Cardano prices surge by 9% – Are 2024 ADA predictions coming true

- ADA was up by 9% within the final 24 hours, whereas whales amassed extra tokens.

- Most market indicators had been bullish, however bearish sentiment remained dominant.

After a week-long double-digit decline, Cardano [ADA] lastly managed to carry its floor by portray its day by day chart inexperienced. Because of the current worth uptick, nearly all of ADA holders had been having fun with earnings.

Due to this fact, AMBCrypto took a take a look at the token’s well being to see what helped ADA register these positive factors.

Cardano buyers are having fun with earnings!

Cardano shed various its worth final week as its worth dropped by greater than 14%. Fortunately, issues turned within the blockchain’s favor quickly as its day by day chart turned inexperienced.

In response to CoinMarketCap, ADA was up by greater than 9% within the final 24 hours alone. On the time of writing, ADA was buying and selling at $0.5331 with a market capitalization of over $18 billion, making it the eighth largest crypto.

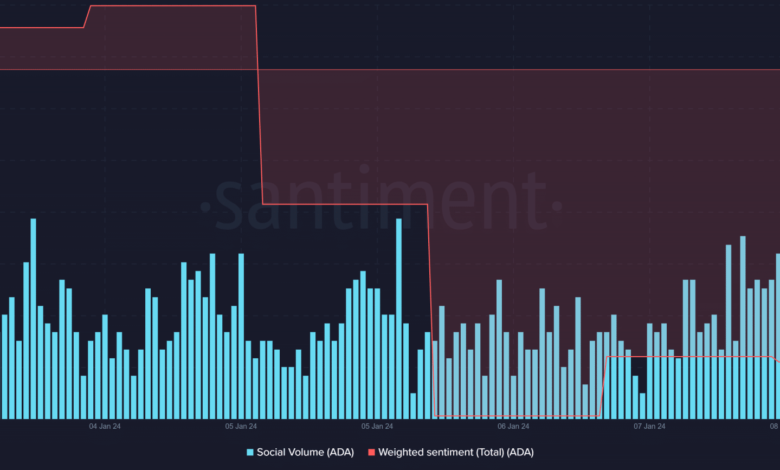

The excellent news was that ADA’s worth hike was accompanied by an increase in buying and selling quantity, which is usually thought-about to be a optimistic sign. Due to the value uptick, ADA grew to become a sizzling subject of debate within the crypto house, as evident from the rise in its social quantity.

Supply: Santiment

It was stunning to see that regardless of the value rise, ADA’s Weighted Sentiment continued to stay low, which means that bearish sentiment was dominant available in the market.

Nonetheless, AMBCrypto’s evaluation of IntoTheBlock’s data revealed that the value uptick did make greater than 50% of Cardano buyers worthwhile.

Supply: IntoTheBlock

A potential cause for this uptrend, other than the bullish market situation, might be the whale exercise across the token. Santiment’s information revealed that whereas small holders didn’t enhance their holdings whereas whales acted in a different way.

The variety of ADA holders with greater than 100 million tokens did accumulate extra as evident from the chart. Not solely that, whale exercise at massive was additionally excessive, as ADA’s whale transaction rely remained excessive all through the final week.

Supply: Santiment

Will Cardano keep this pattern?

The hike within the token’s worth additionally resulted in a spike in ADA’s day by day on-chain transaction quantity in revenue chart on the eighth of January 2024. Nonetheless, its MVRV ratio nonetheless remained low.

Supply: Santiment

Reasonable or not, right here’s ADA’s market cap in BTC phrases

To higher perceive what to anticipate from ADA, AMBCrypto checked its day by day chart. Our evaluation discovered that ADA’s worth rebounded from the underside restrict of the Bollinger Bands, suggesting an extra rise in its worth.

Moreover, one other bullish indicator was Cardano’s Cash Stream Index (MFI), because it additionally registered an uptick.

Supply: TradingView