Chintai and Splyce target retail access to tokenized securities on Solana

Actual-world asset (RWA) protocols Splyce and Chintai have launched a brand new product on Solana designed to provide retail customers entry to institutional-grade tokenized securities — a transfer that might broaden the enchantment of RWA tokenization on one of many world’s largest blockchains.

The product is powered by technique tokens, or S-Tokens, which give retail customers with publicity to yields generated by Chintai. Whereas customers by no means straight maintain Chintai’s tokenized securities, S-Tokens act as a “mirror” by a mortgage construction backed by the underlying belongings.

S-Tokens are designed to broaden entry to RWA yields past institutional traders. In the present day, most institutional RWA merchandise function as “walled gardens” with strict capital necessities and compliance hurdles, limiting retail participation, the businesses informed Cointelegraph.

The S-Token mannequin goals to bridge this hole, providing retail customers entry to institutional-grade yields whereas permitting issuers to stay compliant.

With Splyce, customers can interact with these belongings straight by their present Web3 wallets, sustaining the permissionless expertise that sometimes defines DeFi.

“There aren’t any jurisdictional restrictions on the place S‑Tokens will be provided — they’re as permissionless as USDC or USDT,” Ross Blyth, Splyce’s chief advertising officer, informed Cointelegraph. “That mentioned, deposits are nonetheless topic to straightforward KYC/AML monitoring to make sure compliance with Anti-Cash Laundering necessities.”

The primary iteration of S-Tokens will contain the Kin Fund, a tokenized actual property fund launched by Kin Capital on the Chintai community.

