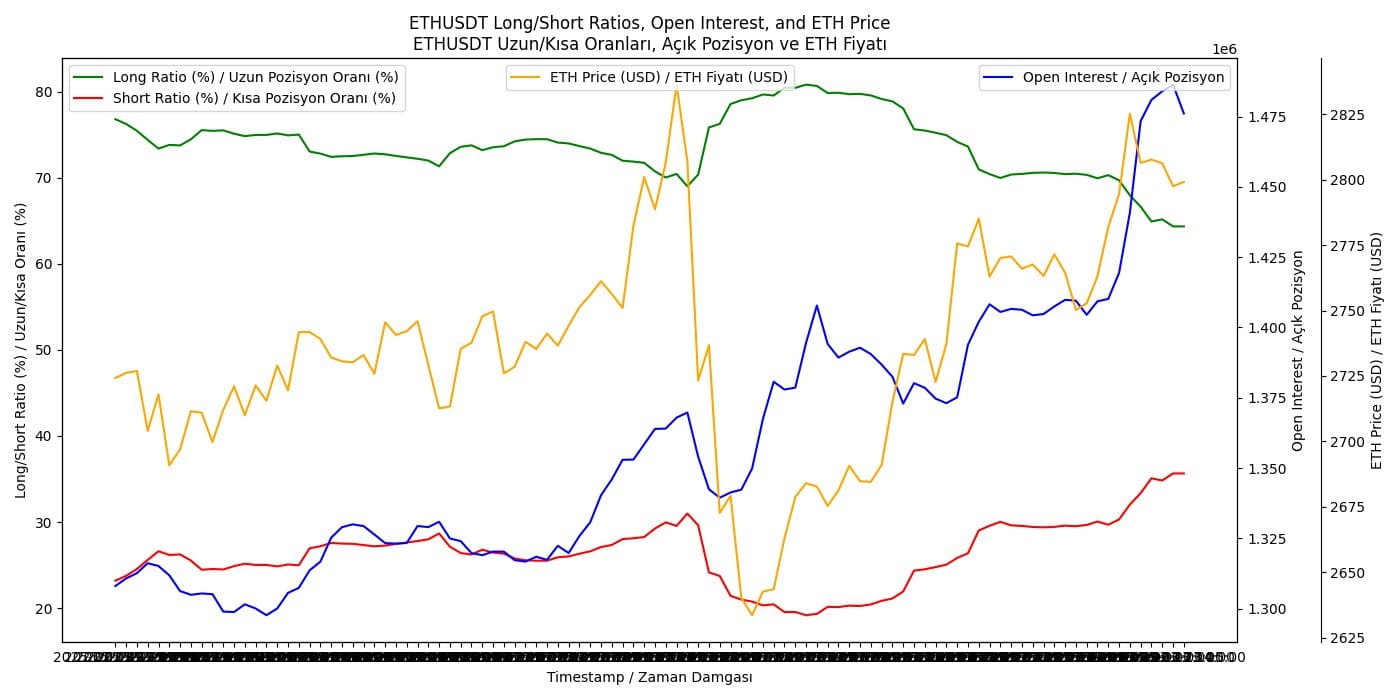

The share of retail quick positions for Ethereum [ETH] has been rising, whereas that of lengthy positions is declining. The Quick Ratio has climbed above 30%, whereas the Lengthy Ratio has dropped under 75%.

This shift is accompanied by growing Open Curiosity (OI), suggesting retail buyers are betting in opposition to Ethereum.

As of press time, ETH’s worth has risen above $2,775, but when this bearish sentiment prevails, a pullback towards $2,700 is feasible.

Conversely, if OI continues rising whereas shorts get squeezed, ETH may break previous $2,825 and intention for increased ranges. Because the lengthy positions lower, this might signify apprehension about Ethereum’s near-term development potential.

Supply: X

If this development continues, ETH may check decrease help ranges. Conversely, if the market sentiment shifts and lengthy positions start to extend, we would observe a rebound in the direction of $2800 or increased.

Binance continues to massively offload ETH

The sentiment of retail buyers aligns with Binance, which has been transferring important quantities of Ethereum to centralized change bridges and market makers. The quantities vary from 1.003K ETH value $2.79M to 1.52K ETH value $4.25M.

This excessive stage of exercise, together with giant inflows to market makers and exchanges, might point out that Binance is facilitating liquidity or presumably decreasing its holdings in response to market situations.

The potential implications for Ethereum’s worth are combined.

Supply: Arkham

On one hand, if these transfers are meant to satisfy growing demand on exchanges or for market-making functions, it may stabilize and even improve the ETH worth as a result of increased liquidity and buying and selling quantity.

If that is Binance liquidating its holdings, it may result in a worth drop as a result of elevated provide in the marketplace.

This implies additional sell-side stress from exchanges may both affirm a bearish development or, if met with adequate buy-side demand, may result in a bullish reversal.

MACD confirms a bullish crossover

Nonetheless, Ethereum’s worth motion revealed a bullish sign, with the MACD crossing above its sign line.

This bullish crossover, mixed with stabilization on the key help stage round $2,650 after the Bybit hack, suggests potential for a worth upswing.

The speedy goal following this bullish sign might be the latest resistance at $3,000. If Ethereum breaks by way of this barrier, the following important stage might be round $4,000 and past.

Supply: TradingView

Conversely, if the bullish momentum wanes and fails to maintain, ETH might retest the help at $2,650.

A break under this level may result in additional declines, with the following important help at $2,490.