Why BONK’s consolidation could end with THIS double bullish pattern

- Presently, BONK trades inside a double bullish sample, indicating accumulation and the potential to realize the next value degree.

- Nonetheless, on-chain sentiment stays combined. Whereas some metrics spotlight a bearish presence, others recommend elevated liquidity, leaving the market divided.

Over the previous month, Bonk [BONK] has struggled, dipping by 25.29% and failing to ship positive aspects for traders. Regardless of this, current value motion exhibits a glimmer of restoration, with the asset gaining 0.16% within the final 24 hours.

AMBCrypto has recognized sturdy bullish alerts supporting BONK’s current minor uptick. Nonetheless, the sustainability of BONK’s rally stays unsure attributable to misaligned dealer sentiment, which poses a possible impediment.

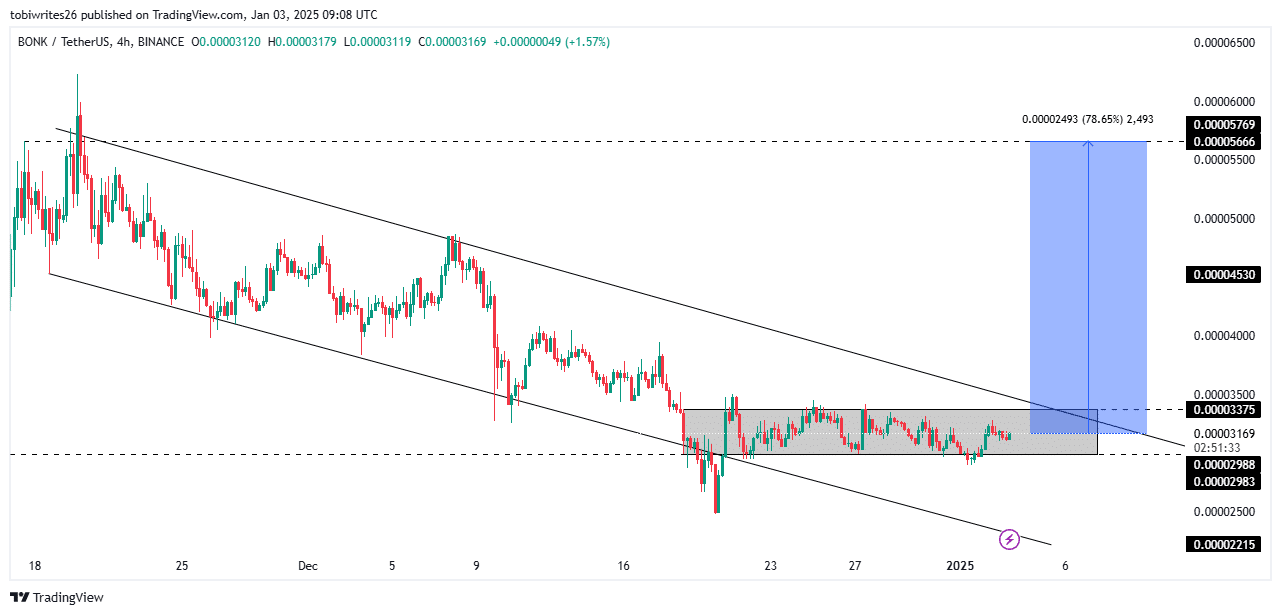

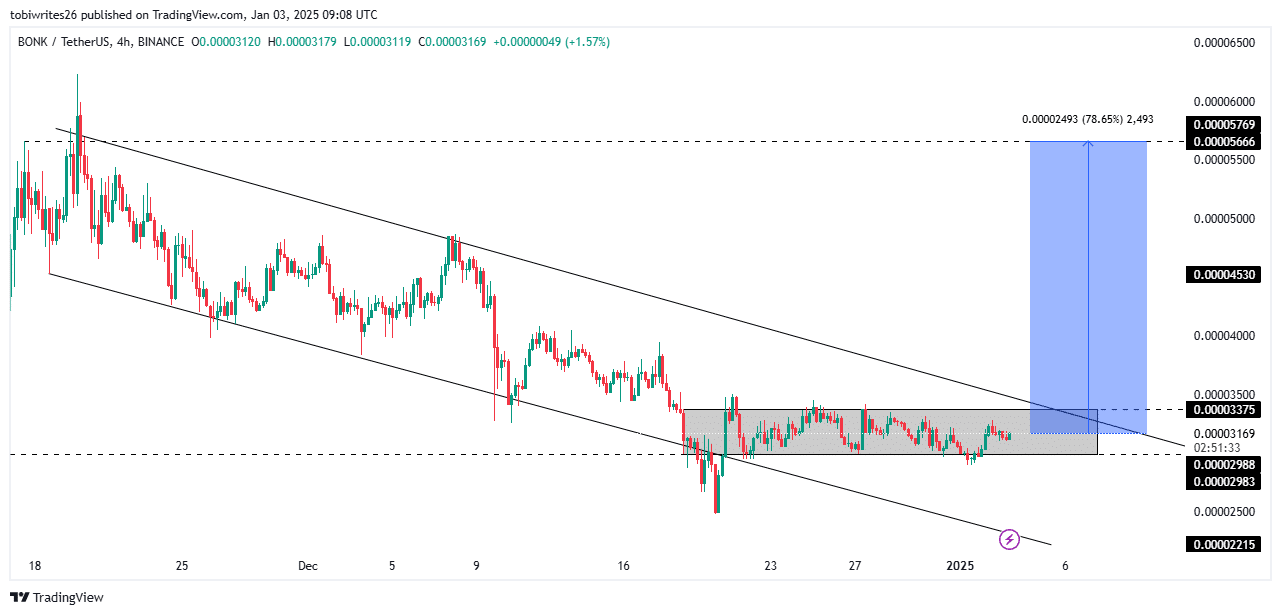

A double bullish sample within the accumulation zone

At press time, BONK was buying and selling inside two bullish patterns: a bigger descending channel and a consolidation section throughout the channel, displaying ongoing accumulation.

The descending channel sometimes signifies decrease lows as patrons bid at lowering costs earlier than the market rallies. Inside this construction, the consolidation section, marked by an oblong field, displays value distribution between outlined help and resistance ranges.

A breakout from this consolidation section and a breach of the descending channel’s resistance line may probably lead BONK to a big rally, reaching $0.00005666—a 78.65% acquire from its present degree.

