Bitcoin drops to $104K: Can $3.3B in inflows spark BTC’s reversal?

- Whale promoting contrasts with $3.3B inflows and long-term holders including 881K BTC.

- NVT spikes, new tackle development slows, and liquidation zones threaten elevated volatility.

On the eleventh of June, Bitcoin [BTC] accumulation wallets noticed the most important single-day influx of 2025, absorbing 30,784 BTC value $3.3 billion.

These wallets, usually tied to long-term holders and never linked to exchanges, now collectively maintain 2.91 million BTC.

Notably, this occurred whereas Bitcoin traded round $104,719, reflecting a 2.41% every day drop. Regardless of short-term volatility, the dimensions and conviction of those inflows counsel a long-term bullish bias.

This habits implies that enormous holders are positioning for a possible upside at the same time as retail sentiment seems cautious.

Whales vs. LTHs

A distinguished whale pockets just lately deposited 1,000 BTC value $106 million to Binance, persevering with a promoting streak that started in April 2024.

To this point, this pockets has offloaded 6,500 BTC, signaling a powerful intent to understand earnings as worth approaches key resistance.

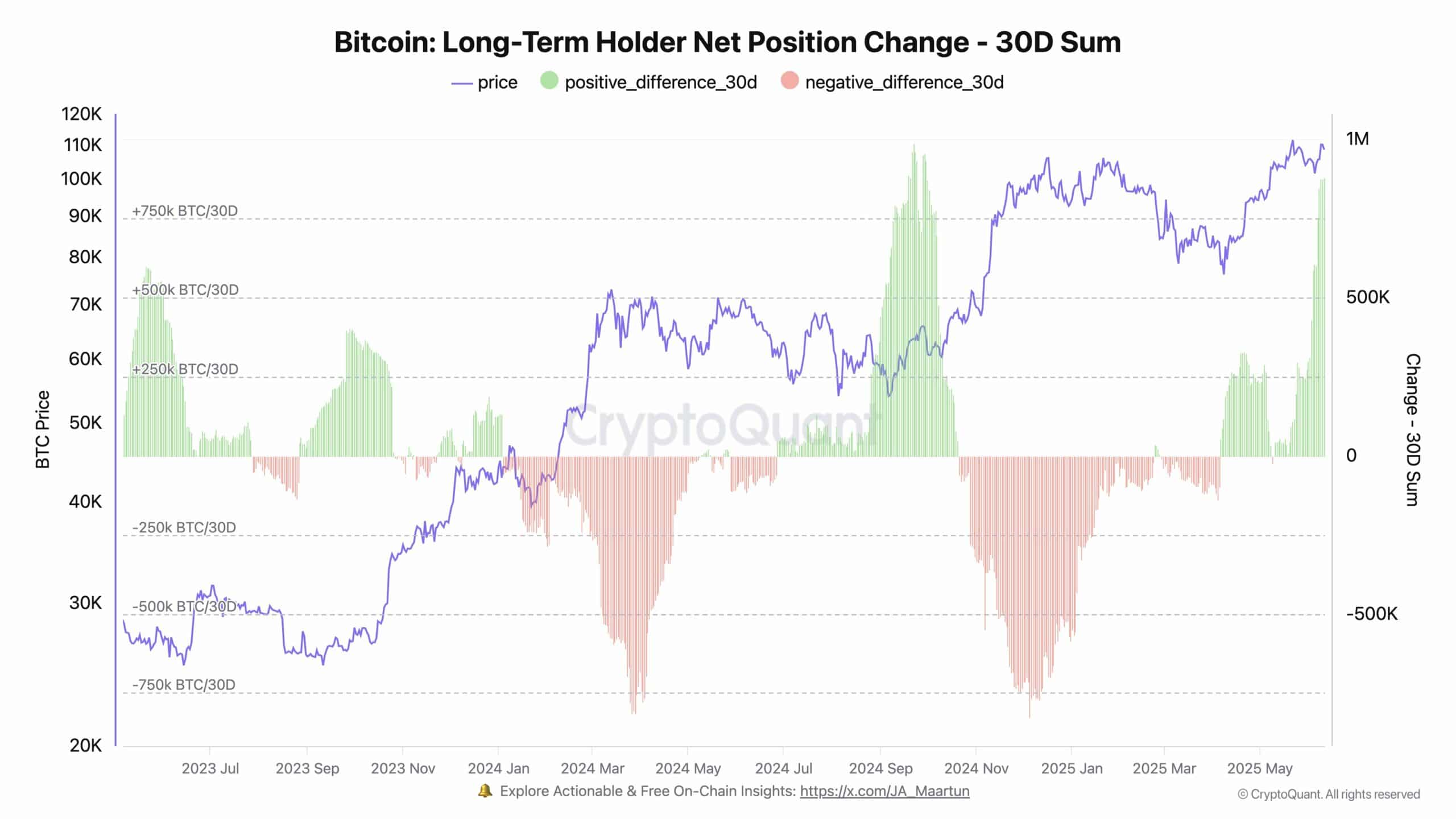

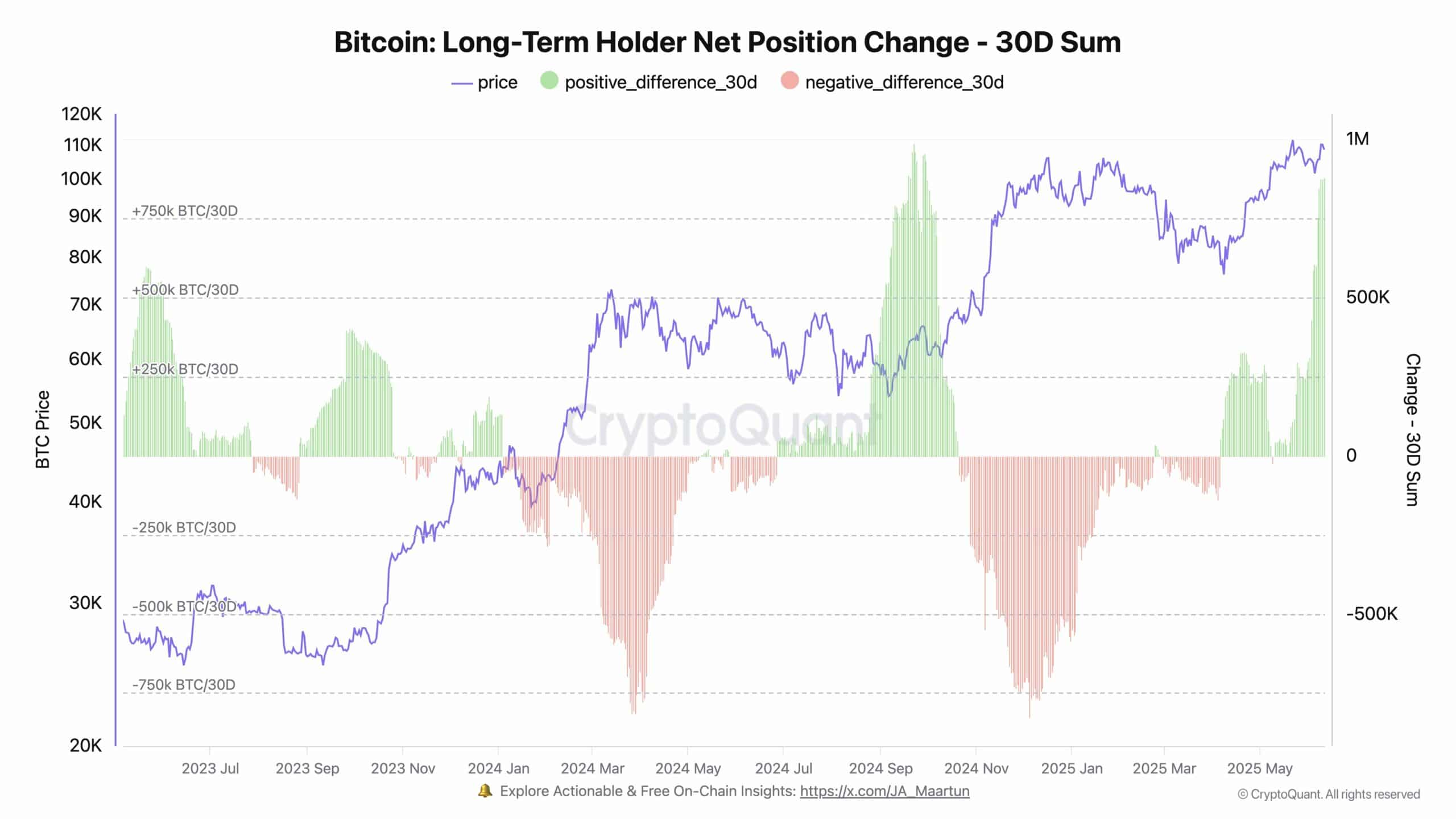

Nonetheless, the whale nonetheless holds 3,500 BTC, indicating it’s not a full exit however a tactical distribution. In distinction, long-term holders have added a staggering 881,578 BTC up to now 30 days, in keeping with CryptoQuant.

This aggressive accumulation reveals unwavering conviction in Bitcoin’s long-term upside regardless of short-term volatility and whale exits.

