Bitcoin Open Interest Rises By $1.8 Billion As BTC Breaks $27,000

Knowledge reveals the Bitcoin Open Curiosity has shot up by $1.8 billion because the cryptocurrency’s value has damaged the $27,000 stage.

Bitcoin Open Curiosity Has Exploded Throughout The Previous Day

The “Open Curiosity” indicator retains monitor of the full quantity of Bitcoin futures contracts at present open on all spinoff alternate platforms.

When the worth of this metric rises, it implies that the traders are opening up new positions available on the market proper now. Typically, the cryptocurrency turns into extra more likely to show volatility when this occurs, as new contracts normally indicate a rise within the complete leverage within the sector (“leverage” naturally being the mortgage quantity holders can choose to take in opposition to their positions).

However, the indicator happening implies {that a} internet quantity of contracts are both closing up or getting liquidated. The asset could turn out to be extra calmer following such a pattern.

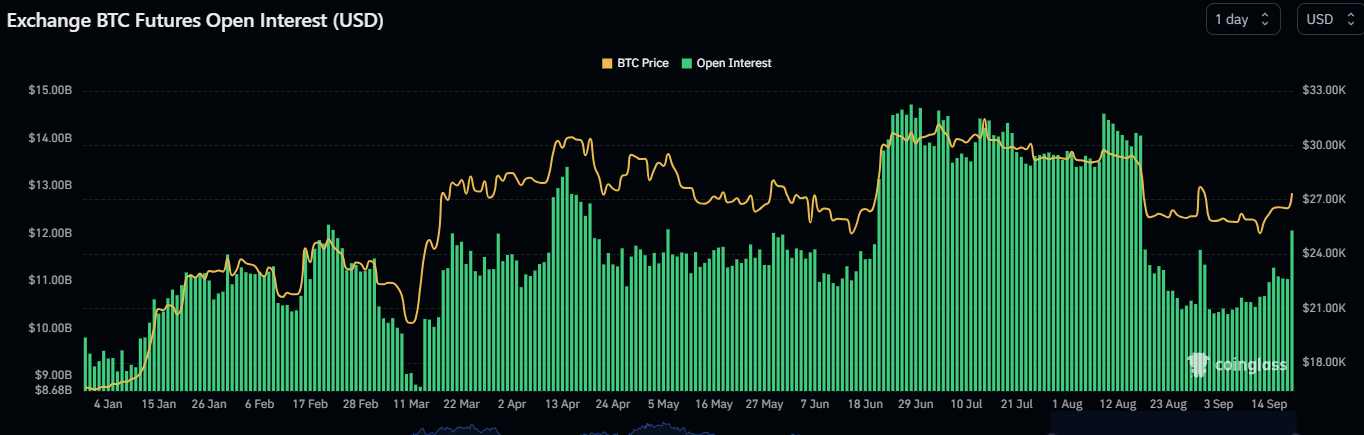

Now, here’s a chart from CoinGlass that reveals the pattern within the Bitcoin Open Curiosity over the 12 months 2023 up to now:

Appears like the worth of the metric has shot up over the previous day | Supply: CoinGlass

The above graph reveals that the Bitcoin Open Curiosity has registered a slightly sharp surge as we speak. The primary instigator behind this futures rush seems to be the surge within the cryptocurrency’s mark past the $27,000 stage.

Earlier than this rise, the indicator had a price of $11.04 billion, however now it has hit the $12.81 billion mark, suggesting a rise of a whopping $1.77 billion (about 16%).

This fast progress within the Open Curiosity can naturally result in the asset changing into extra risky, though it’s exhausting to say in what path this volatility may seem.

If this rise has come from shorts leaping in to wager in opposition to the asset, an extra rise would outcome of their liquidation, thus fueling the value enhance even additional. If, nevertheless, the contracts being opened are lengthy, then it might not finish very effectively for the rally.

The chart reveals that the Open Curiosity had an analogous spike again in the course of the Grayscale rally final month, however the longs that had opened then had ended up discovering liquidation, as the value had returned to decrease ranges.

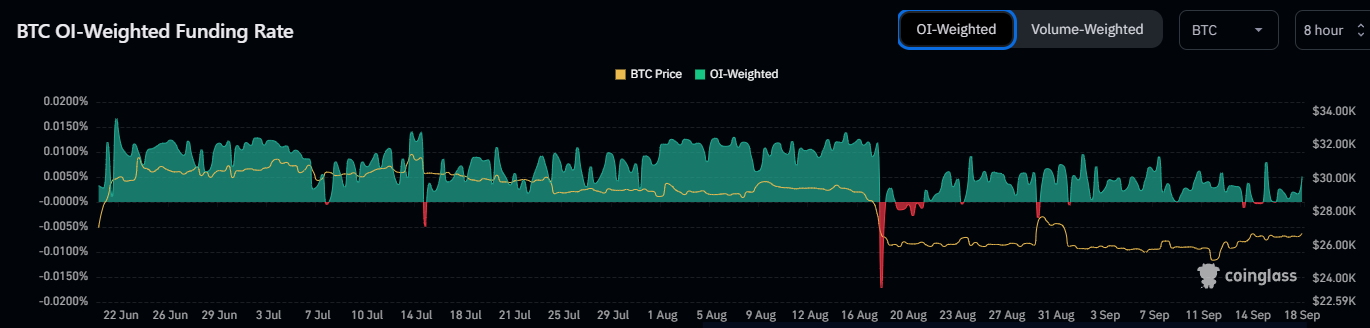

The funding charge, which measures the periodic price that futures merchants pay one another, could present hints about whether or not the brand new positions are shorts or longs.

The worth of the metric appears to have been inexperienced in latest days | Supply: CoinGlass

As is seen within the graph, the Bitcoin funding charge is optimistic at present, but it surely hasn’t modified a lot with the Open Curiosity rise, implying that lengthy and quick positions are unfold extra evenly on this enhance.

It stays to be seen the place the cryptocurrency goes within the coming few days and if the Open Curiosity surge will play any function.

BTC Worth

Bitcoin had surged to $27,400 earlier within the day however has since retraced again to $27,200.

BTC has surged in the course of the previous day | Supply: BTCUSD on TradingView

Featured picture from Dmytro Demidko on Unsplash.com, charts from TradingView.com, CoinGlass.com