Can Ethereum’s HODLers save ETH from dipping to $3,169?

- Ethereum has plunged 12% this week, mirroring the broader battle as altcoins face double-digit losses.

- Its restoration now hinges greater than ever on a wider market rebound.

Ethereum[ETH] has misplaced over half of its post-election good points and is now caught in a high-stakes tug-of-war.

With Bitcoin’s consolidation holding again any main breakout, buyers are enjoying it protected. So, given the present panorama, is it time to train warning or seize the chance?

The dimensions is tipping in favor of…

Historically, Bitcoin’s[BTC] stagnation signaled the beginning of an altcoin season – however not this time. Altcoins are struggling to achieve traction, with 70% of the highest 10 high-caps (excluding stablecoins) struggling double-digit losses in only a week.

Ethereum hasn’t escaped the downturn both, with a 12% weekly drop, partly resulting from sturdy U.S. financial knowledge. The ETH/BTC pair is hitting every day lows, making ETH’s rebound look tied to a broader market restoration.

However the strain doesn’t cease there. Whales are feeling the warmth, dumping 10,070 ETH at $3,280, locking in a $1M loss. In consequence, ETH was down by 1.15%, sitting at $3,227, at press time. Nonetheless, the stakes are larger than ever.

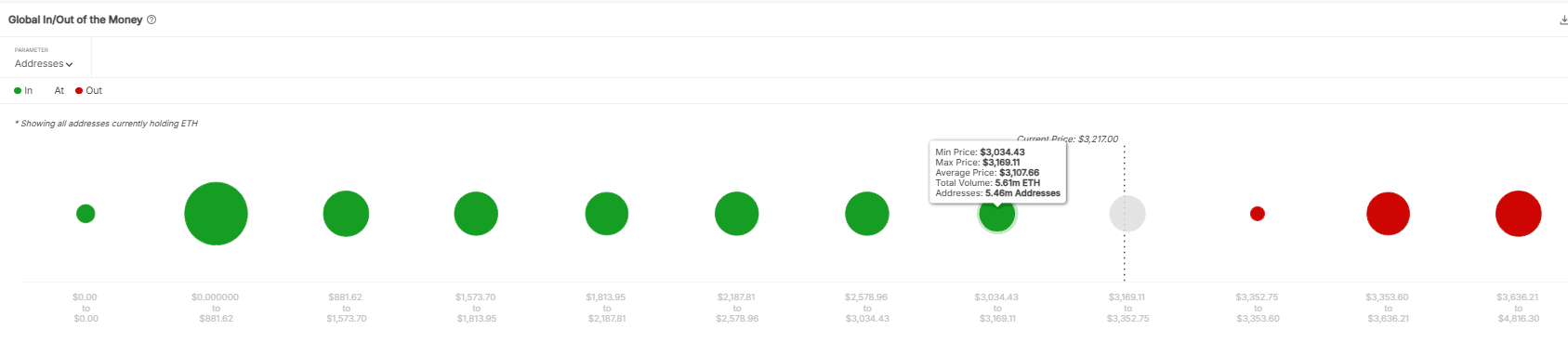

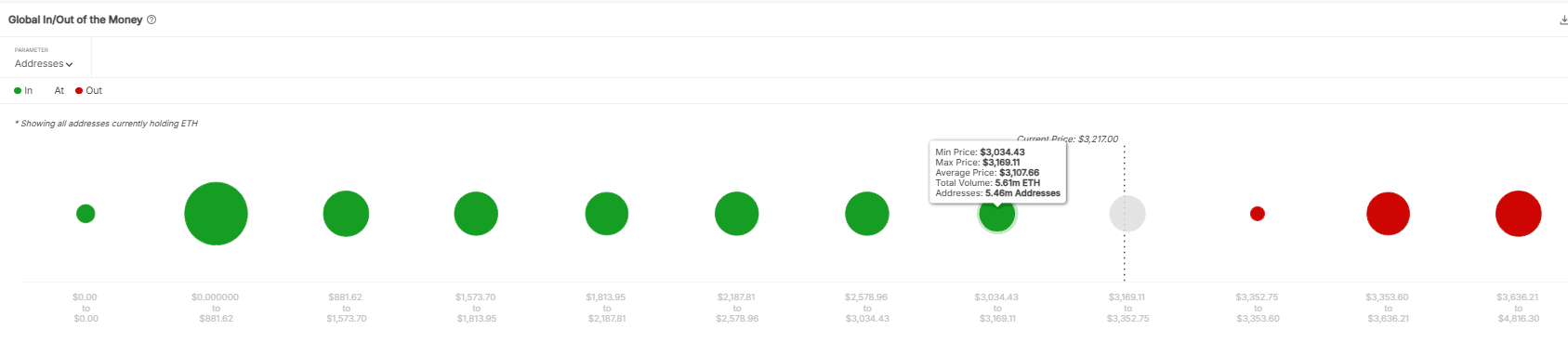

If capitulation continues, ETH might dip to $3,169. At this degree, 5.46 million addresses, holding 5.61 million ETH, have been purchased at that worth.