Supply: CryptoQuant

Can bulls conquer the $112K provide wall?

Bitcoin’s worth has failed a number of instances to breach the $112K resistance. The market construction nonetheless leans bullish on account of rising trendline assist.

Nonetheless, the Relative Energy Index (RSI) dipped under 50, highlighting waning momentum. Subsequently, except patrons reclaim the $106K zone quickly, the danger of one other pullback towards $101K will increase.

Nonetheless, bulls may entice late shorters in the event that they handle to push costs above this congestion zone. Market indecision round this degree is more likely to outline BTC’s subsequent transfer.

Supply: TradingView

Is BTC’s valuation outpacing its utility?

The Community Worth to Transaction (NVT) ratio surged 15.21% to 36.49, reflecting rising divergence between market cap and on-chain switch quantity.

Such spikes have traditionally indicated speculative overvaluation. Subsequently, this metric now means that Bitcoin’s worth could also be rising quicker than precise demand for transactional use.

If this development persists, it may precede an area high. Nonetheless, excessive NVTs also can happen throughout early phases of long-term uptrends, particularly when holders desire accumulation to spending.

Supply: CryptoQuant

What’s maintaining BTC energetic?

Over the previous week, energetic addresses rose by 1.69%, whereas new addresses fell by 2.36%. This means present customers stay engaged at the same time as new consumer inflows gradual.

