Bitcoin’s historic correlation reveals why BTC can rally beyond $100K

- Analysts imagine that BTC could be on the verge of a serious rally, citing historic on-chain indicators.

- Nevertheless, profit-taking continues to use downward strain, limiting rapid good points.

Bitcoin [BTC] has delivered spectacular efficiency, accounting for a 46.59% month-to-month achieve and boosting its market capitalization to $1.94 trillion.

Even so, momentum has slowed, with no clear market course rising but. Over the previous 24 hours, BTC’s worth has edged up by 0.80%, retaining it in a consolidation part.

AMBCrypto’s evaluation means that whereas BTC is range-bound, historical past reveals it tends to interrupt greater as soon as market sentiment improves.

BTC nonetheless has room to rally

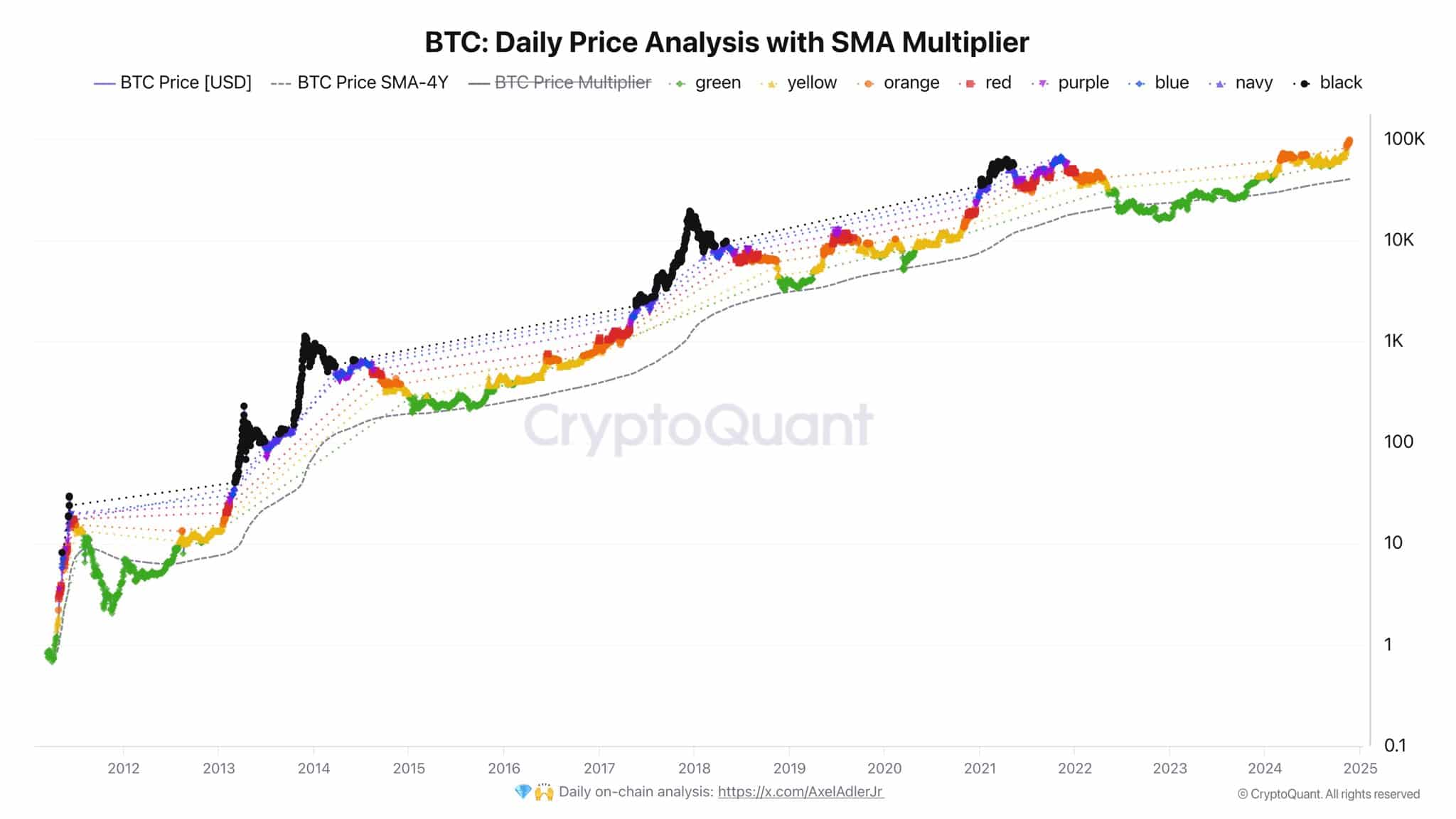

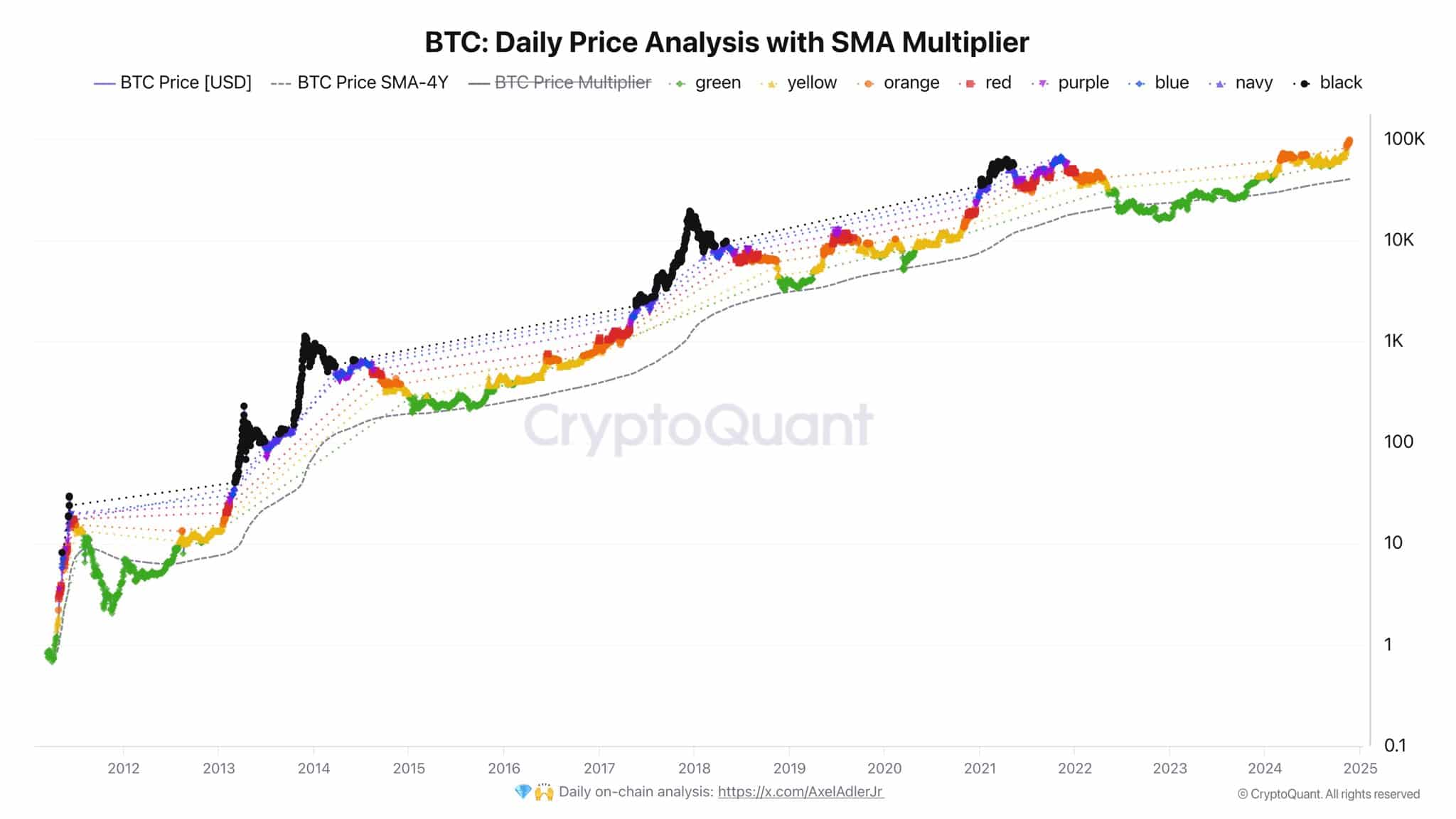

Based on a chart shared by Alex Adler Jr., Bitcoin has but to achieve its cyclical peak.

The chart examines BTC’s efficiency utilizing the Easy Shifting Common (SMA) Multiplier, a instrument designed to trace worth traits throughout market cycles.