What these HODLers do subsequent will likely be essential to ETH’s subsequent transfer. It’s a high-stakes gamble: HODL and anticipate a market rebound, or money out earlier than one other crash hits.

Supply: IntoTheBlock

Will Ethereum whales take the danger?

The choice includes a mix of psychology and knowledge. Statistically, ETH continues to be 33% above its post-election ranges, a worth level that has served as sturdy help up to now.

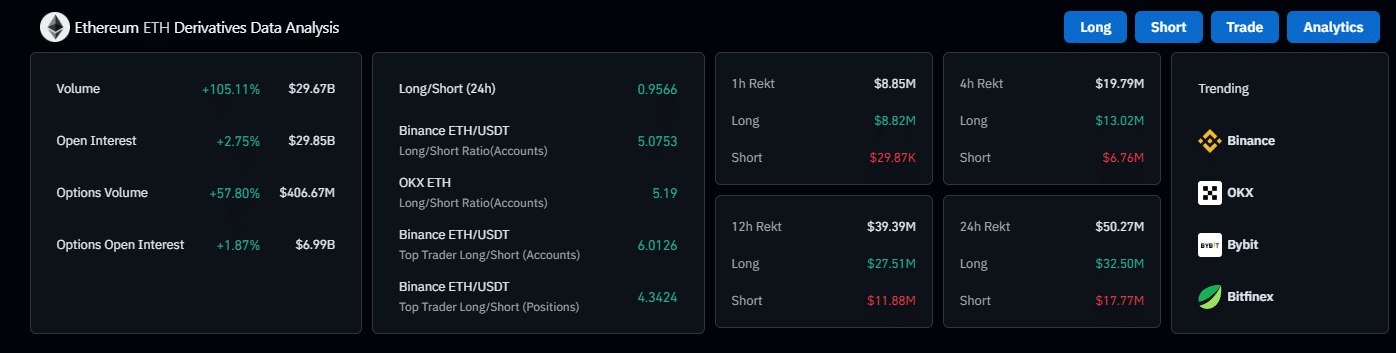

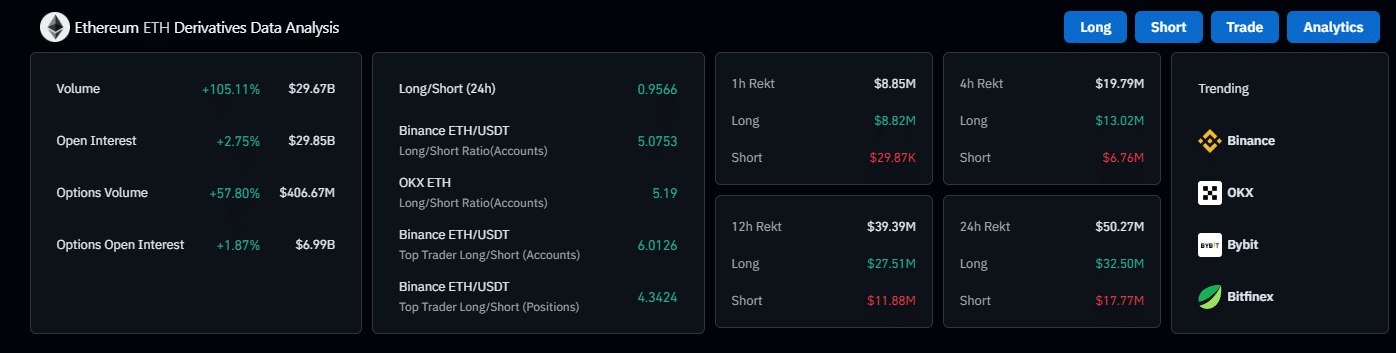

Moreover, futures markets are buzzing, with spinoff quantity hovering by 105% and Open Curiosity (OI) climbing by 2%.

Supply: Coinglass

However there’s extra at play – buyers are banking on a repeat of the This autumn cycle, hoping for one more ‘Trump pump.’ Little question, the psychological momentum is there, however will it’s sufficient? In line with AMBCrypto, a transparent ‘Sure’ continues to be far off.

Learn Ethereum’s [ETH] Value Prediction 2025–2026

Why the uncertainty? Main gamers are shedding confidence, which might deplete the FOMO, fueling the present market optimism. Retail and institutional capital has but to circulate again in, and worry is excessive.

Not like the final Trump rally, which despatched Ethereum hovering to $4K, an identical response this time feels more and more unlikely. Even with the Trump pump, it won’t be sufficient to spark a powerful restoration for Ethereum.

Briefly, warning is essential proper now. Ethereum’s restoration is tightly tied to the broader market rebound. The optimism surrounding the potential for a Trump pump is tempting, nevertheless it’s essential to not get swept away by the “hype.”