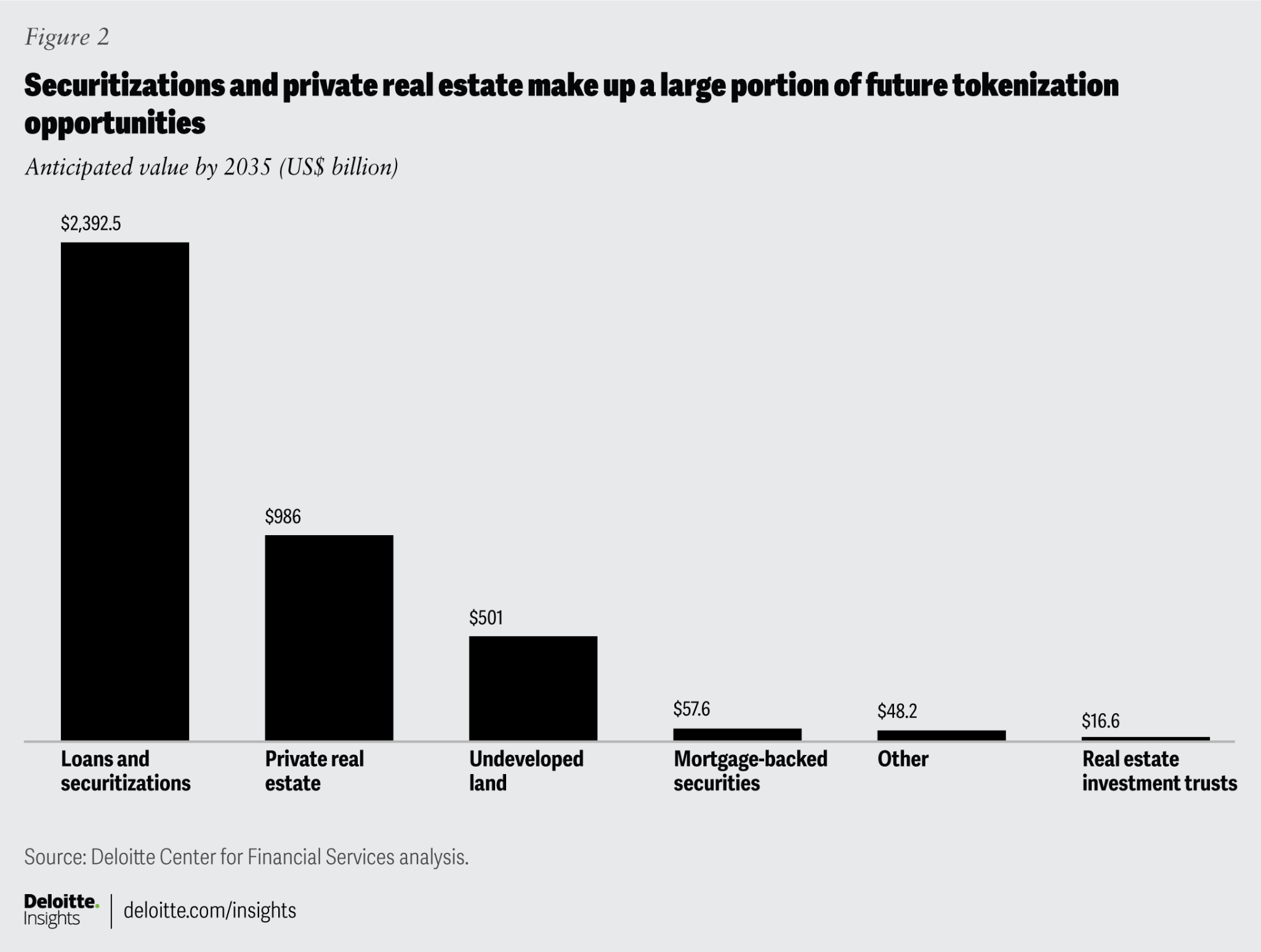

Deloitte recognized loans and securitization and personal actual property as two of the potential largest tokenization alternatives of the following decade. Supply: Deloitte

“Distribution and liquidity have all the time been the largest hurdles for RWAs,” Chintai managing director Josh Gordon informed Cointelegraph. “Quickly, institutional-grade belongings can be tradable throughout Solana decentralized exchanges with the identical ease as tokens at the moment.”

Associated: VC Roundup: VCs gas vitality tokenization, AI datachains, programmable credit score

A possible enhance to Solana’s RWA momentum

Solana, identified for its excessive throughput, low charges and robust developer ecosystem, has been gaining notable traction within the real-world asset house.

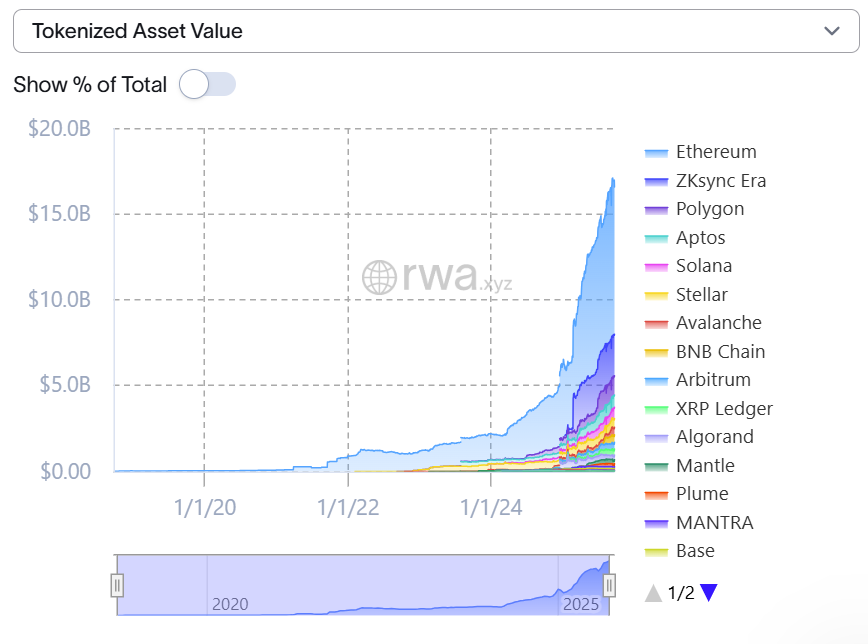

In keeping with trade knowledge, tokenized belongings on Solana at the moment are valued at greater than $656 million. Solely 4 different networks — Ethereum, ZKsync Period, Polygon and Aptos — at present assist increased ranges of tokenized belongings.

Tokenized asset values throughout main networks. Supply: RWA.xyz

Because the begin of the 12 months, the worth of tokenized belongings on Solana has grown by greater than 260%. The community’s largest non-stablecoin tokenized merchandise embrace the Ondo US Greenback Yield and the Ondo Quick-Time period US Authorities Bond Fund, which give tokenized entry to yield-bearing merchandise similar to short-term US Treasurys.

As well as, BlackRock launched its USD Institutional Digital Liquidity Fund (BUIDL) on Solana earlier this 12 months. Whereas BUIDL has rapidly develop into the dominant tokenized US Treasury product throughout blockchains, its presence on Solana additional underscores the community’s rising function in institutional RWA adoption.

Though the most important RWA merchandise on Solana are nonetheless geared primarily towards certified institutional patrons or accredited traders, limiting retail entry, alternate options are rising. Ondo Finance has additionally introduced plans to increase retail entry on Solana by its partnership with Alchemy Pay.

In the meantime, Ondo’s YieldCoin (USDY) is obtainable to retail customers on Stellar, based on MEXC.

These developments come as Solana emerges as a platform for tokenized equities, with Ahead Industries — a Nasdaq-listed firm and Solana treasury holder — planning to tokenize its inventory on the blockchain by a partnership with Superstate, a regulated issuance platform.

Associated: $400T TradFi market is a big runway for tokenized RWAs: Animoca