The evaluation makes use of color-coded zones—starting from inexperienced (starting of cycle) to black (prime of cycle)—to signify Bitcoin’s market sentiment throughout totally different phases, from accumulation to peak hypothesis.

In his put up, Adler said:

“The orange dot has arrived. Crimson, purple, blue, navy, and black—are coming.”

Supply: X

This implies BTC continues to be removed from the height of its cycle, with 5 extra phases forward. Traditionally, these phases comply with a predictable sample, with the ultimate “black” part marking the onset of a decline.

If this sample holds, BTC might surpass the extremely anticipated $100,000 goal that has captured market consideration.

AMBCrypto explored extra insights into why Bitcoin, regardless of these promising metrics, has but to see its rally totally materialize.

Revenue-taking exercise slows BTC rally

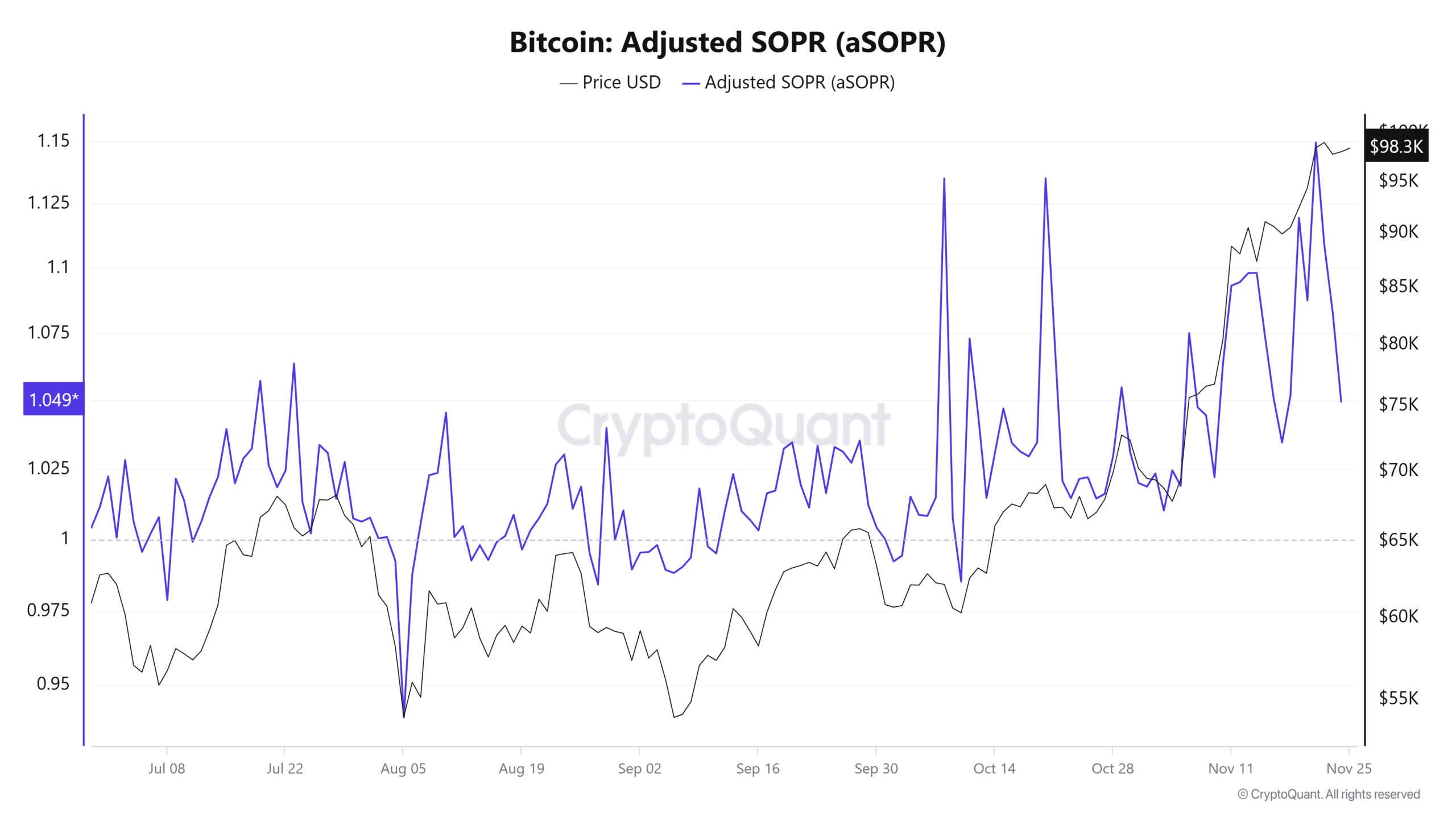

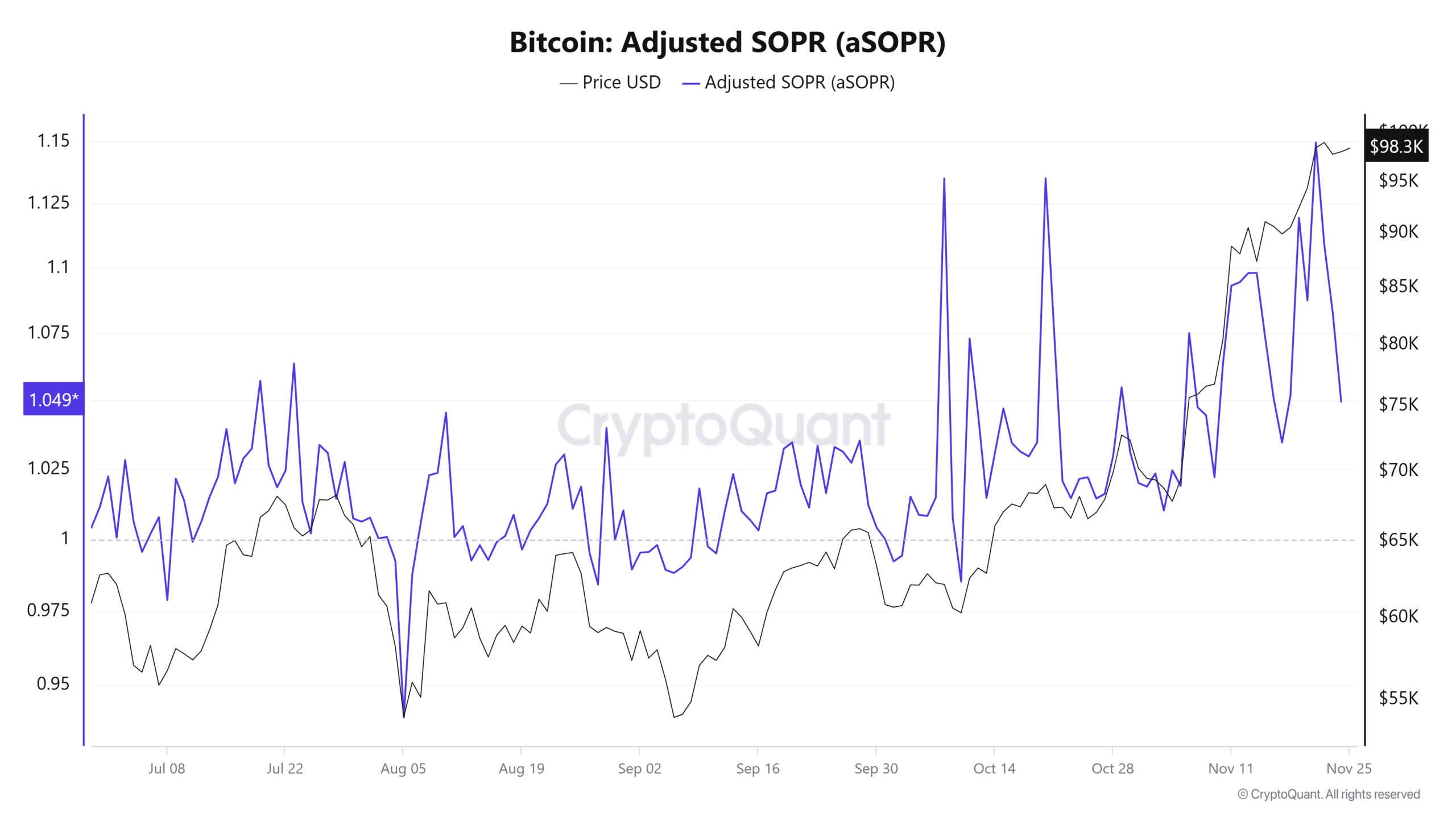

CryptoQuant’s latest insight reveals that heightened profit-taking exercise is weighing on Bitcoin’s (BTC) worth momentum, stopping it from making important upward strikes.

The Adjusted Spent Output Revenue Ratio (aSOPR), which measures whether or not buyers are promoting their BTC holdings at a revenue or loss, sat at 1.049 at press time.