Supply: TradingView

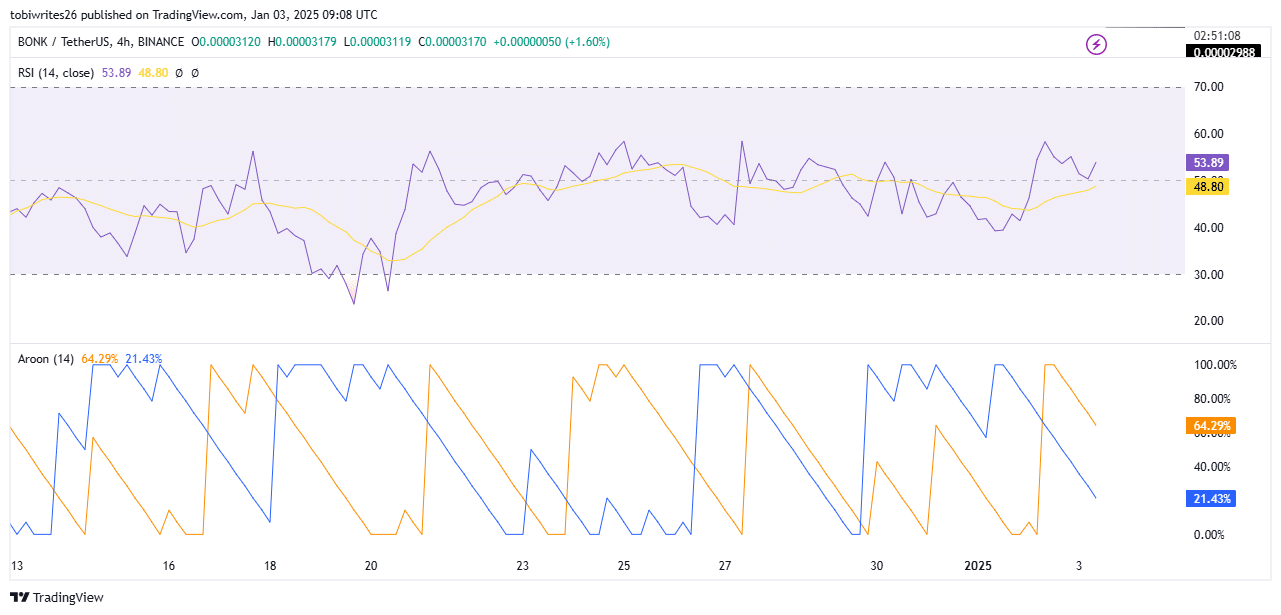

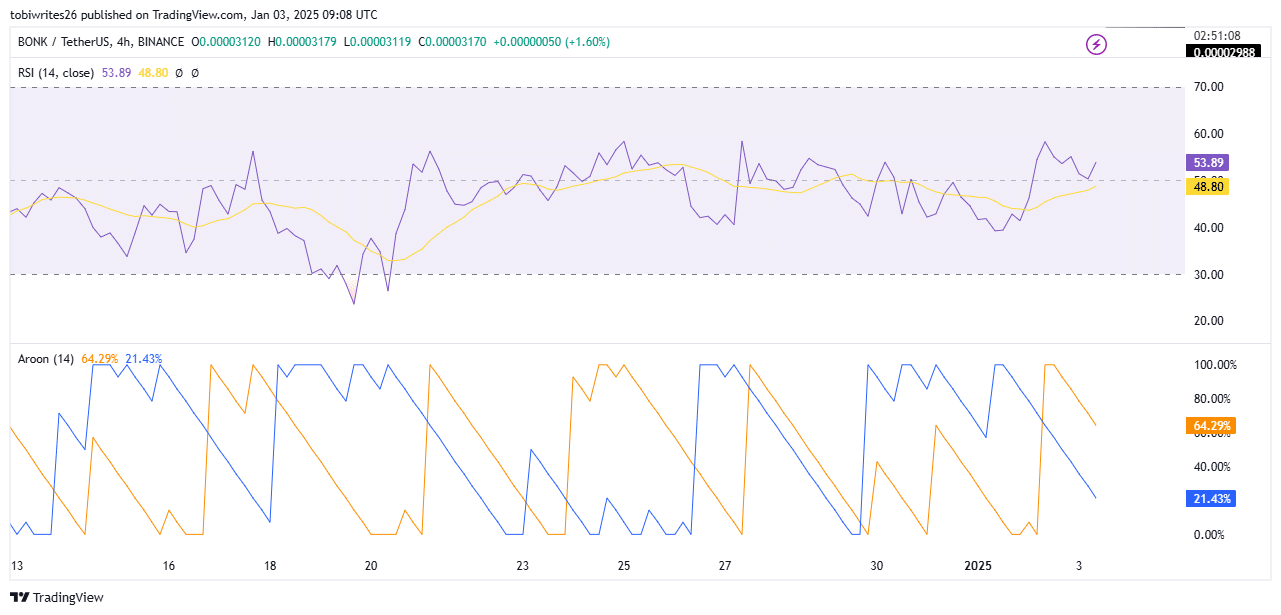

Technical indicators help this bullish outlook. The Relative Power Index (RSI), a measure of value momentum, has bounced completely off the impartial line at 50 and stood at 53.89, suggesting upward momentum.