Subsequently, the market is probably going operating on inside momentum fairly than attracting recent capital.

Whereas this dynamic can assist short-term rallies, long-term sustainability normally requires increasing the consumer base.

Nonetheless, the rise in energetic wallets indicators that dedicated holders are nonetheless taking part, which stabilizes the community throughout unsure circumstances.

Supply: IntoTheBlock

Liquidation clusters intention at volatility

The 24-hour Binance liquidation heatmap highlights dense lengthy liquidations round $105K and $102K. Subsequently, worth actions into these zones could set off cascading stop-losses.

This setup will increase volatility threat if bears push under these thresholds. Nonetheless, if BTC holds above $104K, it might entice quick positions and provoke a aid bounce.

These clustered zones usually act as inflection factors, amplifying whichever facet features momentum. Consequently, merchants ought to monitor these ranges for sharp strikes in both course.

Supply: CoinGlass

Will long-term holders gas the subsequent breakout?

Regardless of worth rejection close to $112K and short-term whale promoting, long-term accumulation and report inflows into HODL wallets replicate sturdy conviction.

Community fundamentals seem blended, with weakening consumer development however regular exercise from present individuals.

Elevated valuation metrics counsel warning, however purchaser habits implies confidence in long-term upside.

Subsequently, if Bitcoin can reclaim $106K and defend key assist, the subsequent leg towards new highs might be underway.