A studying above 1 signifies that buyers had been promoting at a revenue, and this has added strain on BTC’s worth, slowing its rally.

Supply: Coinglass

Moreover, the Take Purchase/Promote Ratio, an indicator that reveals whether or not consumers or sellers dominate the market, learn 0.963 on the time of writing.

This means that promoting quantity outweighs shopping for quantity, giving bears the higher hand and additional delaying BTC’s upward motion.

Buyers hold BTC from dropping

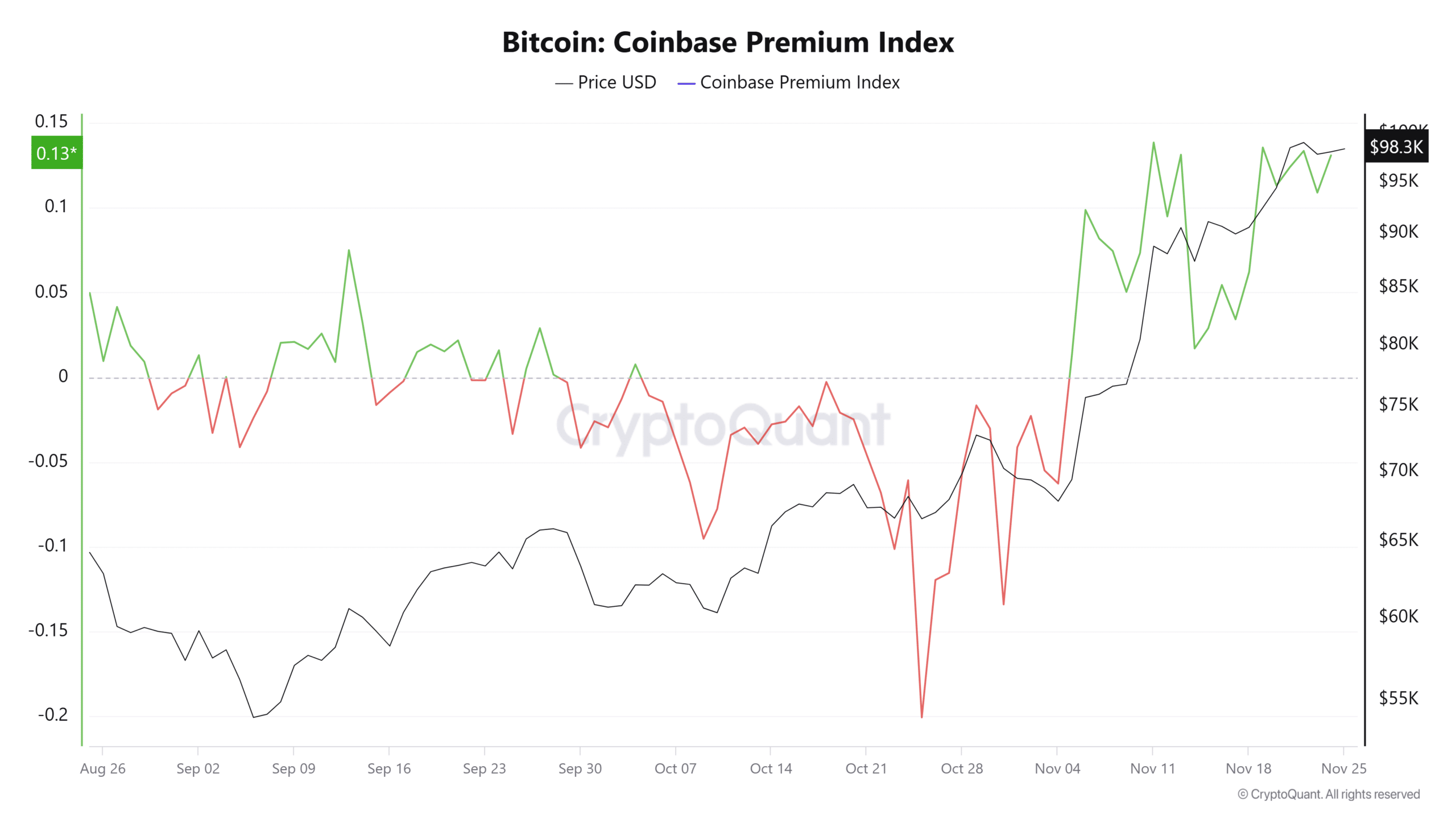

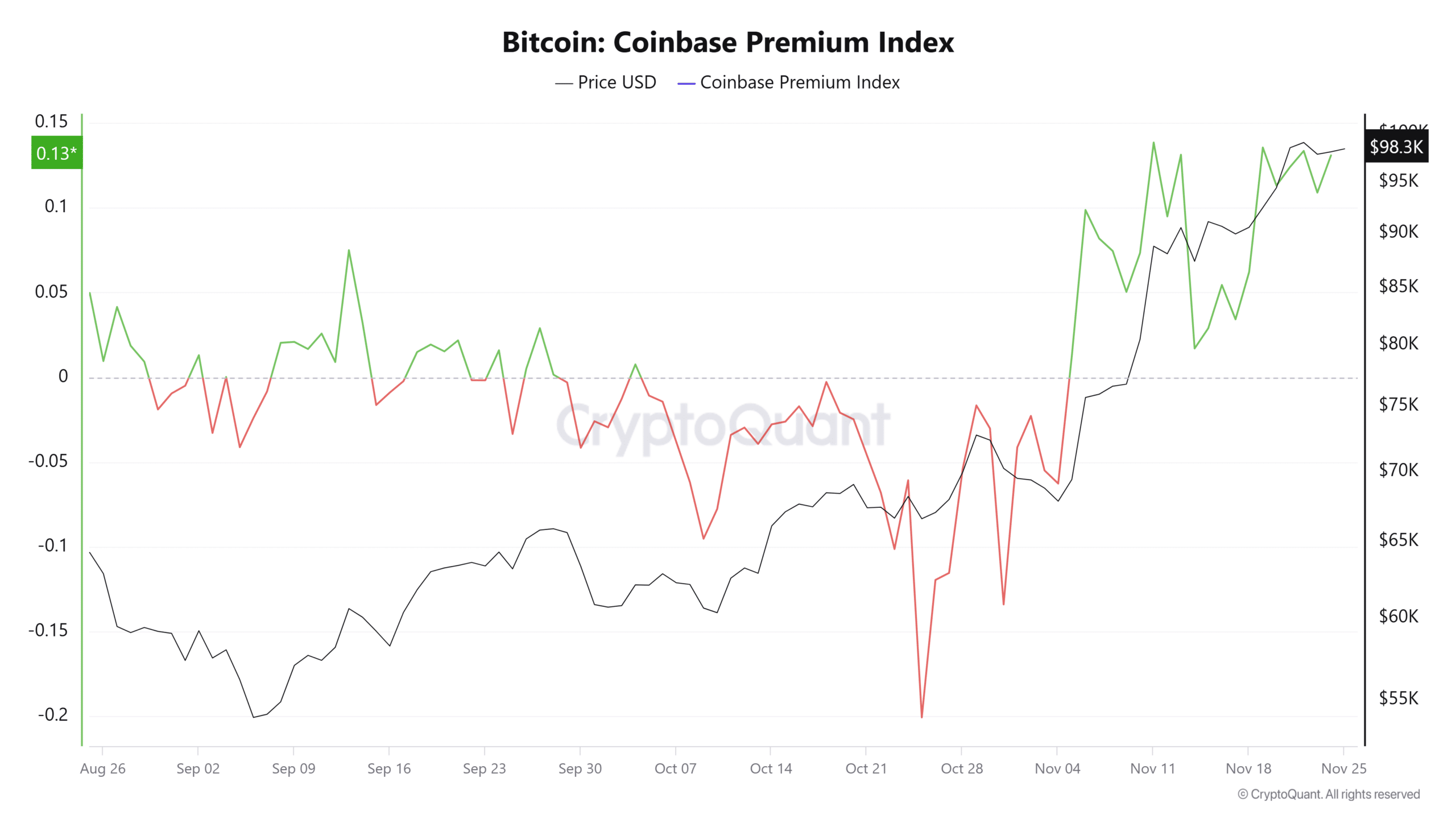

CryptoQuant stories that U.S. buyers have been actively shopping for Bitcoin (BTC) in current days.

The Coinbase Premium Index, which measures the value distinction between BTC on Coinbase and Binance, has ticked greater, sitting at 0.1308. That is near its November excessive of 0.1384.

Supply: Coinglass

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

A optimistic studying on this index—above zero—signifies stronger shopping for exercise from U.S. buyers in comparison with different markets.

This elevated demand has helped stabilize BTC’s worth, stopping additional declines.