BlackRock’s Bitcoin ETF Blows Past $80,000,000,000, Faster Than Any Other Exchange-Traded Fund in History: Bloomberg Analyst

Senior Bloomberg analyst Eric Balchunas says that BlackRock’s Bitcoin (BTC) exchange-traded fund has surpassed the $80 billion landmark sooner than any ETF in historical past.

In a brand new thread on the social media platform X, Balchunas says that the iShares Bitcoin Belief ETF (IBIT) is now price $83 billion, the twenty first largest ETF general.

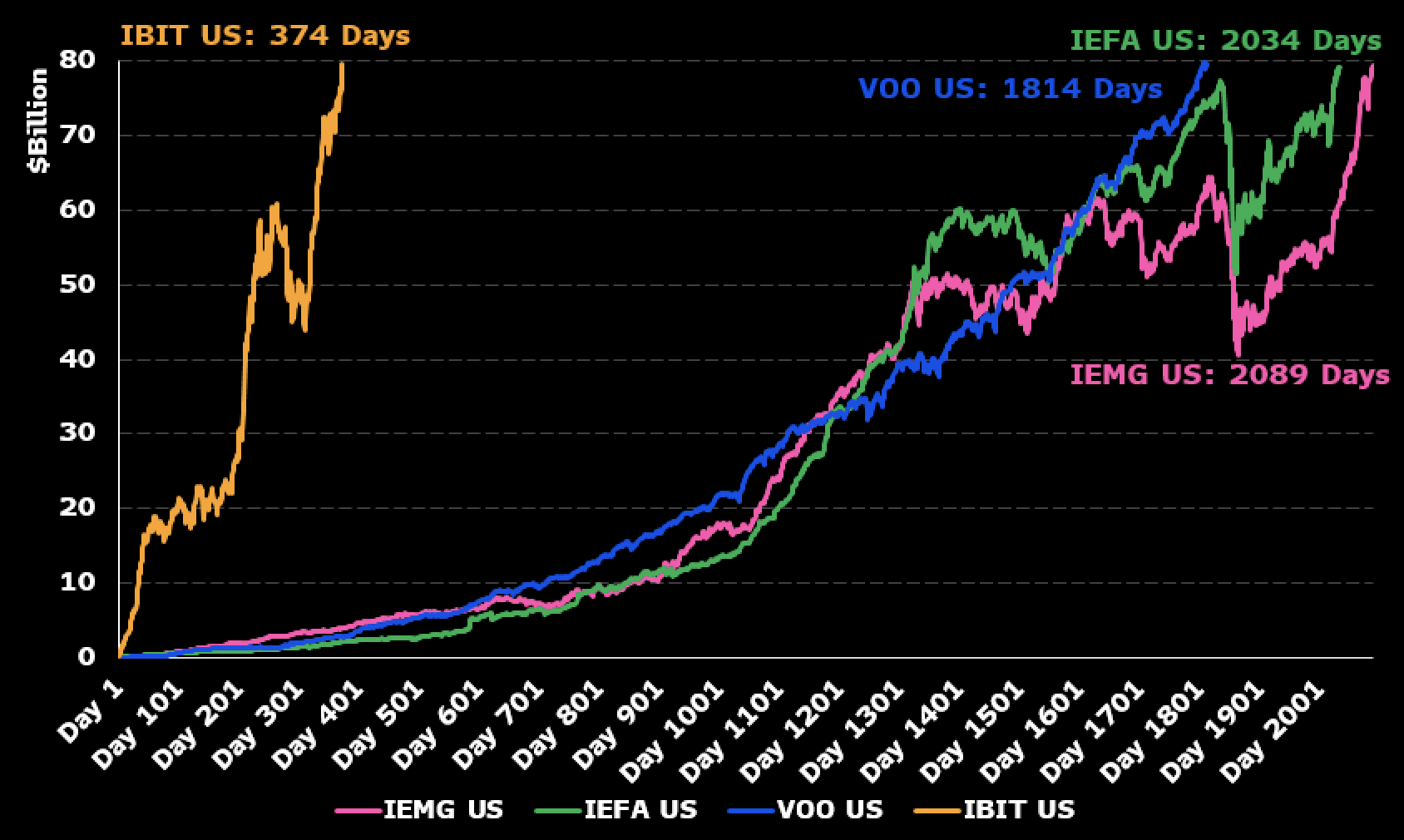

“IBIT blew by way of the $80 billion mark [on Friday], quickest ETF to get there in 374 days, about 5x sooner than the earlier file, held by VOO, which did it in 1,814 days.”

Balchunas goes on to note that Bitcoin’s rallies are closely contributing to the overall property of all the prevailing BTC-based ETFs.