When the RSI stays above 50 and traits larger, because it does for BONK, the chance of continued value positive aspects will increase.

Supply: TradingView

The Aroon indicator additional confirms bullish momentum. The Aroon-Up (orange) is at 64.29%, outpacing the Aroon-Down (blue) at 21.43%. This means sturdy shopping for exercise and means that BONK stays in an accumulation section.

The Aroon indicator tracks the power and course of traits by measuring the time since current value highs and lows.

Nonetheless, AMBCrypto has noticed some market hesitancy, with sure cohorts displaying indicators of promoting stress.

Potential delay in BONK’s upswing

The memecoin could expertise a pause or slowdown earlier than persevering with its upward trajectory.

On the time of writing, Open Curiosity (OI) has declined by 4.97% over the previous 24 hours, dropping to $12.15 million. A lower in OI sometimes alerts bearish sentiment, because it suggests lowered dealer participation or exiting positions.

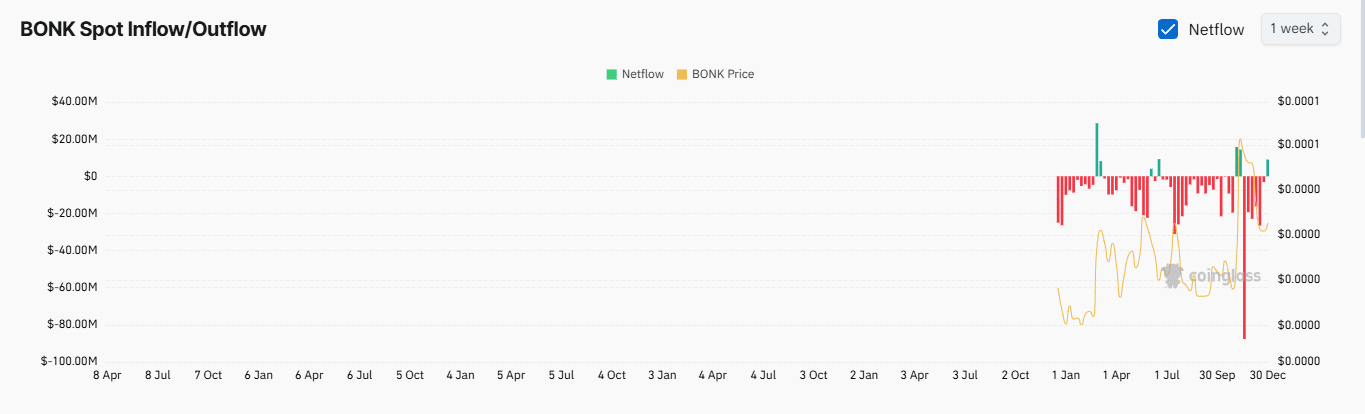

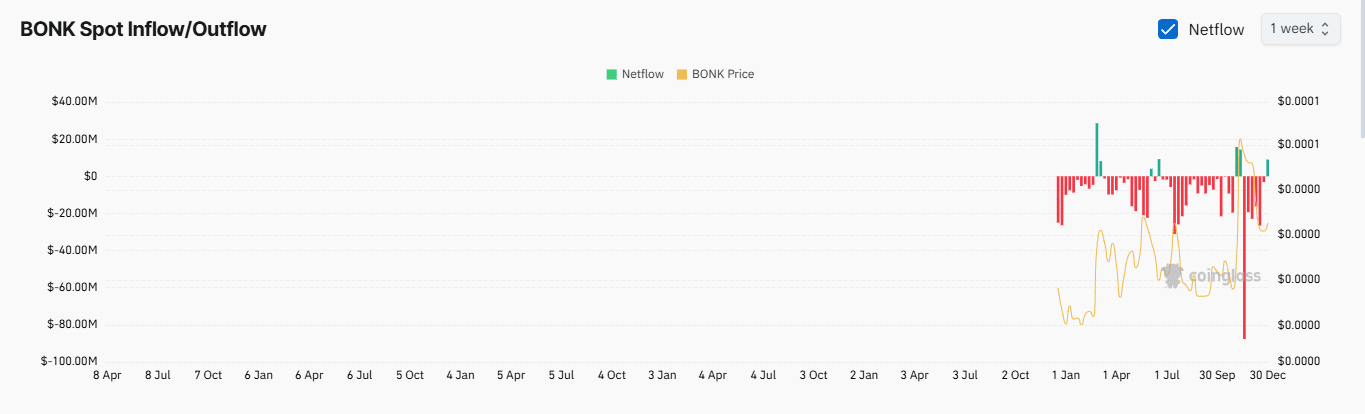

Moreover, Alternate Netflow information signifies unfavorable traits for BONK. There was a big influx of funds into exchanges, totaling $7.85 million up to now week.

Supply: Coinglass

This motion displays elevated promoting stress as extra market individuals switch property to exchanges.

If these traits persist, BONK dangers remaining in its consolidation section for an extended interval earlier than breaking out to the upside. Nonetheless, if patrons step in and accumulate the asset, the memecoin may resume its rally sooner.

TVL development for BONK

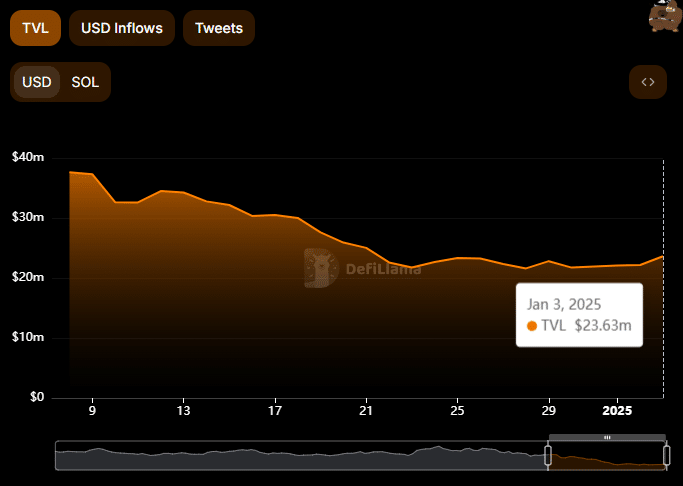

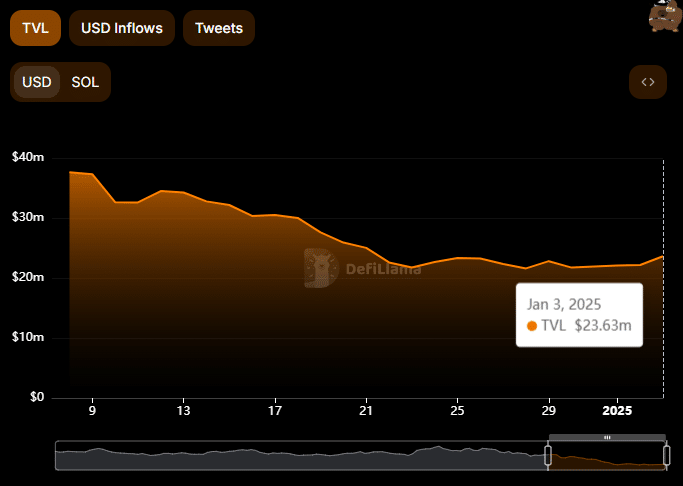

The Complete Worth Locked (TVL) of Bonk Staked SOL (bonkSOL), a liquid staking token (LST) tied to BONK validators, has seen a big surge.

Supply: DeFiLlama

Learn Bonk’s [BONK] Value Prediction 2024-25

As of now, the TVL stands at $23.59 million, marking its highest degree because the twenty first of December.

This notable liquidity influx into the memecoin’s validator pool is predicted to have a optimistic ripple impact on BONK itself.