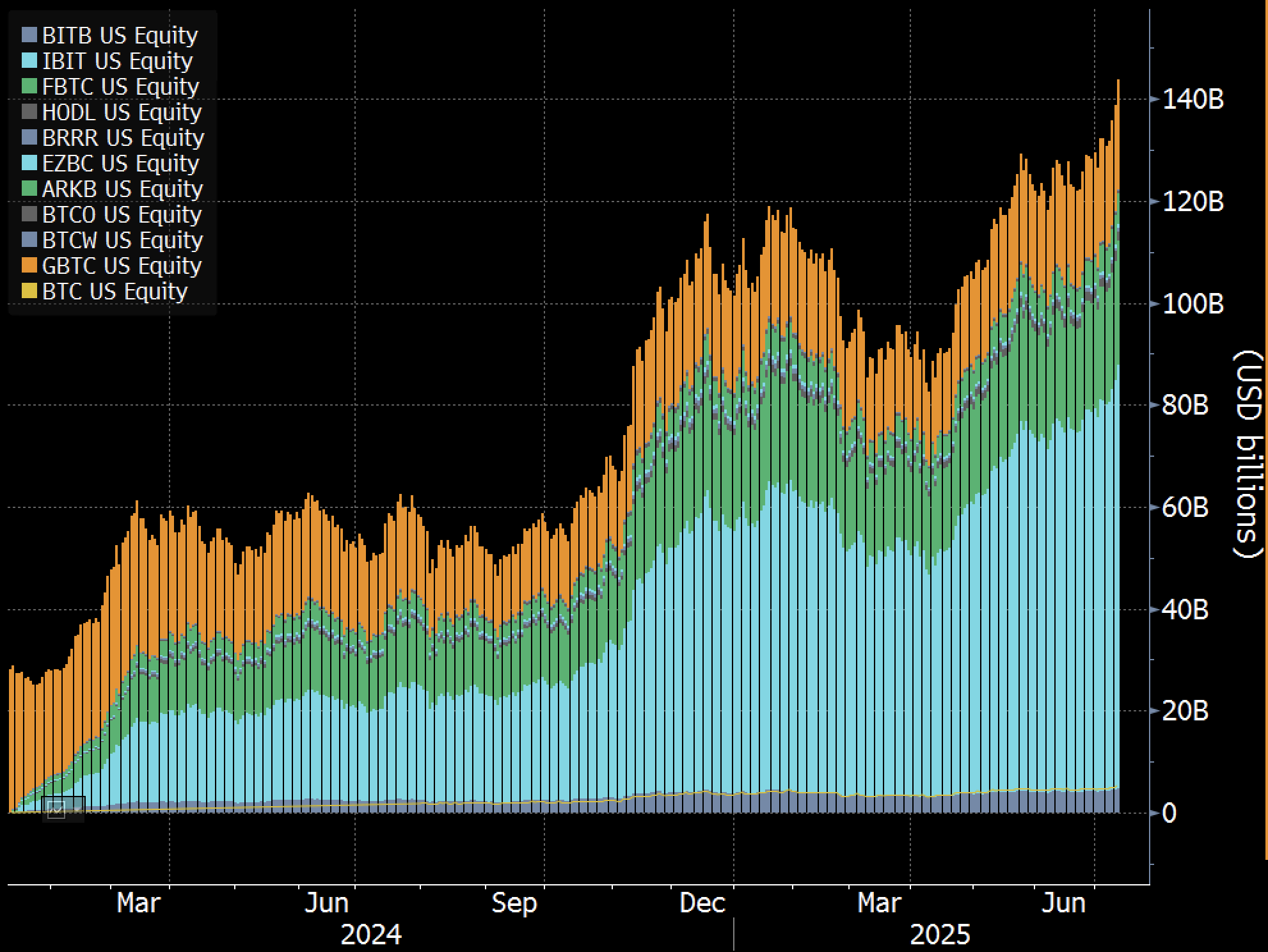

“Complete property for all of the spot Bitcoin ETFs crossed $140 billion for first time as properly.. They took in over $1 billion final evening but it surely was actually the large transfer up in value that’s doing many of the heavy lifting right here.”

He additionally notes that BlackRock’s Ethereum (ETH)-based ETF (ETHA) had one in all its greatest weeks but, busting into the highest 10 by way of inflows.

“Don’t look now, however ETHA took the sixth spot on the weekly circulate leaderboard. Hanging with the large canine for the primary time. $675 million in per week isn’t any joke, though nonetheless residing in BTC’s shadow with IBIT grabbing an absurd $1.7 billion.”

BTC and IBIT are buying and selling for $122,260 and $67.21 at time of writing, respectively, whereas ETH and ETHA are valued at $3,031 and $22.80.

Observe us on X, Facebook and Telegram

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Worth Motion

Surf The Day by day Hodl Combine

Generated Picture: Midjourney